Can I buy a house with no down payment?

If you’re looking for a no-down-payment mortgage, there are a few options to explore.

Government-backed VA and USDA loans allow no down payment but have special eligibility requirements. You could apply for a low-down-payment mortgage and use an assistance program to cover your out-of-pocket cost. And some private lenders offer their own no-down-payment mortgages which might come with additional perks like no PMI.

Ready to get started?

Check your no down payment mortgage options. Start hereIn this article (Skip to…)

- No down payment loans

- Who is eligible?

- Down payment assistance

- Credit score requirements

- Private mortgage insurance

- Closing costs

- Down payment sources

Four no-down-payment mortgages for 2026

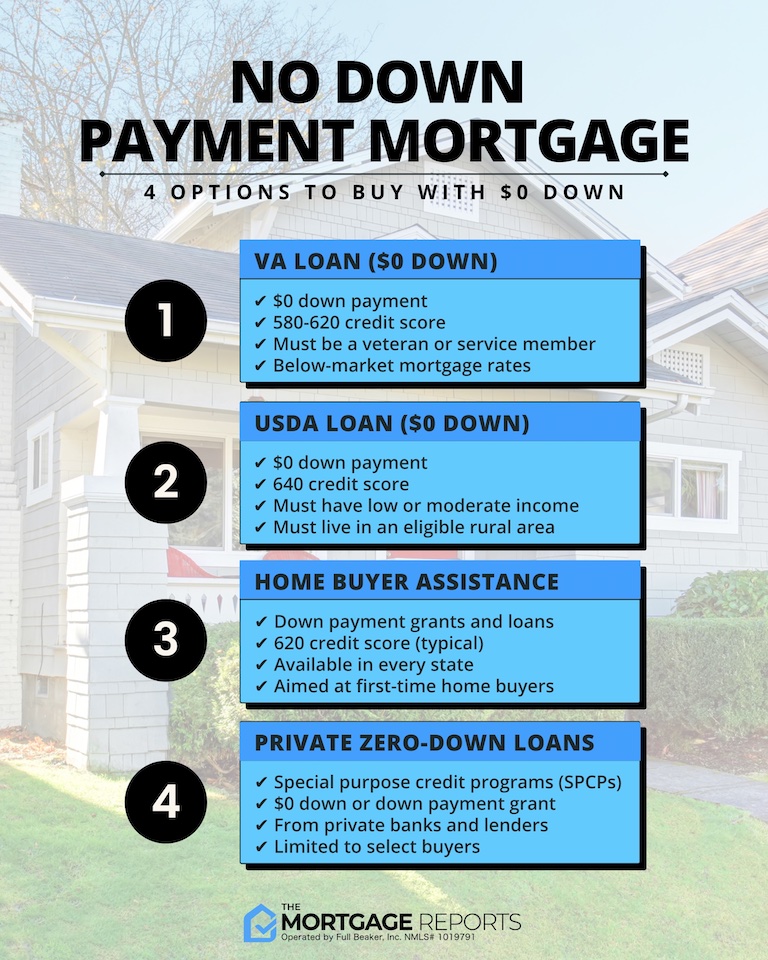

Just two major home loan programs offer “true” no-down-payment mortgages. The VA loan and USDA loan both allow buyers to pay zero out of pocket toward the home price. However, these government-backed loans have special guidelines and only a minority of home buyers are eligible.

The good news is that buyers who aren’t eligible for a VA or USDA loan have other options to consider, including down payment assistance and private no-down-payment home loans.

Check your no down payment mortgage options. Start hereNo-down-payment mortgage options:

- Zero-down VA loan

- Zero-down USDA loan

- Down payment assistance programs

- Private no-down-payment mortgages

Here’s what you should know about each program before you apply.

1. Zero-down VA loan

The VA mortgage is a true zero-down home loan. VA loans are backed by the U.S. Department of Veterans Affairs and are only available to veterans, active-duty military members, and a few military-related groups.

Check your zero-down VA loan eligibility. Start hereIf you qualify, you can buy a house with zero down payment. However, you still have to pay upfront closing costs and a one-time VA funding fee which is typically 2.3% of the loan amount. Most home buyers roll the funding fee into their loan balance so they don’t have to pay it in cash upfront.

The VA loan is also unique because it’s a zero-down mortgage with no PMI. After the one-time funding fee, buyers will never pay ongoing mortgage insurance. This can save a lot of money compared to a conventional or FHA mortgage.

VA loans are typically the most affordable option for eligible veterans. So if you have a military service history of any kind, it’s worth checking your eligibility for this program.

2. Zero-down USDA loan

The other no-down-payment mortgage is the USDA loan. USDA mortgages are backed by the U.S. Department of Agriculture. They’re intended to make homeownership more affordable in underpopulated or underdeveloped areas; therefore, you have to buy a home in a “rural” area to qualify. However, this definition is broader than home buyers might expect. Many suburbs and small towns are included in USDA’s definition of “rural”.

Check your zero-down USDA loan eligibility. Start hereBuyers should note that while the USDA requires no down payment, these loans do charge upfront and monthly mortgage insurance premiums. But USDA mortgage insurance is typically cheaper than FHA or conventional PMI. And interest rates on USDA loans tend to be lower, too.

All in all, this zero-down program can be incredibly affordable for those who qualify.

3. Low-down-payment loan plus down payment assistance

Not all buyers will qualify for a no-down-payment mortgage, considering that you must have a military service history to get a VA loan or live in a rural area to use the USDA program. However, creative home buyers might be able to make a “DIY” no-down-payment mortgage.

Check your low down payment options. Start hereBy using a low-down-payment home loan and getting down payment assistance to cover your contribution, you could potentially get into a home with zero out of pocket. And, unlike VA and USDA loans, there are no special guidelines to qualify for a low-down-payment mortgage.

Low-down-payment mortgage options:

- Conventional 97 loans: 3% down, 620 credit score

- Fannie Mae HomeReady loans: 3% down, 620 credit score

- Freddie Mac Home Possible loans: 3% down, 660 credit score

- FHA loans: 3.5% down, 580 credit score

Down payment assistance programs (DPAs) are available in every state, often at the county or city level. Every program has its own eligibility requirements, but typical DPA guidelines look for first-time home buyers who make low or moderate income for their area.

This money typically comes in the form of either a grant or a loan with low or no interest. Such loans are generally forgivable after five to 10 years.

In addition, DPA money can often be used for your closing costs as well as your down payment. However, many programs offer between 3% and 5% of the home price, which would not be enough to fully cover both down payment and loan fees. So you’ll still have to pay at least some closing costs out of pocket.

4. Private no-down-payment mortgages

Some mortgage lenders offer their own in-house programs with no down payment. These loans might offer other perks, too, like no private mortgage insurance (PMI). However, not everyone can qualify.

Check your mortgage options. Start herePrivate zero-down home loans are often Special Purpose Credit Programs restricted to select home buyer groups — for instance, low-income borrowers or those in historically underfunded communities. So check out the program guidelines before you apply.

Examples of private no-down-payment mortgages:

- Bank of America Community Affordable Loan Solution: Zero down payment and zero closing costs for eligible first-time home buyers in select designated markets (largely Black/African American and/or Hispanic-Latino neighborhoods)

- TD Bank Home Access Mortgage: Provides a $5,000 grant that home buyers can use to cover their down payment. Designed to “increase homeownership opportunities in Black and Hispanic communities across several markets within the Bank’s footprint”

- Chase Bank DreaMaker Mortgage: Requires 3% down but can be paired with a Chase Homebuyer grant of up to $7,500 to cover your down payment. Grant program available in select areas across the country

- Navy Federal Credit Union Homebuyers Choice Loan: No down payment and no private mortgage insurance for eligible first-time home buyers. Must be a Navy Federal CU members to apply which requires current or former military service

These are just a few examples of no-down-payment mortgage programs; our list is not comprehensive. In addition to big-name banks, smaller local lenders and credit unions might offer zero-down loan programs in your area. So do some research online or ask your real estate agent if they know of any local lenders that can help.

Who can buy a house with no down payment?

It’s easiest to buy a house with no down payment if you qualify for a zero-down VA loan or USDA loan. Veterans and active-duty service members are usually eligible for the VA program, while the USDA home loan is intended for buyers with moderate income in rural areas and small towns.

Check your mortgage options. Start hereOther buyers may be able to purchase a home with no down payment if they qualify for down payment assistance. Many first-time home buyers who make below-average income for their area could be eligible for DPA funds. But you don’t always have to be a first-time buyer to qualify; rules vary by program and your local DPA might allow repeat buyers, too.

How can I find down payment assistance?

There are thousands of down payment assistance programs nationwide. Surprisingly, though, few home buyers are aware of them.

If you’re in search of down payment assistance, a great first step is to contact your local housing finance authority. These state agencies often run their own DPAs. And those that don’t can likely point you toward other organizations offering home buyer assistance.

Check your mortgage options. Start hereYou can also ask your mortgage loan officer about DPA options in your area. They may even be able to recommend programs they’ve worked with in the past. Keep in mind, however, that many DPAs work with a shortlist of pre-approved lenders. If the company you’ve selected doesn’t work with a local DPA, your loan advisor might not be aware of it.

Finally, you can often find down payment assistance programs by simply Googling “down payment assistance in [your state or city].” Each program’s website should point you toward a list of participating lenders; you’ll contact one of those to start your application.

Importantly, if you hope to use DPA, you should start looking at programs early in your home-buying process. Many assistance programs have special requirements such as home buyer education courses and in-person counseling, which could delay your purchase if you don’t complete them ahead of time.

No down payment credit score requirements

Most lenders require a minimum credit score of 580 for a no-down-payment VA loan or 640 for a zero-down USDA loan. FHA loans are also available with a FICO score of 580, though you’ll need a 3.5% down payment to qualify. If you want to use a conventional loan with just 3% down, you’ll need a credit score of 620 or higher.

You can see a full list of credit score requirements to buy a house here.

Can I buy a house with zero down and no PMI?

The VA loan program allows veterans and service members to buy a house with zero down and no PMI. VA loans have a one-time upfront funding fee that can be rolled into the loan amount, but no ongoing private mortgage insurance fees.

Select home buyers might be able to buy with no money down and no PMI using a Special Purpose Credit Program such as the Bank of America Community Affordable Loan Solution. These unique mortgage programs are typically geared toward historically-marginalized, Black or Hispanic borrowers in select neighborhoods.

Check your mortgage options. Start hereThe USDA loan also allows zero down but always requires mortgage insurance (MI). There’s an upfront MI fee equal to 1% of the loan amount and an annual fee equal to 0.35% of the loan amount. This is paid in monthly installments along with your mortgage payment.

Conventional loan borrowers with less than 20% down will almost always pay PMI. Some banks do offer no-PMI loan options, however, these usually charge higher interest rates. And keep in mind that your mortgage rate is permanent (unless you refinance), while PMI can be canceled after you’ve built up a sufficient amount of equity.

Before opting for a no-PMI loan, think carefully about how long you plan to stay in the home and whether or not a higher mortgage interest rate would cost you more in the long run.

Can I buy a house with no down payment and no closing costs?

All mortgage loans charge closing costs — even no-down-payment mortgages. Closing costs help pay for your mortgage lender’s operating fees and third-party services, like the home appraisal and title report. These expenses are necessary when setting up a mortgage and buyers almost always have to pay them.

Check your mortgage options. Start hereIf you qualify for down payment assistance, the money can often be used for your closing costs as well as your down payment. However, it’s unlikely the loan or grant you receive will be large enough to cover the full cost of both items. So you should expect to pay something out of pocket even when using DPA.

You can learn more about closing costs and strategies to reduce them here.

How can I get money for a down payment?

The down payment doesn’t have to come from your savings account. In fact, there are many different ways to source funds for a down payment, some of which don’t come from your own pocket at all.

Check your home equity options. Start hereSix ways to get money for a down payment:

- Cash out investment accounts

- Take a loan or withdrawal from your 401(k)

- Use gift money from a family member or other donor

- Apply for down payment assistance

- Use a “gift of equity” when buying the home from a family member or friend

- Supplement your savings with a part-time job or gig work

It’s important to note that any funds you use for a down payment must be “sourced and seasoned.” That means the lender can clearly see where the money came from and it’s been in your account for a healthy amount of time. Basically, lenders want to make sure you’re not taking on an additional loan to cover your down payment that could interfere with your ability to make mortgage payments later on.

If your down payment is a gift, you’ll need a clear paper trail showing the money moving from the donor’s account into yours. And the donor will need to verify that it’s a true gift rather than a loan.

If you already own property, you can also make a down payment on your next home by cashing out your current one. Provided you’ve built up enough home equity, you could tap the property’s cash value using a cash-out refinance, home equity loan, or home equity line of credit (HELOC). This allows you to fund your new home purchase without selling your current home.

Your next steps

A no-down-payment mortgage can help you buy a home without saving for years and years. And, while not every home buyer will qualify with zero down, there are programs allowing as little as 3% or 3.5 percent. So most buyers have an option to get into their new home with very little out of pocket.

Get in touch with a mortgage lender to learn about no-down-payment mortgage options and find out whether you qualify.

Time to make a move? Let us find the right mortgage for you