Your guide to understanding the income limit for USDA loan programs

USDA loan income limits play a key role in determining eligibility, alongside factors like household size and geography.

The income limit for a USDA loan typically ranges from $112,450 for 1-4 member households to $148,450 for 5-8 member households in many areas.

Verify your USDA loan eligibility with Neighbors Bank. Start hereWhether you want to buy a new home or refinance via USDA, this program tends to be accessible and affordable.

In this article (Skip to...)

The USDA home loan program

The USDA loan program is one of the best mortgage loans available for qualifying borrowers.

Check your USDA loan eligibility. Start hereIt’s a zero-down loan — which means there’s no down payment required — and mortgage insurance fees are typically lower than those for conventional loans or FHA loans. USDA interest rates tend to be below-market, too.

To qualify for 100% financing, home buyers and refinancing homeowners must meet standards set by the U.S. Department of Agriculture, which is the government agency that insures these loans.

Luckily, USDA guidelines are more lenient than many other loan types.

USDA loan income limits

The income limit for USDA loan programs varies, but most counties can expect a range of $112,450 for 1-4 member households to $148,450 for 5-8 member households. Although many rural areas have limits as low as $91,900 and $121,300, respectively.

Check your USDA loan eligibility. Start hereUSDA median income limits are one of the qualifying requirements for this popular rural housing program. USDA lenders use these limits during the underwriting process to ensure applicants meet the program’s requirements.

USDA loan income limits are set at 115% of your area median income (AMI). That means your annual income can’t be more than 15% above the median income where you live.

The actual dollar amount varies by location and household size. For instance, USDA allows a higher income for households with 5-8 members than for households with 1-4 members.

Additionally, USDA allows buyers to deduct qualified childcare expenses for children aged 12 and under from their household income. As an example, if you are $2,000 over the household income limit, but your documented childcare costs are $5,000 per year, you would still be eligible. Similar deductions may apply for households with members who have disabilities.

And, USDA income limits are higher in areas where workers typically earn more. Here’s how USDA income eligibility works.

Factors affecting USDA income limits

The income limit for USDA loans isn’t a one-size-fits-all number. It’s a dynamic figure shaped by three key factors:

1. Geographic location

USDA income limits by county vary based on the area’s median income.

Example: In Monroe County, Florida, the USDA household income limits for a 4-person household are $116,950, while in Tallahassee, Florida, it’s $91,900 for the same household size.

2. Household size

Your family’s size matters when it comes to USDA home loan income limits. As households grow, so do the income thresholds.

Example: In Tillamook County, Oregon, the income limit for a 2-person household is $91,900 while for a 5-person household in the same county, it is $121,300.

3. Annual adjustments

The USDA reviews and updates rural housing income limits yearly to reflect economic changes. These updates are usually released in the summer, often around May or June, to ensure that the program remains aligned with current cost-of-living standards and median incomes in different regions

Example: In Fairfax County, Virginia, the USDA median income limit for a 3-person household increased from $112,450 in 2023 to $121,300 in 2024 due to changes in the area’s median income.

How USDA loan income limits are calculated

The USDA employs a precise formula to determine income limits for USDA loans. Here’s how they calculate these limits:

- Starting with the area median income: The USDA uses data from the Department of Housing and Urban Development (HUD) to determine the median income for a specific area.

- Applying the base limit: The base income limit is set at 115% of the area’s median income.

- Adjustments for household size: Larger households are allowed higher income limits to reflect the increased cost of living for more people.

Example income calculation:

Let’s say the median income for a 4-person household in Steuben County, Indiana is $79,913.

- Base calculation: $79,913 x 115% = $91,900 (this is the USDA income limit for a 1-4 person household).

- For a 1-4 person household: The income limit remains $91,900

- For a 5-person household: $91,900 x 132% = $121,300

- For a 6-person household: $91,900 x 140% = $128,660

It’s important to note that total household income is considered, not just the income of the loan applicant. This includes income from all adult members of the household, regardless of whether they are on the loan application.

USDA loan limits by county

USDA income limits by county can vary significantly due to differences in local economic conditions and cost of living. To find the specific limits for your area:

- Visit the 2026 USDA loan income limits calculator.

- Enter your address or select your state and county.

- View the USDA rural development loan income limits based on your household size.

It’s important to consult the most up-to-date information, as these limits are subject to annual revisions. Potential borrowers should always verify current limits or speak with a loan officer before proceeding with a loan application.

Approval tips if you exceed USDA loan income limits

If you find yourself slightly above the income limit for USDA loans, don’t lose hope. There are several strategies you can consider:

- Reduce voluntary income carefully: If you’re close to the limit, consider reducing overtime hours or declining bonuses temporarily. However, be cautious, as this could raise concerns with the loan provider about your income stability.

- Exclude certain household members: If adult children or other non-borrowing adults living in the home have their own income, you might be able to exclude them from household income calculations if they can prove financial independence.

- Time your application: Since USDA loan income limits are updated annually, waiting for the next update might work in your favor if limits are expected to increase.

- Explore alternative loan options: If you can’t qualify for a USDA loan, consider FHA loans or conventional mortgages with low down payment options.

USDA loan debt-to-income (DTI) limits

In addition to income limits, USDA DTI limits play an important role in loan approval.

DTI, or debt-to-income ratio, is a percentage that compares your total monthly debt payments to your gross monthly income, indicating how much of your income goes toward paying debts.The USDA considers two types of DTI ratios:

Check your USDA loan eligibility. Start here- Front-end ratio: This should not exceed 29% of your monthly income.

- Back-end ratio: This should not exceed 41% of your monthly income.

However, it’s important to note that USDA DTI ratios can be flexible. With compensating factors like a high credit score or significant savings, you might still qualify with a higher DTI.

How to calculate your USDA DTI ratio

To calculate your DTI ratio:

- Front-end ratio: (Monthly housing expenses ÷ Monthly gross income) x 100

- Back-end ratio: (Total monthly debt payments ÷ Monthly gross income) x 100

Example: if your monthly income is $5,000, your housing expenses are $1,200, and your total monthly debts are $1,800:

- Front-end ratio: ($1,200 ÷ $5,000) x 100 = 24%

- Back-end ratio: ($1,800 ÷ $5,000) x 100 = 36%

In this scenario, both figures fall within USDA ratio guidelines.

Approval tips if you exceed the USDA DTI limit

If your debt-to-income ratio exceeds USDA DTI limits, consider these strategies:

- Pay down existing debts: Focus on paying off high-interest debts to lower your monthly obligations.

- Increase your income: Consider taking on a part-time job or freelance work to boost your income.

- Add a co-borrower: A co-borrower with a strong financial profile can help improve your overall DTI ratio.

- Compensating factors: Highlight factors like a high credit score, significant savings, or stable employment history.

- Consider a larger down payment: While USDA loans don’t require a down payment, making one can lower your loan amount, which could indirectly help with your DTI ratio by reducing the overall debt you need to service.

Remember, working with an experienced lender or loan provider familiar with USDA ratio requirements can greatly improve your chances of approval.

USDA eligibility beyond DTI and income limits

While USDA income limits and DTI ratios are key requirements, USDA loan eligibility encompasses several other important criteria. Understanding these can help you determine if a USDA loan is the right fit for your home-buying journey.

USDA borrower eligibility

Check your USDA loan eligibility. Start here- Minimum credit score: 640 with most lenders

- Clean credit history: No late payments or recent bankruptcy or foreclosure

- Income requirements: household income limits vary by area; often $91,900 for a 1-4 person household

- Employment: Borrowers need a steady income and employment history. Self-employment is eligible

- Geographic requirements: You must own a home in an eligible rural area

- Property requirements: Must be a single-family home you’ll use as your primary residence

- Loan type: Only a 30-year fixed-rate mortgage is allowed

These rules are not set in stone, though.

USDA is flexible about its loan requirements. And lenders can sometimes approve applications that are weaker in one area (like credit score or DTI) but stronger in another (like income or down payment).

USDA mortgage insurance requirements

The USDA single-family housing guaranteed program is partially funded by borrowers who use USDA loans. Through mortgage insurance premiums charged to homeowners, the government is able to keep the USDA rural development program affordable.

Today’s USDA mortgage insurance rates are:

- 1.00% upfront fee, based on the loan size (can be rolled into the loan balance)

- 0.35% annual fee, based on the remaining principal balance

Example: if you’re borrowing $200,000 to buy a new home in rural Franklin County, New York with no money down, your mortgage insurance costs would include a $2,000 upfront mortgage insurance premium, plus a monthly $58.33 payment for mortgage insurance.

Note that the USDA upfront mortgage insurance is not required to be paid as cash. It can be added to your loan balance to reduce the funds required at closing.

USDA property eligibility

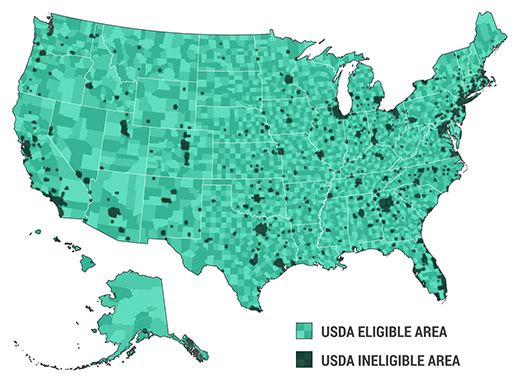

Officially called the “rural development loan,” USDA’s mortgage program is intended to promote homeownership in underserved parts of the country. Because of this, the United States Department of Agriculture will only guarantee loans in eligible rural areas.

However, don’t be deterred by the term “rural.” USDA’s definition is looser than you might expect:

- You don’t have to buy a lot of land or work in agriculture to be USDA eligible

- You just need to live in an area that’s not densely populated

- Officially, USDA defines a rural area as one that has a population under 35,000 or is “rural in character” (meaning there are some special circumstances)

This definition covers the vast majority of the U.S. landmass, so before you write off a USDA loan, check your area’s status.

USDA eligibility map

To determine if a property is eligible for a USDA loan, you can use USDA’s website. Most areas outside of major cities qualify. Here’s how to use the site:

- Accept the eligibility disclaimer

- Select the Single Family Housing Guaranteed option

- Input the property’s address to determine its USDA eligibility

Source: USDAloans.com based on Housing Assistance Council data

FAQ: USDA loan income limits

Check your USDA loan eligibility. Start hereUSDA loan income limits vary by location and household size. In many U.S. counties, the limit is $91,900 for 1-4 person households and $121,300 for 5-8 person households. For some areas, especially those with higher costs of living, the limits may be higher—typically around $112,450 for 1-4 person households and $148,450 for 5-8 person households. Check the USDA website for specific limits in your area.

USDA imposes income limits to ensure the loan program serves its intended purpose of helping low to moderate-income families in rural areas achieve homeownership. These limits help target federal resources to those who need them most while maintaining the program's financial sustainability.

Yes, USDA construction loan income limits are the same as those for regular USDA loans. The type of loan (purchase, refinance, or construction) doesn't affect the income limits. What matters is your location, household size, and total household income.

Next steps: Check your USDA income eligibility

USDA-guaranteed loans can be used for home buying and to refinance real estate you already own (as long as it’s in an eligible rural area).

For those who have a low to moderate income, this is often one of the best loan options available.

USDA loans are great for first-time home buyers in particular, as you don’t need any money saved up for the down payment. But remember — you’ll still have to pay for closing costs.

It could be easier than you think to qualify for a home loan via the USDA program. Check your eligibility with a USDA-approved lender today.

Time to make a move? Let us find the right mortgage for you