Although the housing market is swinging back in favor of home buyers, conditions remain far from ideal as a lack of affordability strains many.

Nearly half (45%) of recent first-time home buyers reported too few homes in their price range, according to a Mortgage Reports survey. Meanwhile, about 24% claimed they didn’t find enough updated or move-in ready homes, and 18% faced too much competition. Only 13% said they didn’t have any significant challenges in their house hunt.

With that being the case, 2025 first-time home buyers are making compromises.

Find your lowest rate. Start hereWhat are you willing to compromise in order to buy a home?

People are still buying properties in spite of imperfect circumstances. However, more are making trade-offs on their journey to homeownership.

“Affordability is still a significant hurdle. With high home prices and elevated mortgage rates, many are exploring creative strategies to get a foot in the door,” said Craig Berry, loan originator and mortgage expert at The Mortgage Reports.

These strategy alterations can be as emotional and logistical as they are financial, with people expanding their search radius or considering different property types.

The personal trade-offs

With a market tighter at the starter home level than the top, prospective buyers are making sacrifices to become homeowners.

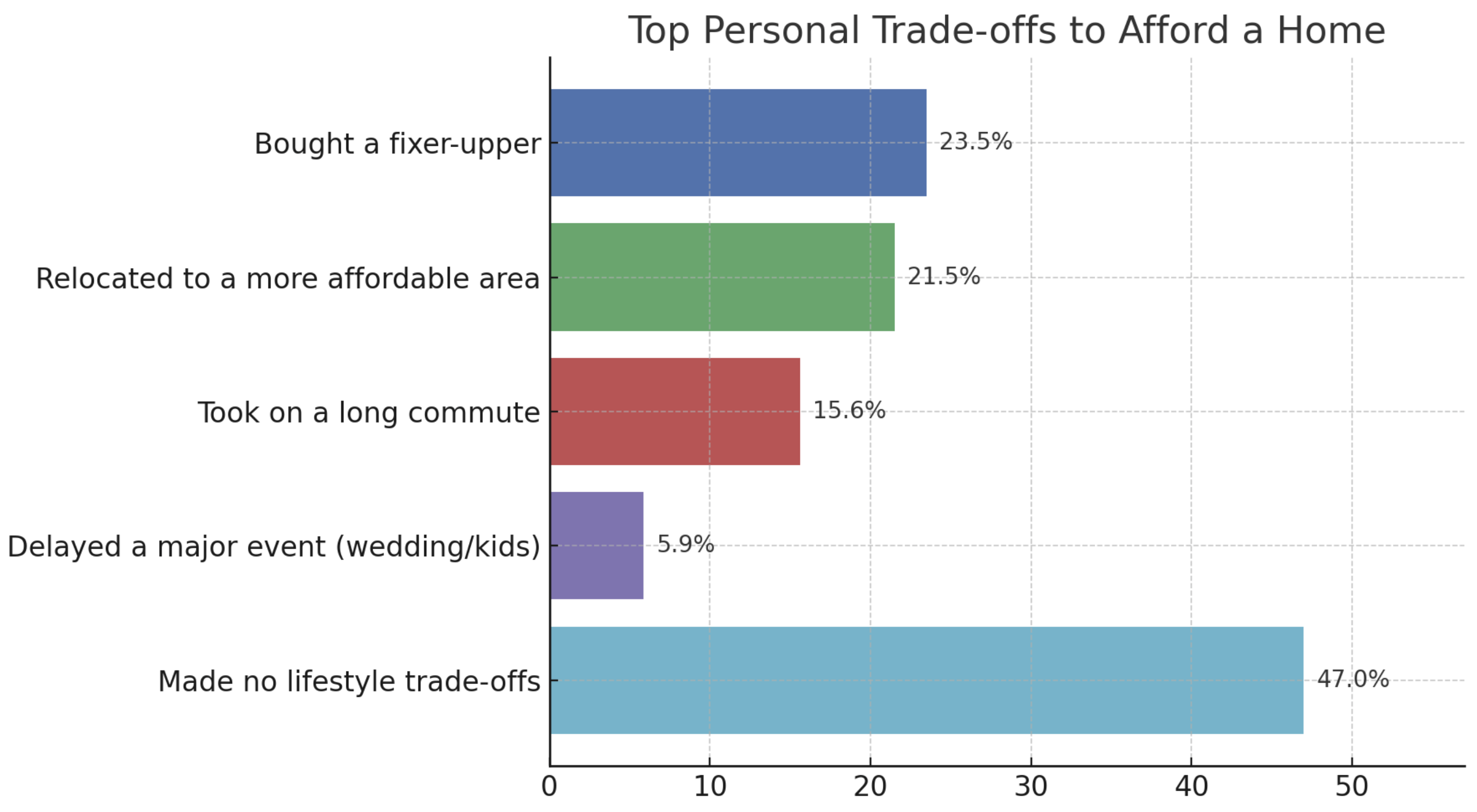

While a 47% share of recent first-time home buyers reported no lifestyle trade-offs, 23.5% chose to purchase a fixer-upper, according to The Mortgage Reports’ Summer 2025 First-Time Home Buyer Survey.

Additionally, 21.5% relocated to a more affordable area, while 15.6% willfully took on a longer commute and 5.9% postponed life milestones like a wedding or having kids.

The house hunt adjustments

Aside from taking personal concessions, successful house hunters recalibrated their search criteria and strategies.

The most common change came with 43.1% expanding their search to more neighborhoods. Just behind that, 41.2% both considered smaller or older homes, and increased their flexibility on features like total bedrooms or yard size. Another 29.4% raised their budget. Only 13.7% of the 2025 first-time home buyers surveyed made no adjustments.

Find your lowest rate. Start hereThe bottom line

Making one of the largest financial decisions of your life can be intimidating, especially with a housing market in limbo and affordability strained.

But mortgage rates trended down over the 2025, inventory keeps rebounding, and the survey also revealed 73% of recent first time buyers negotiated seller concessions. Plus, you can always try to leverage down payment assistance programs to improve your offer.

Buying a home is still possible in 2025, it just may take some compromise to get there. If you’re ready to begin your path to homeownership, reach out to a local mortgage lender today.

Time to make a move? Let us find the right mortgage for you