FHA home loans require just 3.5% down and are ultra-lenient on credit scores and employment history compared to other mortgage types.

The first step to seeing if FHA can make you a homeowner is to run the numbers with this FHA mortgage calculator.

Verify your FHA loan eligibility>Related: How to buy a house with $0 down: First-time home buyer

How to use an FHA loan calculator

Many first-time home buyers aren’t aware of all the costs associated with homeownership.

When you pay your mortgage, you’re not just repaying loan principal and interest to your lender. You also need to pay homeowners insurance, property taxes, and other associated costs.

The FHA mortgage calculator above lets you estimate your ‘true’ payment when all these fees are included. This will help you get a more accurate number and figure out how much house you can really afford with an FHA loan.

Here’s a breakdown to help you understand each of the terms and fees included in our FHA loan affordability calculator:

Down payment

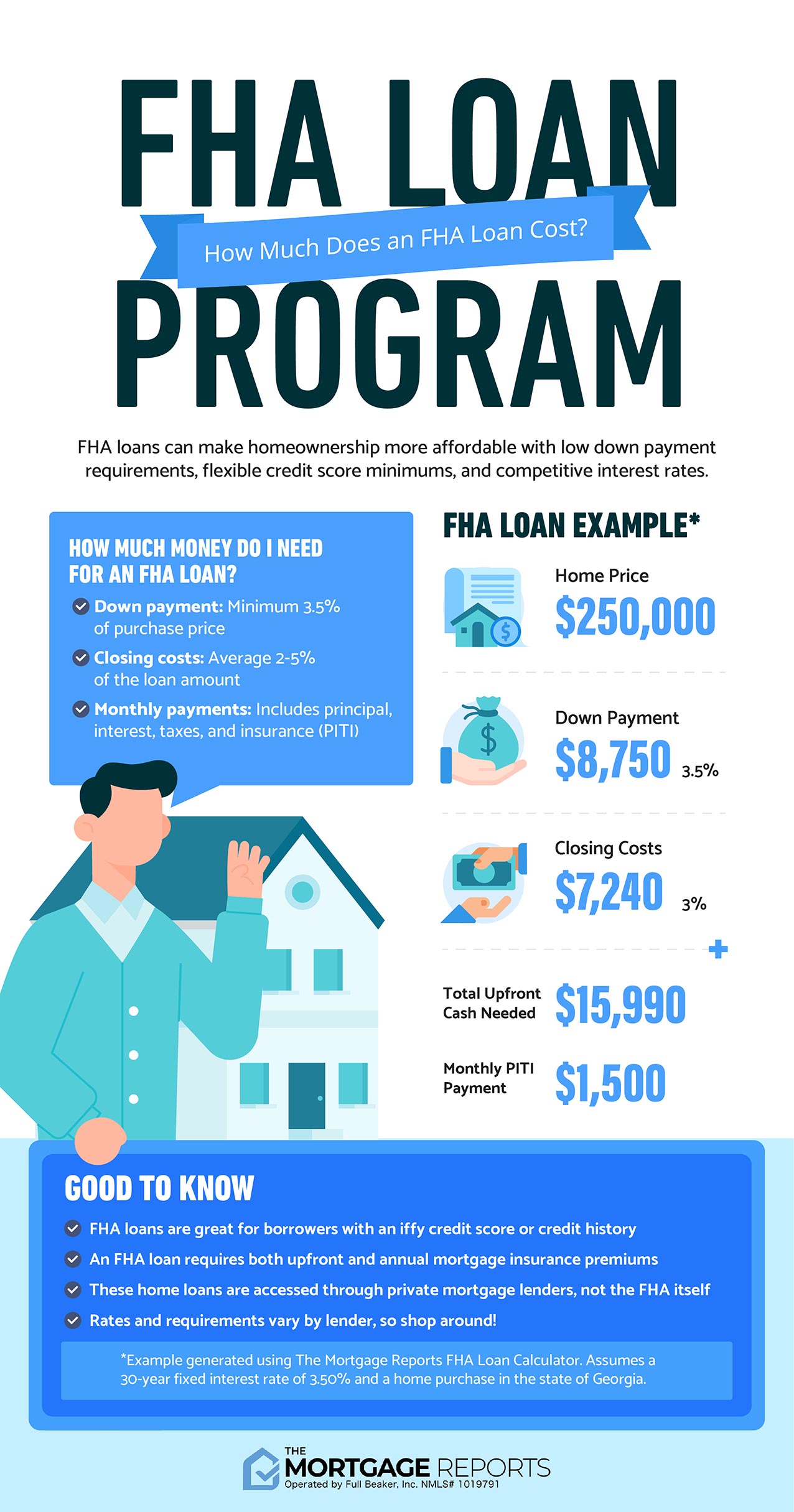

This is the dollar amount you put toward your home purchase. FHA features a low down payment minimum of 3.5% of the purchase price. This can come from a down payment gift or an eligible down payment assistance program.

Loan term

This is the fixed amount of time you have to pay off your mortgage loan. Most home buyers choose a 30-year, fixed-rate mortgage, which has equal payments over the life of the loan. 15-year fixed-rate loans are also available via the FHA program.

FHA offers adjustable-rate mortgages, too, though these are far less popular because the mortgage rate and payment can increase during the loan term.

Interest rate

This is the annual rate your mortgage lender charges as a cost of borrowing. Mortgage interest rates are expressed as a percentage of the loan amount. For example, if your loan amount is $150,000 and your interest rate is 3.0%, you’d pay $4,500 in interest during the first year (0.03 x 150,000 = 4,500).

Principal and interest

This is the amount that goes toward paying off your loan balance plus interest due to your mortgage provider each month. This remains constant for the life of a fixed-rate loan. Your monthly mortgage payment doesn’t change, but each month you pay more in principal and less in interest until the loan amount is repaid. This payment progression is called amortization.

FHA mortgage insurance

FHA requires a monthly fee that is a lot like private mortgage insurance (PMI). This fee, called FHA Mortgage Insurance Premium (MIP), is a type of insurance that protects lenders against loss in case of a foreclosure.

FHA charges an upfront mortgage insurance premium (UFMIP) equal to 1.75% of the loan amount. This can be rolled into your loan balance. It also charges an annual mortgage insurance premium, usually equal to 0.85% of your loan amount. Annual MIP is paid in monthly installments along with your mortgage payment.

Property tax

The county or municipality in which the home is located charges a certain amount per year in taxes. This cost is split into 12 installments and collected each month with your mortgage payment. Your lender collects this fee because the county can seize a home if property taxes are not paid. The calculator estimates property taxes based on averages from tax-rates.org.

Homeowners insurance

Lenders require you to insure your home from fire and other damages. Your monthly home insurance premium is collected with your mortgage payment, and the lender sends the payment to your insurance company each year.

HOA/Other

If you are buying a condo or a home in a Planned Unit Development (PUD), you may need to pay homeowners association (HOA) dues. Loan officers factor in this cost when determining your DTI ratios. You may input other home-related fees such as flood insurance in this field, but don’t include things like utility costs.

Mortgage escrow

Property taxes and homeowners insurance are typically paid to your lender each month along with your mortgage payment. The taxes and insurance are kept in an escrow account until they become due, at which time your lender pays them to the correct company or agency.

Verify your FHA loan eligibility. Start hereFHA mortgage eligibility

FHA mortgages have great perks for first-time home buyers. But to use this loan program, you need to meet requirements set by the Federal Housing Administration and your FHA-approved lender.

FHA loans are typically available to those who meet the following qualifications:

- A credit score of 580 or higher (lower scores may be eligible with 10% down)

- A 3.5% down payment

- A debt-to-income ratio of 43% or less

- 1-2 years of consistent employment history (most likely two years if self-employed)

- A property that meets FHA standards or is eligible for FHA 203k financing

- A loan amount within 2026 FHA loan limits; currently $ in most counties

These are general qualifying guidelines. However, lenders often have the flexibility to approve loan applications that are weaker in one area but stronger in others. For instance, you might get away with a higher debt-to-income ratio if your credit score is good.

If you’re not sure whether you’d qualify for financing, check your eligibility with a few different mortgage lenders.

Many potential home buyers are FHA-eligible but don’t know it yet.

Verify your FHA loan eligibility. Start hereHow does an FHA loan work?

FHA loans are a home buying program backed by the Federal Housing Administration.

This agency — which is an arm of the Department of Housing and Urban Development (HUD) — uses its FHA mortgage program to make homeownership more accessible to disadvantaged home buyers.

FHA does this by lowering the upfront barrier to home buying.

Reduced down payments and lower credit score requirements make homeownership more accessible to buyers who might not otherwise qualify for a mortgage.

Although FHA loans are backed by the federal government, they’re originated (‘made’) by private lenders. Most major mortgage providers are FHA-approved, so it’s relatively easy to shop around and find your best deal on an FHA mortgage.

If you have a sub-par credit score, low savings, or high levels of debt, an FHA mortgage could help you get into a new home sooner rather than later.

FHA loan limits for 2026

FHA has a maximum loan amount of $ for a single-family home in most of the U.S.

However, FHA loan limits increase in more expensive real estate markets and metro areas.

Single-family home loan limits

- Low cost area: $

- High-cost area: $

The FHA defines a low-cost area as one where you can multiply the median home price by 115% and the resulting price is less than $.

On the other hand, high-cost areas exceed $. In these cases, the maximum loan amount is $. About 65 counties in the U.S. have home purchase prices high enough to qualify as a high-cost area.

Many areas fall somewhere between the low- and high-cost ranges, with loan limits set accordingly.

Alaska, Hawaii, Guam, and the U.S. Virgin Islands are special exceptions and have loan limits capped at over $1 million.

Multifamily home loan limits

The Federal Housing Administration also finances mortgage loans for multi-unit properties.

| 2-Unit Property | 3-Unit Property | 4-Unit Property | |

| Low-Cost Area | $ | $ | $ |

| High-Cost Area | $ | $ | $ |

Again these limits are higher in Alaska, Guam, and the U.S. Virgin Islands.

Even though the FHA allows multi-family home purchases, you must live in one of the units as your primary residence.

Verify your FHA loan eligibility. Start hereToday’s FHA loan interest rates

Today’s rates for a 30-year, fixed-rate FHA loan start at % (% APR), according to The Mortgage Reports’ daily rate survey.

FHA loan interest rates are typically competitive and may be lower than those of conventional loans, making them an attractive option for eligible borrowers.

It’s important to keep in mind that FHA loan interest rates can vary based on factors such as credit score, loan amount, and market conditions, so it’s advisable to shop around and compare offers from different lenders.

Why use an FHA loan calculator?

Using an FHA loan calculator can help you in a number of ways, especially if you are new to the real estate market or need a full picture of your future mortgage payments.

Determining home buying affordability

An FHA loan calculator is a useful tool that can help you understand how much you can expect to pay for your mortgage each month. The calculator provides a clear picture of your monthly obligations by inputting details such as loan amount, interest rate, loan term, and other relevant details.

This allows prospective homeowners to effectively plan their budget, ensuring that they can comfortably manage their monthly mortgage payments alongside other expenses.

Understanding the costs of mortgage insurance

Mortgage insurance premiums (MIP) are typically required with FHA loans, and are an additional cost that borrowers must factor into their monthly mortgage payments. This is typically included in an FHA loan calculator calculation, providing a more accurate estimate of monthly costs and assisting borrowers in understanding the full financial implications of their loan.

Common mistakes to avoid when using an FHA loan calculator

It’s important to be aware of a few common errors that can result in inaccurate calculations when using an FHA loan calculator.

Check your FHA loan options. Start hereInaccurate input information

Putting wrong or out-of-date information into the calculator is a common mistake. This includes information such as the purchase price of a home, the length of the loan, the interest rate, and the cost of insurance. To get an accurate estimate of your potential mortgage payments, you must enter accurate and up-to-date information.

Overlooking additional costs

When using an FHA loan calculator, home buyers often forget to add in other costs. Some of these costs are fees for the homeowners association (HOA), property taxes, insurance premiums, and any costs for repairs or renovations. If you don’t include these costs, your estimate of the total monthly mortgage cost could be way off.

FHA mortgage FAQ

You'll need the loan amount, interest rate, loan term, and information on extra costs such as PMI, HOA fees, and property taxes. Make sure all of the information you entered is correct in order to get an accurate estimate of your total monthly mortgage payment.

FHA sets loan limits for each county, which dictate the maximum amount borrowers can qualify for via the FHA program. Loan limits are higher in areas with high-cost real estate, and borrowers purchasing 2-4-unit properties can often get a larger loan amount than those buying single-family homes. Not all borrowers will qualify for the maximum loan size, though. The amount you can qualify for with FHA depends on your down payment, income, debts, and credit.

Home buyers must put at least 3.5 percent down on an FHA loan. That’s because FHA’s maximum loan-to-value ratio is 96.5 percent — meaning your loan amount can’t be more than 96.5 percent of the home’s value. By making a 3.5 percent down payment, you push your loan amount below FHA’s LTV threshold.

Unlike conventional mortgages, FHA loans do not waive mortgage insurance when you put 20 percent down. All FHA homeowners are required to pay mortgage insurance regardless of down payment — though if you put at least 10 percent down, you’ll only pay it for 11 years instead of the life of the loan. If you have 20 percent down and a credit score above 620, you’re likely better off with a conventional loan because you won’t have to pay for PMI.

Yes, you have to pay closing costs on an FHA mortgage just like any other loan type. FHA loan closing costs are close to conventional closing costs: about 2-5 percent of the loan amount depending on your home price and lender. FHA also charges an upfront mortgage insurance fee equal to 1.75 percent of the loan amount. Most borrowers roll this into the loan to avoid paying it upfront. But if you choose to pay upfront, this fee will increase your closing costs substantially.

Typically, the only closing cost that can be included in an FHA loan is the upfront mortgage insurance premium (upfront MIP). Most other closing costs, such as an underwriting fess or origination fees, will need to be paid out of pocket when purchasing a home or using the FHA Streamline Refinance program.

A typical FHA loan payment includes principal and interest on the loan balance, mortgage insurance premiums, monthly homeowners insurance fees, and monthly property taxes. FHA homeowners in a condo or PUD will also have to pay homeowners association (HOA) dues every month.

That depends. FHA loans require mortgage insurance, which will increase your monthly mortgage payments. But so do conventional loans with less than 20 percent down. The cheaper loan for you will depend on your down payment and credit score; if you have great credit and 5 percent down or more, a conventional loan will likely have lower monthly payments. But if you have low credit and 3-3.5 percent down, the PMI on a conventional loan could be more expensive than FHA MIP. Talk to a lender to compare payment amounts and find out which loan is best for you.

FHA mortgage rates are often lower than rates for conventional mortgages. However, a lower interest rate does not always equate to a lower monthly payment. FHA mortgage insurance will increase your payments and the overall cost of the loan, even if the base rate is lower than for other loan types. Looking at annual percentage rate (APR) can be helpful in determining the ‘true’ cost of a loan, since APR accounts for fees as well as interest.

No. FHA loan rates are not set by the government, and they are not consistent from one FHA loan to the next. FHA-approved lenders get to set their own mortgage rates, and some may have more affordable pricing than others. In addition, rates can vary by borrower, with the lowest rates often going to the ‘safest’ borrowers, and higher rates going to borrowers with lower credit and other risky loan characteristics.

Yes, most FHA-approved loan providers can both preapprove and prequalify you for an FHA home loan. Getting prequalified is a less rigorous evaluation of your financial status, while a preapproval will often require verifying financial details like credit score, debt-to-income ratio, and more. Typically, obtaining a preapproval letter from your loan officer will be of more value when house hunting because many sellers and real estate agents prefer to work with qualifying buyers.

FHA loans have a 210-day waiting period before refinancing into another FHA loan using a Streamline Refinance, or refinancing into a conventional loan to remove the monthly mortgage insurance. This waiting period is the same for VA loans, too. Whereas USDA loans have a 6-12 month waiting period, depending on the circumstances. There is no waiting period for refinancing a conventional conforming loan — unless you are tapping home equity with a cash-out refinance, which has a 6-month waiting period.

Check your FHA loan eligibility

Many home buyers qualify for FHA — they just don’t know it yet. Check with a lender to verify your eligibility and find out how much house you can afford via the FHA mortgage program. You can get started below.

Time to make a move? Let us find the right mortgage for youSources: