Types of Home Loans: Find the Best Mortgage for You

No two home buyers are alike. So it makes sense that there’s no one-size-fits-all home loan.

In today’s market, there are many different types of mortgages that can be tailored to each buyer’s unique needs — from borrowers with perfect credit and 20% down to those with lower income and small down payments.

Not sure which type of home loan you should use? Answer a few questions below and we’ll match you with up to three loans that could fit your needs.

Get matched with a home loan

Types of home loans: Overview and requirements

Many first-time home buyers — and even repeat buyers — think you need excellent credit and 20 percent down to buy a home. But that’s no longer the case.

Today’s borrowers can choose from a wide range of home loans to match their needs.

The best mortgage for you will depend on several factors, like your FICO score, down payment, credit history, and the type of home you want to buy. But to help you get started, here’s an overview of the 10 best home loans in today’s market:

| Loan Type | Minimum Credit Score | Minimum Down Payment |

| Conventional 30-Year Fixed-Rate | 620 | 5% |

| Conventional 15-Year Fixed-Rate | 620 | 5% |

| Conventional 97 Loan | 620 | 3% |

| FHA Loan | 580 | 3.5% |

| FHA 203K Loan | 580 | 3.5% |

| VA Loan | 580-620* | 0% |

| USDA Loan | 640 | 0% |

| Jumbo Loan | 680-720* | 10-20%* |

| 5/1 Adjustable-Rate Mortgage (ARM) | 620 | 5% |

| 80/10/10 Loan (“Piggyback Loan”) | 680-720* | 10% plus a 10% HELOC |

*Varies by mortgage lender. Shop around for the best loan terms

Luckily, you’re not on your own when choosing a home loan. Your loan officer or mortgage broker will help you evaluate your options when you apply for pre-approval.

However, it helps to know what you’re looking for so you can come prepared and ask the right questions.

Want to get a head start? The mortgage calculator above will match you with up to three loan types based on your answers to a few simple questions.

This doesn’t guarantee your approval, but it will help you understand which loan types are available — and give you an idea of the minimum requirements to qualify for a mortgage.

Get matched with a home loan. Start here (Mar 4th, 2026)10 Types of home loans for every buyer

Now let’s take a closer look at each of the major home loan types.

30-Year fixed-rate mortgage

A 30-year fixed-rate mortgage (FRM) is by far and away the most popular type of home loan.

Like the name suggests, fixed-rate mortgages have set interest rates that never change over the life of the loan. And since you have 30 years to repay the balance, you’d have lower monthly payments than with a 15-year loan.

Most mortgage types are available with a 30-year term.

For instance, you can get a conventional, FHA, VA, or USDA loan with a 30-year fixed-rate term. The same goes for just about any other loan program.

When most people think of a ‘standard’ mortgage, they’re picturing a 30-year conventional loan. These start at 3-5% down and require a credit score of at least 620.

Conventional mortgages are also very flexible. You can buy a property with anywhere from 1-4 units, and it doesn’t have to be your primary residence. You could also use this program for a vacation home or real estate investment.

15-Year fixed-rate mortgage

A 15-year fixed-rate mortgage works just like a 30-year fixed-rate mortgage. Your interest rate is fixed over the life of the loan, and your monthly payments will never change unless you choose to refinance.

The only difference is the loan term.

A 15-year mortgage is paid off over — you guessed it — 15 years. And since you’re repaying the loan amount in half the time, your mortgage payments will be much higher than with a 30-year loan.

Homeowners tend to choose a 15-year mortgage if they have good cash flow (to afford the higher payments) and want to save money in the long run.

With a 15-year FRM, you’ll end up paying a lot less interest — likely saving you tens of thousands of dollars in total interest payments.

Conventional 97 loan

The conventional 97 loan is a conforming mortgage. That means it conforms to lending rules set by Fannie Mae and Freddie Mac.

Since conforming loans can be purchased by Fannie or Freddie, they’re less risky for mortgage lenders. That means lenders can offer favorable terms and competitive interest rates — even to borrowers without a big down payment or perfect credit.

As a result, conventional 97 loans are available with just 3 percent down. And you only need a 620 credit score to qualify.

Similar programs include the Fannie Mae HomeReady loan and the Freddie Mac Home Possible loan. Both options have a minimum down payment requirement of 3 percent and allow for flexible income and credit qualification.

FHA loan

An FHA loan is a mortgage backed by the Federal Housing Administration. This type of loan is intended for borrowers with lower credit and/or lower income, who need a little extra help qualifying for a mortgage.

Since the FHA insures these loans, mortgage companies can lend to borrowers with imperfect credit without taking on too much risk.

Thanks to this backing, you can get an FHA loan with a FICO score of just 580. And you only need a 3.5 percent down payment.

What’s more, FHA lenders are a little more flexible about your debt-to-income ratio (DTI). So if you already have lots of debt — maybe from student loans or car loans — you might have an easier time qualifying for a mortgage via the FHA program.

FHA 203k loan

Like the FHA mortgage program, FHA 203k loans are backed by the Federal Housing Administration. But the 203k loan is tailored to buyers who want to purchase a fixer-upper home.

With an FHA 203k mortgage, you can finance your home purchase and the cost of repairs at the same time. This leaves you with a single, low-rate loan and only one monthly payment — rather than buying a home and taking out a separate loan to pay for renovations.

The 203k program has many of the same requirements as a standard FHA mortgage. You only need 3.5 percent down and a 580 credit score to qualify in most cases.

However, note that the mortgage process will take a little longer because your lender needs to approve the renovation plans and cost estimates when underwriting the loan.

VA loan

The VA loan program is backed by the U.S. Department of Veterans Affairs. It’s available to:

- Active-duty service members

- Veterans

- Reservists

- National Guard members

- Surviving spouses

For those who qualify, the VA mortgage program is usually the best loan option.

Interest rates are low, there’s no private mortgage insurance (PMI), and best of all, there’s no down payment requirement. VA-eligible home buyers can purchase real estate with $0 down.

Just note there’s a one-time funding fee required by the VA. This can be paid upfront or rolled into your loan balance.

Get matched with a home loan. Start here (Mar 4th, 2026)USDA loan

USDA loans, like VA loans, do not require any down payment. They also have below-market mortgage rates and affordable mortgage insurance.

To qualify for this program, you must buy a home in an eligible rural area. The U.S. Department of Agriculture, which insures USDA loans, determines which areas qualify. Most of the U.S. landmass is eligible, excluding big cities and densely populated suburbs.

The USDA also imposes income limits. Borrowers can’t make more than 115% of the local median income in their area.

Jumbo loan

Most home loans have to be within conforming loan limits set by Fannie Mae and Freddie Mac. For a single-family home, those limits max out at $832,750 in much of the U.S.

But for home buyers in high-priced markets — and those buying luxury homes — there’s another solution: the jumbo loan.

A jumbo loan is any mortgage that exceeds conforming loan limits. (This can also be called a ‘nonconforming loan.’)

Depending on the lender and your personal finances, it’s possible to borrow into the millions with a jumbo mortgage.

Because jumbo loans are not regulated by Fannie and Freddie, mortgage lenders get to set their eligibility requirements. Most require a FICO score of 680-700 or higher and at least 10-20% down payment. However, low-down-payment jumbo loans are available starting at 5% from select lenders.

5/1 ARM

An adjustable-rate mortgage (ARM) is a mortgage loan with a variable interest rate. The rate is usually fixed for the first few years, after which it can adjust once per year depending on the broader interest rate market.

The most popular type of adjustable-rate mortgage is a 5/1 ARM.

A 5/1 ARM has a total loan term of 30 years, but your interest rate is only fixed for the first five. After that, your rate can change annually.

If mortgage rates in general are rising, your ARM rate could potentially go up each year. And your monthly mortgage payments would increase, too. That makes an ARM a lot riskier for long-term homeowners than a fixed-rate mortgage.

Most borrowers only choose an ARM if they know they’ll self the home before the fixed interest rate period is up — typically within the first five years.

Conventional loans, FHA loans, VA loans, and jumbo loans are all available with an adjustable-rate structure.

80/10/10 Piggyback loan

Many borrowers have never heard of an 80/10/10 loan, also known as a “piggyback loan.” But this type of mortgage has unique benefits for the right borrower.

An 80/10/10 mortgage is actually two separate loans:

- A primary mortgage, typically for 90% of the home’s value

- A home equity line of credit (‘second mortgage’) worth 10% of the home’s value

Using this structure, the home buyer makes a 10% down payment. And the home equity line of credit (HELOC) acts as another 10% down payment.

So, in effect, the borrower is putting 20 percent down without actually having to save up the full 20 percent in cash.

The main benefit of this strategy is that you can avoid private mortgage insurance (PMI).

PMI is charged on most loans with less than 20 percent down, and it adds an additional monthly expense for the homeowner. Avoiding it could save you a couple hundred dollars per month.

The downside of a piggyback loan is that you’re taking out two separate home loans at once. So you’ll have two monthly payments, both with interest.

If you’re interested in this strategy, talk to a loan officer or mortgage broker who can help calculate your payments and determine whether a piggyback loan would save you money.

Get matched with a home loan. Start here (Mar 4th, 2026)[email-capture skin=”flat”]

Types of mortgage loans FAQ

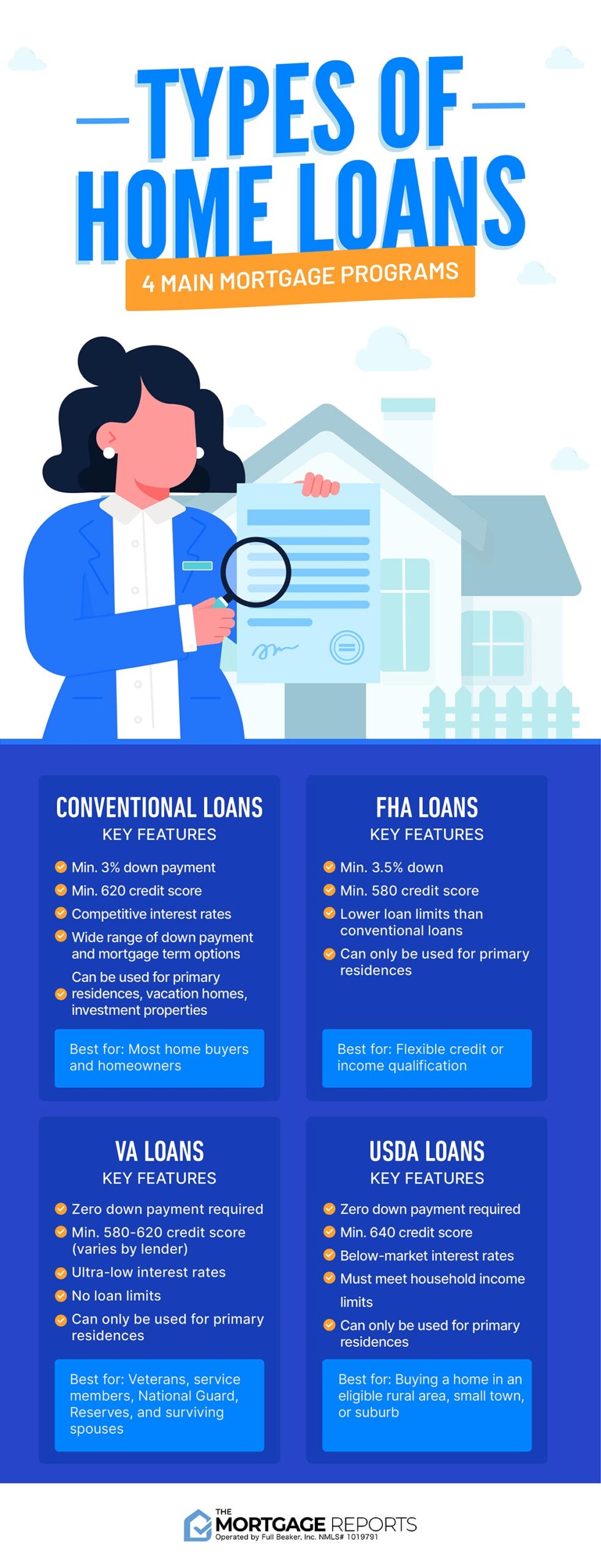

The four main types of home loans are conventional loans, FHA loans, VA loans, and USDA loans. Conventional loans are not backed by the federal government, but most need to meet lending guidelines set by Fannie Mae and Freddie Mac. FHA, VA, and USDA loans are all backed by the federal government but offered by private lenders. Most major lenders offer all four mortgage programs, though USDA loans can be a little harder to come by.

The most common type of home loan is a conventional mortgage, which is any mortgage not backed by the federal government. This is what most people think of as a ‘standard’ mortgage. Conventional loans are flexible; down payments can range from 3 to 20 percent or more, and you only need a 620 credit score to qualify with most lenders. These loans make up about 80 percent of the mortgage market, according to the ICE Mortgage Technology Origination Report.

The best type of home loan depends on your situation. If you have great credit and a 20 percent down payment, conventional loans usually offer the best value. If you need extra help qualifying due to lower credit scores or income, an FHA loan might be better. And if you’re a qualifying veteran or military member, a VA loan is almost always the best bet. Your loan officer can help you compare loan options and find the right loan for your needs.

VA loans typically have the lowest interest rates. However, the VA program is only available to eligible service members and veterans. For non-VA buyers with strong credit, a conventional loan will typically offer the lowest rates.

For first-time home buyers with a 20 percent down payment and good credit, a standard conventional loan is usually best. If you’re looking for a low down payment, the VA, USDA, and FHA loan programs are all good options. VA and USDA allow zero down payment for eligible buyers. And an FHA loan can help you qualify with a credit score as low as 580.

Yes! The VA loan program, available to veterans and service members, allows for no down payment. So does the USDA loan program. To qualify with USDA, you must buy in a qualified rural area and your household income must be within local income limits.

The minimum credit score to qualify for a mortgage is 580, via the FHA loan program. VA loans may also allow scores as low as 580, however, VA requirements vary by lender and some want to see a score of 620 or higher. Conventional and conforming loans require a score of at least 620, and USDA loans typically require 640 or higher. If you want a jumbo loan, you’ll likely need a score above 700.

A fixed-rate mortgage is best for most homeowners. That’s because it protects you form interest rate and payment increases over the life of the loan. With a fixed-rate loan, your interest rate will only change if you decide to refinance. An ARM can save you money if you only plan to stay in the home a few years. But if you outlast the initial fixed-rate period on an ARM, you could be subject to rate and payment hikes that make your loan much more expensive in the long run.

There are lots of different refinance options. The best one will depend on your current mortgage and your financial goals. If you want to pull cash from your home equity, a conventional, FHA, or VA cash-out refinance could be best. If you simply want a lower rate and payment, look into a standard rate-and-term refinance. Homeowners with government-backed loans can also take advantage of the Streamline Refinance program, which has easier qualification requirements and reduced closing costs.

Not at all! There are a variety of low- and even no-down-payment mortgage options in today’s market. VA and USDA loans allow for zero down payment; conventional loans start at 3 percent down; and FHA loans only require 3.5 percent. Just keep in mind that if you put less than 20 percent down, you’ll likely have to pay for mortgage insurance. This can increase your monthly payments a little bit.

Qualifying for a mortgage is easier than it used to be. Today’s home loans allow credit scores starting at 580-620 and down payments of 3 or even 0 percent in some cases. Just try to aim for a good balance in your personal finances. If your credit is low, for example, making a bigger down payment can help you qualify. Or if you have a high debt-to-income ratio (DTI), you might need extra cash reserves to make up for it. Finally, remember that lenders set their own requirements. So if you don’t qualify with the first lender you talk to, check with a few others.

Which type of mortgage should you choose?

To recap, here are the main types of home loans in today’s market:

- Conventional 30-year mortgage — The most popular loan type, 5-20% down

- Conventional 15-year mortgage — A shorter loan term and cheaper interest, 5-20% down

- Conventional 97 — 3% down, min. 620 credit score

- FHA loan — 3.5% down, min. 580 credit score

- FHA 203k loan — Finance renovations on fixer-upper homes

- VA loan — For veterans and service members, 0% down

- USDA loan — For rural properties, 0% down

- Jumbo loan — 10-20% down, min. 680 credit score

- 5/1 ARM loan — Variable interest rates

- 80/10/10 loan — Use a second mortgage to avoid PMI

The bottom line is that mortgage programs are flexible. You don’t need perfect finances to buy a house; you just need to find the right loan type for your needs.

If you’re ready to take the next step toward homeownership, it’s worth talking to a lender about your options.

Verify your new rate (Mar 4th, 2026)