USDA mortgages offer an affordable path to homeownership with no down payment and lower interest rates, but strict eligibility rules can derail first-time or lower-income borrowers.

To help borrowers understand their odds, The Mortgage Reports analyzed 2024 Home Mortgage Disclosure Act (HMDA) data by county to reveal the top denial reasons and where rejections are most common.

Top reasons for USDA loan denial

While they tend to be a cheaper path to homeownership, loans backed by the U.S. Department of Agriculture (USDA; also known as Farm Service Agency (FSA)) have distinct requirements compared to conventional or FHA mortgages that can trip up would-be borrowers.

To help house hunters avoid the most common reasons for USDA loan rejection, The Mortgage Reports analyzed 2024 Home Mortgage Disclosure Act (HMDA) data down to the county level to shed light on why and where it happens.

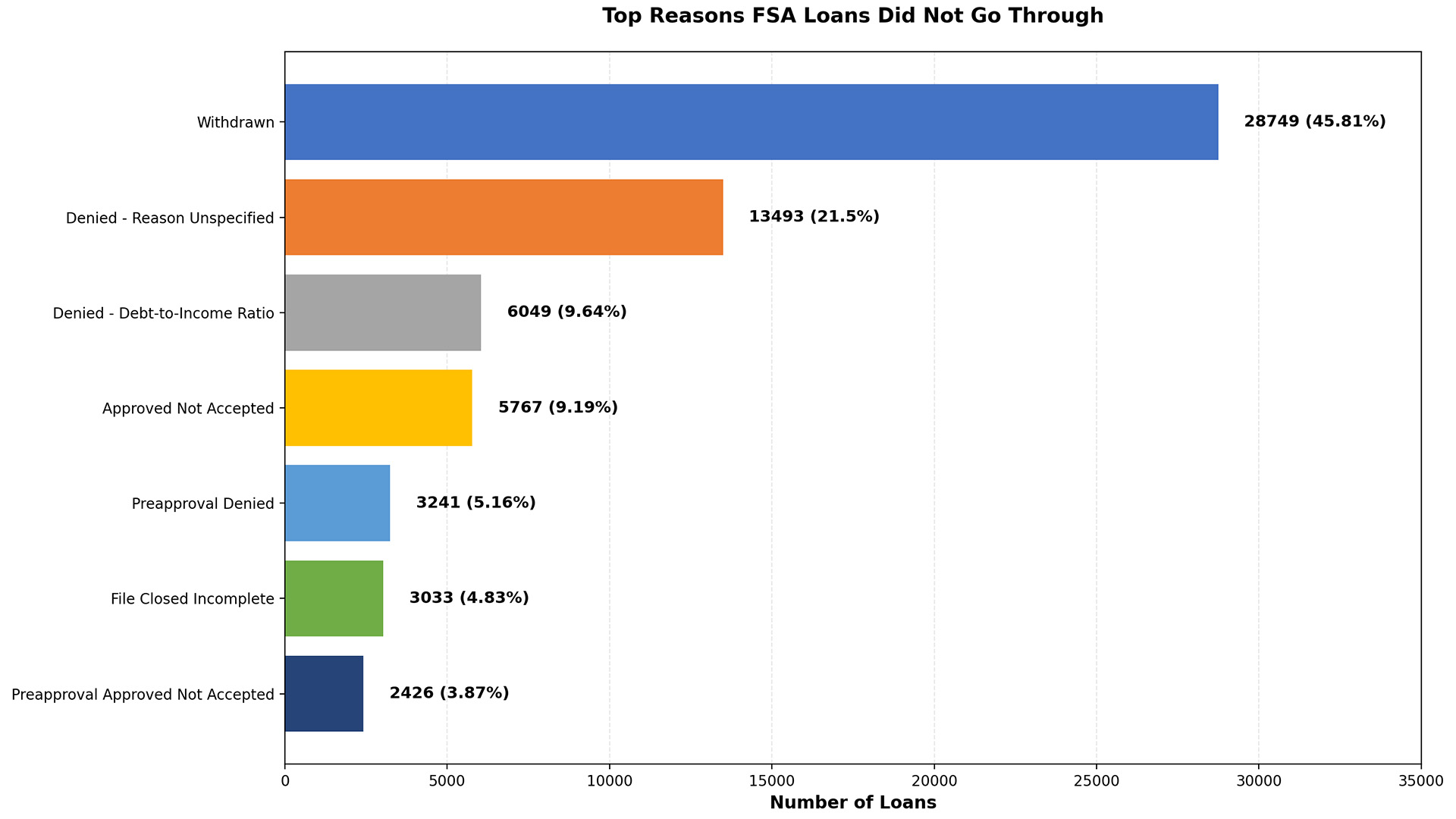

Mortgage withdrawals topped the list, with 45.8% of USDA loans that didn’t go through in 2024. Unspecified denials accounted for 21.5% and too high debt-to-income ratios were third at 9.6%.

In other words: many applicants weren’t rejected because of poor credit but because they didn’t finish the process or failed to meet debt and income limits.

Top Reasons FSA Loans Did Not Go Through

- Nearly half (46%) of FSA loans were withdrawn, the most common reason by far.

- About 22% were denied for unspecified reasons, showing a lack of clarity.

- Roughly 10% were denied due to high debt-to-income ratios, reflecting affordability issues.

- About 9% were approved but not accepted, suggesting borrowers found better options or changed plans.

- Around 5% failed due to incomplete files or preapproval denials, pointing to documentation and qualification hurdles.

Established under the Housing Financing Act in 1949 to develop rural parts of the country, USDA loans offer low- to moderate-income home buyers financing with no money down, lower mortgage insurance, and below-market interest rates.

Where the most USDA loan denials occurred

By 2024 USDA mortgage denials, Ellis, Kansas led all counties with a 1.6 ratio (8 denials and 5 approved). Union County, Iowa followed at 1.29 (9 to 7), then Orangeburg County, South Carolina at 0.95 (18 to 19).

These smaller, rural counties often see higher ratios because even a few denials can dramatically skew percentages but the data still offers insight into where borrowers face more hurdles.

Check your USDA loan eligibility. Start hereThe table below shows the top 25 highest ratios of USDA loan denial by county in 2024:

| Rank | County | State | Denied ratio | Denied USDA loans | Approved USDA loans |

| 1 | Ellis | Kansas | 1.600 | 8 | 5 |

| 2 | Union | Iowa | 1.286 | 9 | 7 |

| 3 | Orangeburg | South Carolina | 0.947 | 18 | 19 |

| 4 | Hendry | Florida | 0.857 | 6 | 7 |

| 5 | Richland | Illinois | 0.857 | 6 | 7 |

| 6 | Charlotte | Florida | 0.833 | 5 | 6 |

| 7 | Macomb | Michigan | 0.833 | 5 | 6 |

| 8 | Newaygo | Michigan | 0.833 | 5 | 6 |

| 9 | Trempealeau | Wisconsin | 0.800 | 4 | 5 |

| 10 | Brunswick | North Carolina | 0.750 | 15 | 20 |

| 11 | Lee | Iowa | 0.714 | 5 | 7 |

| 12 | Piscataquis | Maine | 0.714 | 5 | 7 |

| 13 | Oneida | New York | 0.714 | 5 | 7 |

| 14 | Crawford | Iowa | 0.700 | 7 | 10 |

| 15 | San Bernardino | California | 0.697 | 23 | 33 |

| 16 | Barbour | Alabama | 0.667 | 4 | 6 |

| 17 | White | Georgia | 0.667 | 4 | 6 |

| 18 | Calhoun | Iowa | 0.667 | 4 | 6 |

| 19 | Carroll | Kentucky | 0.667 | 4 | 6 |

| 20 | Sunflower | Mississippi | 0.667 | 4 | 6 |

| 21 | Flathead | Montana | 0.667 | 4 | 6 |

| 22 | Doña Ana | New Mexico | 0.667 | 4 | 6 |

| 23 | Walton | Florida | 0.667 | 6 | 9 |

| 24 | Union | South Carolina | 0.625 | 5 | 8 |

| 25 | St. Croix | Wisconsin | 0.625 | 5 | 8 |

By overall volume of USDA denials, Bexar, Texas led all U.S. counties with 41 rejected borrowers in 2024 (while also having the most approvals at 188). Baldwin County, Alabama and Spartanburg County, South Carolina rounded out the top three with 34 and 30 denials, respectively.

The table below shows the top 25 counties by total USDA loan denials in 2024:

| Rank | County | State | Denied USDA loans | Approved USDA loans | Denied ratio |

| 1 | Bexar | Texas | 41 | 188 | 0.218 |

| 2 | Baldwin | Alabama | 34 | 93 | 0.366 |

| 3 | Spartanburg | South Carolina | 30 | 149 | 0.201 |

| 4 | Pinal | Arizona | 26 | 130 | 0.200 |

| 5 | Mobile | Alabama | 24 | 108 | 0.222 |

| 6 | San Bernardino | California | 23 | 33 | 0.697 |

| 7 | Aroostook | Maine | 21 | 47 | 0.447 |

| 8 | Williamson | Texas | 21 | 92 | 0.228 |

| 9 | Limestone | Alabama | 20 | 91 | 0.220 |

| 10 | Marion | Florida | 20 | 93 | 0.215 |

| 11 | Horry | South Carolina | 19 | 50 | 0.380 |

| 12 | Polk | Florida | 19 | 69 | 0.275 |

| 13 | Orangeburg | South Carolina | 18 | 19 | 0.947 |

| 14 | Jackson | Mississippi | 17 | 87 | 0.195 |

| 15 | Santa Rosa | Florida | 16 | 49 | 0.327 |

| 16 | Brunswick | North Carolina | 15 | 20 | 0.750 |

| 17 | Lowndes | Mississippi | 15 | 48 | 0.313 |

| 18 | Kaufman | Texas | 15 | 50 | 0.300 |

| 19 | Lee | Mississippi | 14 | 38 | 0.368 |

| 20 | Franklin | Pennsylvania | 14 | 72 | 0.194 |

| 21 | Harrison | Mississippi | 13 | 62 | 0.210 |

| 22 | Dyer | Tennessee | 13 | 65 | 0.200 |

| 23 | Clark | Indiana | 13 | 67 | 0.194 |

| 24 | Riverside | California | 12 | 20 | 0.600 |

| 25 | Evangeline Parish | Louisiana | 12 | 27 | 0.444 |

Applying for a USDA loan

A mortgage with no down payment, plus comparatively lower interest rates and insurance premiums offer borrowers an affordable path to homeownership. However, USDA loans have different requirements from conventional loans.

To qualify:

- The property must be in a USDA-designated rural area, generally with a population below 10,000 (or up to 20,000 if it’s outside a metro area).

- It must be a primary, single-family residence that meets USDA safety and accessibility standards. (You can visit the USDA’s property eligibility site here.)

- Borrowers typically need a credit score of at least 640, a steady two-year employment history, a DTI below 41%, and an income below 115% of the area median.

Borrowers also pay a 1% upfront guarantee fee and a 0.35% annual fee, though both can often be rolled into the loan amount.

The borrower must be a U.S. resident and typically needs a credit score above 640, showcase a steady employment history over the last two years, a debt-to-income ratio below 41%, and an income under 115% of the area median. Notably, borrowers must pay a 1% upfront guarantee fee and 0.35% annual fee, but closing costs can be rolled into the loan amount.

See our full explainer on USDA mortgages here.

USDA loan types

USDA home loans come in a few different sizes and the best fit depends on your situation.

For buying a house, you can decide between USDA Guaranteed or USDA Direct.

The Guaranteed loan is backed by the USDA but goes through a private lender. Borrowers are subject to meeting all the requirements laid out in the section above.

Direct, also called Section 502 Direct Loans, come straight from USDA funding instead of through a lender. This program is more exclusive since it aims at buyers with very low income (less than 80% of the area median) and only applies to homes under 2,000 square feet. It also comes with comparatively lower credit requirements and longer repayment terms (33-to-38 years versus 30 years).

Verify your USDA mortgage eligibility. Start hereFor buying land and building a house or repairing your current one, there are the USDA Construction Loan and USDA Home Improvement Loan, also known as the Single Family Housing Repair Loan and Grant Program.

If a USDA loan isn’t quite for you, other low-to-no down payment alternatives include mortgages backed by the Federal Housing Administration (FHA) and Department of Veterans Affairs (VA).

How to avoid a USDA loan rejection

If you’re pursuing a USDA mortgage, you can dramatically improve your approval odds by taking these proactive steps:

- Confirm your location early. Use the USDA’s property eligibility map to ensure your target home qualifies.

- Check your income and DTI. Stay below 115% of your area’s median income and aim for a DTI under 41%.

- Don’t withdraw your application. Nearly half of failed USDA loans are self-withdrawn — often due to confusion or frustration mid-process.

- Work with a USDA specialist. Choose lenders who regularly originate USDA loans; they understand the nuances and paperwork.

- Prepare your documents upfront. Income verification and tax returns are key — missing paperwork leads to delays or denial.

Bottom line on USDA loans

The biggest reason USDA loans fail isn’t poor credit but preventable issues like incomplete applications or debt-to-income challenges.

With early preparation, verified income, and a USDA-savvy lender, borrowers can overcome these hurdles and tap into financial assistance programs that make homeownership even more affordable.

If you’re ready, reach out to a local mortgage lender who specializes in USDA loans and get started.

Time to make a move? Let us find the right mortgage for you