Key Takeaways

- Approved HECM borrowers can receive funds as a lump-sum, fixed monthly payment, or line of credit.

- Because HECMs are FHA-backed, all properties must meet HUD safety and habitability standards.

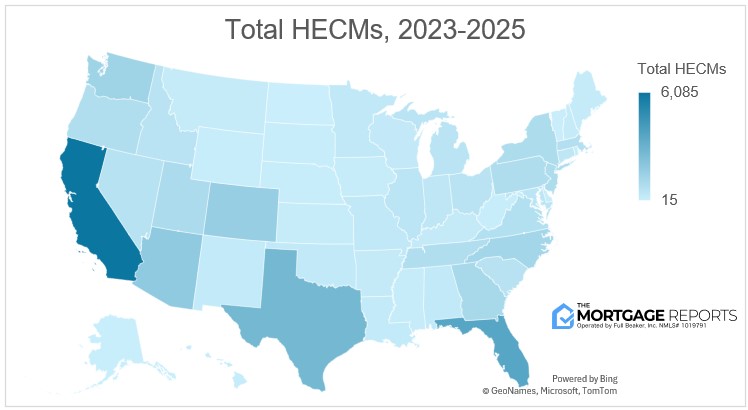

- California, Florida, and Texas led the nation in HECM volume from 2023–2025, reflecting where senior homeowners hold the most housing wealth.

A HECM or Home Equity Conversion Mortgage is the most popular type of reverse mortgage.

HECMs (and reverse mortgages overall) are commonly used by older homeowners to pull money from their home and maintain their lifestyle. Where they’re taken out can also show what places have larger populations of senior homeowners and/or costs of living growing at faster paces.

The Mortgage Reports went through and broke down the latest Home Mortgage Disclosure Act (HMDA) data to find out where the most people took out HECMs in the last three years.

A HECM or Home Equity Conversion Mortgage comes backed by the Federal Housing Administration (FHA) and is the most popular of the three reverse mortgage types.

With a HECM, homeowners aged 62 and above can leverage their home equity without making monthly mortgage payments. How much the homeowner can access depends on their age, total equity, current interest rates, and the current loan limit.

HECMs require a HUD-approved counseling session to learn about the costs, your homeowner responsibilities, and individual borrowing limit. If approved, you can opt to receive your funds as a lump-sum, fixed monthly payment, or line of credit. The loan plus accrued interest then gets repaid when the home is sold or passed down.

HECM eligibility, appraisals, and maintenance

Because HECMs are backed by the FHA, properties must undergo FHA appraisals in order to evaluate the market value and whether they meet the safety and structural requirements. Significant repairs, if necessary, must be made before closing. Meanwhile, funds for smaller repairs needed to meet FHA regulations may be set aside by the lender for those jobs after closing.

See if you qualify for a reverse mortgage. Start hereHECM trends by state (2023–2025)

A grand total of 35,229 U.S. homeowners took out a traditional Home Equity Conversion Mortgage (HECM) from 2023 to 2025, according to the latest HMDA data.

Due to the highest population in the country and its expensive reputation, California (perhaps unsurprisingly) led the nation with a 17.27% HECM share and 6,085 overall. The popular states for retirement of Florida (10.33%; 3,639), Texas (7.81%; 2,752), Arizona (5.23%; 1,843) came next, with Colorado (4.65%; 1,638) rounding out the top five.

HECMs around the United States

On the other end of the spectrum, North Dakota finished last with a 0.04% share and 15 HECMs over those three years. Above it came Alaska (0.09%; 32), Washington, D.C. (0.12%; 44), Vermont (0.15%; 52), and Wyoming (0.19%; 68).

The table below shows the HECM grand totals for each state in 2023, 2024, and 2025, in order by overall share:

| Property State | 2023 | 2024 | 2025 | Grand Total by State | Overall HECM Share |

| California | 2,246 | 1,867 | 1,972 | 6,085 | 17.27% |

| Florida | 1,361 | 1,153 | 1,125 | 3,639 | 10.33% |

| Texas | 1,051 | 857 | 844 | 2,752 | 7.81% |

| Arizona | 688 | 592 | 563 | 1,843 | 5.23% |

| Colorado | 616 | 489 | 533 | 1,638 | 4.65% |

| Washington | 487 | 452 | 448 | 1,387 | 3.94% |

| North Carolina | 394 | 379 | 452 | 1,225 | 3.48% |

| Georgia | 391 | 344 | 354 | 1,089 | 3.09% |

| Utah | 371 | 272 | 310 | 953 | 2.71% |

| New Jersey | 316 | 272 | 352 | 940 | 2.67% |

| New York | 295 | 299 | 327 | 921 | 2.61% |

| Pennsylvania | 306 | 262 | 291 | 859 | 2.44% |

| Tennessee | 275 | 281 | 281 | 837 | 2.38% |

| Oregon | 316 | 248 | 269 | 833 | 2.36% |

| Massachusetts | 226 | 259 | 273 | 758 | 2.15% |

| Virginia | 225 | 255 | 252 | 732 | 2.08% |

| Nevada | 227 | 181 | 227 | 635 | 1.80% |

| South Carolina | 189 | 222 | 189 | 600 | 1.70% |

| Ohio | 193 | 180 | 198 | 571 | 1.62% |

| Idaho | 234 | 172 | 165 | 571 | 1.62% |

| Michigan | 171 | 155 | 185 | 511 | 1.45% |

| Illinois | 165 | 156 | 175 | 496 | 1.41% |

| Maryland | 167 | 159 | 169 | 495 | 1.41% |

| Indiana | 140 | 137 | 130 | 407 | 1.16% |

| Connecticut | 129 | 138 | 129 | 396 | 1.12% |

| Minnesota | 127 | 97 | 108 | 332 | 0.94% |

| Missouri | 118 | 99 | 111 | 328 | 0.93% |

| Alabama | 90 | 87 | 103 | 280 | 0.79% |

| Oklahoma | 94 | 89 | 85 | 268 | 0.76% |

| Wisconsin | 82 | 78 | 84 | 244 | 0.69% |

| Louisiana | 92 | 75 | 73 | 240 | 0.68% |

| New Mexico | 80 | 59 | 92 | 231 | 0.66% |

| Kentucky | 69 | 66 | 82 | 217 | 0.62% |

| Arkansas | 65 | 65 | 69 | 199 | 0.56% |

| Montana | 52 | 58 | 71 | 181 | 0.51% |

| New Hampshire | 50 | 59 | 58 | 167 | 0.47% |

| Maine | 53 | 43 | 66 | 162 | 0.46% |

| Hawaii | 49 | 32 | 54 | 135 | 0.38% |

| Mississippi | 41 | 40 | 51 | 132 | 0.37% |

| Kansas | 50 | 40 | 38 | 128 | 0.36% |

| Delaware | 44 | 36 | 46 | 126 | 0.36% |

| Iowa | 40 | 45 | 30 | 115 | 0.33% |

| Rhode Island | 32 | 42 | 37 | 111 | 0.32% |

| Nebraska | 35 | 38 | 34 | 107 | 0.30% |

| South Dakota | 20 | 25 | 26 | 71 | 0.20% |

| West Virginia | 22 | 24 | 23 | 69 | 0.20% |

| Wyoming | 23 | 29 | 16 | 68 | 0.19% |

| Vermont | 19 | 21 | 12 | 52 | 0.15% |

| Washington, D.C. | 15 | 15 | 14 | 44 | 0.12% |

| Alaska | 13 | 7 | 12 | 32 | 0.09% |

| North Dakota | 4 | 6 | 5 | 15 | 0.04% |

| Grand Total by Year | 12,558 | 11,056 | 11,613 | 35,227 |

The bottom line

While best exercised with caution, getting a HECM or another type of reverse mortgage can grant you financial flexibility to maintain your lifestyle or provide funds when you need it most.

It is important to understand the eligibility requirements, payment options, and payback rules. If a HECM sounds like a potential option, reach out to your lender to get started and learn more.

Time to make a move? Let us find the right mortgage for you