Guidance for 2026 home buyers

Are you planning to buy a house in 2026?

With so many potential buyers waiting for improved conditions, you’re likely not alone. But taking all the right steps to get yourself ready and finding the right advice could give you a leg-up on the competition.

To (hopefully) help make matters easier for home buyers, The Mortgage Reports spoke with industry experts to help guide borrowers in 2026.

Answers have been edited for brevity and clarity.

Verify your home buying eligibility. Start hereIn this article (Skip to…)

- How to prepare to buy a house in 2026

- What is unique about Q1’s housing market?

- Early 2026 affordability outlook

- Top advice for 2026 home buyers

How would you prepare if you wanted to buy a home in the first quarter of 2026?

When buying a home, preparation can be your best friend.

Getting all your paperwork and affairs in order gives you a clearer budget, what interest rate you can qualify for, and a chance to clean up your financial profile. Plus, it can give you the competitive advantage of the ability to act quickly. So make your home buying prep list - and maybe even check it twice.

Ralph DiBugnara, president at Home Qualified:

The first quarter of the year is traditionally less competitive depending on what market you’re in. Competition is low in colder weather markets post-holidays and is an easier time to find the price you’re looking for, especially in places devoid of for-sale inventory. In warmer weather climates, you will find many more buyers considering a larger move from another state. Either way, the first quarter of the year is a great time to start your journey because most markets heat up and become more competitive when spring hits.

Charles Goodwin, head of bridge and DSCR lending at Kiavi:

It’s important to educate yourself on the realities of the current market. Understanding true affordability, being clear on your budget, and having realistic expectations about inventory and timing are essential for making smart investment decisions today and in the future. With mortgage rates likely to remain in the low 6% range early in the year, pay close attention to closing costs and loan terms to make the most of your investment. Keep an eye on market activity in the area where you’re buying and be prepared for both the logical and emotional aspects of buying a property.

Danielle Hale, chief economist at Realtor.com:

A first-quarter home shopper has some advantages. First, home prices generally ramp up as we move closer to spring and summer, so pricing tends to be a bit lower than later in the year. However, competition can be a bit stiffer as home shoppers tend to get a jump-start on the year relative to sellers. To buy a home in the first quarter, I would take the time to evaluate your budget, including testing a few different potential mortgage rate scenarios, even though I expect that mortgage rates will be fairly flat around the 6.25% mark in most of 2026.

I would also review your wish list and sort features into must-have versus nice-to-have categories so you’re prepared to make tradeoffs. Then, I would set up a search to be notified when properties that meet your criteria hit the market. The more specific your search criteria, the more likely the results will be a good fit for your needs. This will help sanity check your budget and figure out how many tradeoffs you may have to make. It would also be wise to enlist the help of a real estate professional who can help you navigate the process and think through the pros and cons of any tradeoffs as you search.

Rick Sharga, president and CEO at CJ Patrick Company:

That’s a trick question: If I wanted to buy a home in the first quarter, I would’ve started planning six months ago. But whenever you start, there are really two distinct areas to focus on: financial readiness, and the home itself.

In terms of financial readiness, prospective buyers need to thoroughly assess how much they can afford for monthly housing costs (the rule of thumb historically is housing shouldn’t consume more than about 1/3 of your monthly household income, but today’s high prices and relatively high mortgage rates result in many homeowners spending a bit more than that). Buyers should also check their credit score and clean up any errors that might be negatively impacting it — better scores allow buyers to get the best rates on loans. And by all means work with a lender to get pre-approved (or at least pre-qualified) for a certain loan amount so that you know how much you can spend on a home, and that you’ll be able to get the financing you need to purchase it.

Once you have an idea of your budget, you can start looking for homes that are affordable, and also meet your housing needs. How many bedrooms and bathrooms do you need? Does the home need to be in a certain school district? Does it need to be near public transportation? How far are you willing to commute to your job every day? If you’re handy with tools, should you consider saving money by buying a home that needs some work? After considering all of these things, it often makes sense to work with a real estate agent who’s an expert on the market where you’re looking to buy.

And buying in the first quarter — especially early in the first quarter — is a great time to shop for a home: there’s less competition and because of that, sellers are often more willing to negotiate on prices and terms than they might be during the busier spring and summer selling seasons.

Sam Williamson, senior economist at First American:

Prospective buyers should use the next several weeks to strengthen their financial profile and streamline their ability to act quickly. That means reviewing credit, paying down revolving balances, and avoiding new debt that may complicate underwriting. Liquidity matters as much as the down payment, given the potential for appraisal gaps, inspections, moving costs, and higher-than-expected tax or insurance escrow requirements. A fully underwritten pre-approval can reduce closing risk and improve offer strength. And, with inventory improving in some markets, buyers should identify negotiation priorities in advance — whether credits, repairs, or a rate buydown.

Kelly Zitlow, EVP and senior mortgage advisor at Cornerstone Home Lending:

If you’re planning to buy a home in the first quarter, start by talking with a mortgage lender early. Gather your most recent 30 days of pay stubs and two months of bank or asset statements, then complete a loan application that outlines your income, assets, debts, and two-year employment and residence history. Your lender will review this information, pull your credit, and determine the loan amount you may qualify for. They can also identify any credit or financial issues in advance and provide guidance on how to address them. If everything meets lending guidelines, you’ll receive a pre-qualification or pre-approval letter, putting you in a strong position when you begin shopping for a home.

See what interest rate you qualify for. Start here

What is unique about the first quarter’s housing market conditions?

The housing market can be difficult to navigate by yourself — especially if you’re a first-time buyer. Home buying conditions constantly shift over time and vary geographically.

Broadly, 2026 should be an improved, balanced year for home buyers, with rates expected to descend and inventory rebounding.

DiBugnara: In early fall of 2025, it looked like we were headed towards a lower interest rate market. As we close out the year, it seems that all that positivity has been erased. The first quarter mortgage rates will likely be around the averages we’ve seen in 2025. But with a new Fed chairman on the horizon, we could see some changes to policies that may lower interest rates. We have no idea where interest rates are headed.

Goodwin: 2026 will probably feel a lot like 2025 in many ways. Q1 2026 will likely be characterized by a slow grind back to normal levels of affordability. The lock-in effect remains strong, with many homeowners holding onto properties longer because of the low mortgage rates they secured earlier in the decade. As a result, inventory will likely remain relatively low in the first quarter, and I wouldn’t expect most markets to see significant movement in prices or demand in comparison to 2025.

Hale: The first quarter housing market in any year is really a seasonal ramp-up period. In 2025, buyers gained power as the housing market became balanced for the first time in nine years. In 2026, we’ll likely see that balance shift further toward buyers, as I expect more homes to come on the market than home shoppers. This doesn’t mean that buyers will be able to ask for anything, but I expect sellers to be a bit more flexible as we approach spring 2026.

Sharga: Something unique in today’s market — although not necessarily just in Q1 2026 — is the need to look into homeowner’s insurance before buying a home. Insurance premiums have skyrocketed across the country over the past few years due to the billions of dollars of losses incurred by insurance companies due to extreme weather events. Homeowners in Florida and Texas have seen their annual premiums double (and even triple), which can make it impossible to afford to stay in their homes. Other states, like California, have seen insurers stop issuing new policies, so new homeowners might find it difficult to even get insurance, which also makes it impossible to get a mortgage. So it’s critical to find out if insurance is available on the property and what the annual premiums are and build them into your financial plans.

The other bit unusual thing in today’s market is that it’s actually cheaper to buy a new home than an existing home in many cases (historically, there’s always been a “price premium” on new homes). Builders are working their way through a large backlog of homes under construction, and are offering concessions (usually in the form of upgrades, but sometimes actual price reductions) and are also doing mortgage rate “buy-downs.” This enables a buyer to get a lower mortgage rate than they’d be able to get on the purchase of an existing home (for example, 4.9% instead of 6.25%). That kind of advantage in finance rates can make a big difference in monthly payments, and a huge difference in the amount of interest paid over time.

Williamson: The housing market appears set to begin 2026 on steadier footing, with more supply and improving affordability. Mortgage rates sit near three-year lows, and slower price appreciation—paired with rising inventories—has eased some of the pressure from the pandemic‑era run‑up. Still, regional variation will likely persist, with buyers in supply-rich Southern and Western metros seeing more favorable conditions compared to leaner Northeastern and Midwestern markets.

Zitlow: The first quarter of 2026 has some unique dynamics. January and February are typically lower-volume months for home sales, which can create opportunities for buyers to negotiate on price, concessions, or terms depending on the local market. As spring approaches and buyer activity increases, that leverage often fades as competition heats up.

How do you see affordability playing out in early 2026?

Over the last few years, a lack of affordability forced many prospective home buyers to sit and wait.

Home price growth surged during the Covid pandemic and its aftermath, but finally flattened out to a normalized pace (while even regressing in some markets) in 2025. That is definitely a welcomed development for first-time buyers.

Interest rates also play a major role in affordability. Although influenced by a bevy of economic and geopolitical factors that could cause swings at any time, mortgage rates should (hopefully) be lower compared to the most recent past years.

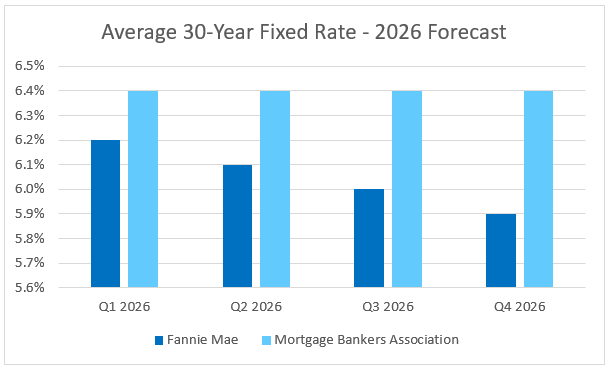

In their December rate forecasts for 2026, Fannie Mae predicted a gradual, linear decline over the course of the year while the Mortgage Bankers Association expects a plateau.

Demand is perhaps the cornerstone variable that will ultimately dictate the year’s affordability. If prices slow and rates fall, there needs to be enough for-sale inventory to meet demand or that spike in wanna-be buyers will offset the strides made in affordability.

DiBugnara: Affordability in 2026 should be slightly better than in 2025. It has become a major focus of the current administration, as it is the biggest obstacle for new home buyers in today’s market. I think a combination of lower mortgage rates, home prices being slightly down, and lower insurance costs could help over the year.

Goodwin: Affordability is key to unlocking housing velocity, and I expect we’ll see a gradual improvement over the course of the first quarter. Mortgage rates are likely to hover around 6.3%, while home prices should remain mostly flat or tick up slightly. Demand will stay relatively steady, but it is unlikely to surge as many buyers and sellers remain cautious.

Hale: Affordability is likely to be better in early 2026 thanks to lower mortgage rates. I actually expect home prices to climb, but not quite as much as inflation will increase. This will give consumer incomes a chance to catch up, helping to improve buyer demand and ultimately home sales.

Sharga: Even though affordability today is the worst it’s been in over 40 years, there’s actually some good news on that front for home buyers. National home price growth has slowed down dramatically — prices across the country will only be up by about 2% year-over-year, which is less than the rate of inflation, and lower than wage growth, which has been around 4% in recent years.

Price appreciation varies by market, largely based on how large the supply of home available for sale is. Low-inventory markets in the Northeast and Midwest are still seeing prices rise by 3-5% a year. On the other hand, states like Florida and Texas, where there’s too much supply, have actually seen prices decline in 2025. And some of the metro areas that had explosive price growth after COVID — Boise, Las Vegas, and Phoenix, to name a few — are also seeing prices fall. Mortgage rates are down about a half point from a year ago, and are expected to decrease slightly in 2026.

All of these trends — higher wages, slowing and declining home prices, and lower mortgage rates — will help improve affordability at least a little bit as we go through 2026.

Williamson: Affordability is expected to continue gradually improving in early 2026 — driven more by moderating home prices and rising incomes than by a sudden drop in financing costs. As a result, demand is likely to reflect life events — growing families, job moves, caregiving, and downsizing — rather than rate movements. But affordability conditions are likely to improve for some buyers more than others, depending on where they’re looking. Tight inventories in the Northeast and Midwest will keep competition firm and price growth steadier, while many Southern and Western metros — supported by robust new‑construction pipelines — will offer more supply and slightly better negotiating conditions.

Zitlow: Affordability in early 2026 will continue to vary widely by market. In many parts of the country, housing supply remains constrained, which keeps home prices firm or rising. In other areas, cooling demand and flat or slightly declining prices create potential opportunities for buyers to negotiate. Mortgage rates are expected to remain relatively consistent with what we’ve seen in recent months, generally hovering in the low 6% range. Rates will continue to be influenced by global financial markets and investor demand for mortgage-backed securities. Barring a major economic shift, I do not anticipate rates moving more than about half a percentage point in either direction from current levels.

Verify your home buying eligibility. Start here

What’s your top first-time home buyer advice for Q1 2026?

Many industry experts believe the best time to buy a home is when you find one that you like and can comfortably afford. Building equity is perhaps the biggest advantage over renting and how a lot of people gain personal wealth.

Generally, early in the year presents home buyers with the advantages of lower demand and eager sellers before the Spring market heats up.

DiBugnara: My top advice for home buyers in 2026 is to get out and start looking now. Low rates, high prices, and more buyers flooding the market aren’t an ‘if’ but a ‘when.’ The best plan would be to get a head start before we see a competitive market that pushes prices up higher and hurts your own personal affordability.

Goodwin: My best advice is to separate the financial equation from the lifestyle equation. I’ve seen people, myself included, get caught up in the numbers, but you’ve got to ask yourself if homeownership or being a landlord actually makes sense for the way you want to live. Weigh the trade-offs honestly, because owning a home is not just about whether or not the math works; it’s about whether or not the investment fits into your day-to-day life.

Hale: My top advice for home buyers is to have a good sense of why they want to buy a home. This will help guide the inevitable tradeoffs that have to be made to get into a home. My second piece of advice is to assemble an expert team to help you navigate the journey.

Sharga: When you’re ready for the financial commitment, don’t make the mistake of waiting for “perfect market conditions.” Odds are that the longer you wait, the more you’ll wind up paying for your home, since prices historically always go up (albeit unevenly sometimes). But do your homework first to avoid unpleasant surprises down the road. Make sure you know what you can comfortably afford. Make sure you’re buying a home that can meet your current needs — and those you might have in the near-term. Lastly, factor in some of the “hidden” costs of homeownership like insurance, property taxes, and maintenance to make sure your dream home isn’t actually a money pit in disguise.

Williamson: Buyers are best served by staying within a comfortable monthly budget, keeping a cushion for taxes, insurance, and maintenance, and being prepared to walk away from deals that stretch the numbers. With some markets becoming more negotiable, preparation and patience can translate into added leverage. Comparing multiple lenders and negotiating for concessions can improve total borrowing cost more reliably than trying to time a perfect rate dip.

Zitlow: Avoid self-approving or self-disqualifying yourself based on what you read online. Every buyer’s financial situation is different and assumptions can be misleading. A conversation with a seasoned mortgage lender can provide clarity, identify options you may not be aware of, and help you create a clear, realistic path to homeownership.

Verify your home buying eligibility. Start hereThe bottom line

Buying your first home is an exciting venture, but it can be just as daunting if you don’t know what to do or how to start.

Preparation is always key, as is knowing how to negotiate your mortgage rate and when to walk away from a stubborn seller.

If you’re ready to begin your path to homeownership, find a local mortgage professional to get started.

Time to make a move? Let us find the right mortgage for you