Getting started with multifamily loans

Multifamily homes offer aspiring landlords a great opportunity to start building their property portfolios. For those without substantial upfront cash, financing through multifamily loans is essential to make these purchases possible.

Multifamily loans are a specialized area of mortgage lending, with unique rules and requirements compared to single-family loans. However, starting with a modest two-to-four-unit property can make financing more accessible than you might expect.

Read on to learn the essentials of multifamily loans—this could be the start of your journey as a property investor.

Check your home buying options. Start hereIn this article (Skip to...)

What are multifamily loans?

Multifamily loans are mortgages specifically designed for those buying buildings with multiple dwelling units. That might be a duplex (two units), triplex (three units), fourplex (aka quadruplex), or a whole apartment building, possibly containing hundreds of units. They could also be multiple adjoining townhouses (terraced properties) or condominiums.

Check your home buying options. Start hereIs this a good time to become a landlord?

Becoming a landlord now could be a smart move. At least, big real estate investors seem to think so. In April 2024, Fox Business said, “Investors of all sizes spent billions of dollars buying homes during the pandemic. At the 2022 peak, they bought more than one in every four single-family homes sold.”

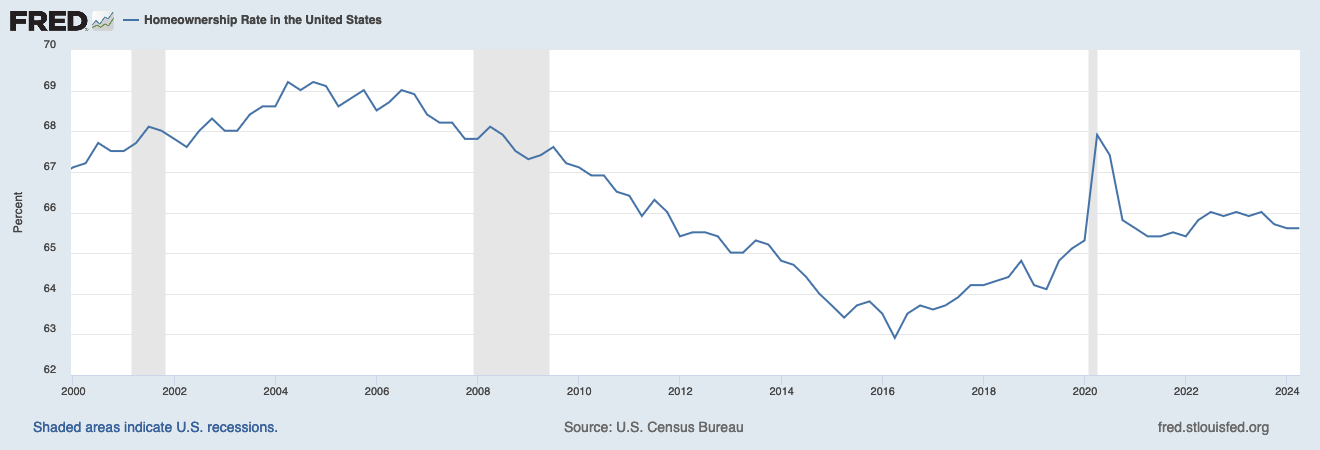

Meanwhile, the following chart, from the Federal Reserve Bank of St. Louis, shows the homeownership rate is low by 21st-century standards, meaning more Americans are renting:

U.S. Census Bureau, Homeownership Rate in the United States [RHORUSQ156N], retrieved from FRED, Federal Reserve Bank of St. Louis

Of course, to maximize your investment’s return, you need to seek out bargains in the local property market. And paying too much for the building can make it much harder to generate a profit.

Multifamily loans vs. single-family home loans

If you wish to purchase a building with more than four dwelling units, you’ll likely need a commercial or special mortgage. Expect a detailed process with several steps and careful review.

However, if you’re happy to buy a building with two, three, or four units, things get much easier. Providing you plan to live in one unit and rent out the other(s), you might qualify for a normal loan branded:

- Fannie Mae or Freddie Mac

- FHA (the Federal Housing Administration)

- VA (the Department of Veterans Affairs)

- USDA (the U.S. Department of Agriculture)

Getting one of these could give you a chance to establish your credentials as a successful landlord, making borrowing for future multifamily purchases much easier, perhaps including using commercial loans.

To be clear, Fannie, Freddie, and the FHA offer specialist mortgages for larger buildings with five or more residential units. But they’re much harder to get than two- to four-unit ones.

Loan limits

The four loans in those bullet points all come with loan limits. These are based on median home values where you wish to buy. And, as the name implies, they relate to the amount you borrow, not the property’s purchase price.

Loan limits are published as a nationwide amount (the standard limit), which applies in many areas. However, if you’re buying somewhere with unusually low property prices, your cap could be lower. There’s a second, higher figure for those wishing to buy in high-cost areas, and that’s the highest you can get anywhere.

New loan limits for 2025 are due to be announced at the end of November 2024. But those for 2024 are:

| Standard Limit | High-Cost Area | |

| 1 Unit | $766,550 | $1,149,825 |

| 2 Units | $981,500 | $1,472,250 |

| 3 Units | $1,186,350 | $1,779,525 |

| 4 Units | $1,474,400 | $2,211,600 |

The only limit on commercial mortgages is the one set by your realistic business plan. Decisions on these are mainly based on anticipated rental income rather than property values.

Types of multifamily loans

General eligibility

Each of the types of loans we mentioned above (Fannie/Freddie, FHA, VA and USDA) has its own minimum eligibility rules. But you’re borrowing private money from private-sector lenders.

Freddie and Fannie (effectively) and the government bodies just guarantee a proportion of your loan, helping lenders moderate their losses if you default.

Check your home buying options. Start hereThat means lenders are entitled to impose their own, higher eligibility thresholds. And, the more you borrow, the more your private-sector lender will want to reassure itself that you’re a good risk.

So, don’t be surprised if your lender wants more from you than the guarantor’s minimum. If that’s an issue, seek out a different lender that’s more accommodating.

Other lender expectations

You may well find that lenders require you to show some experience as a successful landlord. But you can often get around this by agreeing to use a professional property manager to support you, at least until you can prove your own competence.

Lenders may also insist you have cash reserves, sometimes enough to cover six months of monthly payments. Again, if this is an issue, you could try finding a more sympathetic lender.

Rental income

You can count your anticipated rental income when qualifying for multifamily financing. However, there are two caveats:

- Lenders are likely to require an independent appraisal of the likely rental income from the units

- They will probably only take into account roughly 75% of what you’re expecting. That’s because they know that vacant periods between tenants are virtually inevitable so a 100% occupancy rate is effectively unachievable

Conforming conventional loans

We’ve focused on Fannie Mae for this article. But conforming conventional loans are available from Freddie Mac, too. And Freddie and Fannie share a regulator so their products tend to be very similar.

Fannie has a bewildering array of multifamily loans and refinancing options on offer. And it’s worth taking your time to explore each to find your ideal choice.

Fannie’s “starter pack” for landlords can come in the form of standard purchases, no-cash-out refinances, and HomeReady and HomeStyle Renovation loans. These all require the borrower to occupy one of the building’s units.

In 2024, Fannie Mae implemented changes to its qualifying criteria for these loans. Most importantly, it lowered the down payment requirement.

Previously, you needed a down payment of 15% of the purchase price on a 2-unit multifamily loan, and 25% on 3- and 4-unit ones. But now you need only 5% down across all those loans.

Yes, that’s more than the 3% down payment required for a Fannie-conforming single-family home. But this is still a fantastic innovation for wannabe landlords. You could now buy rental properties years before you planned simply because you need to save up less.

Fannie and Freddie’s other qualifying criteria include a 620 or better credit score, and a debt-to-income (DTI) ratio of between 36% and 50%.

Just don’t forget our earlier warning about lenders imposing their own requirements over and above Fannie’s and Freddie’s. You can’t blame them being cautious if you’re borrowing a lot of money

FHA loans

Providing your multifamily loan covers two, three or four units, the FHA treats these as it does a single-family loan. And the qualifying criteria for those include the following:

- Credit score of 580 or higher

- Down payment of 3.5% of the purchase price

- DTI (see above) of 45% of lower

If you’re anxious to become a landlord quickly, that 3.5% down payment is very attractive. However, bear in mind that you’ll be on the hook for mortgage insurance until you refinance (with closing costs) to a different type of loan or finish paying down your mortgage.

VA multifamily loans

There’s a truism in the mortgage industry: If you’re eligible for a VA loan, you need a very good reason to choose another type of mortgage.

And that applies to multifamily loans for two- to four-units as much as any other. Because you’ll need:

- Zero down payment

- A credit score of 620-640 or higher. There’s no VA minimum but lenders tend to prefer borrowers in that range

- A DTI of 41% but you can include up to 75% of your realistic anticipated rental income in that calculation

Better yet, VA loans usually come with the lowest of all mortgage interest rates and no continuing mortgage insurance.

And there’s yet another potential benefit. If you have a pal, partner, spouse or anyone else who’s entitled to a VA loan, you can combine your firepower and buy a property with up to six residential units.

Verify your VA loan eligibility. Start hereUSDA loans

USDA-guaranteed loans appear not to be available to individuals. You may have to create a for-profit LLC to apply.

The USDA intends this loan program to help low- and moderate-income tenants in rural areas (and some smaller towns and suburbs). One rule is, “Average rent for an entire project (including tenant-paid utilities) cannot exceed 30% of 100% of area medium income, adjusted for family size.”

The USDA does have a direct-lending program that avoids private-sector lenders. And that is open to individual borrowers.

However, it’s on a first-come-first-served basis for as long as funds last. And the program was closed on the day this article was written. Still, you can click the link in the preceding paragraph for more details and to see if funding is available when you read this.

Securing a multifamily loan

Pick your perfect lender

Many lenders are uncomfortable with multifamily loans. So, you’ll have to shop around for those that offer them.

And engage with multiple lenders. Just as with other mortgages, you are likely to find huge variations in the mortgage rates, closing costs and eligibility requirements different lenders offer.

Time to make a move? Let us find the right mortgage for youGet into good financial shape

You’ll likely be borrowing a chunky sum of money. And being in great financial shape can make a big difference to the mortgage rate and closing costs you’ll have to pay. It might even be the difference between your loan application being approved or denied.

Take time to work on the following:

- Raise your credit score

- Pay down some of your debts, especially store and credit card balances. This will help lower your DTI

- Save for your down payment — and try to build your cash reserves

- Work on appearing a stable borrower — Don’t chop and change industries or employers unless it’s obviously part of normal career progression. And don’t open new (or close old) credit accounts unless you reach the final payment on an installment loan

Of course, saving up is tough when you’re also reducing your debts. So, do the best you can. But if prices for rental properties are stagnant or falling where you want to buy (or even rising only slowly), you can afford to take your time.

Before you do anything, read How to Become a Landlord in 2024. That article seeks to explore the cons as well as the pros of owning rental property. And it’s important you recognize both before you commit.

Consider property management

Many landlords use property managers to look after every aspect of their rental properties or to do the tasks they’re no good at.

For example, you may not have the temperament to be an effective rent collector. Or you may not have the legal knowledge to draft watertight leases or rental agreements. Or perhaps you wouldn’t know where to start when you need to vet applicants for tenancies.

There’s nothing wrong with using professionals to fulfill all or certain tasks and to hold your hand when you’re feeling lost — providing your rental income will cover the extra management costs and still give you a profit.

The bottom line on multifamily loans

Becoming a landlord is a huge step. And you should educate yourself about what you’re taking on as early in the process as possible.

The financing side can make or break the viability of your new business. So, take care selecting the right type of mortgage for you and the lender with your best deal.

And get yourself into good financial shape before you apply. That could shave a worthwhile amount off your mortgage rate and closing costs, which might affect your profitability.

There’s clearly money to be made in rental properties. Just make sure you get your share by being highly businesslike in your approach.