What’s the average down payment on a house?

The average down payment on a house is far less than many first-time home buyers believe.

In fact, the median down payment on a home is only 13% according to the National Association of Realtors (NAR). And for buyers aged 23 to 41, that drops to just 8-10 percent.

And, with some loan programs, it’s possible to make a down payment of three or even zero percent.

Check your low-down-payment loan options. Start hereIn this article (Skip to...)

- Average down payment

- Minimum down payments

- PMI and down payments

- Benefits of smaller down payments

- Is it worth putting 20% down?

- Tips to help if you’re short on cash

- Today’s best rates

Average down payment on a house in 2026

In its 2022 report, the National Association of Realtors (NAR) examined home purchase trends in the U.S. The NAR found the median down payment for all home buyers was 13 percent. But first-time buyers often prefer a smaller down payment and the average varies a lot by age group.

Check your low-down-payment loan options. Start hereMedian down payment on a house by age of buyer:

- All buyers: 13%

- 22-31: 8%

- 32-41: 10%

- 42-56: 15%

- 57-66: 21%

- 67-75: 28%

- 76-96: 30%

Remember that these are only medians. Some buyers put down more, and others less. The right down payment for you will depend on your loan program and your financial goals.

Is 20% down required?

Many first-time home buyers think they need 20% down to buy a house. But that’s far from true. The median down payment for younger buyers is only 8% — and many loan programs allow 3%, 3.5%, or even zero down.

As you can see in the list above, only buyers in their late 50s and older reach the 20% threshold as a group.

Older buyers are much more likely to already own homes. This means they can use equity — rather than depending on their savings account — to make their down payment. They’re also less likely to have obligations like student loan debt and car payments.

But it shouldn’t be necessary for anyone of any age to save up a 20% down payment. That’s why low-down payment and no-down mortgage options exist.

Down payment requirements by loan type

The average down payment on a home is just a benchmark, much like the average mortgage interest rate.

Home buyers don’t need to make the average down payment. They only need to meet a minimum down payment requirement. And that varies by loan program.

Verify your low-down-payment eligibility. Start hereMinimum down payment by loan type:

- VA loan: 0% down

- USDA loan: 0% down

- Conforming loan: 3% down

- FHA loan: 3.5% down

- Jumbo loan: Often 10-20% down

You can learn more about these loan types and see how they compare here.

Typical down payments on jumbo loans and other non-conforming mortgages almost always run higher than government-backed and conventional mortgages.

What is private mortgage insurance (PMI), and how is it related to down payments?

When borrowers put down less than 20% on conventional mortgages, they’re usually required to buy mortgage insurance. This is probably why a lot of buyers think they need to pay 20% down.

Verify your low-down-payment eligibility. Start hereThe two most common types of mortgage insurance are:

- Private mortgage insurance (PMI): Required on conventional loans with less than 20% down. Can be canceled later

- Mortgage insurance premium (MIP): Required on all FHA loans regardless of the down payment. Typically lasts the life of the loan and cannot be canceled (unless you refinance)

Mortgage insurance is one of the biggest drawbacks to making a smaller-than-average down payment.

Why? Because this insurance coverage protects the mortgage lender if you default on your loan. You’re paying to protect the company, not yourself. And mortgage insurance payments can add up.

How much does mortgage insurance cost?

PMI rates on conventional loans vary depending on your down payment amount and your credit score. Typical PMI rates can range from less than 0.5% of the loan amount up to 1.86% annually. That annual fee is broken into monthly payments that are included in your mortgage payment.

The bigger your down payment and the higher your credit score, the less your PMI will cost. For example:

| Credit Score | Down Payment | PMI Rate (Annual) |

| 680-699 | 3% | 1.21% |

| 720-739 | 5% | 0.66% |

| 760+ | 10% | 0.28% |

Source: MGIC

Most FHA loans require 0.85% annually in mortgage insurance. That’s $850 for every $100,000 borrowed — or $2,550 for a loan balance of $300,000. This amount of money would be broken down into monthly payments of about $212.

PMI drops off once you reach 20% equity

The good news is that homeowners aren’t stuck with PMI forever.

If you have a conventional loan, your lender should stop charging PMI when one of the following happens:

- You reach 78% loan-to-value ratio based on your original loan value

- You reach 80% loan-to-value and you request PMI cancellation from your servicer

Loan-to-value ratio is another way of measuring your home equity. If you’ve paid off 20% of your loan balance — or if you made a 20% down payment — you’d have an 80% loan-to-value, or LTV ratio.

FHA mortgage insurance won’t cancel

If you have an FHA loan, mortgage insurance cannot be canceled. But, once you reach 80% LTV, you can likely refinance into a conventional loan with no PMI.

Note that if you put 10% or more down on an FHA loan, your MIP should expire after 11 years.

Also note that VA loans do not charge ongoing PMI, even with zero down. The Department of Veterans Affairs charges an upfront “funding fee” instead of PMI, but that can typically be rolled up in your mortgage loan amount.

Does PMI mean you should wait until you have 20% down?

No! Or, rather, mostly no. But it depends on the housing market where you live and your financial situation.

Overall, homeowners make way more money through home price inflation (appreciation) than they pay out in PMI — especially with a conventional loan that cancels PMI when your loan-to-value ratio (LTV) reaches 80 percent.

Also, while you’re saving up your 20% down, house prices may be increasing — so you’re chasing a moving target. That means it often makes sound financial sense to pay PMI.

For more information, read up on the pros and cons of making a 20% down payment.

Check your low-down-payment loan options. Start here

Benefits of making a smaller down payment on a house

There’s one clear benefit to beginning homeownership with a smaller down payment: First-time buyers become homeowners sooner.

In all but a few areas, you’re likely to see your home’s value grow each year.. That means you’re building home equity rather than paying rent you’ll never see returns on.

Check your low-down-payment loan eligibility. Start hereBut what about PMI? Yes, you’ll likely resent every cent you pay out each month. But you’re almost certain to be free of it soon enough. Either you can prompt your lender to stop charging it when your loan balance reaches 80% of your home’s market value, or you can refinance out of mortgage insurance on an FHA loan.

The ‘right’ down payment amount is different for everyone

What you decide to put down on a house should be based on your current and future financials.

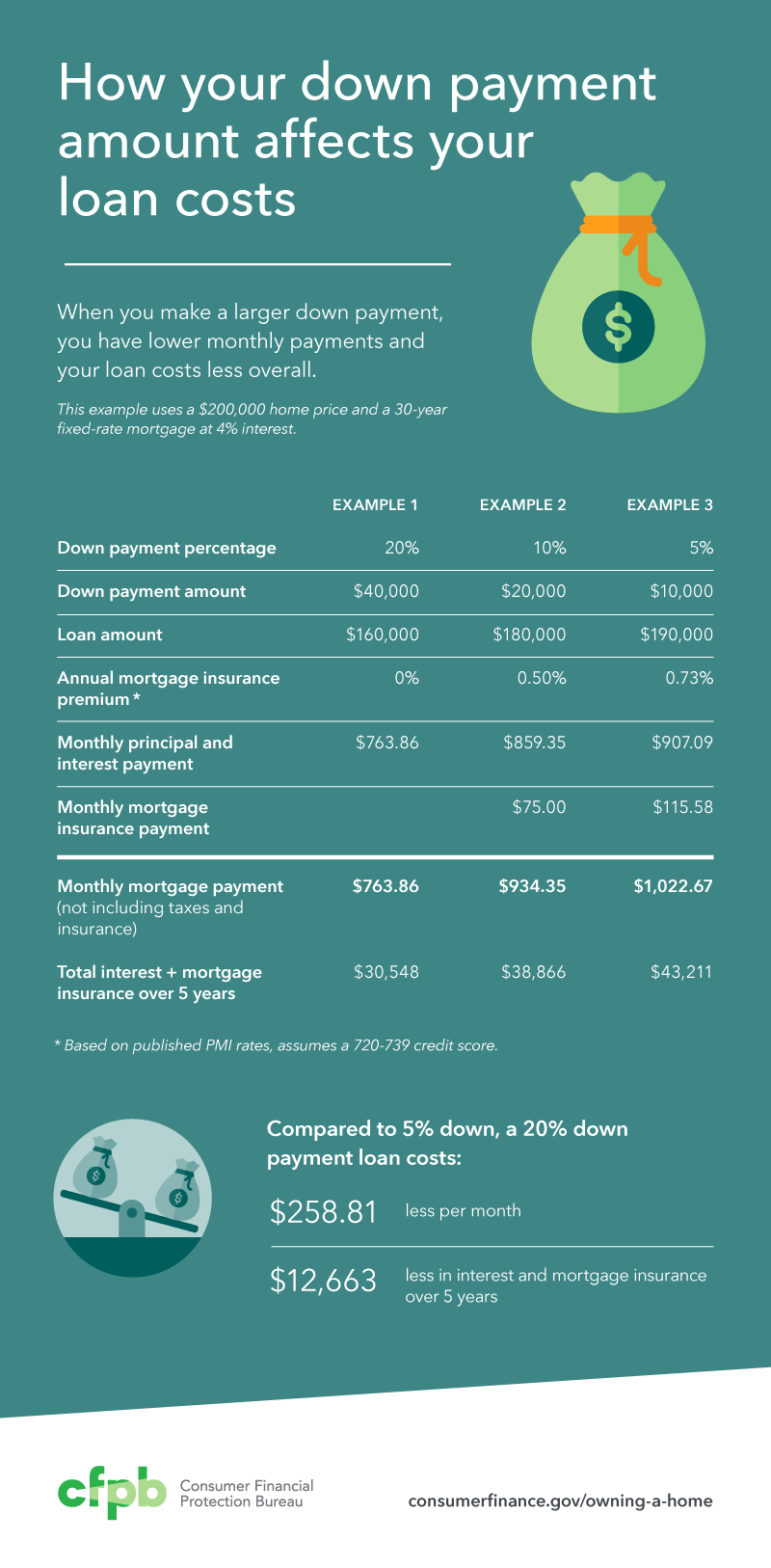

The Consumer Financial Protection Bureau (CFPB) points out, “When you make a larger down payment, you have lower monthly payments and your loan costs less overall.”

Here’s how the CFPB breaks down the numbers:

Use that for guidance. But don’t rely on the figures because they’re just a guide, not the bottom line.

Even if the assumptions these examples make — the size of the mortgage loan, the credit score, and the mortgage rate — don’t reflect your real-life scenario, the trends still apply.

Is it worth making a 20% down payment?

If you decide to carry on saving until you reach the magic 20% down payment figure, you’ll be in line for some significant rewards.

Check your low-down-payment options. Start hereWhy? Because mortgage loans with at least 20% down are considered less risky by mortgage lenders. So borrowers with a big down payment get certain benefits, including:

- A lower interest rate

- Smaller monthly mortgage payments

- No mortgage insurance

True, your mortgage rate will also depend on some other factors, like your credit score and monthly debt burden which will include credit card debt along with student loans, personal loans, and auto loans.

But 20% should earn you a lower interest rate than someone with a smaller down payment and the same credit score and debt-to-income ratio.

Bigger down payment = smaller monthly payments

And of course, your monthly mortgage payments are bound to be lower the more you put down. Because along with a lower interest rate, you have a smaller loan amount.

- If you buy a home for $300,000 with 20% down, you’re borrowing $240,000

- Buy at the same home purchase price with 3% down and you’re borrowing $291,000

In case you want specifics, at 6% interest, the principal and interest payment on a 30-year, $300,000 home loan would be:

- $1,440 a month with 20% down

- $1,740 a month with 3% down

Over the life of a 30-year loan, the 3% down loan would cost about $110,000 more in interest, too. And that’s not counting the PMI you’d pay with a 3% down loan.

In short, more money down means you’d spend a lot less on your home loan over time.

Tips to buy a house if you can’t make a down payment

Suppose you’re keen to become a homeowner as soon as possible. But your savings account isn’t big enough for even a 3% down payment. Are there things you can do? You bet.

Verify your low-down-payment eligibility. Start hereSee if you qualify for a zero-down mortgage

Conventional loans and mortgages backed by the Federal Housing Administration require down payments: at least 3% for a conventional loan and 3.5% for an FHA loan.

But USDA and VA mortgages allow no down payment. The catch? You have to meet special eligibility requirements.

You can only get a VA loan with 0% down if you’re a veteran, current service member, or a member of a related group. So check your eligibility.

If you’re not affiliated with the military, you may be able to get a no-down-payment mortgage via the USDA loan program.

Guaranteed by the U.S. Department of Agriculture, USDA loans require borrowers to have modest income and to buy a home in a designated area. USDA-eligible areas are generally rural but include some less-populated suburbs.

Both these programs make it possible to buy a house with no down payment. But you’ll still need cash to cover closing costs — or a motivated seller who’s willing to pay closing costs for you.

Apply for down payment assistance

There are more than 2,000 down payment assistance (DPA) programs across the country.

Each DPA program provides loans or grants to qualified homebuyers. Some down payment assistance programs will help with closing costs, too.

Most of these programs are designed for first-time home buying, but repeat buyers can often qualify when they haven’t owned a home for the past three years.

Each program is different. So you need to find ones that operate where you want to buy and see what they offer.

Your real estate agent or loan officer should know about local DPA programs. Or you can research them on your own. Use this guide to down payment assistance as a starting point.

Pay with gift money

Most home loan programs allow you to cover some or all of your out-of-pocket costs with gifted money.

This money can typically come from a family member, friend, or even an employer.

The one requirement is that the funds need to be properly documented. The lender needs to be able to see where they came from, and they need a letter stating the donor won’t ask for repayment.

You can learn more about down payment gifts here.

Split the down payment with a co-borrower

There’s a growing trend for homebuyers to purchase with somebody else named on the mortgage. This is called “co-borrowing.”

A co-borrower can be someone who lives in the home like a roommate. Or it may be an “investor non-occupant,” who lives elsewhere and has a purely financial role. Those are often parents, siblings, or friends.

The co-borrower typically takes a financial interest in the property and shares the benefit of home sales price inflation with you.

The upsides? Your co-borrower may chip in for the down payment. And his or her income and credit score count when you make your mortgage application.

The downsides? There are few for you, except you’re sharing the profits of home price appreciation. And the co-borrower is on the hook if things go wrong.

Check your low-down-payment loan options. Start here

Average down payment FAQ

The median down payment on a house in 2022 is 13 percent according to the National Association of Realtors. Typical down payments for younger buyers are lower: about 8 percent for home buyers in their 20s and 10 percent for buyers in their 30s.

Five percent down exceeds the minimum requirements for conventional and government-backed mortgages. But down payment alone doesn’t guarantee loan approval. Lenders also check your credit score, income, and debt to make sure you qualify. A lender could require a higher down payment based on these factors.

No, but putting 20 percent down has benefits: You won’t pay PMI, your monthly payments will be lower, and you’ll likely get a lower mortgage rate. In short, you can save money by making a larger down payment.

If you can’t put 20 percent down, you’ll pay more for your loan, but that might be OK. Home values typically rise over time, so your investment can still pay off — especially when compared to paying rent which puts money in your landlord’s pocket and not your own.

Find out what you can afford

You might be able to afford a home with the money currently in your savings account. And if you’re just short on funds, there are down payment assistance programs that can help.

Explore low-down-payment loan options to see what kind of home you can afford today.

Time to make a move? Let us find the right mortgage for you