How much does it cost to build a house?

Building your own place can be immensely fulfilling. And you should end up with exactly the home you wanted. But you often need a flexible timeline and deep pockets.

How can you finance a land purchase and construction project? Should you even try? Read on to see what your best options could be.

Find your lowest mortgage rate. Start hereIn this article (Skip to...)

- Cost to build a house

- Cost breakout by building stage

- Factors that change building costs

- Ways to finance construction

- Is building a home right for you?

The cost to build a house

In 2022, a new home in the U.S. cost $392,241 to build on average, according to the National Association of Home Builders (NAHB). However, that excludes the cost of buying and financing the land on which you wish to build. With that added in, you may well be looking at something north of $500,000.

Of course, those costs can vary significantly depending on where you live. Some states and areas have vastly more or less expensive land prices and labor costs. Even the costs of materials can differ across the country.

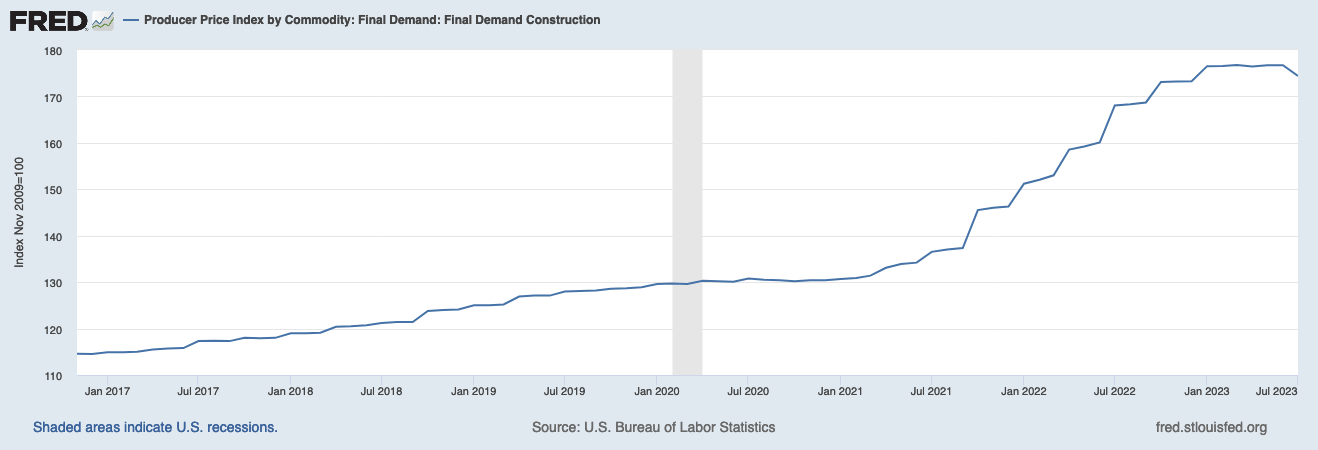

Check your home buying options. Start hereInflation weighed heavily on construction materials in recent years. The following graph from the Federal Reserve Bank of St. Louis suggests price pressures were easing by July 2023. So comparing a friend’s new build from a few years ago may not be a good barometer for new construction now.

Many (probably most) of the homes in the NAHB study were likely built as part of large developments comprising dozens or hundreds of homes. We excluded developers’ costs, such as financing, marketing, sales commissions and profits from the numbers we cited. Large developers also may enjoy economies of scale on labor and materials costs that won’t be open to you on a single project. So, use the NAHB’s figures only as a very rough guide when calculating your own cost to build a house.

Breakouts of the costs associated with each building stage

The NAHB breaks down those average 2022 costs by different elements in the process:

Find your lowest mortgage rate. Start here- Site work (fees for permits, impact, inspections, architects and engineers): $29,193

- Foundations: $43,086

- Framing: $80,280

- Exterior finishes (including doors, windows, garage door, roofing and exterior wall finish): $46,108

- Major systems (plumbing, electrical, HVAC and other): $70,149

- Interior finishes (everything to bare-wall finish, including kitchen, bathrooms and appliances): $94,300

- Final steps (landscaping, outdoor structures, driveway, clean up ...): $23,065

- Unspecified others: $6,059

Remember, those are only the elements that make up the average cost to build a house of $392,241. Read on for why your costs could be much higher or lower.

Factors that can change the cost to build a house

An endless list of things can make your home-building project’s costs vary from the average. Some of the biggest include:

Find your lowest mortgage rate. Start here- Location — Labor costs and land prices aren’t consistent across the country, with some states and areas significantly more or less expensive than others. Urban settings generally have higher costs than rural ones

- Isolation — You may dream of living far from the general public or off the grid entirely, but you’ll likely pay more for materials and labor to travel there

- Site conditions — If your construction site isn’t easily accessible for heavy machinery and deliveries, you’ll have to pay for it to be made so. If it’s steeply sloping or hard to excavate, that, too, will add to your costs

- Square footage — A sprawling McMansion can cost 10 or 20 times as much to build as a tiny house. The NAHB study says the average home comprised 2,561 sq. ft. in 2022. So, scale up or down from that

- Finishes — Will you be importing slabs of Italian marble and several antique fireplaces and fountains from Europe? Or will you rely on Home Depot and your contractor’s trade accounts for your finishes? The price difference could run from the thousands into millions

- Amenities — Do you want a pool, firepit, hot tub, home theater, gym, games room, indoor basketball court, and a dedicated gift-wrapping room? Those luxuries will cost extra

It’s good to have an average homebuilding budget as a starting point. But you’re going to have to make a lot of adjustments as your plans evolve.

Ways to finance a newly constructed home

Unless you have serious funds squirreled away, you’ll likely have to borrow to finance the purchase of your land and to pay for your construction project.

Check your home loan options. Start hereYou have a dizzying array of options, including:

- Land loans (aka lot loans) — Especially useful if you want to hold the land for a while before developing it

- Home equity loans — Borrow a lump sum secured by the equity (the amount by which the value of your home currently exceeds your mortgage balance) in your existing home. You repay in equal installments over a period that you largely set

- Home equity lines of credit (HELOCs) — Again, you’ll need plenty of equity in your existing home. You get a line of credit, meaning you receive a credit limit and can draw up to that amount. You pay interest only on your balance so these can be good for short-term borrowing or longer-term projects where costs arise over time

- Personal loans — No collateral required. But you’ll typically need an uber-high credit score and very sound finances to get a competitive rate

- Construction loans — These short-term loans can be combined with land loans to finance the whole process of getting you into your custom home. You can then refinance both into a new mortgage. Or you can opt for a “construction-to-permanent loan,” which lets you pay for everything with a single closing on your mortgage

For many homebuyers, a construction-to-permanent loan is the obvious choice. Popular ones of these are government-backed, by the FHA, VA or USDA. And that means you need only a small (3.5%) or no down payment. You also don’t need a stellar credit score to get approved.

Who offers these loan types?

There’s no shortage of lenders of home equity loans, HELOCs or personal loans. Nearly all mortgage lenders offer the first two, and plenty of banks and specialist lenders offer the third.

However, land loans and construction-to-permanent loans are a different matter. They’re specialist loans that many lenders — with otherwise wide portfolios of mortgage products — won’t touch them.

But don’t despair! They’re out there. You just have to track them down.

Is building a home right for you?

Building your own home isn’t for everyone. But the advantages of doing so are immense.

Most importantly, you get to choose everything: from the building style and layout, to every detail of the finishes. That means you get a sense of complete ownership that evades many who buy an pre-designed home from a developer.

Check to see what mortgage rate you qualify for. Start hereBut there are disadvantages. First, the cost to build a house is often higher than buying an existing home. Then there’s the hassle. Even if you employ a project manager, there will be endless details that only you can decide upon. And, of course, you could face frustrating delays and cost overruns. If you’re impatient or on a tight budget, you could save a lot of headaches by opting for an existing home.

The bottom line: Cost to build a house

Don’t underestimate the challenges and costs of building a house. But also don’t underestimate the sheer joy of living in a home that’s been custom-built to meet your needs.

It’s like commissioning a tailor-made suit or gown that fits you precisely. You look great and feel comfortable. Of course, this tends to come at a higher price — both the dollar costs and the probability of unexpected budget and timeline changes.

But you have plenty of choices when it comes to financing your adventure. If you’re ready, reach out to a local lender and see what your best loan options are.

Time to make a move? Let us find the right mortgage for you