Planning a home equity loan or HELOC refinance?

Be prepared, because things have changed a lot. You may be able to pay less for your second mortgage with a home equity line of credit (HELOC) refinance or new home equity loan (HELOAN).

The HELOC has a drawing period, in which it functions a lot like a credit card. Your minimum payment is interest-only, and based on your current balance and interest rate.

The HELOAN usually carries a fixed rate. It delivers a lump sum at closing, and you repay the loan in equal monthly installments.

Check your home equity eligibility. Start hereWhat is HELOC payment shock?

What happens with some HELOC borrowers is that they max out their credit lines during the drawing period and just make the minimum payment. But when the drawing period ends, the entire balance must be repaid over the remaining term of the loan.

If you have a 15-year HELOC, your drawing period might be five years, and then you have ten years to pay off the entire balance. If you have a 25-year HELOC, your drawing period might be ten years, and once that ends, you get 15 years to repay the balance.

Making things worse, HELOCs almost always come with variable rates. And lately, interest rates have been heading higher.

HELOC refinance options

If you can pay down your loan balance quickly, that’s a great way to avoid a payment spike and extra interest charges. But not everyone can do this. Fortunately, you probably have additional choices:

- You can replace your HELOC with a new HELOC. This gives you more time to pay off your balance, and may lower your payment.

- You can replace your HELOC with a HELOAN, giving you a fixed interest rate and additional time to retire your balance. Your payment should be lower as well.

- You can combine the HELOC and your first mortgage into a new first mortgage.

Determine your goal for refinancing. Reducing current mortgage payments, lowering your interest rate, or getting access to new funds are all valid goals. Each has its pros and cons.

Whatever refinancing you choose, it could provide more liquidity and some financial relief. However, stretching out the repayment of a loan balance can increase your overall interest expense, even if your new rate is lower.

What to do before your HELOC resets

If you’re in the early stages of your HELOC, now’s the time to consider an exit strategy.

The below chart shows how the repayment period length and the interest rate affect the monthly cost of a $20,000 HELOC.

| Repayment Term | 4.00% | 6.00% | 8.00% |

| 20 Years | $120 | $140 | $170 |

| 10 Years | $200 | $220 | $240 |

| 5 Years | $370 | $390 | $400 |

Now is the time to take action and get your balance down to an affordable range — before you’re obligated to a higher payment than you can make. The table below shoes how reducing your balance before the repayment period begins can keep your payment affordable.

| Balance | 4.00% | 6.00% | 8.00% |

| $20,000 | $370 | $390 | $405 |

| $15,000 | $275 | $300 | $305 |

| $10,000 | $185 | $195 | $200 |

Coming up with cash isn’t a solution for everyone, however. You might have to take other action to prevent your HELOC payment from rising beyond your reasonable ability to pay. Consider solutions that apply to HELOCs after they’ve reset.

Qualifying for a HELOC in today's world

HELOC refinance requirements are more stringent than they were ten years ago. So, you may have to meet guidelines that didn’t exist when you took out your loan.

Today, lenders must determine your ability to repay (The ATR Rule) before approving a HELOC refinance. You’ll probably have to provide more documentation to qualify for a new mortgage as well.

In most cases, you must have at least 20 percent equity in your home to refinance, although highly-qualified borrowers can find HELOCs and HELOANs of up to 90 percent of their property value.

Decide how you want to refinance

Knowing your financial position helps you choose the best way to refinance your HELOC. Personal economic factors determine if it makes sense to combine your first mortgage and HELOC into a new loan, or just refinance the HELOC.

Keep in mind that closing costs are usually lowest for a HELOC and higher for a HELOAN. Refinancing both of your loans into a new first mortgage may get you the lowest interest rate, but often comes with higher closing costs.

This is partly because these loans are usually considered cash-out refinances, which lenders consider riskier than standard rate-and-term refis.

To see if it makes sense to combine your loans, compare the “blended rate,” a weighted average of the first mortgage and a new HELOC or HELOAN, with the interest rate for a new cash-out refinance.

How to calculate your blended rate

A blended rate tells you the overall interest rate you’re paying on thee total of several accounts with different amounts and / or interest rates.

For instance, if you paid 4.0 percent interest on a $50,000 loan, and 5.0 percent on another $50,000 loan, your blended rate is 4.5 percent.

Here’s how the calculations look:

- First, you add the loan balances together to find the total of all loans. In this case, that’s $100,000.

- Next, you divide each balance by the total. In this case, $50,000 / $100,000 is .50, or 50 percent.

- Multiply the interest rate of each account by its proportion (percent of total). That gives you an adjusted or weighted rate for each account.

- Finally, add all of the weighted rates together. That’s your blended rate.

| Loan A | Loan B | |

| Loan Amount | $50,000 | $50,000 |

| Total of All Loans | $100,000 | |

| Percent of Total | 50.0% | 50.0% |

| Interest Rate | 4.0% | 5.0% |

| Rate * Percent of Total | 2.0% | 2.5% |

| Total of all Weighted Rates | 4.5% |

Usually, though, a HELOC balance in considerably lower than that of the first mortgage. It’s not an easy 50/50 deal. But the calculations are the same.

Blended rates for smaller HELOCs

| First Mortgage | HELOC Balance | |

| Loan Amount | $275,000 | $25,000 |

| Total of All Loans | $300,000 | |

| Percent of Total | 91.7% | 8.3% |

| Interest Rate | 4.0% | 7.5% |

| Rate * Percent of Total | 3.67% | 0.63% |

| Total of all Weighted Rates | 4.29% |

If you can’t find a refinance mortgage wrapping both loans into a new one at a better rate than 4.29 percent, you might want to scrap any consolidation plans. If it’s cheaper and makes sense, you may refinance your first and second mortgages separately, or just keep your current first mortgage and replace your HELOC.

Blended rates for larger HELOCs

If, however, your HELOC balance is relatively large, a cash-out refinance might be a great solution. In this case, the borrower plans to keep the property for five more years, and is looking at rates for 5/1 ARMs.

So, if the blended rate turns out to be less than 3.0 percent available for 5/1 mortgages, combining the first mortgage and HELOC into a new loan makes sense. In this case, the blended rate is an expensive 5.48 percent.

| First Mortgage | HELOC Balance | |

| Loan Amount | $85,000 | $50,000 |

| Total of All Loans | $135,000 | $ |

| Percent of Total | 63.0% | 37.0% |

| Interest Rate | 4.0% | 8.0% |

| Rate * Percent of Total | 2.52% | 2.96% |

| Total of all Weighted Rates | 5.48% |

Getting a new HELOC or HELOAN

Getting a new HELOC, if your finances make it possible, would reset your entire mortgage loan to the draw period. That gives you an entirely new term to repay the loan.

However, you’ll probably have a variable interest rate, which can make budgeting a challenge. As the Fed raises interest rates, the bank raises your HELOC rate.

A new HELOAN almost always carries a fixed interest rate. However, the fixed rate is higher than the variable rate of a HELOC, and your closing costs will probably be higher.

Cash-out HELOC refinance

Lenders consider two mortgages taken out at different times then combined into one mortgage a “cash out refinance.”

You can get a cash-out refinance up to 80 percent of your property value under most conventional (non-government) mortgage programs.

FHA allows cash-out up to 85 percent, and doesn’t add extra charges for cash out. However, the mortgage insurance can be steep.

VA home loans for military households allow cash out up to 100 percent of the property value if you’re eligible.

If you have enough home equity, you may be able to refinance your first mortgage and HELOC, plus pull additional cash out of the property.

Avoid this loan type if it doesn’t fit your financial objectives.

When the junior mortgage can block your primary loan refi

HELOCs and HELOANs are also called “second mortgages” because their liens are “junior” to the lien held by the lender with the first mortgage.

What that means is if you lose your home to foreclosure, the lender with the first mortgage gets paid first out of any auction proceeds. The junior lien-holder only gets repaid if there is enough money left over.

If you decide to refinance a first mortgage separately from your HELOC, you may have some title issues. The holder of the second mortgage must agree to “subordinate” its lien to that of the new first mortgage lender.

That’s because once the old first mortgage is repaid, the HELOC automatically moves into first position. Naturally, the new first mortgage lender won’t be willing to take on the risk of being in second position.

The only way this transaction can happen is if the HELOC lender agrees to drop into second position once the new first mortgage closes.

If this is your refinancing plan, start the re-subordination process early and work to get junior’s cooperation.

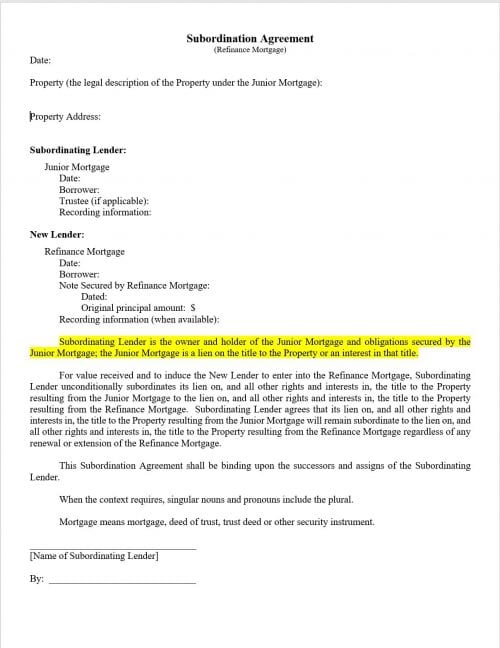

What you’ll need is a subordination agreement from your second mortgage holder. Your refinance lender can request that, but make sure you get involved to make sure the HELOC lender cooperates.

Second mortgage lenders aren’t always the most cooperative when asked to subordinate their loan. Sometimes they are worried about the terms of the new loan. Often, they are bombarded with subordination requests.

Just know that getting your subordination document isn’t a one-day process.

Here is a sample provided by Freddie Mac:

Common requirements for subordination approvals include minimum credit scores and maximum CLTV (combined loan-to-values). You may be able to secure a subordination by paying down the balance of a home equity loan or reducing your available credit on a HELOC.

What are today’s mortgage rates?

Current refinance rates are slightly lower than they were last week. However, rates for first mortgages, home equity loans and HELOCs move constantly as economic conditions change.

Time to make a move? Let us find the right mortgage for you