Key Takeaways

- Everything's bigger in Texas: The Lone Star State led in loan volume for three mortgage types for homebuyers under 25 years old.

- USDA rules the South: the Southeastern quadrant of the U.S. accounts for the most USDA loans.

- Conventional mortgages big in Midwest, Northeast: The highest shares of conventional loans came in Wisconsin, New York, and others.

- FHA leads in Southwest: FHA loans have the most popularity across the desert and mountain west states.

Despite the uphill affordability battle, Generation Z still finds ways to become homeowners.

To uncover where the age demographic has the most success and the loan types they’re using, The Mortgage Reports analyzed the latest Home Mortgage Disclosure Act (HMDA) data.

Verify your first-time home buyer eligibility. Start hereGen Z homebuyers

Much ado has been made about the difficulties faced by many younger home buyers. While the false narrative of exorbitant latte-and-avocado-toast-spending grabs headlines, wages have not kept up with property values for decades. It’s resulted in later generations controlling less wealth than preceding ones during the same times in their lives, in a comparatively more expensive world.

Despite the challenges, a little over 232,000 under-25 home buyers took out a mortgage in 2024, according to The Mortgage Reports analysis of the latest HMDA data.

The research showed what states under-25-year-old homebuyers flocked to in 2024 and what loan types they used. While the analyzed 2024 HMDA data exclusively covers Gen Z it doesn’t cover the entire demographic, cutting off the eldest two years (those born in 1997 and 1998).

Strongholds for conventional Gen Z borrowers

Due to their wide availability among lenders, conventional loans are the most popular with all borrowers. This held true with last year’s under-25 borrowers as well, with the data showing 61.4% (142,434) took out a conventional mortgage.

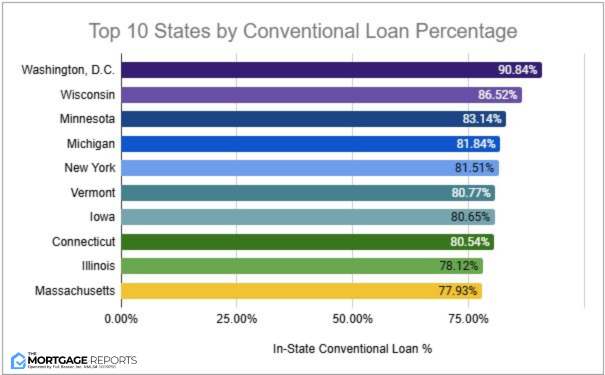

Broken down by conventional loan percentage, the nation’s capital topped the list with a 90.84% conventional share. Wisconsin’s 86.52% and Minnesota’s 83.14% came next. The chart below shows the full top-10:

Top 10 States by Conventional Loan Percentage

By volume, Texas led the country with 9,394 conventional loans, followed by 9,047 in Ohio, and 7,641 in Michigan. Below is the full top-10:

| State | Total Conventional Loans | In-State Conventional Loan % | % of U.S. Conventional Loans |

| Texas | 9,394 | 44.45% | 6.60% |

| Ohio | 9,047 | 74.39% | 6.35% |

| Michigan | 7,641 | 81.84% | 5.36% |

| Indiana | 7,364 | 72.03% | 5.17% |

| Illinois | 6,830 | 78.12% | 4.80% |

| Pennsylvania | 6,226 | 76.02% | 4.37% |

| Florida | 6,133 | 48.42% | 4.31% |

| North Carolina | 5,290 | 57.35% | 3.71% |

| Minnesota | 5,177 | 83.14% | 3.63% |

| Wisconsin | 4,981 | 86.52% | 3.50% |

See our full guide to conventional loans here.

Gen Z FHA mortgage hotspots

With more lenient underwriting requirements and lower down payment requirement, mortgages insured by the Federal Housing Administration (FHA) can be especially attractive to first-time home buyers.

In 2024, 26.32% (61,088) of under-25 borrowers got an FHA-backed home loan.

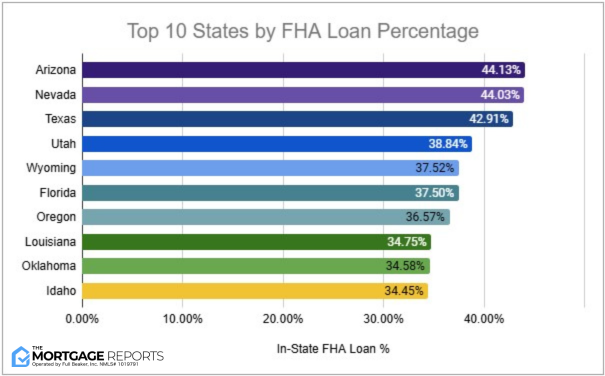

Arizona led all states with a 44.13% FHA loan percentage, just edging out 44.03% in Nevada and 42.91% in Texas. The chart below shows the top-10:

Top 10 States by FHA Loan Percentage

By total count, Texas paced the country with 9,069 FHA loans, overshadowing 4,750 in Florida and 2,704 in California. Below is the full top-10:

| State | Total FHA Loans | In-State FHA Loan % | % of U.S. FHA Loans |

| Texas | 9,069 | 42.91% | 14.85% |

| Florida | 4,750 | 37.50% | 7.78% |

| California | 2,704 | 32.67% | 4.43% |

| Arizona | 2,675 | 44.13% | 4.38% |

| Georgia | 2,390 | 31.71% | 3.91% |

| Ohio | 2,211 | 18.18% | 3.62% |

| Indiana | 2,092 | 20.46% | 3.42% |

| Tennessee | 2,025 | 30.14% | 3.31% |

| Alabama | 1,925 | 32.60% | 3.15% |

| North Carolina | 1,743 | 18.90% | 2.85% |

Bases for Gen Z VA mortgages

Backed by the U.S. Department of Veterans Affairs, VA mortgages are designed to help active-duty military personnel, veterans and certain other groups become homeowners at a more affordable cost.

An 8.86% share (20,552) of under-25 home buyers got a VA loan in 2024.

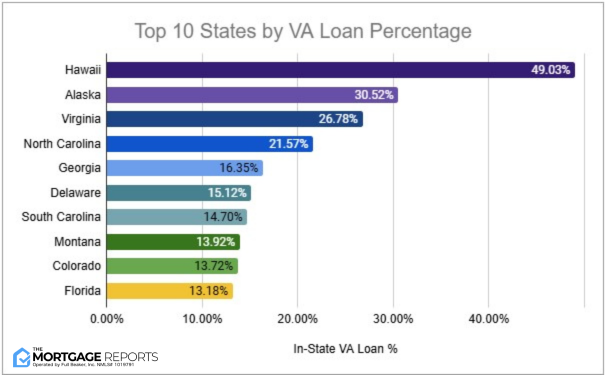

Hawaii, while low in overall volume, led the U.S. with a 49.03% VA loan percentage. Alaska came next with 30.52% and Virginia took third place at 26.78%. The chart below shows the top-10:

Top 10 States by VA Loan Percentage

Everything really is bigger in Texas, including its 2,285 VA loan count. North Carolina and Virginia followed with 1,990 and 1,755 VA loans, respectively. Below is the full top-10:

| State | Total VA Loans | In-State VA Loan % | % of U.S. VA Loans |

| Texas | 2,285 | 10.81% | 11.12% |

| North Carolina | 1,990 | 21.57% | 9.68% |

| Virginia | 1,755 | 26.78% | 8.54% |

| Florida | 1,669 | 13.18% | 8.12% |

| Georgia | 1,232 | 16.35% | 5.99% |

| California | 878 | 10.61% | 4.27% |

| South Carolina | 813 | 14.70% | 3.96% |

| Tennessee | 626 | 9.32% | 3.05% |

| Colorado | 606 | 13.72% | 2.95% |

| Ohio | 567 | 4.66% | 2.76% |

Gen Z USDA loan outposts

Mortgages backed by the U.S. Department of Agriculture help people buy a home in rural and suburban areas. While restricted to certain geographies, they have no down payment requirement and easier qualifications to meet.

In 2024, 3.45% (8,009) of under-25 mortgage borrowers got a USDA home loan.

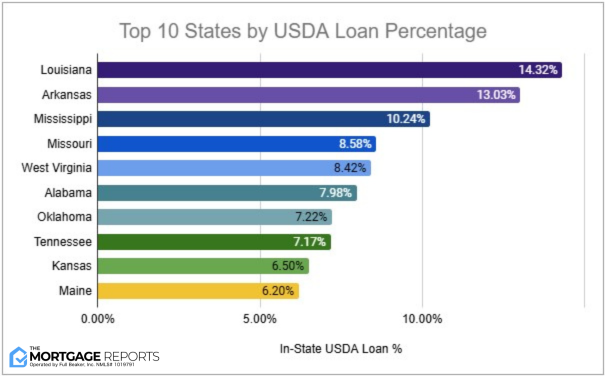

Louisiana led all states with a 14.32% USDA loan percentage. A 13.03% share in Arkansas and 10.24% in Mississippi rounded out the top three. The chart below shows the full top-10:

Top 10 States by USDA Loan Percentage

By overall count, Missouri produced the most USDA loans for under-25-year-old home buyers with 632 in 2024. The Show-Me State beat Louisiana’s 592 and Tennessee’s 482. Below is the top-10:

| State | Total USDA Loans | In-State USDA Loan % | % of U.S. USDA Loans |

| Missouri | 632 | 8.58% | 7.89% |

| Louisiana | 592 | 14.32% | 7.39% |

| Tennessee | 482 | 7.17% | 6.02% |

| Alabama | 471 | 7.98% | 5.88% |

| Arkansas | 432 | 13.03% | 5.39% |

| Indiana | 426 | 4.17% | 5.32% |

| Texas | 385 | 1.82% | 4.81% |

| Ohio | 336 | 2.76% | 4.20% |

| Kentucky | 323 | 6.13% | 4.03% |

| Pennsylvania | 304 | 3.71% | 3.80% |

The bottom line

Affordability puts up roadblocks for many potential young home buyers. To help themselves and boost their chances, first-time borrowers should be prepared, learn how to negotiate, heed expert advice, and look into financial assistance programs.

If you’re ready to begin your path to homeownership, reach out to a local mortgage lender to figure out the best loan type for you and get started.