Key Takeaways

- East Coast bias: the top states for young, female homebuyers fall all along the Atlantic coast of the U.S.

- Rugged and rural: The highest shares of Gen Z male homebuyers came in Alaska, Mississippi, and the Dakotas.

- The volume trio: Texas, Florida, and Ohio led by Gen Z homebuyer volume for both male and female borrowers.

Generation Z is entering the housing market and becoming homeowners. Although affordability constraints define many of their home buying journeys, some still find success.

But who is having more success within the demographic? And which states welcomed the most female borrowers last year? What about same sex borrowers? The Mortgage Reports analyzed the latest Home Mortgage Disclosure Act (HMDA) data to find out.

Verify your first-time home buyer eligibility. Start hereGen Z home buying trends

A total of 232,083 U.S. home buyers under 25 years old took out a mortgage in 2024, according to the latest HMDA data. Overall, men accounted for 61.9% of the primary borrowers, women for 33.4%, and those who fell into neither category or did not disclose took up the remaining 4.6%.

The Mortgage Reports combed through the numbers to get a sense of where Gen Z* homeowners are landing and broke it down further to see which states had the highest ratios by gender.

*The analyzed 2024 HMDA data exclusively covers Gen Z but doesn't cover the entire demographic, cutting off the eldest two years (those born in 1997 and 1998).

Women Gen Z Homebuyers around the U.S.

Top states for women homebuyers

Who runs the (homebuying) world? Girls.

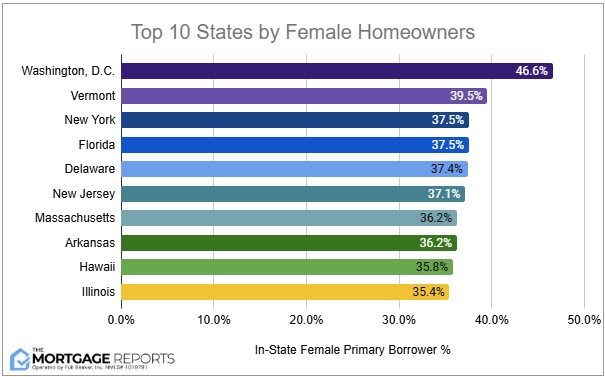

In just over half the country (25 states and the District of Columbia), the ratio of female primary borrowers under-25 went above the national average in 2024. Washington, D.C. topped the list with a 46.6% share of women Gen Z homebuyers. Vermont placed second at 39.5%, with New York and Florida’s 37.5%, and Delaware’s 37.4% rounding out the top five. The chart below shows the full top-10:

Top 10 States by Women Borrowers

More Gen Z women homebuyer stats

Broken down further, we looked at female primary borrowers and their co-applicants as well.

Washington D.C. also topped the charts in single female homebuyers with a 32.1% share, followed by 21.7% in Connecticut and 20.7% in Illinois, versus the U.S. mean of 15.3%. Idaho had the highest ratio of primary female-secondary male home loans at 24%, just ahead of 23.1% in Vermont and 21.5% in Utah, and 14.7% across the country.

Rhode Island, D.C., and California led by percentage of same sex female mortgages at 6.3%, 6.1%, and 5.6%, respectively. That compared to a 3.1% national average. By volume, Texas paced the country with 6,898 Gen Z female-led mortgages in 2024. Florida’s 4,752 and Ohio’s 3,951 came next.

Verify your first-time home buyer eligibility. Start hereThe table below shows the top-20 states where the primary borrower was an under-25-year-old female in 2024. It also gives the percentages of single borrowers, borrowers with a male co-applicant, and same sex borrowers, alongside the volumes for each state:

| State | % Female Primary Borrowers | % Single Female Borrowers | % Female-Male Borrowers | % Female-Female Borrowers | Total Under-25 Female Primary Borrowers | Grand Total (All Under-25 Borrowers) |

| Washington, D.C. | 46.6% | 32.1% | 8.4% | 6.1% | 61 | 131 |

| Vermont | 39.5% | 11.9% | 23.1% | 4.2% | 113 | 286 |

| New York | 37.5% | 18.4% | 15.1% | 3.6% | 2,020 | 5,382 |

| Florida | 37.5% | 15.5% | 16.4% | 5.2% | 4,752 | 12,666 |

| Delaware | 37.4% | 19.7% | 14.5% | 3.1% | 230 | 615 |

| New Jersey | 37.1% | 16.3% | 16.6% | 3.5% | 880 | 2,371 |

| Massachusetts | 36.2% | 14.5% | 15.9% | 5.4% | 665 | 1,835 |

| Arkansas | 36.2% | 16.1% | 17.0% | 2.7% | 1,201 | 3,316 |

| Hawaii | 35.8% | 11.9% | 18.7% | 3.5% | 111 | 310 |

| Illinois | 35.4% | 20.7% | 11.6% | 3.0% | 3,098 | 8,743 |

| Oregon | 35.4% | 9.4% | 20.1% | 5.0% | 678 | 1,917 |

| Montana | 35.2% | 11.2% | 20.5% | 3.2% | 220 | 625 |

| Nevada | 35.1% | 13.8% | 16.1% | 4.6% | 771 | 2,194 |

| New Mexico | 35.0% | 16.7% | 14.2% | 3.7% | 797 | 2,276 |

| Colorado | 34.9% | 11.4% | 17.9% | 5.1% | 1,542 | 4,418 |

| Connecticut | 34.6% | 21.7% | 10.0% | 2.7% | 518 | 1,495 |

| South Carolina | 34.6% | 16.0% | 15.0% | 3.3% | 1,914 | 5,531 |

| Maryland | 34.6% | 16.5% | 13.5% | 4.0% | 1,035 | 2,994 |

| Minnesota | 34.5% | 16.3% | 15.3% | 2.6% | 2,147 | 6,227 |

| Iowa | 34.2% | 18.2% | 14.0% | 1.7% | 1,722 | 5,028 |

Top states for men homebuyers

While the U.S. progressed beyond women not being allowed to open their own credit card or bank account, HMDA data suggests it’s still a man’s world.

In addition to holding the majority (61.9%) of under-25 homebuyers in 2024, that ratio went above two-thirds in some states. Alaska and Mississippi paced the nation with 67.3% male Gen Z borrowers, ahead of 66.9% in Nebraska, 66.7% in North Dakota, and 66.5% in Louisiana. The chart below shows the full top-10:

Top 10 States by Male Borrowers

More Gen Z men homebuyer stats

While there is plenty of overlap in the top states, male borrowers by co-applicant showed more variance than females.

North Dakota led by single male homebuyer share with 47.3% share, followed by 46.8% in Louisiana, and 46.3% in Alaska, compared to the U.S. average of 38.6%. Utah had the highest ratio of primary male-secondary female home loans at 30%, beating out 27.4% in Idaho, 24.8% in Washington, and 18.2% nationwide.

California led by percentage of same sex male mortgages at 11.1%. That edged out Utah’s 9.8%, D.C.’s 9.2%, while overshadowing the 4.6% national mean. By sheer volume, the same three states led the way. Texas came first with 13,327 Gen Z male-led mortgages in 2024, followed by 7,419 in Ohio and 7,365 in Florida.

Time to make a move? Let us find the right mortgage for youThe table below shows the top-20 states where the primary borrower was an under-25-year-old male in 2024. It also gives the percentages of single borrowers, borrowers with a female co-applicant, and same sex borrowers, alongside the volumes for each state:

| State | % Male Primary Borrowers | % Single Male Borrowers | % Male-Female Borrowers | % Male-Male Borrowers | Total Under-25 Male Primary Borrowers | Grand Total (All Under-25 Borrowers) |

| Alaska | 67.3% | 46.3% | 17.4% | 2.9% | 375 | 557 |

| Mississippi | 67.3% | 45.3% | 19.0% | 2.7% | 1,893 | 2,812 |

| Nebraska | 66.9% | 41.0% | 21.1% | 4.4% | 1,577 | 2,357 |

| North Dakota | 66.7% | 47.3% | 15.8% | 3.5% | 664 | 996 |

| Louisiana | 66.5% | 46.8% | 16.6% | 2.7% | 2,751 | 4,135 |

| South Dakota | 66.1% | 41.6% | 21.1% | 3.0% | 732 | 1,108 |

| New Hampshire | 65.8% | 37.9% | 22.2% | 4.8% | 359 | 546 |

| Wisconsin | 65.7% | 44.2% | 17.9% | 3.1% | 3,783 | 5,757 |

| Wyoming | 65.4% | 43.7% | 18.9% | 2.4% | 432 | 661 |

| Indiana | 64.5% | 44.2% | 17.0% | 3.1% | 6,594 | 10,223 |

| Kansas | 64.3% | 42.2% | 18.7% | 3.2% | 1,967 | 3,061 |

| Utah | 64.2% | 23.9% | 30.0% | 9.8% | 2,726 | 4,243 |

| Alabama | 63.9% | 42.0% | 18.7% | 2.8% | 3,771 | 5,905 |

| Tennessee | 63.6% | 37.2% | 21.9% | 4.3% | 4,271 | 6,718 |

| Kentucky | 63.5% | 41.6% | 19.3% | 2.4% | 3,344 | 5,270 |

| Pennsylvania | 63.4% | 42.2% | 17.1% | 3.5% | 5,190 | 8,190 |

| Texas | 63.1% | 37.7% | 19.9% | 5.0% | 13,327 | 21,133 |

| Montana | 62.6% | 37.6% | 19.7% | 4.5% | 391 | 625 |

| Iowa | 62.5% | 43.7% | 15.8% | 2.9% | 3,145 | 5,028 |

| Washington | 62.5% | 30.9% | 24.8% | 6.1% | 2,540 | 4,064 |

The bottom line

Affordability can be a major issue for young house hunters.

If you or someone you know needs help in becoming a homeowner, learn what you need to be prepared and how to negotiate, take advice from the experts, and see if you qualify for down payment assistance.

If you’re ready, reach out to a local mortgage lender and get started.