Because USDA mortgages may reveal hotspots of home buying affordability, The Mortgage Reports analyzed 2024 HMDA data to find where they’re most prevalent.

USDA loans don’t need a down payment and typically offer lower comparative interest rates. But this type of financing isn’t available everywhere or for everyone.

See where USDA mortgages are most popular and if it’s the right home loan for you.

Verify your USDA loan eligibility with Neighbors Bank. Start hereUSDA hubs

Established under the Housing Financing Act in 1949 to develop rural parts of the country, loans backed by the U.S. Department of Agriculture (USDA) offer low- to moderate-income home buyers financing with no money down, lower mortgage insurance, and below-market interest rates.

To qualify, borrowers must fall under the income limits and the property must be for primary residency located in an eligible area.

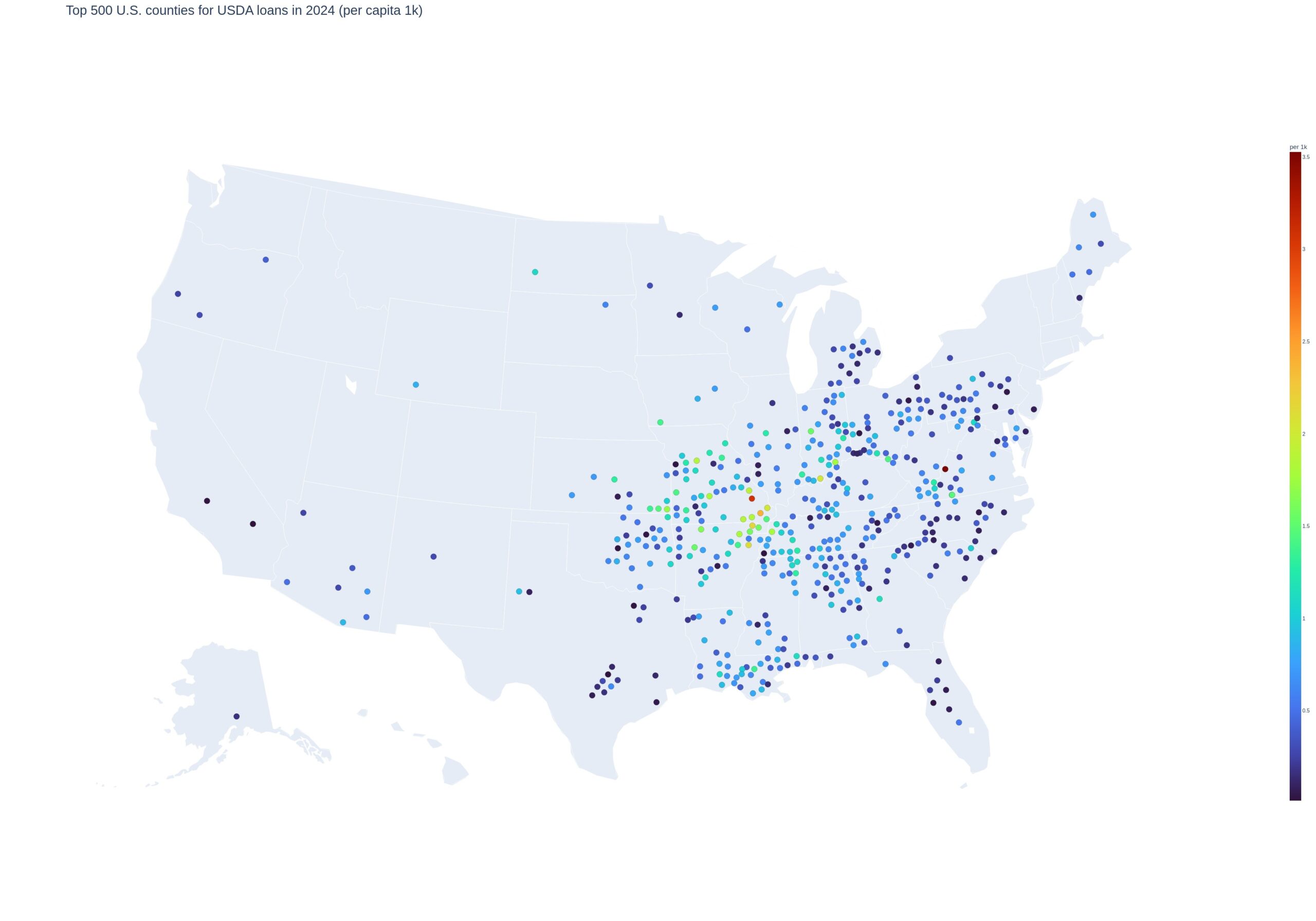

Because of the restrictions around USDA mortgages, they tend to reveal pockets where home buying can cost less. To find them, The Mortgage Reports analyzed 2024 Home Mortgage Disclosure Act (HMDA) data down to the county level. We pulled the top 20 U.S. counties by USDA density and volume.

By USDA mortgages per capita, Madison, Missouri led the high density counties at a rate of 3.1 out of every thousand home loans. Stoddard County, Missouri followed at 2.4 then came Clay County, Arkansas at 2.2.

Top U.S. counties for USDA loans (per capita)

The table below shows the top 20 highest rates of USDA loans per capita by county in 2024:

| Rank | County | State | Population | USDA loan count | USDA per 1k | Average loan amount |

| 1 | Madison | Missouri | 12665 | 39 | 3.079 | $139,615 |

| 2 | Stoddard | Missouri | 28547 | 68 | 2.382 | $137,059 |

| 3 | Clay | Arkansas | 14399 | 31 | 2.153 | $99,516 |

| 4 | Poinsett | Arkansas | 22740 | 48 | 2.111 | $137,083 |

| 5 | Perry | Indiana | 19218 | 39 | 2.029 | $147,564 |

| 6 | Scott | Missouri | 37967 | 77 | 2.028 | $138,117 |

| 7 | St. Francois | Missouri | 66864 | 127 | 1.899 | $163,583 |

| 8 | Ripley | Missouri | 10755 | 20 | 1.860 | $132,000 |

| 9 | Saline | Missouri | 23177 | 43 | 1.855 | $141,047 |

| 10 | Butler | Missouri | 42166 | 77 | 1.826 | $140,584 |

| 11 | Laclede | Missouri | 36245 | 65 | 1.793 | $158,385 |

| 12 | Lawrence | Arkansas | 16265 | 29 | 1.783 | $138,448 |

| 13 | Dyer | Tennessee | 36681 | 65 | 1.772 | $164,692 |

| 14 | Scott | Indiana | 24468 | 43 | 1.757 | $178,721 |

| 15 | Cherokee | Kansas | 19236 | 33 | 1.716 | $135,303 |

| 16 | Boone | Arkansas | 37896 | 62 | 1.636 | $159,032 |

| 17 | Dunklin | Missouri | 27795 | 44 | 1.583 | $115,682 |

| 18 | Greene | Arkansas | 46182 | 73 | 1.581 | $150,890 |

| 19 | Montgomery | Indiana | 38155 | 59 | 1.546 | $168,559 |

| 20 | Johnson | Arkansas | 25932 | 40 | 1.542 | $149,250 |

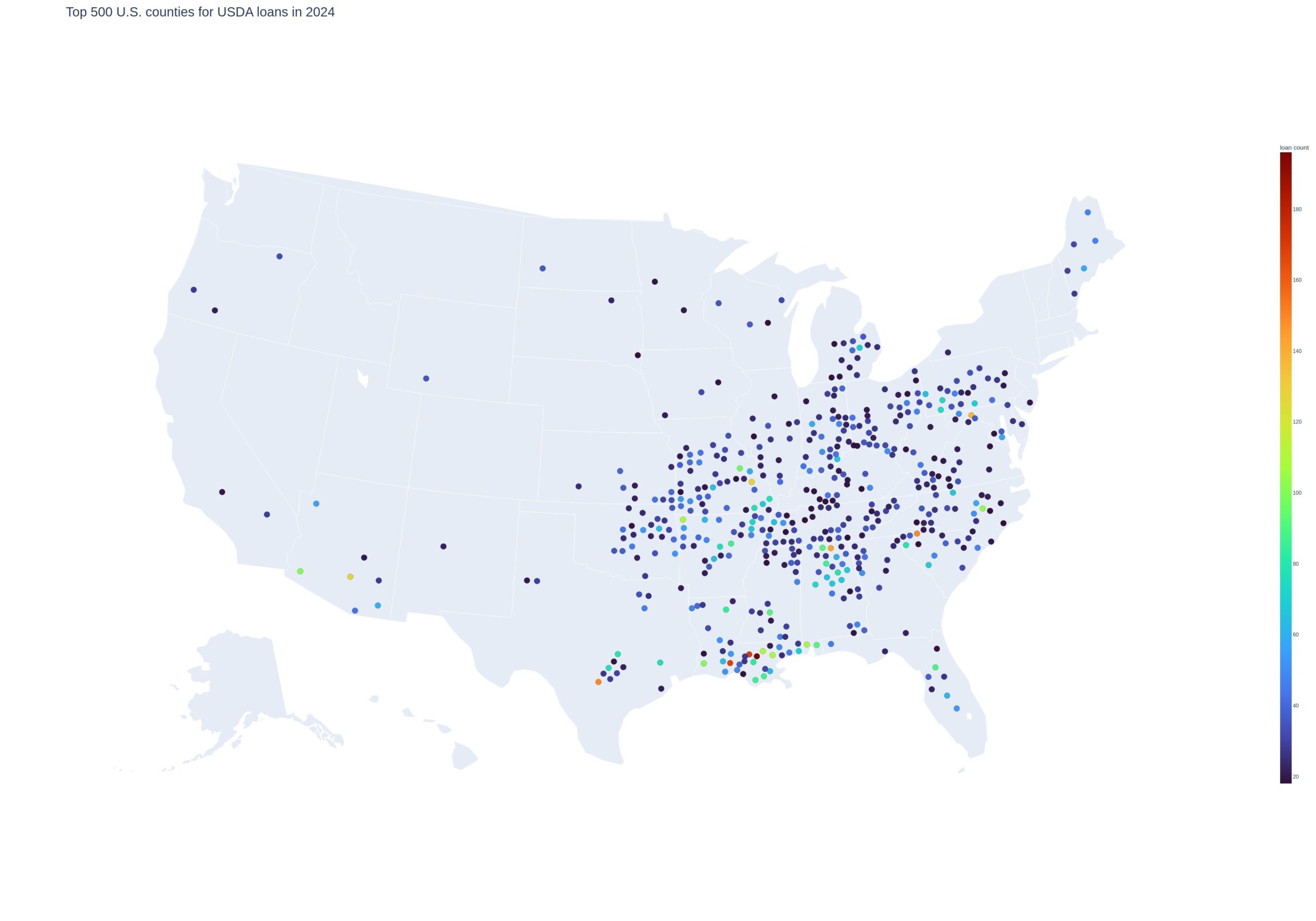

By total loan count regardless of population, Livingston Parish, Louisiana led all U.S. counties with 196 USDA loans in 2024. Louisiana rounded out the top three with 169 in East Baton Rouge Parish and 168 in Lafayette Parish.

Top U.S. counties for USDA loans (by total loan count)

The table below shows the top 20 highest total USDA loans by county in 2024:

| Rank | County | State | USDA loan count | Average loan amount |

| 1 | Livingston Parish | Louisiana | 196 | $218,929 |

| 2 | East Baton Rouge Parish | Louisiana | 169 | $218,077 |

| 3 | Lafayette Parish | Louisiana | 168 | $215,893 |

| 4 | Bexar | Texas | 150 | $259,400 |

| 5 | Spartanburg | South Carolina | 149 | $245,134 |

| 6 | Madison | Alabama | 142 | $264,296 |

| 7 | Berkeley | West Virginia | 137 | $262,299 |

| 8 | St. Francois | Missouri | 128 | $163,594 |

| 9 | Pinal | Arizona | 127 | $283,819 |

| 10 | Benton | Arkansas | 109 | $257,202 |

| 11 | Tangipahoa Parish | Louisiana | 109 | $216,468 |

| 12 | Mobile | Alabama | 107 | $210,701 |

| 13 | St. Tammany Parish | Louisiana | 107 | $221,822 |

| 14 | Johnston | North Carolina | 104 | $312,981 |

| 15 | Calcasieu Parish | Louisiana | 101 | $185,297 |

| 16 | Yuma | Arizona | 101 | $255,297 |

| 17 | Franklin | Missouri | 97 | $191,289 |

| 18 | Rankin | Mississippi | 91 | $233,901 |

| 19 | Baldwin | Alabama | 91 | $276,868 |

| 20 | Limestone | Alabama | 91 | $254,011 |

Applying for a USDA loan

Does a loan with no down payment combined with comparatively lower interest rates and insurance premiums appeal to you? As long as you meet all the requirements, a USDA mortgage could be your cost-effective solution to homeownership.

In order to be eligible, the property must be a single-family, primary residence, located in a rural area. The USDA defines ‘rural’ as places with a population below 10,000 that are “rural in character” or “in open country,” or places with a population below 20,000 not situated in a Metropolitan Statistical Area. (You can visit the USDA’s property eligibility site here.) The property must also meet the minimum safety and accessibility standards.

Additionally, you must be a U.S. resident and typically need a credit score above 640, a steady employment history in the last two years, a debt-to-income ratio below 41%, and an income under 115% of the area median. Notably, borrowers must pay a 1% upfront guarantee fee and 0.35% annual fee, but closing costs can be rolled into the loan amount.

See our full explainer on USDA mortgages here.

USDA loan types

USDA home loans come in a few different sizes and the best fit depends on your situation.

For buying a house, you can decide between USDA Guaranteed or USDA Direct.

The Guaranteed loan is backed by the USDA but goes through a private lender. Borrowers are subject to meeting all the requirements laid out in the section above.

Direct, also called Section 502 Direct Loans, come straight from USDA funding instead of through a lender. This program is more exclusive since it aims at buyers with very low income (less than 80% of the area median) and only applies to homes under 2,000 square feet. It also comes with comparatively lower credit requirements and longer repayment terms (33-to-38 years versus 30 years).

Verify your USDA mortgage eligibility. Start hereFor buying land and building a house or repairing your current one, there are the USDA Construction Loan and USDA Home Improvement Loan, also known as the Single Family Housing Repair Loan and Grant Program.

If a USDA loan isn’t quite for you, other low-to-no down payment alternatives include mortgages backed by the Federal Housing Administration (FHA) and Department of Veterans Affairs (VA).

Bottom line on USDA loans

With their borrower-friendly financial terms and looser parameters, USDA can provide a cheaper path to homeownership — as long as you meet the eligibility criteria.

Even with their low interest rates and no down payment requirement, it’s still beneficial to be prepared, learn how to negotiate, and see if you qualify for financial assistance programs.

If you’re ready, reach out to a local mortgage lender who specializes in USDA loans and get started.

Time to make a move? Let us find the right mortgage for you