How to build (and pay for) your dream home

Today’s tight housing markets and low interest rates have raised home prices in many areas.

Instead of competing to buy an existing house, you might consider building a new home.

There are great perks to building your own home: you have control over the layout and materials, you can choose the location, and there’s no competition from other buyers.

However, financing a home construction project is more complicated than buying an existing home. So it’s important to understand the process and costs involved before jumping in.

Check your construction loan optionsIn this article (Skip to…)

- Basics of building a house

- How construction loans work

- Construction loan costs

- Types of construction loans

- Timeline for construction loans

- Choosing a contractor

- How much can I borrow?

- Building a house vs. buying

Building a house: the basics

Building a home is very different from buying a home off the market — especially when it comes to financing the cost of construction.

A mortgage on an existing home is fairly straightforward: you take out a single loan which involves one application, on appraisal, one closing date, and one set of closing costs.

With a new home construction, the process can be complicated. There’s not just a mortgage to consider, but also financing for the land, labor, and materials.

If you’re considering building a home, here are a few things to keep in mind:

- Financing your dream home project may require a series of loans with multiple rounds of paperwork and fees. However, certain loan programs and lenders can consolidate this process

- “One-time-close” construction loans could help you finance the land, construction, and mortgage all with a single loan

- Expect to make a larger down payment for a construction loan than for a traditional mortgage — typically 20% to 25% (versus as little as 3% for a home purchase)

- Planning is essential. The lender has to approve your builder and your construction plans along with your personal finances

- Building versus buying — Costs vary widely by location, but may be similar in many areas

If you want a custom home in your ideal location — and you have the time and money to make a construction loan happen — building a new house could be a great choice.

If you’re in a rush, though, you might be better off buying an existing property off the market.

Purchasing a home is usually faster than building one, and you’ll typically have lower hurdles to clear for things like down payment and credit score.

How construction loans work

Building your own home could require one, two, or even three separate loans. For example, you need financing to:

- Buy the land

- Pay the construction costs

- Pay off the lot and construction loan with a standard mortgage, which you can pay off over up to 30 years

‘True’ construction loans are short-term loans, usually 6-18 months. They’re used only to finance home construction (not the land or permanent mortgage). And in most cases, you pay interest only on what you borrow.

Construction loan rates are usually variable interest rates based on the prime rate plus a certain percentage

Some programs let you wrap construction loan interest into the permanent financing. This can be helpful if you’re also trying to pay an existing mortgage or rent while building your new house.

How much does a home construction loan cost?

Expect to pay more for construction financing than you would for a traditional home loan — even if the cost to build or buy is virtually the same.

New home construction loans cost more for a couple reasons:

- More risk — Lenders take on a bigger risk because the construction process includes more variables. And, the home being used as ‘collateral’ for the loan amount does not yet exist. This risk translates into higher interest rates compared to standard mortgages

- More paperwork — Money is disbursed at different points in the construction process, and the lender has to verify enough work has been completed to justify the next “draw” of funds

Lenders also require lien waivers proving builders have paid their subcontractors before issuing draws.

Draws can be done in stages, for example, a lender might divide the project into seven stages and release money at each stage. Or they may allow builders to request money based on the percentage of completion.

In general, the more draws allowed, the nicer it is for the builder. However, every draw adds to your costs because of the admin work involved.

Is it cheaper to buy or to build a home?

The idea of building a new home might scare you because you believe it’s the pricier option. But, depending on location and home features, the cost of building a house is comparable to buying an existing home.

The average new home costs $296,652 to build, according to the National Association of Home Builders’ 2020 study.

Real estate site Zillow reports the average price of an existing home at $269,039.

Both of these numbers vary widely — by hundreds of thousands of dollars in some cases — depending on the state and specific area where you plan to buy or build.

Verify your home buying eligibility

Types of construction loans

Some home buyers use up to three separate loans to build a home: one loan to buy the land, one to build the home, and one to convert the construction costs into a permanent mortgage (which works like a typical home loan).

You could consolidate these steps, especially if your builder is willing to finance construction costs until you use a standard mortgage loan to pay off the builder.

Or, you could look for a mortgage that finances the entire process with one loan.

One-time-close construction loans

Some lenders offer “one-time-close” or “construction-to-permanent” loans. These are construction loans that convert to traditional mortgages after you get the certificate of occupancy for your home.

For instance, Fannie Mae, FHA, VA, and USDA programs all offer one-time close construction loans.

These mortgages require only one closing, and you get approved only once, alleviating the risks of two approval processes. If you get a fixed-rate mortgage, you can lock in your interest before construction begins.

For more information, see:

- FHA one-time-close construction loans

- VA one-time close construction loans

- USDA one-time-close construction loans

However, these mortgage programs can be harder to find from mainstream lenders, so you should expect to shop around if you want one of these loans.

Getting separate loans for each stage of the construction process might be easier from a lender standpoint. It might give you more control as well, because you can shop for the best rates on each loan.

However, using two or three loans means paying two or three sets of closing costs — and going through the underwriting process multiple times.

Check your home loan optionsFannie Mae construction-to-permanent loan

Many shoppers who prefer the “single-closing” strategy choose Fannie Mae’s construction-to-permanent loan option.

With this program you’d make no mortgage payments while the home remains under construction. Instead, loan repayment begins after closing.

Like any construction-to-permanent loan, Fannie Mae will roll construction costs into your permanent mortgage once you have a certificate of occupancy.

This loan can generate “instant home equity” because Fannie Mae bases its loan-to-value ratio on construction costs, including lot acquisition, assuming that number is lower than the home’s eventual value.

For example, if a home costs $200,000 to build, but an appraiser values it at $250,000, Fannie Mae would still base its LTV on the $200,000 in construction costs. You could put $40,000 down (20% of $200,000) and take out a $160,000 loan.

Because of the home’s value of $250,000, you’d instantly have $90,000 in home equity ($250,000 minus the $160,000 loan balance). It’s important to remember construction costs and property values vary a lot by state.

Two-time-close loans

The other financing option is a two-time-close construction loan — two separate loans. You’ll get a construction loan first, and then repay it when construction ends by refinancing into a permanent mortgage.

This means applying for two different loans with two closings, and all the associated closing costs for both.

Many lenders require you to have a permanent mortgage lined up before they’ll release funds for the building process.

This two-loan strategy gives you flexibility if there’s a construction delay requiring you to extend the construction loan term.

And, you may have access to better refinancing choices than with a construction-to-permanent or one-time-close loan.

Which construction loan is best?

The beauty of a construction-to-permanent mortgage is that you avoid multiple loan applications, packages of lender fees, and title charges.

However, the major drawback is that these loans lock you in with your construction lender.

You don’t always know what mortgage rate you’ll be offered until the construction is complete. Or if you are locked in, rates may have dropped during the construction period, and you may be able to do better with another lender.

One-time-close construction loans can be simpler and cost less upfront, but you might end up with a higher mortgage rate in the long run.

Never accept your lender’s permanent rate without comparing current mortgage rates from its competitors.

One-time-close mortgages can save money by consolidating some fees, but it’s no savings if your permanent loan’s interest is significantly higher than current mortgage rates.

If you plan to keep your home and mortgage for many years, it may pay to replace your construction-to-permanent loan with a better one. You may also be able to negotiate a lower rate with your construction lender if you bring in offers from other lenders.

Refinancing a construction loan to a mortgage loan

If you use a short-term construction loan that only covers building costs, you’ll likely need to refinance into a traditional mortgage once construction is complete.

People who take out construction-only loans may be owner-builders who plan to act as their own contractor or do the lion’s share of the building themselves.

Many mortgage lenders won’t work with owner-builders because they can’t be certain that the house will really be a primary residence and not a “spec” deal.

You might also choose a construction-only loan to have more control over the permanent financing.

You’d be able to shop for the lowest mortgage rate once the home becomes ready for occupation.

How to shop for a construction loan refinance

When your home nears completion, start comparing mortgage rates and interviewing lenders. Don’t let your credit score drop during construction, because that will increase your interest rate and make approval harder.

Just about any program open to traditional home refinances should be available to you as well. Get several quotes from competing lenders, and try to get them on the same day so you can make an effective evaluation.

Once you have your lender, get your application approved as soon as you can. You’ll not want costly delays once your home is ready to occupy.

How long does it take to get a home construction loan?

A 90-day approval process on construction loans is common, because the lender must approve the project and the builder, not just you.

Your builder should submit construction plans — including a description of materials and a cost breakdown — for the lender to evaluate.

The builder’s construction plans should include floor plans, ceiling heights, timetables — everything it will take to create your dream home. Experienced builders will likely already know about your lender’s requirements.

When the lender has your builder’s construction plans in hand, it will appraise the value of the home upon its completion.

Construction loan approval often takes up to 90 days. Building the home itself can take anywhere from 4 months to over a year.

Your lender will also evaluate your personal finances during the approval process.

For most programs, you need a solid credit history, a good FICO score, and a reliable income. You may have to make loan repayments during construction. Lenders prefer you have adequate savings for cost overruns and unexpected costs.

Most lenders are helpful in this process, even providing builder approval packages.

However, approval policies, costs, and loan terms can vary significantly. So compare construction loan costs to see what you can afford and interview lenders carefully before applying for loans.

Start your home loan approval todayHow long does it take to build a home?

On average, it can take anywhere from four to 12 months to build a home.

The amount of time varies with the complexity of the job, the skill of the builder, and outside forces like the weather.

A small production home on a fraction of an acre lot might take four to six months. An enormous custom home on an acre or more takes 10-16 months. Labor and materials availability also influence construction completion dates.

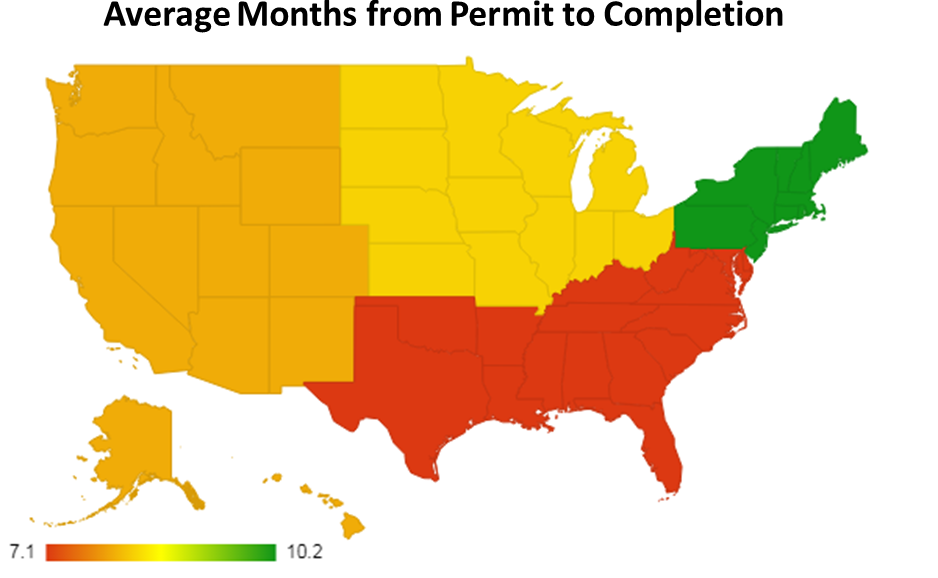

According to the U.S. Census, average build times also depend on your location:

Source: U.S. Census, Characteristics of New Housing, 2018. Image: ThePlanCollection.com

Pre-construction issues frequently slow projects down when clearing and prepping land reveals surprises, especially on large lots.

Permitting can also throw off your schedule and may be a bit political. And your municipality requires you to get permits, code inspections, and approvals throughout construction.

The bigger the home you’re constructing, the more patience and persistence you’ll need.

Choosing a builder or contractor

To get financing for your dream home project, you’ll need to work with a qualified builder or general contractor.

You may have imagined being an owner-builder, and you may have the skills to make this happen.

But in reality, you’d need to be an owner-builder with deep enough pockets to finance the project yourself, because most banks won’t back a do-it-yourself project.

In addition, most lenders have standards for builders, and if yours doesn’t meet them, you can’t finance your construction with a mortgage lender.

This can be an advantage for you — by protecting themselves from unqualified builders, lenders are also protecting you.

How to find a qualified builder

You can check your builder’s licensing status and usually find complaints by looking online for your state contractor’s board.

Or, just search for your prospective contractor’s name, location, and the word “license” to get this information.

Personally interview at least three builders or general contractors on your short list and learn all you can about how they complete construction projects. Know whether your personalities mesh, because you’ll work with them almost daily for six months or longer.

Note what’s included and what’s guaranteed (defects, overruns, and deadlines, for instance).

As with any expensive contract, don’t sign off on anything you don’t understand. Get a buyer’s real estate agent specializing in new construction or a real estate attorney to help if you need it.

How much can I borrow for my home building project?

When you’re buying an existing home, it’s possible to finance up to 100% of the home’s value depending on your loan program.

Not so with construction loans. Expect your lender to finance only 75% to 80% of your home’s eventual value.

This leaves a 20% to 25% down payment requirement for you, the borrower.

Lenders require large down payments because building your own home requires a commitment for up to a year or more. Borrowers who make a substantial down payment tend to be less likely to walk away mid-project.

The amount you can borrow after your down payment depends on the loan program you use.

FHA and conventional loans have different maximums, and lenders may set their own limits. So check with your lender to see how much you can borrow based on your loan type and finances.

Find out how much home you can afford

You control the out-of-pocket costs for building a house by creating an affordable budget.

Once you know what you can spend, work with a reputable builder who knows the area and who can tell you what you can and can’t afford to include in your new house.

The Mortgage Reports has a home affordability calculator you can use to discover how a monthly payment translates to a loan amount, or how much home you can afford given your earnings and current expenses.

Begin with the basic essentials, adding a 10% cushion for cost overruns. If you can afford additional amenities, add them in.

Construction costs can escalate, so it’s smart to budget for this. For this reason, lenders often build in 5% to 10% for contingencies.

For instance, if you plan to spend $200,000 building, you may have to qualify for a $220,000 loan.

The builder should include a description of materials and a cost breakdown, which you’ll need when you apply for a construction loan.

Verify your maximum loan amount

Building versus buying your dream home

Building versus buying is a personal choice, and your personal finances and preferences should guide you.

As you decide, consider these pros and cons.

Pros of buying an existing home

Buying a home can be faster and easier than building one.

You’ll avoid unforeseen delays in the building process, and you don’t have to pay for rent or a mortgage while waiting for your new home to be completed.

In addition, existing homes are often in established residential neighborhoods. Typically, that means they’ll have mature trees and landscaping that adds substantial home value.

Mature trees and shrubbery can also lower energy prices. In the summer, shade from tall trees reduces cooling costs. During the winter, mature trees and shrubs decrease heating costs by blocking winds.

If you buy in a well-developed area, you may also have amenities like shops, restaurants, and entertainment within walking distance.

Cons of buying an existing home

Depending on its age, purchasing an existing home means buying all of its problems.

Older houses have more wear and tear, are often less energy-efficient, and can sometimes require expensive maintenance. How much those are and when they’re necessary depends on the home’s age.

About 50% of the average house needs replacement during its first 30 years. A house with a heating or cooling system, appliances, or a roof past half its useful lifespan means you’ll probably end up replacing those items.

Homeownership costs add up to thousands of dollars, depending what repairs or replacements are necessary and where you live.

By building a house, you might not have any significant maintenance costs for the first 10 years. And you will probably have some sort of warranty protection.

Research shows that homes built after the year 2000 save their owners 21% annually on energy costs.

Verify your home buying eligibilityPros and cons of building a new home

Building your home puts you in control of all the decisions, big and small, that go into a new home — from the square footage of the storage space to the height of the backyard fence.

But there are potential pitfalls when building a new home, too. Here’s what you should know.

Pros of building a home

Retrofitting an existing residence can get pricey. A major advantage of building new is that, from layout to location, you can tailor it to your tastes and family needs.

When you build a house, you can put it where you want it and create the environment you need.

A new house also gets equipped with the latest features like energy-efficient materials, technology-friendly wiring, and security systems.

And you have almost complete control over the construction materials used in your house, as well as the cost of building a home.

Your builder selection is probably the most important decision you’ll make, so don’t enter the relationship lightly.

That means you can make aesthetic decisions (like hardwood vs. carpet) as well as practical decisions. For instance, you might avoid toxins in the materials, making the interior environment safer for you and your family.

In addition to making your home eco-friendly, adding Energy Star or green appliances makes it energy-efficient, reducing utility costs. You can choose to invest more in some areas of the house and less in others.

There are other financial benefits to building your own house, too:

- You don’t pay for premium features you don’t want, like a finished attic or wall-to-wall carpeting

- You may get more value for money because you get the layout you desire

- Maintenance and repair costs will be low for the first 7 to 10 years. Minor repairs get covered under your home warranty, and you usually have a one- to ten-year builder warranty

There aren’t likely to be any unexpected negative surprises if you choose the right builder or contractor for your project, and get your home built properly.

Your builder selection is probably the most important decision you’ll make, so don’t enter the relationship lightly.

Cons of building a home

Home building can be complicated. It may disrupt your lifestyle.

What if the timing doesn’t work out and you sell your current home, but have to wait several more months to complete your new home? Chances are you’d have to put everything in storage and find temporary housing.

Home construction projects are prone to:

- Delays from improperly structured contracts

- Delays from changes to the construction plan

- Cost overruns

- Weather delays

- Delays because materials were delivered late

Good planning can help avoid many of these problems, but others may happen unexpectedly.

For example, following Hurricane Katrina, the cost of building materials soared — not something you’d necessarily predict.

Botched or late custom orders are not unusual. And, when a builder or subcontractor fails to follow the most recent home blueprint, the effect can be disastrous.

As long as the mistake isn’t something huge like improperly installed load-bearing walls, it’s fixable, though not usually cost-free.

Sometimes, builders or general contractors hide or cause construction defects. There may be home warranty problems that you don’t know about. If your builder or home warranty doesn’t cover these defects, you may face large costs to correct problems.

Buying a fixer-upper: A happy medium?

One way to split the difference between buying and building is rehabbing. That is, you buy a house with a lot and foundation, and finance your renovations right into the purchase.

You can do this with one of several products:

- The FHA 203(k) loan bases your loan amount on the improved value of the property and requires only 3.5% down for most applicants

- Fannie Mae’s HomeStyle mortgage allows you to finance second homes and rentals as well as primary residences. Put as little as 5% down

- If you have low-to-moderate income, the HomeReady loan can get you in the door with just 3% down and flexible underwriting

- Freddie Mac’s Renovation Mortgages are similar to Fannie Mae’s products. Guidelines do vary, though, so you might get approved for one even if you’re declined for another

As with any mortgage, it pays to compare offers from multiple lenders.

Building a house: The bottom line

Homeownership has lots of advantages whether you build or buy.

Succeeding in building your own home requires a strong team. Your builder and your lender will be key members of this team. They can make your dream home a reality.

Select your builder and lender carefully, and you’ll have a great chance to build the home you want within your budget.

Time to make a move? Let us find the right mortgage for you