Mortgage rate forecast for next week (Feb. 23-27)

Mortgage rates fell for the second straight week and flirted with falling into the 5%'s for the first time since September 2022.

The average 30-year fixed rate mortgage (FRM) dropped to 6.01% on Feb. 19 from to 6.09% on Feb. 12, according to Freddie Mac. The last time the average 30-year FRM went above 7% was Jan. 16, 2025.

“This lower rate environment is not only improving affordability for prospective homebuyers, it’s also strengthening the financial position of homeowners. Over the past year, refinance application activity has more than doubled, enabling many recent buyers to reduce their annual mortgage payments by thousands of dollars,” said Sam Khater, chief economist at Freddie Mac.

| Average 30-year fixed rate | 1-week ago | 4-weeks ago | 3-months ago | 1-year ago |

| 6.01% | 6.09% | 6.09% | 6.26% | 6.85% |

The latest borrowing activity

Though lagging, the most recent weekly mortgage application report from the Mortgage Bankers Association showed a seasonally adjusted 2.8% increase for the seven days ending Feb. 13. The refinance index rose 7% week-over-week while surging 132% from a year ago. The purchase index inched up 3% weekly and stands 8% higher year-over-year.

“Mortgage applications increased last week as the dip in rates led to a strong rebound in refinance activity. [Purchase applications] continued to run ahead of last year’s pace, and we expect lower mortgage rates and the seasonal uptick in new listings to support homebuyer demand in the weeks ahead,” said Bob Broeksmit, CEO at the MBA.

Find your lowest mortgage rate. Start hereIn this article (Skip to...)

- Will rates go down in February?

- 90-day forecast

- Expert rate predictions

- Mortgage rate trends

- Rates by loan type

- Mortgage strategies for February

- Mortgage rates FAQ

Will mortgage rates go down in February?

"Rates could edge down if incoming data, particularly the jobs report, signals renewed labor market weakening that could prompt the Fed to consider cutting sooner."

-Sam Williamson, senior economist at First American

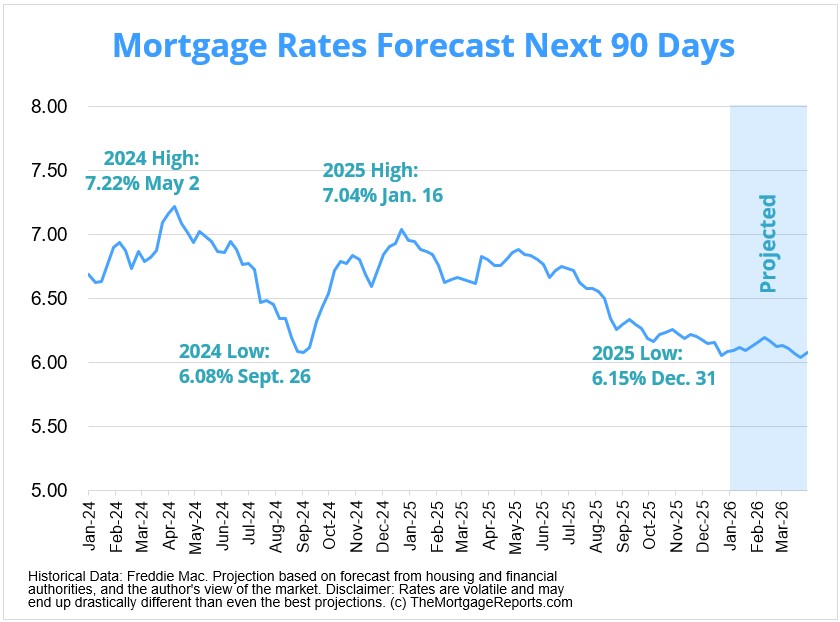

Mortgage rates fluctuated significantly in 2023, with the average 30-year fixed rate going as low as 6.09% and as high as 7.79%, according to Freddie Mac. That range narrowed from 6.08% to 7.22% in 2024, and narrowed further in 2025 between 6.15% and 7.04%.

Find your lowest mortgage rate. Start hereWe may have already seen the peak of this rate cycle. But if inflation rises, mortgage rates could uptrend. Many factors drive interest rates, which makes them subject to volatility and could change direction any given week.

Experts weighed in on whether 30-year mortgage rates will climb, fall, or level off in February.

Expert mortgage rate predictions for February

Hector Amendola, president at Panorama Mortgage Group

Prediction: Rates will moderate

“There are early signs the housing market is stabilizing. Even modest declines in rates are helping restore buyer confidence, and existing home sales are slowly improving. We saw atypical movement in mortgage applications late last year. Mortgage applications increased in the fall and into December, which is typically a slower period. While these trends are encouraging, the long-term health of the housing market will depend on affordable housing supply, price stability, and wages continuing to catch up.”

Dan Cooper, capital markets and servicing EVP at Cornerstone Home Lending

Prediction: Rates will moderate

“Mortgage rates are expected to remain largely unchanged throughout February, as persistently higher-than-desired inflation continues to be offset by a slowly weakening — yet still resilient — labor market. While political developments may cause occasional short-term volatility, those movements tend to be brief and have little impact on the broader rate trend.”

Ralph DiBugnara, president at Home Qualified

Prediction: Rates will moderate

“In the past few years, January and February have been a time for higher mortgage rates, making it a bad start for real estate. I believe that February will hold at the average rate we are seeing through January unless more definitive statements are made on who will be taking over the Federal Reserve chair seat. President Trump has also made statements about the Fed picking up some of their previous policies to buy mortgage back securities. For now I see the average 30-year fixed mortgage rate for February at 6.125% and the average 15-year fixed at 5.625%.”

Charles Goodwin, head of bridge and DSCR lending at Kiavi

Prediction: Rates will moderate

“I expect to see mortgage rates remain relatively stable in February, with room to drift modestly lower even in the absence of a Fed meeting. The 10-year Treasury yield will remain the primary driver, influenced by incoming labor market and inflation data, but I’m also keeping an eye on emerging government policy as an additional factor to watch.

“Recent actions by the current administration seem to target the demand side of housing affordability, including the announcement of an injection of liquidity into mortgage backed securities, which is already applying downward pressure on rates. Absent any major surprises in economic data, I anticipate that mortgage rates will hover around 6% throughout February, with volatility most likely to come from policy or macroeconomic shocks.”

Danielle Hale, chief economist at Realtor.com

Prediction: Rates will moderate

“Financial markets face a lot of wildcards in the next month. We’ll continue to see the rollout of economic data delayed by the government shutdown, we may see a Supreme Court decision on the legality of wide-ranging tariffs, and geopolitical tensions are likely to continue to be a source of volatility. Mortgage rates have recently benefited from the announced purchases of mortgage backed securities by Fannie and Freddie. These purchases have reduced spreads between mortgage rates and other long-term rates, benefiting home shoppers and their buying power.

“Looking ahead, I don’t expect much more reduction from this source. Instead, I expect that the broader economic and political context driving overall rate trends will matter more in the near term. While there is likely to be a lot of noise, and even some modest upward pressure, I expect mortgage rates to remain in the low 6% range, a level that has recently been sufficient to motivate more homebuyers and sellers to act.”

Marc Halpern, CEO at Foundation Mortgage

Prediction: Rates will moderate

“The Federal Reserve is unlikely to lower rates substantially through 2026. We may see one or two cuts in the coming months, but the market is already pricing in a slow and steady reduction until the average 30-year mortgage sits just below 6%. Between now and then, however, there will be no meaningful savings for homebuyers and homeowners. The good news is that the remainder of the year will be a buyer’s market in the housing space.”

Brett Humphrey, founder and CEO at Joynt

Prediction: Rates will moderate

“Mortgage interest rates have declined recently but are likely to remain above 6% for the next several months. The problem is that home prices are elevated making monthly payments out of reach for many buyers. It is time for buyers to consider other options to enter the purchase market. Alternative pathways to homeownership such as buying with friends are a real possibility with the right legal and ethical guardrails in place. There is more than one way to move from renting to buying.”

Tony Julianelle, CEO at Atlas Real Estate

Prediction: Rates will moderate

“For February, I expect rates to stay in the 6% neighborhood. We’ve seen the 30-year fixed hover around 6% to 6.1% in January, and I don’t see anything on the horizon that moves the needle dramatically one way or the other in the near term.

The Fed held steady at their January meeting, which wasn’t a surprise. Inflation is trending in the right direction, getting closer to the 2% target, but it’s not there yet. The labor market is cooling but not collapsing. Both of those factors give the Fed room to be patient, which means we’re probably looking at June at the earliest for the next cut if the data cooperates.

What’s worth watching is the narrowing spread between the 10-year Treasury and mortgage rates. That spread has come back closer to historical norms after being unusually wide for the past couple years. If that trend continues, we could see some incremental improvement in mortgage rates even without aggressive Fed action. There’s also the administration’s recent housing affordability push, including the proposed $200 billion mortgage bond purchase, that could provide a tailwind if it moves forward.

My take: rates bounce around 6% through February, with a reasonable chance we briefly touch below that threshold. But I wouldn’t count on a sustained move into the mid-5s anytime soon without a meaningful shift in economic conditions or a recession scare.”

Sam Williamson, senior economist at First American

Prediction: Rates will moderate

“Mortgage rates are expected to hold in the low-6% range in February as the Federal Reserve kept policy rates unchanged at its January meeting. After three consecutive cuts late last year, policymakers appear inclined to pause and evaluate how those moves are filtering through the economy. At the same time, officials remain split on where ‘neutral’ sits, and the latest dot plot shows a meaningful bloc leaning toward holding steady, signaling a higher bar for additional cuts.

“Those factors limit how far mortgage rates could drift lower in February—particularly if markets begin to price in fewer cuts, spaced farther apart. Rates could edge down if incoming data, particularly the January jobs report, signals renewed labor market weakening that could prompt the Fed to consider cutting sooner. Conversely, firmer inflation or signs of resilience in hiring and the broader economy would likely keep rates near current levels.”

Mortgage interest rates forecast next 90 days

As inflation ran rampant in 2022, the Federal Reserve took action to bring it down and that led to the average 30-year fixed-rate mortgage spiking in 2023.

When inflation gradually cooled in 2024, the Fed made three rate cuts (September, November, and December). Amid the uncertainty and chaos of 2025, the Federal Reserve Open Market Committee held the federal funds rate range steady at its first five meetings, before continued instability and weakened job markets justified three cuts to end the year. The central bank then held rates at its first 2026 meeting, resuming its wait-and-see approach during a time of murky economic outlooks.

Find your lowest mortgage rate. Start hereOf course, rates could rise or fall on any given week due to many factors or if another global event causes widespread uncertainty in the economy.

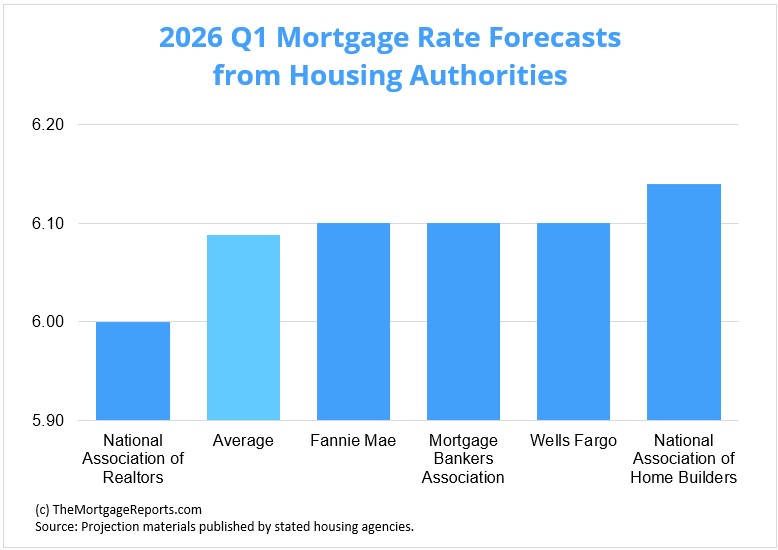

Mortgage rate predictions for 2026

The 30-year fixed-rate mortgage averaged 6.01% as of Feb. 19, according to Freddie Mac. Only one of the five major housing authorities we looked at predict 2026’s opening quarter average to finish below that.

National Association of Realtors sits at the low end of the group, projecting the average 30-year fixed interest rate to settle at 6%. Meanwhile, the National Association of Home Builders had the highest Q1 forecast of 6.14%.

| Housing Authority | 30-Year Mortgage Rate Forecast (Q1 2026) |

| National Association of Realtors | 6.00% |

| Fannie Mae | 6.10% |

| Mortgage Bankers Association | 6.10% |

| Wells Fargo | 6.10% |

| National Association of Home Builders | 6.14% |

| Average Prediction | 6.088% |

Current mortgage interest rate trends

Mortgage rates decreased for the second week in a row.

The average 30-year fixed rate fell to 6.01% on Feb. 19 from 6.09% on Feb. 12. The average 15-year fixed mortgage rate followed suit, falling to 5.35% from to 5.44%.

| Month | Average 30-Year Fixed Rate |

| February 2025 | 6.84% |

| March 2025 | 6.65% |

| April 2025 | 6.73% |

| May 2025 | 6.82% |

| June 2025 | 6.82% |

| July 2025 | 6.72% |

| August 2025 | 6.59% |

| September 2025 | 6.35% |

| October 2025 | 6.25% |

| November 2025 | 6.24% |

| December 2025 | 6.19% |

| January 2026 | 6.10% |

| February 2026 | 6.07% |

Source: Freddie Mac

After hitting record-low territory in 2020 and 2021, mortgage rates climbed to a 23-year high in 2023 before descending over 2024 and 2025. Many experts and industry authorities believe they will follow a downward trajectory in 2026. Whatever happens, interest rates are still below historical averages.

Dating back to April 1971, the fixed 30-year interest rate averaged around 7.8%, according to Freddie Mac. So if you haven’t locked a rate yet, don’t lose too much sleep over it. You can still get a good deal, historically speaking — especially if you’re a borrower with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

Mortgage rate trends by loan type

Many mortgage shoppers don’t realize there are different types of rates in today’s mortgage market. But this knowledge can help home buyers and refinancing households find the best value for their situation.

Find your lowest mortgage rate. Start hereWhich mortgage loan is best?

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high-priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits, which max out at $ in most parts of the U.S.

On the other hand, if you’re a veteran or service member, a VA loan is almost always the right choice. VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance (PMI). But you need an eligible service history to qualify.

Conforming loans and FHA loans (those backed by the Federal Housing Administration) are great low-down-payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620. FHA loans are even more lenient about credit; home buyers can often qualify with a score of 580 or higher, and a less-than-perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates — similar to VA — and reduced mortgage insurance costs. The catch? You need to live in a ‘rural’ area and have moderate or low income to be USDA-eligible.

Mortgage rate strategies for February 2026

Mortgage rates displayed their famous volatility throughout 2024 before 2025’s gradual downtrend. The Federal Reserve ended 2025 with three-straight rate cuts and projected the potential for more in 2026, providing optimism for modestly descending rates over the course of the year.

Find your lowest mortgage rate. Start hereHowever, the Trump Administration’s wealth and power consolidation, alongside unstable inflation caused the Fed to pause in January. As always, the committee said it would adjust its policies as necessary — which could mean additional cuts, none at all or even possible raises.

Here are just a few strategies to keep in mind if you’re mortgage shopping in the coming months.

Be ready to move quickly

Indecision can lead to failure or missed opportunities. That holds true in home buying as well.

Although the housing market is becoming more balanced than the recent past, it still favors sellers. Prospective borrowers should take the lessons learned from the last few years and apply them now even though conditions are less extreme.

“Taking too long to decide to make an offer can lead to paying more for the home at best and at worst to losing out on it entirely. Buyers should get pre-approved (not pre-qualified) for their mortgage, so that the seller has some certainty about the deal closing. And be ready to close quickly — a long escrow period will put you at a disadvantage.

“And it’s definitely not a bad idea to work with a real estate agent who has access to “coming soon” properties, which can give a buyer a little bit of a head start competing for the limited number of homes available,” said Rick Sharga.

If mortgage rates continue on a downward trajectory, more and more buyers will likely enter the market after being priced out on the sidelines. Being decisive (and prepared) should only play to your advantage.

Shopping around isn’t only for the holidays

Since interest rates can vary drastically from day to day and from lender to lender, failing to shop around likely leads to money lost.

Lenders charge different rates for different levels of credit scores. And while there are ways to negotiate a lower mortgage rate, the easiest is to get multiple quotes from multiple lenders and leverage them against each other.

“For potential home buyers, it’s important to get quotes from multiple lenders for a mortgage, as rates can vary dramatically, especially during such a volatile period,” said Odeta Kushi.

As the mortgage market slows due to lessened demand, lenders will be more eager for business. While missing out on the rock-bottom rates of 2020 and 2021 may sting, there’s always a way to use the market to your advantage.

How to shop for interest rates

Rate shopping doesn’t just mean looking at the lowest rates advertised online because those aren’t available to everyone. Typically, those are offered to borrowers with great credit who can put a down payment of 20% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if buying a home)

- Your home equity (if refinancing)

- Your loan-to-value ratio (LTV)

- Your debt-to-income ratio (DTI)

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a ‘real’ rate quote based on your financial situation.

You should get three to five of these quotes at a minimum, then compare them to find the best offer. Look for the lowest rate, but also pay attention to your annual percentage rate (APR), estimated closing costs, and ‘discount points’ — extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Compare mortgage and refinance rates. Start here

Mortgage interest rate FAQ

Current mortgage rates are averaging 6.01% for a 30-year fixed-rate loan and 5.35% for a 15-year fixed-rate loan, according to Freddie Mac’s latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Mortgage rates could decrease next week (Feb. 23-27, 2025) if the mortgage market takes a cautious approach to a possible recession. However, rates could rise if lenders account for the Federal Reserve taking measures to counteract inflation or if a global event brings economic uncertainty.

If inflation continues to dissipate and the economy cools or goes into a recession, it's likely mortgage rates will decrease in 2026. Although, it's important to remember that interest rates are notoriously volatile and are driven by many factors, so they can rise during any given week.

Mortgage rates may rise in 2026. High inflation, strong demand in the housing market, and policy changes by the Federal Reserve in 2022 and 2023 all pushed rates higher. However, if the U.S. does indeed enter a recession, mortgage rates could come down.

Freddie Mac is now citing average 30-year rates in the 6% range. If you can find a rate in the 5s or 6s, you’re in a very good position. Remember that rates vary a lot by borrower. Those with perfect credit and large down payments may get below-average interest rates, while poor-credit borrowers and those with non-QM loans could see much higher rates. You’ll need to get pre-approved for a mortgage to know your exact rate.

For the most part, industry experts do not expect the housing market to crash in 2026. Yes, home prices are over-inflated. But many of the risk factors that led to the 2008 crash are not present in today’s market. Low inventory and massive buyer demand should keep the market propped up. Plus, mortgage lending practices are much safer than they used to be. That means there’s not a subprime mortgage crisis waiting in the wings.

At the time of this writing, the lowest 30-year mortgage rate ever was 2.65%. That’s according to Freddie Mac’s Primary Mortgage Market Survey, the most widely used benchmark for current mortgage interest rates.

Locking your rate is a personal decision. You should do what’s right for your situation rather than trying to time the market. If you’re buying a home, the right time to lock a rate is after you’ve secured a purchase agreement and shopped for your best mortgage deal. If you’re refinancing, you should make sure you compare offers from at least three to five lenders before locking a rate. That said, rates are rising. So the sooner you can lock in today’s market, the better.

That depends on your situation. It’s a good time to refinance if your current mortgage rate is above market rates and you could lower your monthly mortgage payment. It might also be good to refinance if you can switch from an adjustable-rate mortgage to a low fixed-rate mortgage; refinance to get rid of FHA mortgage insurance; or switch to a short-term 10- or 15-year mortgage to pay off your loan early.

It’s often worth refinancing for 1 percentage point, as this can yield significant savings on your mortgage payments and total interest payments. Just make sure your refinance savings justify your closing costs. You can use a mortgage calculator or speak with a loan officer to crunch the numbers.

Start by choosing a list of three to five mortgage lenders that you’re interested in. Look for lenders with low advertised rates, great customer service scores, and recommendations from friends, family, or a real estate agent. Then get pre-approved by those lenders to see what rates and fees they can offer you. Compare your offers (Loan Estimates) to find the best overall deal for the loan type you want.

What are today’s mortgage rates?

Mortgage rates are rising, but borrowers can almost always find a better deal by shopping around. Connect with a mortgage lender to find out exactly what rate you qualify for.

Time to make a move? Let us find the right mortgage for you1Today's mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- http://www.freddiemac.com/research/datasets/refinance-stats/index.page