Mortgage rates could surprise us this week

Borrowers and experts alike have been eyeing this week’s Federal Reserve meeting as a key moment for mortgage rates.

The Fed is expected to announce on Wednesday that it will start “tapering” its Covid-era bond-buying program, which has been keeping mortgage rates low over the last year and a half.

In theory, that means rates should go up. But there’s a catch.

We’ve known about the Fed’s plans for a while now. So the announcement won’t come as a surprise.

And that means — contrary to popular belief — we might not see a big rate spike after the Federal Reserve meeting, if any at all.

Find your lowest mortgage rate. Start hereIs the Fed going to raise interest rates this week?

In the simplest terms, no. The Federal Reserve does not set mortgage rates, and it does not have the power to raise or lower them at will.

However, the Fed does have two levers with which it can influence mortgage interest rates:

1. The federal funds rate

The federal funds rate is the interest rate at which banks lend to one another overnight. Fixed mortgage rates are not based on the fed funds rate or tied to it in any way — although they can be indirectly influenced by it. So when the Fed raises its benchmark rate, mortgage rates just might tag along.

However, the Federal Reserve has indicated it likely won’t increase its benchmark rate until 2022 at the earliest. So experts are not expecting big news on the rate front at this week’s Fed meeting.

2. The Fed’s bond-buying program

Unlike the fed funds rate, the Federal Reserve’s bond-buying program has a direct impact on mortgage rate trends.

Since the beginning of the pandemic, the Federal Reserve has been buying $40 billion per month in mortgage-backed securities (MBS). MBS are a kind of bond that helps determine mortgage interest rates.

By keeping demand for MBS artificially high, the Fed has forced mortgage rates to stay low during the Covid pandemic.

But now that the economy is on a path to recovery, the Fed has determined it’s time to start pulling back on this stimulus program. This process is known as “tapering” — a word you’ve likely heard if you’ve been following mortgage rates over the past few months.

Why we might not see a big rate spike after the Fed meeting

Most rate-watchers are expecting a formal announcement about when the Fed will start tapering its bond-buying program after this week’s Fed meeting.

In theory, an official start to tapering should lead to higher rates for home buyers and homeowners.

That’s what happened when the Fed ended a similar program in 2013.

But the Federal Reserve has been careful this time around.

Fed Chair Jerome Powell has been upfront about the central bank’s plan to start pulling back on stimulus before the end of the year. And that means this week’s tapering announcement — if it happens — won’t be a surprise.

Keep in mind that mortgage rates are determined by investors. And investors often act based on what they expect the market to do.

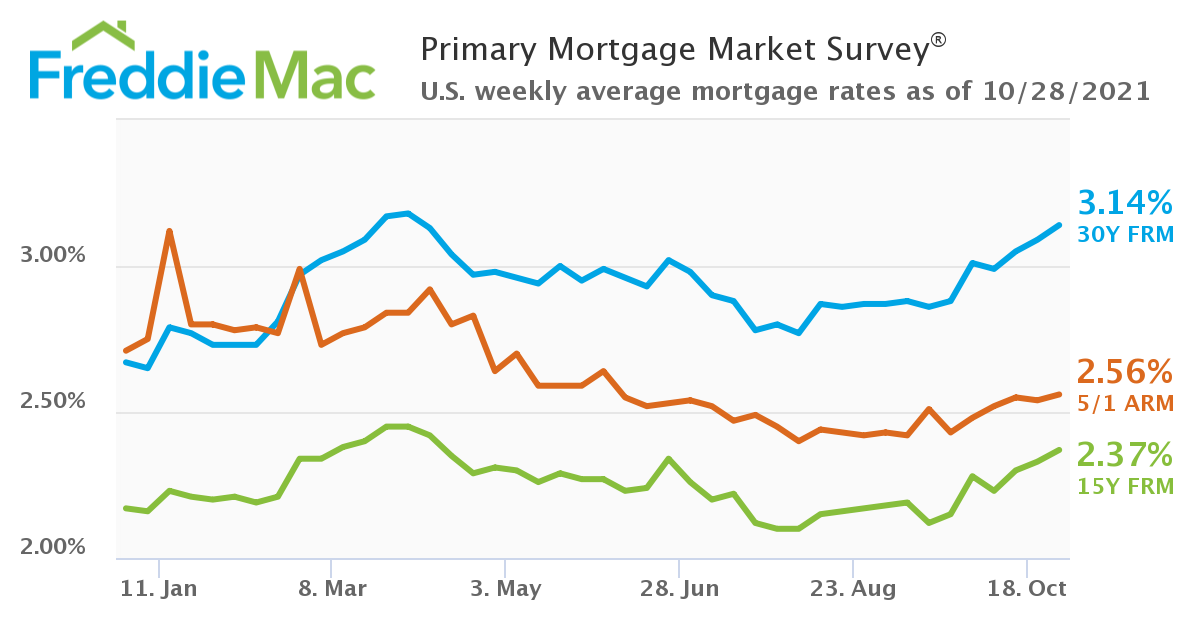

So there’s a good chance the Fed’s tapering plans have already been priced into today’s mortgage rates. Indeed, average rates have increased substantially over the past few weeks leading up to the Federal Reserve meeting:

Source: Freddie Mac

So we might not see a big increase after the meeting, as many experts have been predicting.

Don’t get complacent — higher rates are still coming

What does all this mean if you’re a home buyer or a homeowner looking to refinance?

First, it means you shouldn’t panic about rates skyrocketing after this week’s Federal Reserve meeting. At this point, a huge rate spike like the one borrowers saw in 2013 seems unlikely.

However, now is not the time to get complacent.

Rates are still expected to rise in 2021 and 2022. And there are two big reasons for that:

- Inflation — Higher inflation typically leads to higher rates. And the annual U.S. inflation rate was at a 13-year high in September

- Economic recovery and growth — As Covid cases continue to decline, and the economy continues to improve, it seems inevitable that rates will go higher. Keep in mid that a stronger economy typically leads to higher interest rates for mortgage borrowers

We might see a slow, steady rate climb rather than a sharp increase. But most experts agree that higher rates are coming sooner or later.

So, if you’re in a position to lock a rate soon, it’s a good time to do so.

Pandemic-era, “record-low” rates might be gone for good. But there are still great deals to be had for qualified borrowers.

Just be sure you shop around to find the best lender and interest rates for your situation. Doing so could save you thousands — and in today’s rising rate environment, finding your best deal is more important than ever.

Time to make a move? Let us find the right mortgage for you