Looking for a mortgage bank? Try a non-bank lender

A few years ago, everyone went to “the bank” for mortgages. Or at least 70 percent of home buyers did, according to a new study by the Urban Institute. But today, non-bank institutions have the majority of the mortgage market.

More importantly, they don’t lend the same way banks do, so if “the bank” says no to you, a non-bank lender might say yes.

Verify your home buying eligibilityCredit looser thanks to non-banks

The study, Five things every policymaker should know about nonbanks and the evolving mortgage industry, found that the emergence of non-bank mortgage lenders has changed the industry in several important ways.

First, most homebuyers have traditionally obtained mortgages from a regulated bank. But today, non-bank lenders have been a big factor in making more credit available for home purchases.

What credit score do you need for a mortgage?

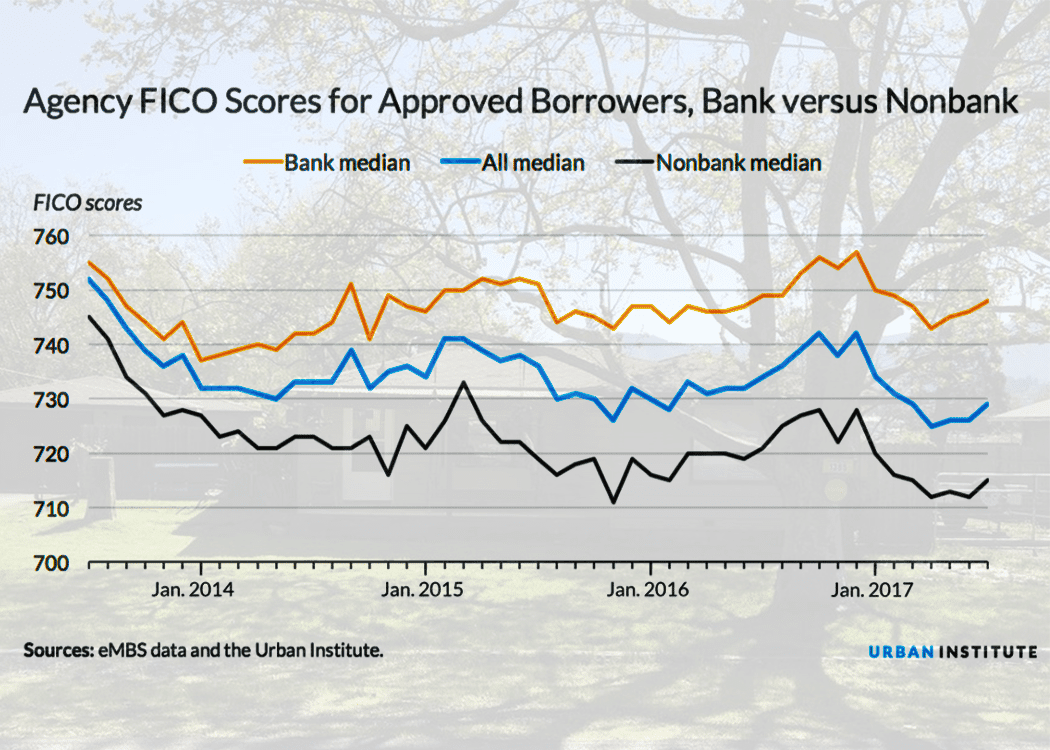

While median credit scores have declined 23 points for all loans since 2013, for non-banks, the decline was 30 points (from 745 to 715), but just 7 points for banks.

That goes double for FHA

Non-banks have really stepped into the gap created by reluctant banks in the government-backed loan sector.

That is because, while FHA guidelines are extremely flexible, allowing FICO scores as low as 500 and debt-to-income ratios as high as 50, most lenders impose stricter guidelines, called overlays.

Beating overlays for conventional and government-backed home loans

Non-banks are less likely to apply strict overlays than banks are, and this has cause their market share to spike. While non-banks originated about a third of government mortgages four years ago, today, they have nearly 80 percent of the market.

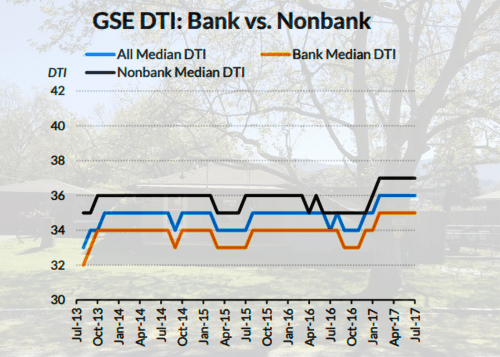

Debt-to-income is higher for non-bank mortgages

It’s not just lower FICO scores that make a difference for non-banks. They also let applicants stretch their incomes a little further.

Your debt-to-income (DTI) ratio can tell you how much home to buy

While many programs, including FHA and Fannie Mae, allow borrowers to spend as much as 50 percent of their income on housing and their other account payments, it’s the non-banks that seem more likely to actually approve loans that push the envelope.

Why are non-banks more flexible than mortgage banks?

The Urban Institute’s researchers concluded that non-banks did not create some magical surge of business. Instead, mortgage banks pulled back from lending to riskier applicants and allowed non-banks to take that business.

Why has this happened?

Banks, say the study’s authors, have pulled back from Fannie Mae, Freddie Mac and FHA lending for three main reasons:

- Uncertainty about litigation and regulations, not knowing when lenders might have to buy back loans from investors

- The increased cost of dealing with delinquent mortgages

- For government loans, the False Claims Act has been used since 2011 to punish lenders for underwriting mistakes — many believe overzealously.

Which is better? A mortgage broker or a bank?

Non-banks, being less regulated than banks, have less to fear from the enforcement of recent mortgage reforms than banks do. But what’s bad for banks might be good for you.

Verify your home buying eligibilityTurned down by a mortgage bank? No biggie

What this means for you, the mortgage consumer, is that you have options if a bank (or any institution) turns down your mortgage application.

Turned down for a mortgage: What's next?

Here’s your course of action:

- Get the reason you were turned down. The lender should have given you an “adverse action”letter explaining why your application was denied.

- Assuming that you can’t quickly and easily fix the issue, contact more lenders. Explain what the problem was, for example, your FICO is 630 but the lender has a minimum score of 640 for FHA loans.

- Find lenders that do not apply overlays that affect you. These are likely to be non-bank mortgage lenders.

- Get quotes from these nice non-bank lenders, and apply with one offering a good deal.

If even the non-bank lenders won’t approve you, your next step is to improve your credit, pay off debt, shop for a less-expensive house or look for non-prime financing.

What are today’s mortgage rates?

Current mortgage rates for banks and non-banks are extremely low. Political and economic uncertainty has kept investors in bonds and mortgage-backed securities, causing interest rates to stay down.

To find your best deal, contact several competing mortgage lenders and compare their offers before applying.

Time to make a move? Let us find the right mortgage for you