Key Takeaways

- FHA loans tend to work better for buyers with lower credit scores or higher debt levels, while conventional loans reward stronger credit with lower long-term costs.

- Conventional loans usually offer cheaper mortgage insurance over time, but FHA loans provide more flexible qualification standards upfront.

- Comparing personalized FHA and conventional quotes shows which loan is cheaper for you.

There’s no one-size-fits-all mortgage. When deciding between a conventional loan vs FHA loan, you’ll have to compare costs and benefits based on your personal finances.

A conventional loan is often better if you have good or excellent credit because your mortgage rate and PMI costs will go down. But an FHA loan can be perfect if your credit score is in the high-500s or low-600s. For lower-credit borrowers, FHA is often the cheaper option.

These are only general guidelines, though. And the choice between a conventional vs FHA loan might be different for you. So be sure to look closely at both loan types and choose the best one for your financial situation.

In this article (Skip to...)

- FHA vs conventional

- Down payments

- Mortgage rates

- Credit scores

- Debt-to-income ratio

- Mortgage insurance

- Loan limits

- Additional options

- FAQ

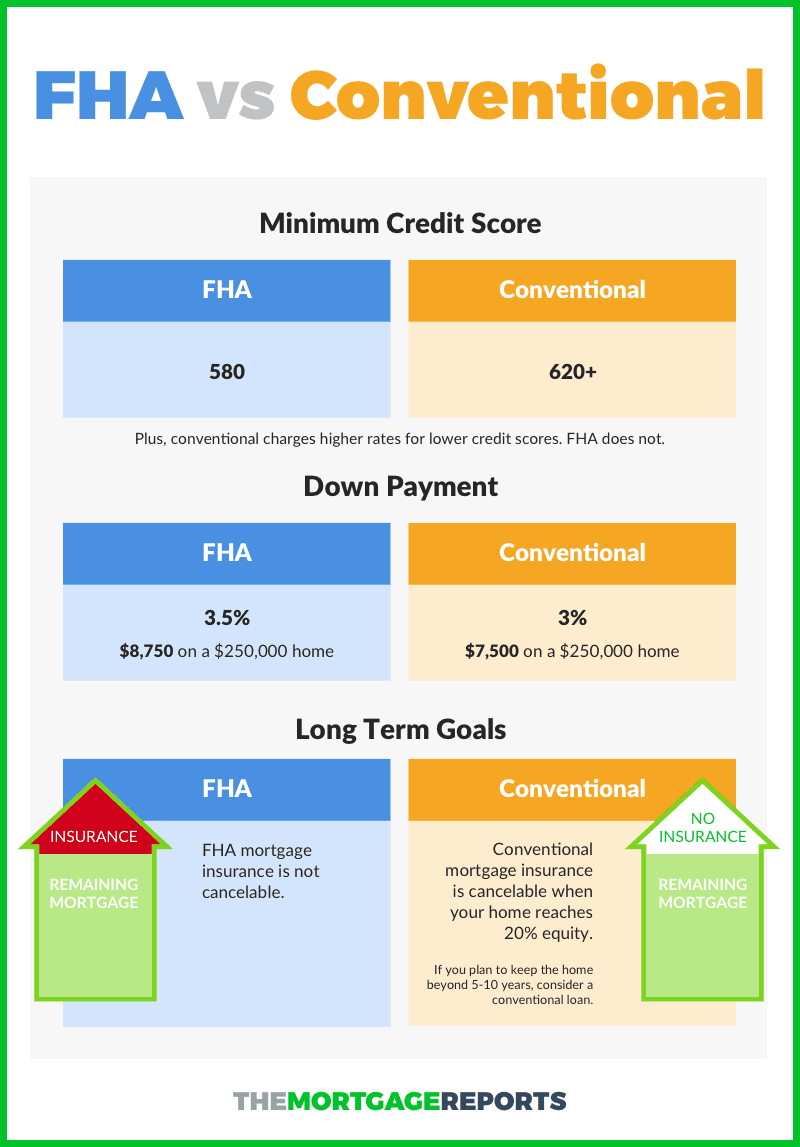

FHA vs conventional comparison chart

There are plenty of low-down-payment options for today’s home buyers. But many will choose either a conventional loan with 3% down or an FHA loan with 3.5% down.

Compare conventional vs FHA loans. Start hereSo, which type of home loan program is better? That depends on your financial situation. Here’s an overview of what you need to know about qualifying for a conventional loan vs FHA loan

| Conventional 97 Loan | FHA Loan | |

| Minimum Down Payment | 3% | 3.5% |

| Minimum Credit Score | 620 | 580 |

| Maximum Debt-to-Income Ratio | 43% | 50% |

| Loan Limit for 2026 (in most areas) | $ | $ |

| Income Limit | No income limit | No income limit |

| Mortgage Insurance | Annual fee | Annual and upfront fee |

FHA vs conventional loans: Down payment

Your down payment plays a major role in deciding between a conventional 97 loan vs FHA loan because each has different minimum down payment requirements. Here’s how they compare:

Compare conventional 97 vs FHA loans. Start here- FHA loans require a minimum down payment amount of 3.5% with a 580+ credit score or 10% with a score between 500-579.

- Conventional 97 loans require a minimum down payment amount of just 3%.

One key difference? All FHA borrowers must pay mortgage insurance, regardless of down payment, while conventional loans only require private mortgage insurance (PMI) if the down payment is less than 20%. But more about mortgage insurance below.

FHA vs conventional loan: Interest rates

At first glance, FHA loan interest rates often appear lower than those for conventional loans. For example, FHA vs conventional rates today might be listed as low as % (% APR) for an FHA loan and % (% APR) for a conventional mortgage*.

Compare conventional vs FHA rates. Start hereBut those numbers don’t tell the full story. FHA vs conventional loan rates vary based on your financial profile, broad economic factors like Federal Reserve policies, and whether you opt for a fixed-rate or adjustable rate mortgage. Which is why a personalized rate quote is the best way to determine your true FHA vs conventional rate.

- FHA loan interest rates are typically lower and more stable, especially for borrowers with moderate credit, since government backing reduces lender risk.

- Conventional loan interest rates vary based on credit score and loan-to-value (LTV) ratio—borrowers with strong credit get the best rates, while higher-risk applicants pay more.

The difference between FHA vs conventional loan interest rates is only part of the equation. Factors like credit score, loan type, and lender pricing can all influence the actual rate you qualify for.

*Current conventional loan vs FHA interest rates sourced from The Mortgage Reports' lender network. Rates are for sample purposes only; actual rates may vary.

FHA vs conventional loans: Credit scores

Your credit score isn’t just a number—it determines your eligibility for a conventional 97 loan vs FHA loan and influences your monthly mortgage payments. The higher your score, the better your mortgage rate and loan options.

Compare conventional vs FHA loan options. Start hereDifference between conventional and FHA loan minimum credit score requirements:

- FHA loans requires a 580 credit score with 3.5% down, or 500-579 credit score with 10% down.

- Conventional loans require a 620 credit score or better.

If your credit score is between 500 and 620, an FHA loan is likely the only type of mortgage you qualify for. But if your credit score is above 620, it’s worth looking into a conventional 97 loan with 3% down.

FHA vs conventional loans: Debt-to-income ratio

Your debt-to-income ratio (DTI) plays a key role in choosing between an FHA vs conventional loan. This ratio compares your monthly debt payments to your gross income, which helps lenders asses whether or not you can afford the new mortgage.

Compare FHA loan vs conventional loan options. Start here- FHA loans allow for a higher DTI—up to 50% in some cases.

- Conventional loans typically cap DTI ratios at 43%, meaning monthly debts can’t exceed 43% of your income.

However, lenders set their own requirements, so if your DTI ratio is above 45%, you may need to shop around for FHA-approved lenders. This is especially true in high-cost areas, where real estate prices drive up mortgage payments and push DTI limits higher.

FHA vs conventional loans: Mortgage insurance

FHA and conventional loans both charge mortgage insurance. But the cost varies depending on which type of loan program you have and how long you keep the mortgage.

Compare home loan options. Start here- FHA loans: The costs for FHA mortgage insurance premium (MIP) are the same for most borrowers: 0.55% of the loan amount per year, with a one-time upfront premium of 1.75%.

- Conventional loans: The costs for private mortgage insurance (PMI) vary depending on your credit score and loan-to-value ratio. You’ll only pay PMI when you put less than 20% down, and you’ll only continue to pay monthly premiums until you reach 20% home equity.

| Conventional Loans | FHA Loans | |

| Mortgage Insurance Type | Private Mortgage Insurance (PMI) | Mortgage Insurance Premium (MIP) |

| Upfront Mortgage Insurance Premium | n/a | 1.75% of loan amount |

| Annual Mortgage Insurance Rate | Up to 2.25% of loan amount | 0.55% of loan amount |

| Duration | Until the loan reaches 80% LTV | 11 years (down payment of 10% or more) OR life of the loan (down payment of 3.5% to 10%) |

The cheaper mortgage insurance option depends on your financial situation. With a conventional 97 loan, insurance drops at 80% loan-to-value (or 20% home equity, as loan officers call it). Over time, this can make a conventional 97 vs FHA loan the better value, especially for borrowers with good credit.

FHA vs conventional: Loan limits

Both the FHA and conventional loans have limits on the amount of money you can borrow.

Compare home loan options. Start here- FHA loan limits for a single-family home is $ in most of the U.S. in 2026.

- Conventional loan limits for a single-family home is $ in 2026.

Any loan amount that exceeds these limits is considered a non-conforming loan or jumbo loan.

FHA vs conventional loan: Home appraisals

One of the biggest differences between an FHA loan vs conventional is the appraisal process. In competitive markets, sellers may be hesitant to accept FHA-backed offers due to stricter FHA appraisal standards.

- FHA appraisals: These follow stricter guidelines, similar to VA and USDA loans. In addition to determining market value, appraisers assess the home’s safety, security, and overall condition to meet FHA requirements.

- Conventional appraisals: Lenders require an appraisal to confirm the home’s market value. Some buyers may qualify for hybrid appraisals or property inspection waivers, making the process faster and more flexible.

Because FHA appraisals have more stringent requirements, sellers may choose between an FHA vs conventional loan based on how quickly and easily the home is likely to appraise. If an FHA appraisal uncovers issues, the deal could fall through, forcing the seller to start over and disclose any flagged problems to future buyers.

Compare conventional and FHA mortgage rates. Start hereFHA vs Conventional infographic

Alternative low-down-payment loan programs

If you’re still undecided about conventional 97 vs FHA loans, explore other low-down-payment mortgage options that offer little to no upfront costs to make homeownership more accessible.

Compare your home loan options. Start here- Fannie Mae HomeReady: This home loan offers below market interest rates, reduced private mortgage insurance costs, and it allows the income of everyone living in the household to qualify. However, there are income limits, loan maximums, and you’ll need a FICO score of 620 or more and a DTI of 50% or less

- Freddie Mac Home Possible: Similar to HomeReady, it has income and loan limits, and it requires a minimum credit score of 660, 3% down payment, and DTI below 43%. However, Freddie Mac Home Possible offers flexible loan approval requirements that help low-income families become homeowners

- VA loan: This mortgage loan requires no down payment and offers flexible credit score minimums and below-market rates. VA loans have no maximum loan amounts. Plus, bankruptcy and foreclosure are not immediate disqualifications. Yet, this program is only available to eligible service members and veterans

- USDA loan: This rural housing government-backed loan requires no down payment and has no maximum home purchase price. Although there are drawbacks. This government-agency loan does have property standards that require the home to be located in a rural area. There are also income limits for the buyer, and it does carry mortgage insurance for the entire loan term

Most low-down-payment loans are for primary residences only—not vacation homes or investment properties. For most first-time home buyers, the choice comes down to conventional 97 loan vs FHA, as VA loans are for military borrowers, USDA loans have location and income limits, and HomeReady has income restrictions.

Conventional loan vs FHA loan FAQ

Compare FHA and conventional loan options. Start hereThe better loan depends on your financial situation. If your credit score is below 680 or your debt-to-income ratio (DTI) is higher (up to 50%), an FHA loan vs conventional loan might be the better choice. However, if your credit score is higher, a conventional loan vs FHA often offers lower interest rates and monthly mortgage repayments.

You can switch from an FHA to a conventional loan by refinancing your mortgage. This means you get a new conventional loan to pay off your existing FHA loan. This might make sense to do if you have at least 20 percent equity in your home and a 620 or higher credit score. Then, you may be able to save by switching from an FHA to a conventional loan with no PMI.

A conventional loan vs FHA can be more cost-effective for borrowers with higher credit scores. If you put down at least 20%, you won’t need private mortgage insurance, unlike FHA loans, which require mortgage insurance regardless of down payment size. The conventional 97 loan vs FHA allows for just 3% down, while FHA loans require at least 3.5%.

Not at all. FHA loans are a great option for borrowers who need a low down payment (3.5%) and have a credit score as low as 580. They provide a more accessible path to homeownership compared to a conventional vs FHA loan, which has stricter requirements.

One downside of an FHA loan vs conventional loan is the mortgage insurance requirement, which applies for the life of the loan unless you refinance. If you have strong credit or a large down payment, a conventional loan vs FHA may be a better choice.

Most conventional loans require a credit score of at least 620, though some lenders may have higher minimums. Plus, your conventional mortgage rate will be better the higher your credit score is. If your credit is on the lower end, be sure to shop around with different mortgage lenders for the best deal.

FHA loans generally require a credit score of 580 or higher. If your credit score is between 500-579, you may still qualify, but a minimum down payment amount of 10% is required.

Conventional loan vs FHA loan interest rates can vary. While FHA loan interest rates are often lower due to backing by the Federal Housing Administration, conventional rates may be more competitive for borrowers with strong credit scores (typically 680+).

You might qualify for a conventional loan vs FHA if you have a credit score of at least 620, a debt-to-income ratio of 43 percent or lower, a 3 percent down payment, and a steady, two-year employment history proven by tax returns and bank statements. For a conventional 97 loan vs FHA, only single-family homes qualify—multi-unit properties aren’t eligible.

A conventional loan vs FHA requires a higher credit score—typically 620 or more. FHA loans allow for lower credit scores (500-580), making them more accessible for borrowers with limited credit history.

Mortgage insurance is a type of insurance that protects lenders in case the borrower defaults on the loan. With a conventional loan, private mortgage insurance (PMI) is generally required if the down payment is less than 20%. With an FHA loan, mortgage insurance premiums (MIP) are required for the life of the loan.

FHA loans generally have more flexible underwriting requirements compared to conventional loans. They may allow for higher debt-to-income ratios, lower credit scores, and non-traditional credit histories. Conventional loans may have stricter underwriting requirements.

Yes, you can refinance from an FHA loan to a conventional loan. Refinancing may help you get a lower interest rate, lower monthly payments, or eliminate mortgage insurance. However, it’s important to evaluate the potential costs, benefits, and qualification requirements before proceeding with the refinance.

Conventional loan vs FHA: The bottom line

For today’s low down payment home buyers, there are scenarios in which the FHA loan is what’s best for financing. But there are scenarios in which the Conventional 97 is the clear winner. Mortgage rates for both home loans should be reviewed and evaluated.

Ready to make a home purchase? Talk with a loan officer about your mortgage options. You should compare personalized quotes for both FHA and conventional loans to see which one is cheaper for your situation and suits your needs best.

Time to make a move? Let us find the right mortgage for you