The Interest-Only Party Is Over, And It’s Time To Repay Your HELOC

Home equity lines of credit, aka HELOCs, can be really helpful mortgage products. You only pay interest on the amount of credit you use, and you can pay your loan off and reuse it during its term.

Your HELOC payment can get you into trouble, however, if you don’t plan for both stages of this loan — the draw period and the repayment period.

Verify your new rateThe Two Stages Of HELOCs

Many industry insiders describe HELOCs as being similar to credit cards. And there’s some truth to this. Like credit cards, HELOCs are “revolving” accounts.

That means you can tap them (up to your account limit) whenever you want. You can pay the balances down or off, and reuse them again and again.

But credit cards are considered “open-ended” credit. That means there is no specific term in which you must pay off the entire balance. Your minimum payment covers the interest and some small percentage of the account balance.

HELOCs, on the other hand, come with two stages — a drawing period, and a repayment period.

A 15-year HELOC with a five-year draw period gives you ten additional years in which to repay it. The 25-year HELOCs with ten-year drawing stages give you 15 years to repay.

Step One — The Fun One

During the drawing stage, you get to spend money, and you’re not required to pay anything but your interest charges.

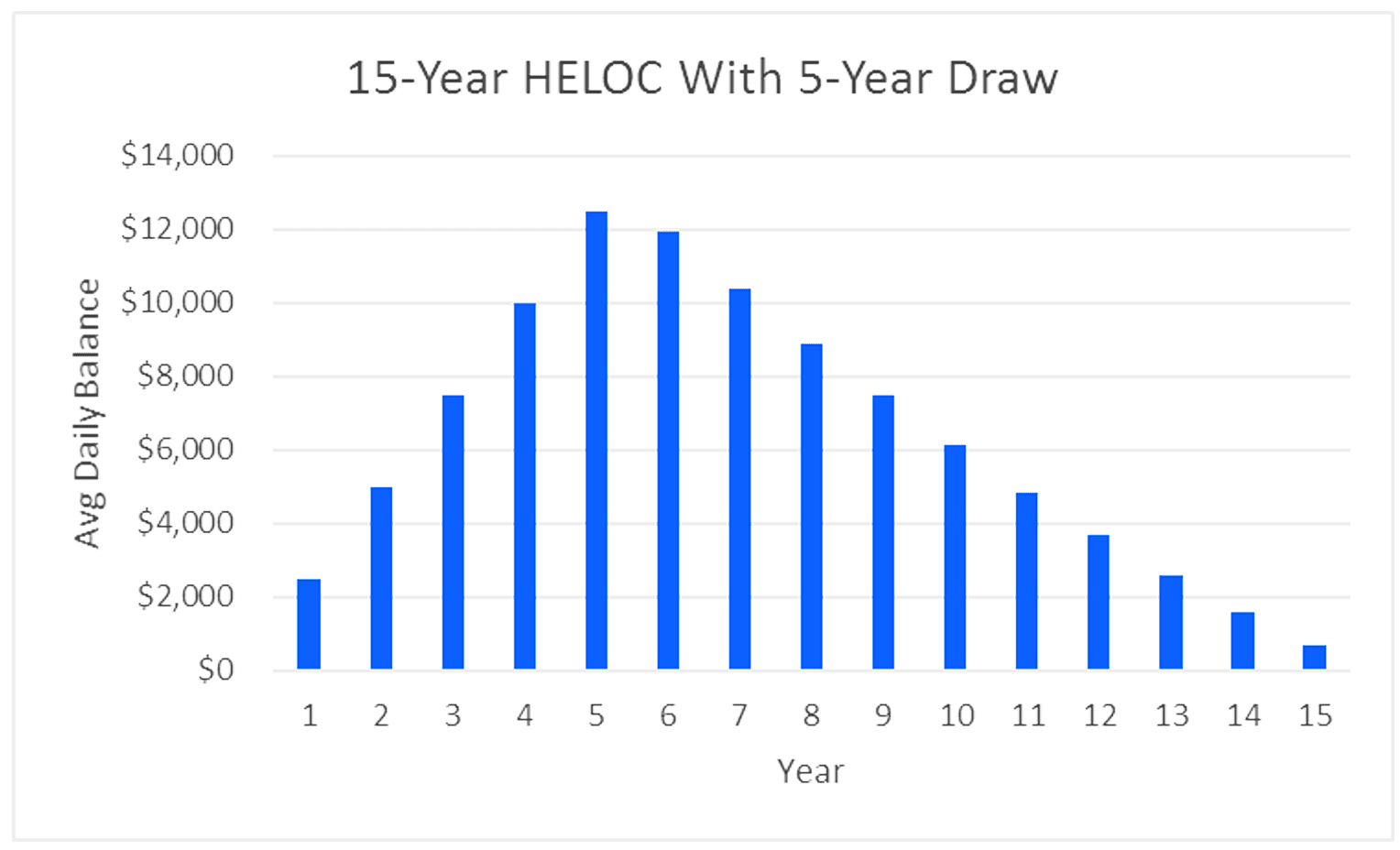

If your average daily balance is $2,500 in the first year, and your interest rate starts at 3.00 percent, your payment is only $6.25 per month.

If you add $2,500 a year to your balance, and you make interest-only payments, your balance grows over time. And it must be repaid.

These figures are somewhat simplified because in reality, your rate and balance are usually calculated daily.

Unlike a credit card, the HELOC has one potentially dangerous attribute. During the first (drawing) stage, the minimum monthly payment only covers the interest.

Unless you pay more than required, your loan balance doesn’t go down. So when the repayment stage begins, your required payment can really step up.

Verify your new rateDon’t Trip Over The Second Step

During the repayment phase, the borrower can no longer tap the credit line, and the balance must be repaid. The payment depends on the balance, interest rate, and remaining loan term.

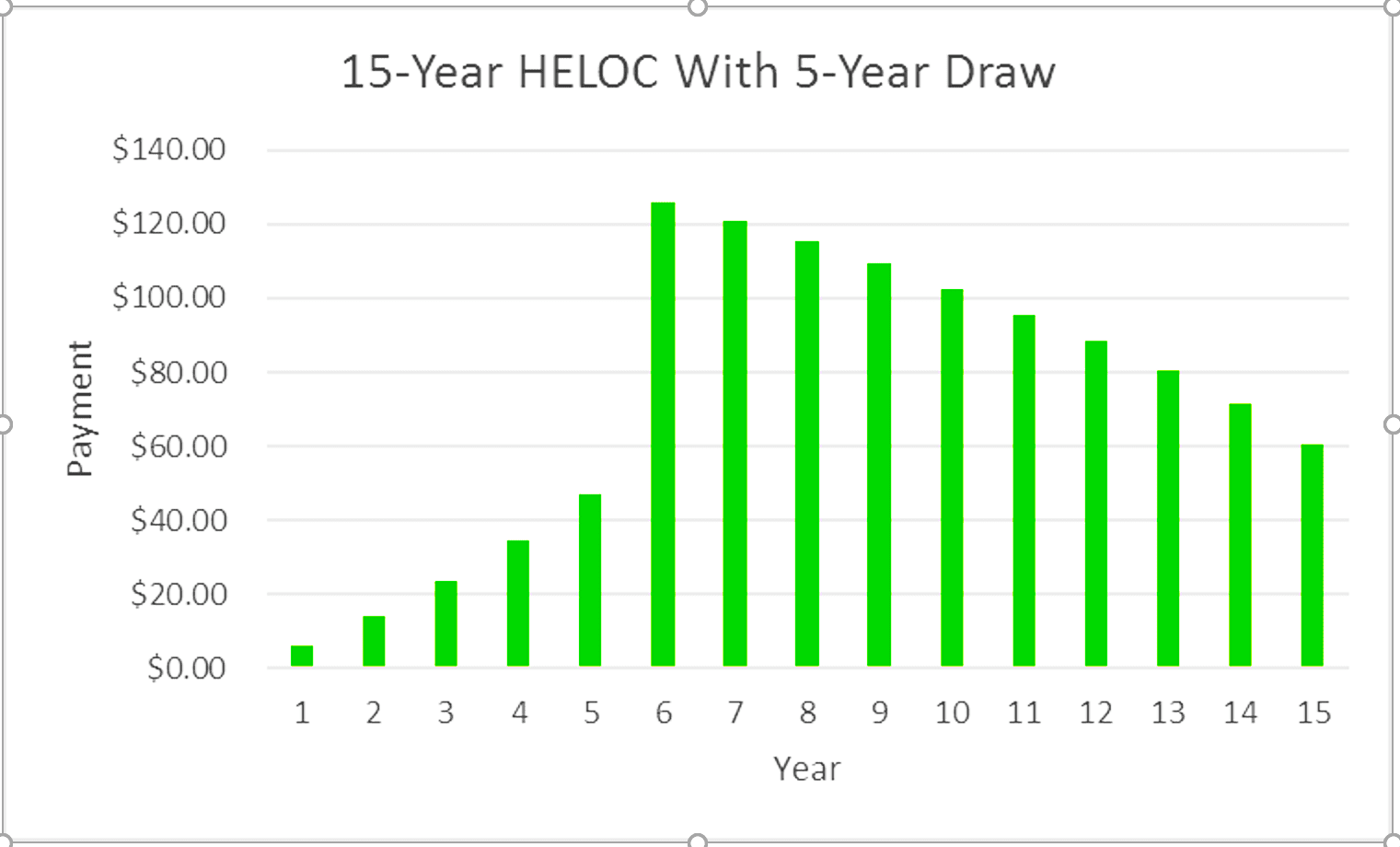

Look what happens in Year Six, when there are ten years left to repay the balance. The borrower has continued to spend $2,500 a year, and in this case, the interest rate has risen.

That cute little $6.25 payment in our example is now about $125 a month. And that’s assuming interest rates stay relatively low — under five percent by Year Six if they only rise slightly each year.

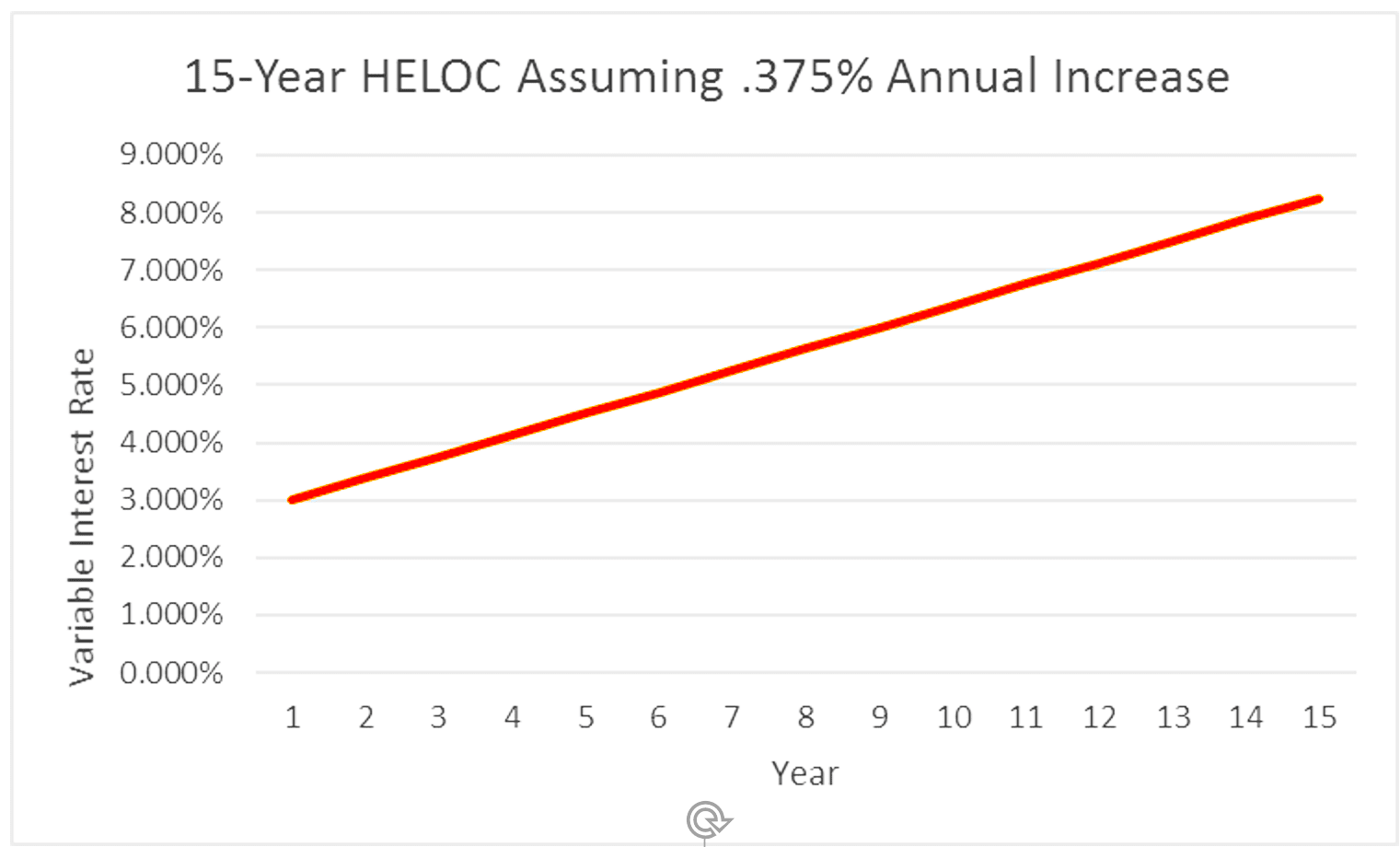

This chart shows what could happen over time with even modest interest rate increases — .375 percent each year in this example.

How Can You Head Off Future HELOC Payment Increases?

You can prevent HELOC shock by employing several strategies.

Don’t max out your credit while making the minimal payment. Simply pay extra each month toward your principal balance to minimize interest charges.

Refinance into a fixed-rate home equity loan, and obtain a rate that won’t increase. This can make budgeting easier and get you back on track with an affordable payment.

If you have enough equity, you could wrap the HELOC balance into a new first mortgage.

If you used your HELOC for certain energy-related home improvements, your new mortgage would be considered a rate-and-term refi, which costs less. Otherwise, your refinance would likely be considered a cash-out refinance, which often comes with higher closing costs.

A good loan professional can help you sort out your options and choose the right program.

What Are Today’s Mortgage Rates?

Today’s current rates are lower than they were in the wake of the 2016 election, but they are expected to climb slowly over time. If you’re concerned about future payments on a HELOC or other variable-rate loan, it’s time to compare available mortgages and get yourself into something stable.

Time to make a move? Let us find the right mortgage for you