What is a piggyback mortgage?

A piggyback loan — also called an “80/10/10 loan” — uses two separate loans to finance one home purchase. The first loan is a conventional mortgage that typically covers 80% of the home price. The other loan is a second mortgage (usually a HELOC) that covers 10 percent. The remaining 10% will be covered by your down payment.

Why would someone use two loans to buy one home? Because the piggyback mortgage simulates a 20% down payment with only 10% out of pocket. So you get to enjoy lower rates and no PMI without saving extra cash.

Compare your loan options. Start hereIn this article (Skip to…)

- How piggyback loans work

- Piggyback loan benefits

- Piggyback loan example

- Requirements

- How to get one

- Types of piggyback loans

- Financial planning

- Refinancing

- Piggyback loan FAQ

How a piggyback loan works

A piggyback loan combines two separate home loans — a larger first mortgage and a smaller second mortgage — to help you buy a home more affordably. The second mortgage acts as part of your down payment. When you make a 10% cash down payment and take out a 10% second mortgage, you’re effectively putting 20% down. This leads to lower interest rates and no private mortgage insurance (PMI).

Compare your loan options. Start hereA piggyback loan is often called an “80/10/10 loan” due to its structure: a first mortgage for 80% of the home price, a second mortgage for 10% of the home price, and a 10% down payment.

Components of a piggyback loan

The first part of a piggyback loan — your 80% conventional loan — works like any other primary mortgage. It covers the majority of the home’s purchase price and you’d qualify based on your credit score, debt-to-income ratio, and income. Most buyers get a 30-year, fixed-rate loan.

The second loan, which often covers 10% of the purchase price, is usually a home equity line of credit (HELOC). A HELOC is a “second mortgage,” meaning it’s secured by your home equity and has its own monthly payment, separate from your first mortgage.

HELOC terms can vary. Most have variable interest rates, which means the loan’s rate and payment could change monthly. Interest-only HELOCs charge only interest during the first 10 years of the loan term, but those are best for temporary financing since they cost more in the long run.

Benefits of a piggyback mortgage

A piggyback loan simulates a 20% down payment on a conventional mortgage. Putting 20% down isn’t required, but doing so can benefit home buyers in a variety of ways.

Compare your loan options. Start here- Lower interest rates: Lenders can offer lower rates when you’re borrowing only 80% of the home’s value or less

- No private mortgage insurance: Twenty percent down eliminates monthly private mortgage insurance premiums. PMI is required with less than 20% down

- Smaller loan size: The more you put down, the less you’ll need to borrow with your primary mortgage. Shaving 10% off the loan size allows some buyers to stay within conforming loan limits, which can eliminate the need for a more expensive jumbo mortgage

Of course, you have to factor in the monthly payment on your second mortgage. While you’d be saving money on your primary mortgage payments, the HELOC comes with its own cost that will be eliminated only when you pay the loan off. Borrowers who save more on the first loan than they spend on the second loan benefit from piggybacking.

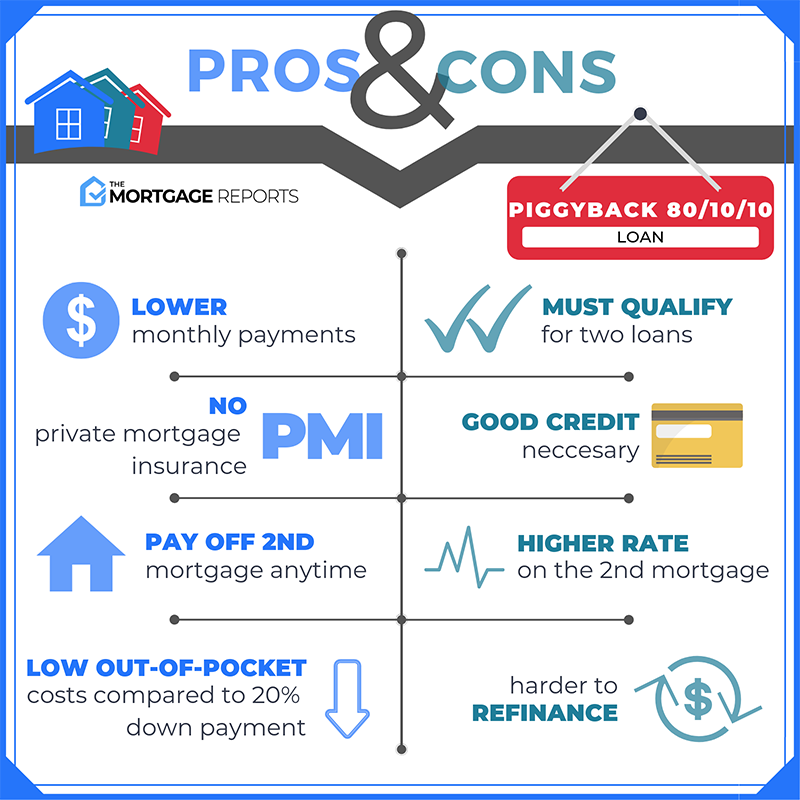

Pros of a piggyback mortgage:

- Lower out-of-pocket down payment

- Lower monthly mortgage payments

- No PMI premiums

- Second mortgage can be paid off anytime

Cons of a piggyback mortgage:

- It’s harder to qualify for two loans

- Second mortgage has a higher rate

- Second mortgage often has a variable rate

- Refinancing is more complicated

Piggyback mortgage example

Let’s say you’re buying a $400,000 home. You have $40,000 in your savings account, which is enough for a 10% down payment. You’ll need a mortgage loan to pay the remaining $360,000.

Compare your loan options. Start here- Using a 30-year, fixed-rate mortgage at 6.25%, your monthly payment for principal and interest would be $2,275

- You’d also pay private mortgage insurance (PMI) premiums of about $300 per month, based on a PMI rate of 1% of the loan amount

- For this example we’ll say property tax and homeowners insurance add $500 a month

- Your total house payment with one mortgage would be $3,075

If you used a piggyback loan to buy this same $400,000 home, your second mortgage would provide another $40,000 to match your $40,000 cash down payment. As a result, your primary mortgage amount would go down to $320,000.

- Using a 30-year, fixed-rate mortgage at 6%, your primary mortgage payment would be $1,970

- Your HELOC, at 6% interest, would require monthly payments of about $286

- No PMI is required since you’re putting 20% down

- We’re still estimating $500 a month for property tax and insurance

- Your total house payment with a piggyback loan would be about $2,756

As you can see, combining two loans in this scenario saved more than $300 a month — mostly because this plan dodged PMI premiums, but also because of the lower interest rate you get with 20% down. Although the PMI is just temporary, the lower rate is permanent, which adds to long-term savings.

Compare your loan options. Start here

Piggyback mortgage requirements

Remember that when you apply for an 80/10/10 mortgage, you’re actually applying for two loans at once. You have to qualify first for primary mortgage as well as a home equity line of credit (HELOC). That makes qualifying for a piggyback loan a little tougher than qualifying for a single mortgage.

Compare your loan options. Start hereFor example, you might be able to get a conventional loan for 80% of the home’s value with a credit score of just 620. But to qualify for a HELOC as well, you’ll likely need a credit score of 680-700 or higher.

You’ll also need a debt-to-income (DTI) ratio no higher than 43%, and the DTI calculation must account for both monthly mortgage payments.

Finally, HELOCs have higher interest rates than 30-year mortgages. So a strong application is important to get you the lowest rate possible on both loans and keep your borrowing costs down.

How to get a piggyback loan

When you get a piggyback loan, you’re applying for two separate mortgages at once. Some lenders let you get both mortgages in the same place. But more often, borrowers end up getting their first mortgage from one lender, and their second mortgage from another.

Compare your loan options. Start hereLuckily, you don’t have to go out and find that second mortgage on your own.

Most borrowers looking for an 80/10/10 loan simply tell their loan officer that’s what they want. The loan officer can then recommend a company to use for the second mortgage, which they will have worked with in the past. In this way, your “first mortgage” lender can help shepherd both applications through at once, making the process a lot more streamlined.

If you do go it alone and find your own second mortgage, make sure your primary mortgage lender knows your plans.

Compare your loan options. Start here

Types of piggyback loans

There are two ways a piggyback loan can be structured. The first — an 80/10/10 loan, which we just looked at — is the most popular. But a 75/15/10 loan is also an option. With this variation, the primary mortgage finances only 75% of the home price instead of 80 percent.

Compare your loan options. Start here80/10/10 piggyback structure:

- 80% of the purchase price is financed by the primary mortgage

- 10% comes from a second mortgage, often a HELOC

- 10% still comes from the buyer’s cash down payment

75/15/10 piggyback structure:

- 75% of the purchase price is financed by the primary mortgage

- 15% comes from a second mortgage, often a HELOC

- 10% still comes from the buyer’s cash down payment

Some home buyers use the 75/15/10 structure to avoid getting a jumbo mortgage or to finance a home that requires a higher down payment (like an investment property).

How piggybacking can avoid jumbo loans

By definition, a conforming loan follows guidelines set by Fannie Mae and Freddie Mac. Conforming loans must be within local loan limits set by these agencies each year. For example, in 2026, the conforming loan limit for most of the U.S. is $.

A mortgage that exceeds this maximum loan size won’t qualify for a conforming mortgage. The buyer would need a jumbo loan instead. Jumbo loans often cost more and often have stricter qualifying rules.

In some cases, making a larger down payment can push a loan back within conforming loan limits. If you don’t have the upfront cash for a larger down payment, a piggyback mortgage could be the answer.

Piggybacking back within loan limits: an example

For this example, we’ll say you’re buying a $850,000 home and you have saved up $85,000 for a down payment. You’d need a $765,000 mortgage to finance the rest of the home price. That’s higher than the conforming loan limit for most of the U.S., meaning this scenario would require a jumbo loan.

Now let’s try the 75/15/10 piggyback loan, instead. This plan would add another 5% — $42,500 — to your down payment, lowering your primary loan amount to $637,500. That’s almost $10,000 less than the conforming loan limit for 2022.

You could now qualify for a conventional loan, thanks to the down payment boost from your second mortgage.

75/15/10 piggyback for condos

It’s also common to see the 75/15/10 used to buy a condominium. This is because mortgage rates for condos are higher when the loan-to-value ratio (LTV) of the first mortgage exceeds 75 percent.

To avoid paying higher rates, condo buyers may limit their first lien size to 75% of the condo’s value. They then make a 10% down payment and the remaining 15% is covered by a HELOC.

Compare your loan options. Start here

Piggyback loans for financial planning

Piggyback loans offer another distinct advantage over “one-loan” programs: They can be excellent tools for financial security and planning. That’s because of how the piggyback loan is structured. The second loan in a piggyback is often a home equity line of credit (HELOC), which gives you a convenient borrowing source as a homeowner.

Check your HELOC rates. Start hereHELOCs are extremely flexible. They work a lot like credit cards, giving you the opportunity to borrow up to a set credit limit, repay the line, and then borrow again. As an added benefit, HELOC interest rates are much lower than credit card rates. But keep in mind that a HELOC used as part of a piggyback mortgage starts off “maxed-out,” and you’ll have to pay it down before you can re-borrow from the line..

For example, if you pay $10,000 to reduce your HELOC balance, you could write yourself a $10,000 check against the HELOC later and use the money for any purpose. You can even pay your HELOC in full and then leave it open for future use.

At some point, usually after 10 years, you can no longer withdraw money from the HELOC and must repay any remaining balance via monthly payments.

Remember that HELOCs have variable rates

HELOCs are more flexible than most home loans, but sometimes this flexibility can be a drawback.

For example, most HELOCs have variable interest rates. That means your rate and payment amount can change from month to month, depending on market conditions. When the Fed raises its benchmark rate, your HELOC payment amount would increase, too.

A $40,000 HELOC at 6% interest would require $268 a month; a $40,000 HELOC at 8% interest would charge about $335 a month.

The good news is that HELOC rates trend far lower than other loans with variable rates. So they’re still a cheaper source of borrowing than credit cards or personal loans, for example.

Refinancing a piggyback mortgage

You might wonder: If I get a piggyback loan, will I ever be able to refinance it? The answer is yes — but refinancing with a second mortgage is a little more complicated.

Compare your loan options. Start hereYou might be able to pay off the second mortgage when you refinance. In this way, you could combine two mortgage loans into one, effectively cutting down on your interest rate and overall interest paid.

As long as you can prove you used the full second mortgage to purchase your home, this will not count as a cash-out refinance. That means you can enjoy lower rates. You will need enough equity in your home to pay off the second mortgage when you refinance; however, with home prices rising quickly across the nation, many homeowners are building equity faster than they anticipated.

Your second option is to refinance only the primary mortgage, leaving the second lien (the “piggyback loan”) untouched. To do this, you’d need to work with the lender that owns your second mortgage. It must agree to take second position behind your new, refinanced mortgage. This is called a “subordination agreement.”

Overall, you shouldn’t be blocked from refinancing your piggyback loan into a lower rate at some point in the future. But be aware that there will be extra hoops to jump through.

Piggyback loan FAQ

Compare your loan options. Start hereYes, you can still get an 80/10/10 mortgage. However, they’re far less common than other mortgage types. You’ll have to do extra research to find a lender that offers both the primary and secondary mortgage. Or, talk with your preferred lender and see if it will help you find and apply for the second mortgage.

To qualify for an 80/10/10 loan, you’ll need a 10 percent down payment, stable income and employment with tax records to prove it, and a debt-to-income ratio no higher than 43 percent. You’ll likely also need a credit score of 680 or higher.

For the right home buyer, a piggyback loan can be a great idea. If the loan will eliminate private mortgage insurance or help your mortgage stay within conforming loan limits, it can pay for itself. But the piggyback loan structure is complex and won’t make sense for every buyer. If you’re considering a piggyback mortgage, get in touch with a lender and ask them to help you compare interest rates, monthly payments, and total loan costs for all your loan options. This will help you determine which loan type makes the most sense for you.

As you shop around with mortgage lenders, ask whether each lender is OK with a piggyback loan. Even if the lender can’t provide both loans in the piggyback, it may refer you to another lender for the second mortgage. Working with a loan officer who’s executed piggyback loans in the past can help your loan process go more smoothly and easily.

Pairing two loans can avoid PMI, but in some cases, it makes sense to pay for PMI instead of getting a second mortgage. If you don’t have the cash for a 10 percent down payment, it might be better to opt for a low-down-payment mortgage like the FHA loan, VA loan, or USDA loan. This lets you buy a house and start building equity sooner. Then, you can refinance into a no-PMI loan later.

There are two ways to refinance a piggyback loan. If you have enough equity, you can combine both piggyback loans into one new mortgage. Or, you can refinance only your first mortgage and leave your second mortgage (the smaller piggyback loan) untouched. This will require the approval of your second mortgage lender.

You generally have to pay PMI if you put less than 20 percent down. But not always. The 80/10/10 piggyback mortgage is one way to avoid PMI with only 10 percent down. And special loan programs, usually run by big banks, may let you skip PMI without 20 percent down. But these often have higher interest rates, so weigh the overall costs and savings before moving forward with a no-PMI loan program.

What are today’s mortgage rates?

Mortgage rates have risen from their all-time lows, which is a good reason to make a bigger down payment if possible. Piggyback loans boost your down payment size, and a bigger down payment can reduce your overall borrowing costs. To find out how much you could save, start with a mortgage pre-approval.

Time to make a move? Let us find the right mortgage for you