What is a 5/1 ARM loan?

An 5/1 adjustable-rate mortgage, also called a 5/1 ARM, is a home loan with an interest rate that changes throughout the loan. These types of adjustable-rate loans typically grow in popularity during times of rapidly rising mortgage rates. In fact, according to the Mortgage Bankers Association, ARMs made up nearly 10% of all new home applications as of mid-2022.

Today, very few ARMs have rates that adjust “throughout the loan.” Pretty much all of them have a fixed rate for an initial period, after which the loan rate changes periodically, usually once a year.

Rates on ARMs have historically been lower than those for equivalent fixed-rate mortgages. So, either your monthly payments can be lower or you may be able to afford a better, more costly home. And, if you plan to move before the initial fixed period is up, it may make sense to stick with an ARM.

Check your adjustable mortgage rates. Start hereIn this article (Skip to...)

- What 5/1 ARM means

- How 5/1 ARMs work

- 5/1 ARM rates

- 5/1 ARM loan types

- ARM requirements

- ARM pros and cons

- Adjustable-rate loan FAQ

What “5/1 ARM” means

Most ARMs you’ll see advertised come with two numbers attached to the ARM name, formatted x/y. A 5/1 ARM is what we’re discussing today. But you might also see 3/1 ARMs, 7/1 ARMs, and 10/1 ARMs. Others may be available.

The first numeral tells you how long your interest rate will remain fixed. With a 5/1 ARM, your rate won’t change for the first five years of your 30-year mortgage. But, with a 7/1 ARM, your lender fixes your rate for the first seven years.

Nowadays, the second numeral is almost always “1”. And it means your lender can adjust your rate up or down one time each year once your fixed-rate period is over. It’s unlikely you’ll ever see an x/6 ARM advertised. But, if you do, that means your lender would be allowed to vary your rate every six months. Quirky, eh?

Adjustable-rate mortgages

You already know that ARM stands for an adjustable-rate mortgage. But what does that mean in practical terms?

With an ARM, your interest rate begins to float once your fixed-rate period is over. So, with a 5/1 ARM, your rate will begin to float up or down at the start of year six. And it will continue to do so until you sell your home and redeem (pay off) your mortgage, refinance the loan, or finish paying it down, normally at the end of 30 years.

We’ll explore how rates float in the next section.

How 5/1 ARM loans work

Once the initial fixed-rate period is over, your ARM rate will float up or down in line with other interest rates. Most loans, including ARMs, are ultimately tied to the Federal Reserve’s federal funds rate. So it will likely rise when the Fed hikes that rate and may fall when it cuts it.

Although there’s typically an ultimate relationship between your ARM rate and the Fed, it’s unlikely that it will be the federal funds rate that’s mentioned in your mortgage agreement. Normally, your lender will specify a “prime rate” to which your loan is directly tied. Often, that’s the prime rate published daily in the Wall Street Journal, but lenders are free to nominate others.

Don’t think your 5/1 ARM rate will be the same as the prime rate. That rate is the one banks charge to their most financially secure commercial clients: think long-established global brands. Sadly, few if any individuals are as creditworthy as those. So, your lender will add a “margin” of x% to the base rate to reflect the added risk attached to your loan.

Do adjustable-rate mortgages have caps?

Almost all ARMs today come with valuable protections that can shield you from volatility in interest rates. These come in the form of caps, which can limit how far your rate can move:

- At the end of your initial, fixed-rate period

- During any single subsequent year

- Over the entire lifetime of your loan

Your 5/1 ARM may come with one, two, or all three of those caps. Or it might come with none. So, if these are important to you (and it’s hard to imagine why they wouldn’t be), you should ask your lender about the terms it’s offering.

Every lender is legally obliged to send you a loan estimate within three days of receiving your loan application. These are mines of information. There are special ones for ARMs. And financial regulator the Consumer Finance Protection Bureau has a sample one of these on its website.

Check that out and look especially closely at the Projected Payments section on page 1. On the loan estimate you receive, you will notice the highest levels (“max”) your monthly payments can reach during different phases of your mortgage.

Check your adjustable mortgage rates. Start here

5/1 ARM rates

Rates on a 5/1 ARM are almost always significantly lower than those for an equivalent 30-year fixed-rate mortgage (FRM). And they’re usually lower than those for a 15-year FRM.

Of course, mortgage rates fluctuate all the time. And, occasionally, a 15-year FRM may be less costly (in terms of interest) than a 5/1 ARM. But market conditions would have to be beyond freakish for a 15-year FRM to undercut that 5-year ARM.

Of course, there’s a reason ARM rates are more competitive: You’re sharing with the lender the risk of mortgage rates moving higher. Usually, your lender shoulders all that risk, but you assume some of it for a lower rate.

In general, shorter term loans have lower interest rates. And that means that a 3/1 ARM will usually have a lower rate than a 5/1 one. And a 5/1 one will usually have a lower rate than a 7/1 one. By the time you get to a 10/1 ARM, its rate might not be much lower than one for a 30-year FRM.

For more information on ARM rates, read 5/1 ARM vs. 15-year fixed: What’s better in 2022? and How ARM rates work: 3/1, 5/1, 7/1, and 10/1 mortgages.

5/1 ARM loan types

You can find ARM versions of most types of mortgages:

- Conventional loans — Not backed by the government. These include loans that conform to Fannie Mae and Freddie Mac’s requirements

- FHA loans — Backed by the Federal Housing Administration

- VA loans — Backed by the Department of Veterans Affairs

- Jumbo loans — An XXXL conventional loan that can run into millions

Note that mortgages backed by the U.S. Department of Agriculture (USDA loans) are not on that list. Those are limited to FRMs.

ARM requirements

How do you qualify for a 5/1 ARM? Well, you have to choose the type of mortgage you want from the four on that last list. And then you have to meet the loan requirements for the one you picked.

ARM requirements consider many factors, most importantly your credit score, existing debt burden, and the size of your down payment as a proportion of the home’s sales price. Use the links below to find the main qualifying criteria for each type of mortgage:

There is one important thing to note. When considering applications for an ARM, lenders might count the highest monthly payment your loan could reach during the variable period rather than the one that will apply during your initial, fixed-rate period.

Lenders will be assessing that you’ll still be able to comfortably afford to keep up with payments even if the worst happens to rates. And this could especially affect something called your debt-to-income ratio.

Pros and cons of an ARM

Here’s our take on the main pros and cons of a 5/1 ARM:

| Pros | Cons |

| You'll get a lower mortgage rate to start with |

That rate might rise later if interest rates generally do |

| Your lower rate means a lower monthly payment |

Your monthly payment might rise above the one you could have fixed if rates rise |

| Caps on rate rises can protect you from the worst effects of high rates |

Caps can’t protect you completely and not all ARMs have them |

| You may get a higher home price budget |

That may depend on how your lender calculates your debt-to-income ratio |

| You can save a bundle if you know you'll move again before your fixed-rate period ends |

Life’s never certain. Suppose your circumstances change and you don’t want to move before a higher rate kicks in |

The more certain you are that you’ll be moving on and buying a different home when or before your initial fixed-rate period expires, the lower the risk you’ll be shouldering — and the more attractive an ARM will be.

Compare your mortgage options. Start hereIs a 5/1 ARM a good idea?

A 5/1 ARM can be a great idea. Many people who have one have saved a bundle over the years. But that’s partly because interest rates tumbled in 2007 and stayed low for most of the next 15 years.

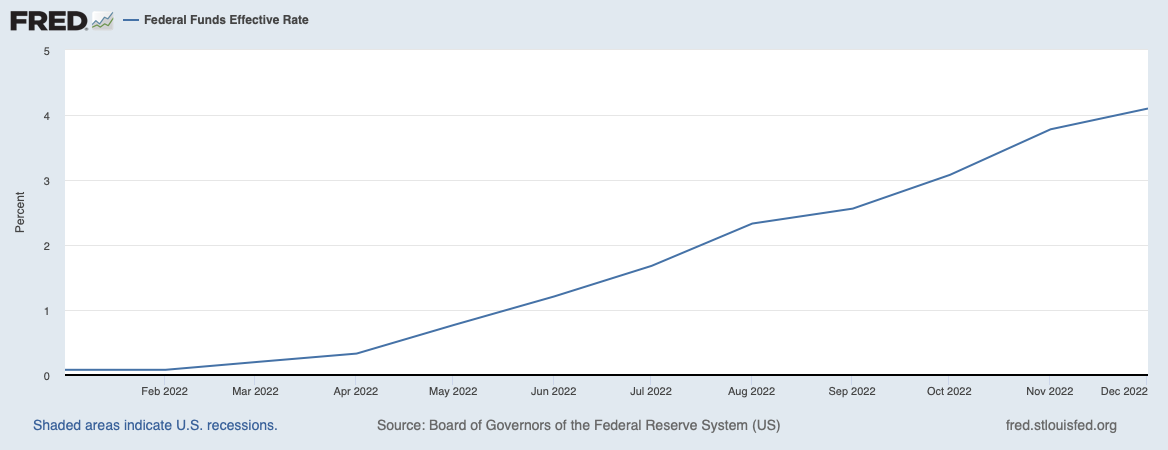

But, as this graph from the Federal Reserve Bank of St. Louis shows, the federal funds rate was rising quickly in 2022:

And ARMs are inherently riskier during times of rising rates. So, it’s a good idea to choose an initial fixed-rate period that will last at least until you sell the home you’re now purchasing and buy another. If that’s likely to be more than seven years, you may be better off with a fixed-rate mortgage. But run the numbers using our mortgage calculators to see what works for you better at the time you read this.

5/1 ARM FAQ

What does it mean to have a 5/1 ARM with a 30-year term?

You get a 30-year mortgage. But its rate is fixed only for the first five years. After that, your rate will float up or down in line with general interest rates. However, many ARMs come with caps that limit how far your rate can float.

Can you pay off a 5/1 ARM early?

Yes. However, some ARMs come with prepayment penalties. Check your loan estimate for details of any such costs. Often, these apply only if you pay off your mortgage during its first few years.

What credit score do you need for a 5/1 ARM loan?

That depends on which type of mortgage you choose. With FHA loans, your score can be as low as 580 with a 3.5% down payment — or 500 if you’re making a down payment of 10% or more of the home’s purchase price. Conventional loans require a score of 620 or better.

Should I do a 5-year or 7-year ARM?

You should pick the one closest to the date when you’re going to sell the home and move on. If this is going to be your forever home, you might be better off getting a fixed-rate mortgage.

Does a 10/1 ARM ever make sense?

It can. But that depends on the difference at the time between the rate for a 30-year FRM and a 10/1 ARM. Check to see whether the savings you stand to make with the ARM justify the extra risk starting in year 11.

What are the downsides of an ARM mortgage?

They all have to do with risk. What if my life changes and I can’t move before my fixed-rate period ends? What happens then if interest rates rise sharply? Will I be able to afford my monthly payments or will any caps on rate rises protect me sufficiently?

What’s better, an ARM or a fixed-rate mortgage?

They both have pros and cons. A fixed-rate mortgage is safe and predictable. An ARM is the same for as long as the fixed-rate period lasts. After that, ARMs are riskier because their rates could rise. The big advantage of an ARM is that it typically has a much lower interest rate (and so monthly payments) during the introductory fixed-rate period.

Your next steps

Your first step is to decide which type of mortgage suits you best. Then you can compare quotes for 5/1 ARMs from multiple lenders so you can find your best deal. Let us introduce you to some lenders we think will want to work with you.

Time to make a move? Let us find the right mortgage for you