Getting approved for a home loan is easier than you think

If you’ve been wondering, "How do I get approved for a home loan?" you’re not alone—securing a mortgage is one of the biggest steps in the homebuying journey.

The good news? With the right preparation and understanding of what lenders look for, getting approved for a home loan can be more straightforward than you think.

In this article, we’ll walk you through the home approval process step by step, helping you navigate the requirements and boost your chances of success.

Get started on the home loan process. Start hereIn this article (Skip to...)

Defining the steps to home loan approval

Understanding how to get approved for a home loan can be a complex journey, especially for a first-time home buyer eyeing a new house or a repeat buyer looking to refinance their existing mortgage loan.

To get your final home loan approval, you’ll need to cross a few important steps along the way. So before we get into the process, let’s first define what each one means.

Compare home loans from multiple lenders. Start todayPre-qualification: Your first step

Pre-qualification is the initial step in the home loan process, offering a quick estimate of how much you might be able to borrow. It’s a simple review of your finances that doesn’t require a detailed analysis. While pre-qualification won’t guarantee loan approval, it gives you a rough idea of your budget and helps you understand your loan options early on.

Pre-approval: A stronger position

Pre-approval is a more comprehensive review of your financial situation. Lenders verify your credit, income, and debts, giving you a clear offer that includes the type of loan, purchase price, and terms you qualify for. Having a pre-approval letter shows sellers that you’re a serious buyer and can speed up the process when you find a home you love.

Final home loan approval: The green light

Final approval is the last step before you can close on your home. After an appraisal and a final underwriting review, your lender will give the official green light. This confirms that you’ve met all requirements and that the lender is confident in your ability to repay the loan. Once approved, you’re ready to move forward with closing and getting the keys to your new home.

Comparing offers from multiple lenders at each stage can help you secure the best deal and make the journey smoother.

How to get approved for a home loan

Now that we’ve defined what each of the home loan approval steps entail, let’s go over how these work in a typical mortgage application process. When getting approved for a home loan, each stage requires careful preparation and informed decision-making.

Here’s the breakdown of what you can expect when getting approved for a home loan:

Get started on the home loan process. Start here1. Obtain lender pre-qualification

As you might suspect at this point, mortgage pre-qualification is the first step of obtaining your final mortgage loan approval. It gives you a quick estimate of how much you might be able to borrow based on a basic review of your finances. While it doesn’t guarantee a loan or a specific loan amount, it helps you understand your home-buying budget and narrows down your options.

Pre-qualification is faster and easier than mortgage pre-approval, but it doesn’t carry the same weight when it comes to making an offer on a home. It’s mainly a starting point to guide your house-hunting journey.

If you’re ready to move forward, you’ll provide your lender with some basic financial information, like income, debts, and assets. Based on this, the lender can estimate your loan eligibility and give you an idea of how much you could potentially borrow. However, remember that this isn’t a formal commitment, and you’ll need a more detailed process when getting approved for a home loan.

So keep in mind that pre-qualification is just a step, not a final decision. It gives you a rough estimate to guide your search, but for a serious offer, you’ll need to proceed to pre-approval.

2. Complete a full application for pre-approval

Now that you’ve gained a clearer picture of your home-buying budget through pre-qualification, it’s time to take the next step: completing your full application to obtain a pre-approval. A pre-approval goes beyond an estimate—it means a lender is willing to lend you a specific amount, based on a more thorough review of your finances.

Once you’re pre-approved, it’s time to comparison shop for the best mortgage rates and terms. This is when you should apply with several lenders to find the most competitive offer. Even if you’ve been pre-approved by one lender, shopping around could save you thousands over the life of your loan.

If you decide to stay with the lender that pre-approved you, you may need to resubmit some or all of your documents to ensure the information is up to date. Switching lenders means providing a full set of documents again. To speed up the approval process, gather all necessary documents ahead of time, scan them if you’ll be uploading them online, or make copies if you’re submitting them in person. The quicker you submit everything, the sooner you’ll be on your way to final mortgage approval.

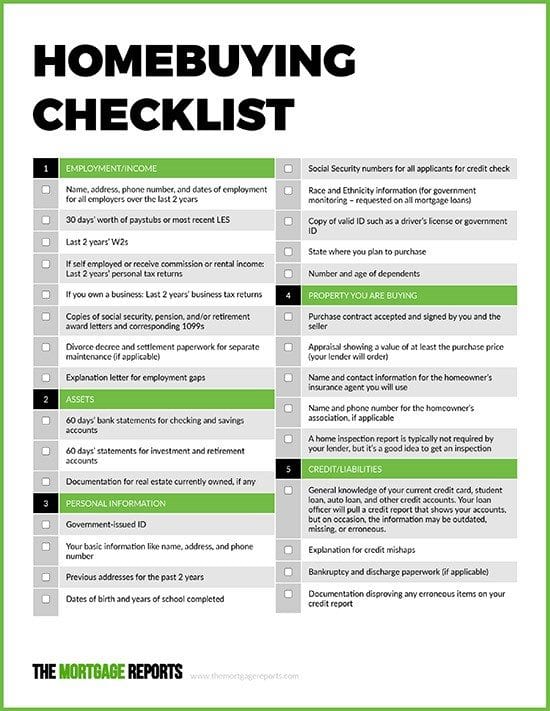

Here’s a checklist of everything you’ll need to get approved for a home loan.

3. Get final home loan approval from the underwriter

“Underwriting” is the final stage when getting approved for a home loan. During underwriting, the lender does a thorough review of your credit, income, assets, debts, and your future home. A specialist underwriter combs through the paperwork, checking for red flags and hidden risks.

Get started on the home loan process. Start hereDuring this final phase home loan approval, be as patient and responsive to the underwriter’s queries as possible. The sooner you resolve issues, the more quickly you can be cleared to proceed to closing.

Many applications sail through with few if any queries. But the more complicated your application is, the more issues your underwriter is likely to raise. This tends to be the case with applicants who are self-employed, rely a lot on tips and bonuses, or who have a troubled employment history.

But don’t worry—once you’ve successfully navigated this stage, you’ll have cleared the final hurdle and be ready to move on to the exciting step of closing on your new home. You’ve officially earned the green light to getting approved for a home loan and can how take the next step toward homeownership.

Requirements to get approved for a home loan

The requirements to get approved for a home loan can seem daunting, especially for those embarking on the journey of homeownership for the first time.

Understanding these requirements is key to a successful mortgage application. Here’s what you need to know to increase your chances of getting approved for a home loan.

Get started on the home loan process. Start hereCredit score requirements

Your credit score plays a pivotal role in determining your eligibility for a mortgage loan. A higher credit score often means more favorable loan options and interest rates.

While a good to excellent score is generally preferred, some loan programs, such as those provided by the Department of Veterans Affairs, may be less strict. Meeting this requirement is an important step in how to get a loan for a house.

| Loan Type | FICO Score Requirement |

| Conventional loans | 620+ |

| FHA loans | 580+ |

| VA loans | No minimum, but 620+ preferred |

| USDA loans | No minimum, but 640+ preferred |

Qualifying income

Lenders evaluate your monthly income to determine your ability to repay a home loan before approving it.

This evaluation takes into account your salary and other income sources like bonuses, part-time work, or freelance earnings. Some lenders may also consider income from social security, alimony, or child support when getting you approved for a home loan.

You’ll need to prove a history of stable income. Lenders typically ask for pay stubs, tax returns, or employer verification to confirm your income. This process is to verify financial stability, a key factor in mortgage approval.

On-time payment history

When getting approved for a home loan, lenders evaluate your payment history to assess your ability to handle financial obligations. This includes examining how you’ve managed your credit card, student loan, car loan, or other debt repayments.

A history of timely payments indicates responsible financial behavior. Conversely, late payments or defaults can negatively impact a lender’s assessment of your reliability. A consistent record of timely payments can positively influence your credit score and your standing with potential lenders, improving your likelihood of loan approval.

Reasonable debt-to-income ratio (DTI)

Your DTI ratio is a comparison of your total monthly debt payments by your gross monthly income. This ratio helps lenders gauge how much additional debt you can handle and maintain timely payments.

For the purposes of a mortgage loan application, your existing monthly debt also includes your potential new housing costs. So that encompasses monthly mortgage payments (principal and interest), property taxes, and homeowners’ insurance, plus any mortgage insurance or homeowners’ association dues.

While each mortgage lender may have different thresholds, a lower DTI is universally favored. Generally, a 36% debt-to-income ratio is “ideal,” but anything under 43% is considered “good.”

| Loan Type | DTI Ratio |

| Conventional loans | 36% (up to 45% with compensating factors) |

| FHA loans | 43% (up to 57% in some cases) |

| VA loans | 41% (higher with compensating factors) |

| USDA loans | 41% (higher with compensating factors) |

A favorable DTI ratio signals to lenders that you’re not overextended with debt and can comfortably manage new mortgage obligations, thus boosting your prospects of getting approved for a home loan.

Down payment minimums

Your down payment is the amount of cash you pay upfront toward the purchase of a home. Down payments vary in size and are typically expressed as a percentage of the purchase price. For example, a 10% down payment on a $300,000 home is $30,000.

The down payment is a key component of a mortgage application. It varies based on the type of loan and lender.

- Conventional loans typically require anywhere from 3% to 20%, with higher down payments often resulting in more favorable loan terms and lower interest rates.

- Government-backed loans like FHA loans, VA loans, and USDA loans may offer lower or no down payment options, making them attractive for those who cannot afford a large upfront payment.

However, it’s important to remember that a smaller down payment usually means a larger loan amount and potentially higher costs over the life of the loan. For many buyers, particularly first-time home buyers, balancing the down payment amount with other financial goals and obligations is a key step in the home-buying process.

| Loan Type | Down Payment Requirement |

| Conventional loans | 3-20% |

| FHA loans | 3.5% |

| VA loans | No down payment required |

| USDA loans | No down payment required |

Additionally, borrowers who put less than 20% down on a conventional mortgage will have to pay private mortgage insurance (PMI) until your principal loan balance drops to 80% of your home’s current appraised value.

FAQ: How to get approved for a home loan

Get started on the home loan process. Start herePrepare all the documents you’ll need before you apply and be responsive to queries. Choose a lender with an end-to-end digital mortgage process if you want the speediest home loan approval. Understanding and following these steps is essential to learning how to get approved for a home loan quickly.

The main barriers to mortgage approval are too low of a credit score, too small of a down payment, too high of a debt-to-income ratio, or an unreliable employment history. Addressing these issues is key to understanding how to get approved for a home loan.

You'll need to bring a variety of financial documents to the bank for a home loan, including past years' W2s—or 1099s for self-employed borrowers—tax returns, pay stubs, and bank statements. You’ll also need identification, like a driver's license. The lender will also pull your credit and verify your employment status. Most lenders have digital application portals nowadays where you can upload these documents digitally instead of bringing physical copies to a brick-and-mortar office.

FHA loans have the lowest FICO score thresholds: 580 with a 3.5 percent down payment or 500 with a 10 percent down payment. But you may be better off with a loan from Fannie Mae or Freddie Mac and their minimum score is 620.

The approval process can vary, but it typically takes around 30-45 days from application to closing.

Getting approved for a home loan

Are you ready to learn how to get approved for a home loan and begin your homeownership journey?

If you’re getting serious about house hunting, it’s time to start the home loan approval process. You’ll want to be preapproved before you make an offer on a home, and then apply for full approval once you have a purchase agreement in place.

By following the tips in this article, you can find the best mortgage loan for your financial situation.

Ready to get started?

Time to make a move? Let us find the right mortgage for you