What’s the best VA loan rate today?

VA loan rates are the lowest of any major loan program, on average. Today’s 30-year fixed VA loan interest rates start at % (% APR), according to our lender network. Compare that to % (% APR) for a conventional loan.

Verify your VA loan eligibility with Veterans UnitedYour rate could be higher or lower than average, but in general, VA loans are available at lower rates even to those without a perfect credit history.

In this article (Skip to...)

- Best VA loan rates

- VA rates vs. other loans

- Why VA rates are lower

- Finding your best rate

- VA loan eligibility

- VA loan credit score

- VA lenders

Your best VA loan rates right now

Because they’re guaranteed by the Department of Veterans Affairs, VA loans can offer exclusively low rates to eligible military members, veterans, and their spouses.

Check your VA loan rates. Start hereKeep in mind that your own rate could be different from the rates shown below depending on your credit score, down payment, and other factors. But if you meet the service requirements for a VA loan, you’ll likely get a better deal than with any other loan product.

Be sure to shop with at least three VA-approved mortgage lenders to find the best VA mortgage rate for your situation.

| Loan Type | Today's Avg. VA Loan Rates* |

| VA 30-year fixed-rate | % (% APR) |

| Conventional 30-year fixed-rate | % (% APR) |

| VA 15-year fixed-rate | % (% APR) |

| Conventional 15-year fixed-rate | % (% APR) |

*Average rates assume 0% down and a 740 credit score. Your own interest rate will be different. See our full loan VA rate assumptions here.

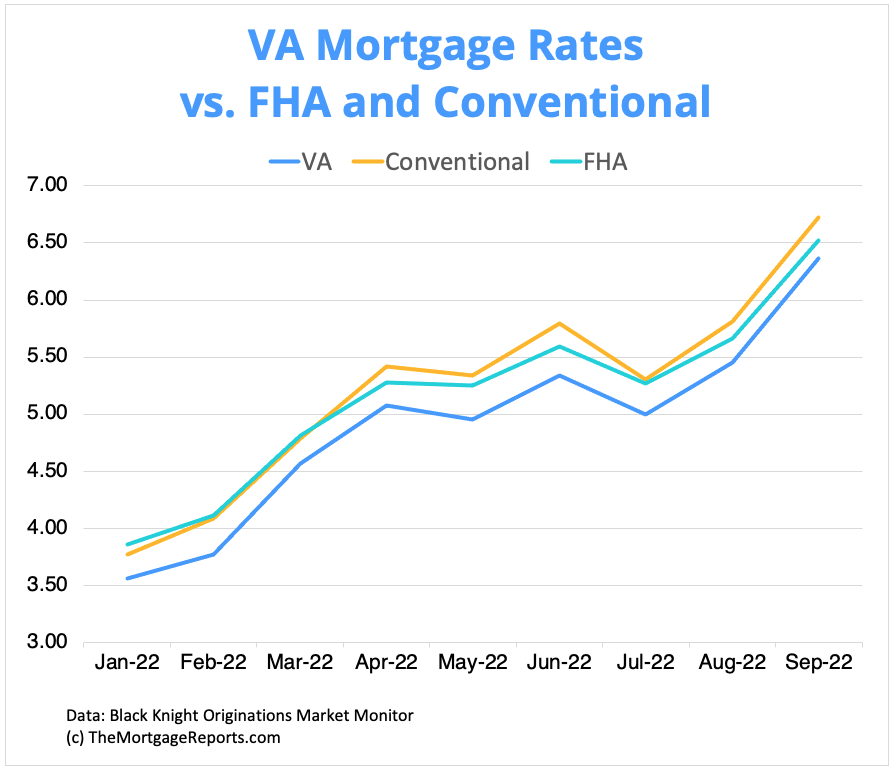

VA loan rates vs. conventional and FHA rates

For years, the best VA loan rates have undercut those offered by conventional mortgages and FHA loan programs.

Lock in your VA loan rate today. Start hereThe chart below shows that VA loan rates were consistently the lowest of any mortgage product throughout 2022, often beating out conventional and FHA rates by nearly half a percentage point. Those lower rates represent big savings for homeowners and home buyers who qualify for the VA loan program.

Why are VA loan rates lower than other mortgage loans?

Strong government backing means lenders can offer discounted interest rates on the VA loan with very little risk.

Check your VA loan rates. Start hereLenders usually charge higher mortgage rates when borrowers have lower credit scores or smaller down payments. But with the Department of Veterans Affairs shouldering a portion of the risk on VA loans, lenders don’t have to apply this surcharge to veterans and service members.

Besides lower interest rates, VA loans come with additional benefits:

- Zero down payment is required

- There’s no private mortgage insurance (PMI)

- Minimum credit scores are flexible

- Maximum loan limits are flexible

- Borrowers can often qualify more easily

No other mortgage offers the same benefits as a VA loan. So if you’re eligible for this program based on your service history, it’s the first type of home loan you should consider.

How do I find the best VA loan rates?

There are three main factors that determine your VA loan rate: current market rates, the lender, and your personal finances.

Check your VA loan rates. Start here- Market rates: Current mortgage rates can move up or down in line with broader financial markets. The overall interest rate environment has a big impact on your individual rate

- Mortgage lenders: Mortgage lenders set their own VA loan rates and these can vary a lot between companies. Call a few lenders, get written quotes, and compare the rate and fees you’re offered. Getting multiple mortgage quotes gives you a chance to see which lenders offer the best rates as well as the lowest origination fees and closing costs. Note that some lenders quote rates based on discount points you’d have to buy upfront at closing

- Your personal finances: Do you have a good credit score? Solid income? Low debt-to-income ratio? Then you shouldn’t have any problem getting approved for low VA mortgage rates. But if you have fair or poor credit, expect to receive a higher rate

Your VA mortgage rate affects the cost of borrowing. Higher rates mean higher monthly mortgage payments and more interest paid over the life of the loan.

The good news is that VA lenders are lenient on credit scores, and even a high VA loan rate could be lower than an average conventional or FHA rate. They call this the “VA home loan benefit” for a reason!

VA loan eligibility requirements

To get access to the best VA loan rates, you have to be eligible for the loan itself. You are likely eligible if you have served:

Check your current VA loan rates. Start here- On active duty between 90 days and two years, depending on service dates

- In the National Guard or Reserves for at least six years

You also must have received an other-than-dishonorable discharge.

In addition to meeting military service requirements, borrowers have to meet their lenders’ minimum financial guidelines. To get a VA loan, you typically need:

- A credit score of at least 580-620

- A debt-to-income ratio below 41%

- A two-year job history

- Steady income with documents to prove it (pay stubs, W-2s, etc.)

- Enough cash saved to pay closing costs

The best way to start the VA loan process is to get a Certificate of Eligibility (COE). This is not a loan approval, but rather a document that shows lenders you are eligible for the program.

Most lenders can get a COE for you in minutes, but if you feel more comfortable going through the Department of Veterans Affairs itself, you can request one via the eBenefits website. In either case, you may need your Form DD214 to prove your service history.

Minimum credit score requirement for a VA loan

The VA does not set a minimum score itself. Instead, lenders get to set their own minimum credit scores for VA loans. Some will go as low as 580 or even 550 in certain situations. Others require a FICO score of 620 or even 660.

Verify your VA loan eligibility. Start hereIf you’ve been denied due to a lower credit score, shop around with different mortgage lenders. You might be surprised that you can easily get approved by one lender but not another.

How to find the best VA loan rates for you

VA mortgage rates can vary based on the lender you choose. The lender’s application process will also determine how easily you can qualify. There are hundreds of VA-approved private lenders across the U.S. So how do you pick the right one — one with great rates and service?

Check your VA loan rates. Start hereStart with VA loan specialists

Referrals from friends are often a good starting point. Our review of top nationwide VA lenders might help, too. Choose a lender and loan officer that do a lot of VA loans — you don’t want someone who is going to forget a crucial step or gets “stuck” on a unique aspect of your loan file. Select at least two or three top lenders and get a written quote “Loan Estimate") from all the lenders on the same day. Compare their rates and fees.

Lowest rates vs. lowest upfront fees

You will have to decide which is more important to you: the lowest rate or the lowest lender fees. Paying fewer upfront fees usually results in a higher rate. Or, you can choose a lower interest rate and pay more upfront for it. This strategy should pay off over the life of the loan if you stay in the home for decades.

Compare Loan Estimates from each lender

Whatever your strategy, compare Loan Estimates from each lender. Sometimes, you can use one lender’s quote to negotiate lower rates or fees from another lender. You’d be surprised at how much room a lender has to alter its first quote. Sometimes you can get a competitive rate and eliminate many fees, just by negotiating.

The VA loan process

Your loan application process will differ based on the type of VA loan you’re looking for.

VA loan refinance

If you have a VA loan and want to reduce your rate, you’ll likely qualify for a VA Interest Rate Reduction Refinance Loan (IRRRL). VA IRRRL rates are lower than other types of loans, and if you last purchased or refinanced in the last few years — or even before that — you may be able to save a lot on interest.

You don’t need a home appraisal, income documentation, or bank statements with the IRRRL. The VA says you don’t even need a new credit report (though most lenders will pull one). The main requirement is that you lower your rate and payment enough that it benefits your situation.

Get today's low VA IRRRL rates. Start hereVA home purchase loan

Home buying with a VA loan is a lot more complex than getting a VA refinance. But it’s well worth it considering today’s lower VA interest rates.

- The first step is getting preapproved with your private lender of choice. With the preapproval letter, you can make an offer on a home

- Once you find a home, the lender will request an appraisal. While that is being completed, turn in income, asset, and credit documents to your lender

- With a clean credit file, you could be a homeowner within 30-45 days, but longer if you have damaged credit or questionable income

For an in-depth look at buying a home with a VA loan, see our guide.

Should I get a VA loan?

The VA mortgage program has both pros and cons, like any home loan. But the benefits outweigh the drawbacks for most VA-eligible home buyers. Here are a few key points to consider when applying for a VA loan.

VA funding fees

Some will tell you to avoid VA loans because of their funding fee. But VA funding fees usually aren’t a deterrent when compared to other loan programs.

VA funding fee cost:

- 2.3% of the loan amount for first-time VA loan users with zero down

- 3.6% for repeat users

- 0.5% for Streamline Refinances

Most home buyers would pay a VA funding fee of $5,750 for a home price of $250,000 with no down payment. At first, that sounds like a lot, but it’s reasonable given the benefits of the program.

Non-VA home buyers typically have to come up with a 3%-5% down payment. That’s at least $7,500 on the same home — a big hurdle, especially for first-time homebuyers.

VA loans, on the other hand, require no down payment at all. And you can wrap the VA funding fee into the loan amount, meaning it can still be a zero-out-of-pocket loan.

No PMI on VA loans

The average home buyer will spend about 1% of the home loan amount per year on private mortgage insurance. Over five years, that’s about $12,500 for a $250,000 loan amount. Sure, the VA funding fee isn’t cheap. But it lets you buy a home now and reduces your monthly payment significantly. Perhaps the only reason you would consider a non-VA loan is if you already had 20% down and good credit.

Is it harder to get an offer accepted?

Some sellers are hesitant to accept VA loans — even when the offer is better on paper. But this can happen to buyers who use any type of financing. Someone with a bigger down payment or an all-cash offer usually beats someone using a larger loan. This is where your real estate agent comes in. It’s their job to educate the seller and their agent that VA loans are no more difficult than other loan types.

It is true that VA appraisers can be a bit pickier about the property. But the minimum property requirements are not that much more stringent than those of FHA or conventional loans.

Connect with a VA mortgage lender. Start here

VA loan rates FAQ

VA loan rates vary by lender and applicant. The good news is, interest rates on VA loans are usually lower than on conventional or FHA loans. So VA-eligible buyers tend to save money.

No. VA loan rates change daily based on market conditions. Even though the VA loan program is set up by the government, VA loan rates are not set by any agency, but rather by each individual lender. Factors like your credit score and loan term make a difference, too. A 15-year VA loan normally offers a lower rate than a 30-year VA loan.

The VA loan is a government-sponsored program, but it is not administered by the U.S. Department of Veterans Affairs or any other government agency. Private mortgage lenders accept applications, then approve loans based on rules published by the VA. The process is very similar to that of any other loan program. When buying, you will apply, supply documentation, get approved, find a home, sign final loan documents, and close on the loan. For a refinance, the VA offers a program called the IRRRL, in which you need almost no documentation and no appraisal. So the process is much faster.

There are two main criteria to qualify for a VA loan. The first is to be eligible based on your military service. The second is to qualify for the loan itself based on lending requirements. Typically, those who served 90 days to two years (depending on service dates) are eligible for the VA loan benefit. Surviving spouses may also be eligible. To qualify for the loan, you usually need a 620 or higher credit score, and enough steady income to cover future housing payments, other debts, and living expenses.

Usually, you can use a VA loan as many times as you want, as long as your previous VA loans were in good standing and are now paid off. When you pay off a VA loan or refinance it with a different loan type, your entitlement is restored. You can use that entitlement again on another primary residence. You also may be eligible to have two VA loans at once if your first purchase price was low and you have remaining entitlement. Keep in mind that you will pay a higher funding fee for the second and subsequent uses of your VA loan benefit.

The VA loan program does offer a cash-out refinance option. This lets you tap your home’s equity and take some of it out as cash, while replacing your current mortgage with a new one. One big perk of the VA cash-out refi is that it’s the only major program that lets you finance 100 percent of your home’s value, so you can withdraw all your available equity. You do not need a current VA loan to use the VA cash-out refinance.

Yes, you could get a fixed-rate mortgage or an adjustable-rate mortgage (ARM) with VA backing. Adjustable rate mortgages tend to offer lower interest rates during their introductory period. After that, your interest rate can change each year. For some active duty service members who plan to sell their homes within a couple of years, an ARM may offer an attractive loan option.

No, the VA home loan benefit exists to help qualifying veterans and their families buy a home to live in. You cannot use a VA loan to purchase a second home, rental property, or property you plan to use for business. You can, however, use a VA loan to buy a home with multiple units, as long as you plan to live in one while renting the others out. The VA also allows you to refinance an investment property with a new VA loan, as long as you can prove you purchased the home as a primary residence and lived there for a reasonable amount of time.

No, the VA loan program does not have a maximum loan limit. Buyers can theoretically get a loan of any size with no down payment — although, the borrower must still qualify for the loan based on credit, income, and debt levels.

The annual percentage rate, or APR, is the annual cost of the loan to a borrower, including both the interest rate and any fees — such as mortgage insurance and closing costs, to name a few. Similar to an interest rate, APR is also expressed as a percentage.

Yes, all sorts of private lenders are authorized to provide VA loans. In fact, some of the nation’s leading VA lenders are credit unions, including Navy Federal Credit Union. We recommend working with a lender that specializes in VA loans. VA loan specialists know the nuances of the VA loan program and its eligibility requirements. They'll help you navigate the process smoothly and work out any snags that come up.

Today’s VA mortgage rates

The VA loan offers lower interest rates than many other mortgage loan programs. In fact, the best VA loan rates often undercut the lowest rates of conventional mortgages and FHA loans. If you meet the military service requirements, take advantage of this benefit.

Time to make a move? Let us find the right mortgage for you