In today’s real estate environment, younger generations are navigating a market shaped by high interest rates, low inventory, and rapidly rising home prices. The path to homeownership has evolved significantly and Millennials and Gen Z are meeting that challenge with distinct mindsets, strategies, and economic circumstances.

Millennials, now in their late 20s to early 40s, have had more time to build financial stability but also carry the weight of economic downturns. Gen Z, many of whom are still in their early to mid-20s, are just beginning their homeownership journey, often with a more flexible and innovative outlook.

The 2024 NextGen Homebuyer Report sheds light on how these two generations are approaching homeownership, what’s driving their decisions, and how they’re responding to affordability challenges in very different ways.

Find the best first-time home buyer loan for you. Start hereThe economic context: Millennials vs. Gen Z at key buying ages

Millennials entered adulthood around the time of the 2008 financial crisis. This timing impacted not only their career opportunities but also their ability to save and invest. Many struggled to build credit, pay down student debt, and accumulate enough savings for a down payment. By the time they were ready to purchase a home, prices had already rebounded—and in many markets, surged past pre-recession levels.

This generation was also influenced by an era of low interest rates, which led some to wait for the “right” time to buy. But even with historically low rates, they faced bidding wars, high urban housing costs, and stiff competition from investors in major markets.

Gen Z, on the other hand, is coming of age in a post-pandemic world where inflation, rising interest rates, and economic uncertainty have defined the early years of their financial independence.

Unlike Millennials, many in Gen Z are entering the housing market amid sustained high prices and mortgage rates that have risen sharply since 2022.

The job market for Gen Z has also been shaped by increased gig work, remote opportunities, and delayed workforce entry due to the pandemic. While they benefit from more flexible career options, income consistency and long-term employment benefits remain less stable compared to previous generations.

Affordability is the central challenge for both groups—but each has had to respond to that challenge from a different economic baseline.

Home buying strategies by generation

Facing barriers to entry, both generations are adopting creative strategies to make homeownership a reality. However, Gen Z appears more willing to challenge traditional norms and adopt unconventional methods.

Co-buying with friends or family

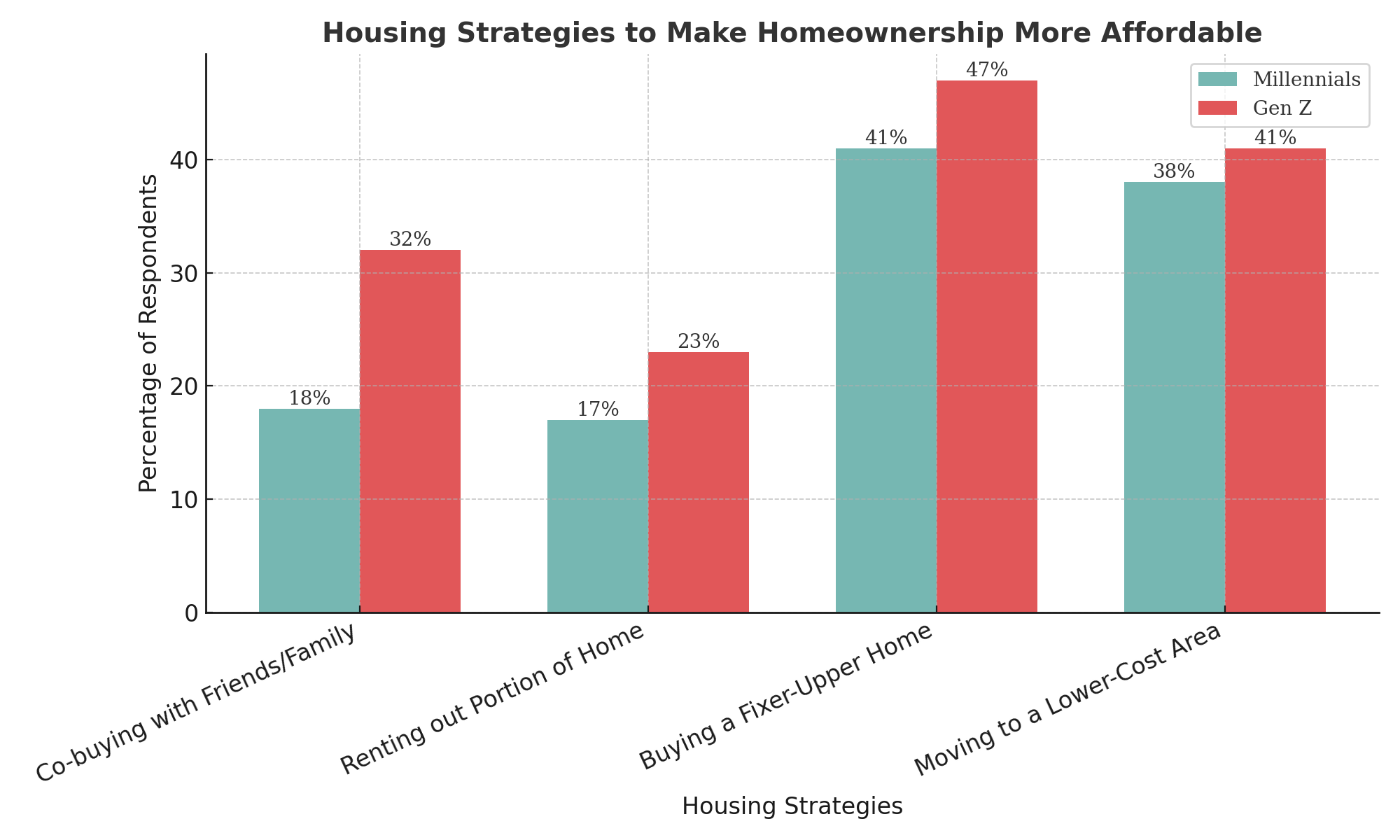

According to the NextGen Homebuyer Report, 32% of Gen Z homebuyers are considering co-buying a home with a friend or family member. That’s a significant jump from the 18% of Millennials who said the same.

Co-buying offers a practical solution to high housing prices and strict lending standards. By combining incomes and splitting costs, buyers can qualify for more expensive homes, share the burden of the down payment, and reduce monthly mortgage obligations.

The idea of communal ownership may have been taboo for previous generations, but Gen Z is redefining what it means to “own a home.” Co-buying appeals to a generation that places less emphasis on traditional timelines (like marriage or children) and more on financial feasibility and flexibility.

Millennials may be more hesitant to co-buy due to their stage of life. Many are already married or have families, making joint ownership with non-partners more complex.

Gen Z, still in earlier stages of adulthood, is more open to alternative paths—especially when it means breaking into the market sooner.

Renting out a portion of the home

Gen Z is also showing a strong interest in turning their homes into revenue-generating assets. The report found that 23% of Gen Z buyers plan to rent out part of their home—compared to 17% of Millennials.

This trend reflects the growing popularity of “house hacking”—a strategy where homeowners rent out a room, basement, or accessory dwelling unit to offset their mortgage payments. In some cases, homeowners may live in one part of the property while renting out the rest on platforms like Airbnb or Vrbo.

Gen Z’s comfort with technology and side hustles makes this approach appealing. They view homeownership not just as a milestone, but as an opportunity to build wealth and generate passive income.

Millennials also engage in house hacking, but often face limitations tied to zoning laws, family needs, or neighborhood preferences. While they helped popularize the concept in the early 2010s, Gen Z seems poised to embrace it more fully—especially as rental demand remains high and housing inventory stays tight.

Buying a fixer-upper

Buying a fixer-upper has long been a strategy for cost-conscious buyers, and today’s younger generations are no exception. Forty-one percent of Millennials and 47% of Gen Z buyers say they are open to purchasing homes that need work.

Driven in part by the popularity of home renovation shows and social media DIY influencers, many buyers see value in purchasing older homes at a discount and making incremental improvements. Renovations can help build equity quickly and allow buyers to customize their living space without the premium cost of new construction.

Gen Z’s appetite for fixer-uppers may also stem from necessity.

In many affordable markets, the majority of available inventory consists of older homes in need of repairs. With limited new construction geared toward first-time buyers, fixer-uppers often represent the only viable option.

For Millennials, fixer-uppers may be a more practical choice for move-up homes or investment properties, especially if they’re already settled in their primary residence. However, both generations need to be mindful of renovation costs, permitting delays, and the challenges of managing a home improvement project.

Moving to a lower-cost area

Relocating to a more affordable area continues to be one of the most effective strategies for overcoming housing barriers. According to the report, 41% of Gen Z buyers are willing to move for affordability, compared to 38% of Millennials.

This willingness to move is fueled by the growing acceptance of remote and hybrid work. Gen Z is entering the workforce during a time when geographic flexibility is becoming the norm rather than the exception.

For many, it’s more important to own a home—even in a different city—than to rent in a high-cost urban center.

Millennials, while also open to relocation, may be more tied to a specific location due to career commitments, family responsibilities, or established community roots. However, the desire to find a better quality of life, lower costs, and more space continues to drive relocation trends across both generations.

Markets like Raleigh, Tampa, Phoenix, and Indianapolis have become hotspots for younger buyers due to their relative affordability, job growth, and livability scores.

The biggest homeownership challenges by generation

While Millennials and Gen Z face some similar hurdles in the homebuying process, each generation also brings its own distinct set of challenges to the table.

Time to make a move? Let us find the right mortgage for youFor Millennials

Millennials have had a turbulent relationship with the housing market. After facing a delayed start due to the 2008 recession, they also battled housing shortages, bidding wars, and record-breaking home prices throughout the 2010s.

One of the most persistent challenges for this group has been student loan debt. Even as income levels rose, the burden of debt made it difficult to qualify for mortgages or save for a down payment.

Many Millennials also entered the market during a time of historically low rates, but high competition, pushing them toward condos or homes in less desirable areas. Urban preference has further complicated affordability, as home prices in cities continue to outpace suburban and rural markets.

For Gen Z

Gen Z is dealing with a different set of challenges.

Mortgage rates, which hovered around 3% just a few years ago, are now over 6% in many areas. This increase has significantly affected purchasing power and monthly affordability.

Lending standards have also become stricter. First-time buyers must show solid credit histories, stable income, and higher reserves—criteria that are often hard to meet early in a career.

Additionally, Gen Z entered the job market during or after the pandemic, which disrupted many traditional career paths and added a layer of economic instability. For those in contract or freelance work, qualifying for a mortgage becomes even more complex.

The future of homeownership: What’s next?

The strategies embraced by Millennials and Gen Z may soon become the new normal.

As affordability continues to challenge buyers across all age groups, co-buying, house hacking, and relocating may no longer be fringe solutions—they may define the next era of homeownership.

Co-buying, in particular, is gaining traction as a socially acceptable and financially sensible option. Shared ownership agreements, fractional property investments, and new proptech platforms are beginning to support this model, making it easier for multiple parties to co-own and manage real estate.

Fixer-uppers are likely to remain attractive, especially as home prices remain high and construction costs continue to slow the delivery of new inventory. Government programs and local grants for renovations could further incentivize buyers willing to take on improvement projects.

Economic conditions will continue to play a pivotal role.

If interest rates stabilize or decline, more Millennials may be able to trade up from their starter homes, opening inventory for Gen Z buyers. On the other hand, if inflation and rate volatility persist, both generations will need to continue adapting in creative ways.

The bottom line for Millennials and Gen Z

Millennials and Gen Z are redefining what homeownership looks like in the 21st century.

While both face unprecedented affordability challenges, their paths diverge in key ways—from who they buy with, to where they’re willing to live, and how they plan to use their homes.

Gen Z appears more open to flexible, income-driven strategies, while Millennials lean on hard-earned financial lessons and life-stage decisions. Despite the challenges, both generations are demonstrating resilience, adaptability, and a deep commitment to achieving homeownership on their own terms.

As they continue to shape the market, expect to see more innovation in lending, home-sharing, and property usage—signs that the next generation of homeowners isn’t just adapting to the market, they’re helping to transform it.