How COVID-19 fundamentally changed mortgages

Mortgage rates, mortgage applications, and the ways lenders do business have all been impacted by the coronavirus.

That’s no surprise. We’re facing a pandemic that has led to unemployment and economic turmoil on an enormous scale. In every industry, there will be far-reaching and long-lasting changes to come out of this.

For mortgage borrowers, the process has fundamentally changed. Initially, COVID-19 made it harder to get a loan.

But over time, the rules have shifted to make mortgage financing easier — and more affordable — for many. And those changes seem like they’re here to stay.

Verify your mortgage eligibilityIn this article (Skip to...)

- The coronavirus and mortgage rates

- How COVID-19 changed lending standards

- E-mortgages are the new norm for faster, easier closings

- “Coronavirus Clauses” in real estate agreements

- New home appraisal rules

- Use new credit reporting rules to your advantage

- Who should get a mortgage right now?

The coronavirus and mortgage rates

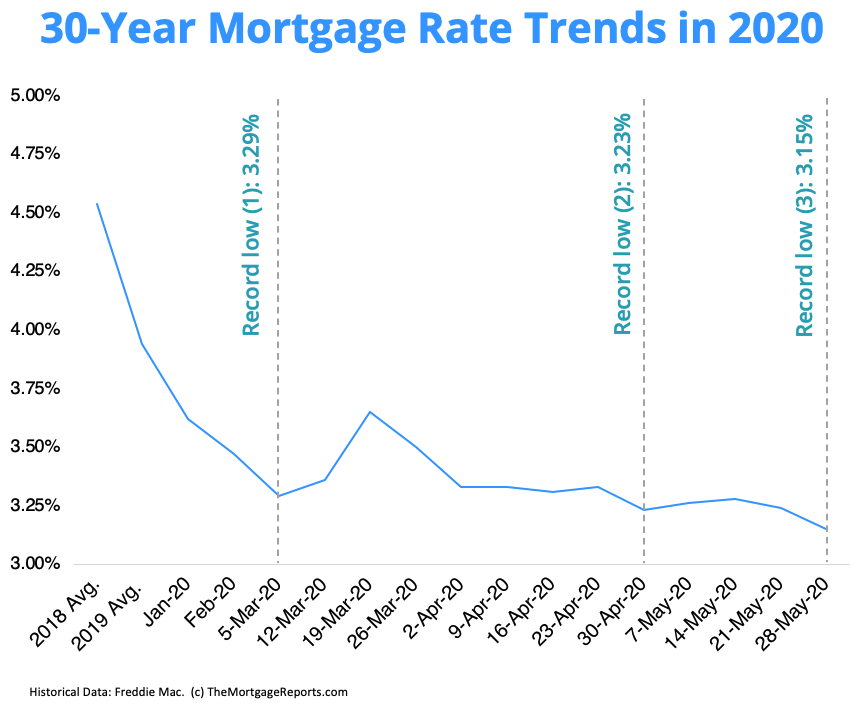

What’s happened with mortgage rates is easy to document. They have sunk to historic lows.

Qualified borrowers with stable employment now have access to some of the lowest rates in financial history.

Before this year, the lowest weekly rate on record was 3.31% in 2012, according to Freddie Mac. Today, lenders are originating mortgages for top-tier borrowers with posted rates at 2.5%.

For those who are currently in a position to buy or refinance, affordability has soared.

And experts predict rates will stay low throughout the year. So for those who are out of work or otherwise unable to take advantage of today’s rates, there may be plenty more opportunities to come.

Check your rates today

How COVID-19 changed lending standards

The coronavirus by itself is not responsible for lower mortgage rates. Rates have been falling since 2018, well before the coronavirus first appeared. What’s surprising is that the virus has not forced rates higher.

- The initial impact of COVID-19 was to restrict mortgage financing. This made sense for prudent mortgage lenders. One reason for lender caution is that home values — the security for mortgage loans — might tumble. A second reason is that with massive unemployment, many borrowers might suddenly be unable to make their monthly payments

- Low rates led to an overflow of applications. With rates falling, lenders faced a flood of applications. Rates initially went up. But, as the chart shows, not for long. Mortgage rates continued their push downward as the Fed cut rates and the economy remained uncertain

- Lenders remained willing to make loans, but with tougher terms for credit, down payments, and other requirements. To give one example: JPMorgan Chase, according to Reuters, began requiring a credit score of 700 and a minimum 20% down for new loans

The cumulative effect of these changes was negative, at first.

With rates extremely volatile, and lenders cracking down on application requirements, it seemed like COVID-19 would make it harder for most people to find mortgage financing.

But as the pandemic has played out, those changes actually reversed. In some ways, it’s now easier and more affordable to get a mortgage or refinance than it was pre-coronavirus.

E-mortgages are the new norm for faster, easier closings

If you can get contactless pizza deliveries, why not contactless mortgage applications and loan closings?

Online mortgages, e-apps, and long-distance closings have been with us for several years. And now they’re almost mandatory. These days there’s little need to come in contact with loan officers, mortgage underwriters, or closing agents.

Qualia, as one example, now offers Connect Video Chat. This system can be used for remote ink-signed notarizations (RIN) during home closings. The system meets state emergency mandates and requirements, as well as RIN guidelines established by Fannie Mae and Freddie Mac.

The speed, lower cost, and convenience of contactless mortgage processing guarantee that the new technologies will emerge as the standard way to do business.

The speed, lower cost, and convenience of contactless mortgage processing guarantee that the new technologies will emerge as the standard way to do business.

Post-coronavirus, it’s likely these technologies will remain the norm — making mortgage borrowing easier and faster for many.

>> Related: The 9 best online mortgage lenders

“Coronavirus Clauses” in real estate agreements

With so much uncertainty in the marketplace, a number of “coronavirus clauses” have been added to standard real estate agreements.

The idea is to protect buyers or sellers from new conditions beyond their control, such as delayed appraisals and home inspections, or situations where closing must be postponed because a buyer or seller has the virus.

“Coronavirus clauses” can extend a closing date by up to 30 days if there are COVID-related delays.

These coronavirus clauses can extend a closing date, usually by up to 30 days, if any of those coronavirus-related issues cause delays in the process. This protects buyers and sellers from purchase agreements falling through.

If you’re in a position to buy or sell right now, it’s worth asking your real estate agent whether there will be a coronavirus clause in the contract — and if not, whether one can be added.

>> Related: Is it still a good time to buy a house?

New home appraisal rules

For years there’s been an argument over how best to value real estate. It’s been a contest between professional, human appraisers, and automated valuation models — AVMs — for valuation supremacy.

Human appraisers have experience on their side, plus an ability to go inside homes. On the other hand, AVMs are quicker and cheaper. They have no idea what’s inside a home. Are there beautiful antique furnishings or 53 cats? The computer doesn’t know.

Because of COVID-19, many appraisers do not want to go inside homes. Many owners don’t want appraisers inside their homes either.

One workaround to handle the question of interior condition is to have owners provide photos and videos.

For example, GetOwnerInsight.com has a system in place to help appraisers, lenders, and AVM systems acquire such graphics.

Government regulators have also issued a temporary rule that says a lender “may close a real estate loan without a contemporaneous appraisal or evaluation, subject to a requirement that institutions obtain the appraisal ... within a grace period of 120 days after closing.”

This should be interesting. Will buyers and sellers agree to a delayed appraisal? What happens if a valuation delivered four months after closing shows that the property has an insufficient fair market value? Does the borrower give back money already paid out to the seller? How? Will the seller be forced to undo the purchase of a replacement property?

These questions are yet unanswered. While the new appraisal requirements make a transaction easier in the short-term, they could pose challenges in the long run.

The temporary 120-rule ends December 31st. And virus or no virus, don’t expect to see it in the final regulations.

Use new credit reporting rules to your advantage

For years, borrowers have only been allowed one free credit report every 12 months from each of the three major credit reporting agencies (CRAs) — Equifax, Experian, and TransUnion.

COVID-19 radically changed the credit reporting system.

The big three CRAs stepped up in April and made an unprecedented offer: Free credit reports for everyone at AnnualCreditReport.com. Not yearly, but weekly, through April 2021.

Free and frequent credit reports are hugely important. All kinds of businesses are allowing consumers to lower or suspend payments.

As a result, during and coming out of the crisis, borrowers will need to keep a close eye on how those temporary measures affect their credit.

During and coming out of the crisis, borrowers will need to keep a close eye on how temporary measures like forbearance affect their credit.

For example, millions of borrowers have entered into mortgage forbearance programs. Forbearance allows mortgage borrowers to reduce and even halt payments for principal and interest for as long as a year.

The old standard of ‘pay in full and pay on time’ is no longer absolute. If a creditor says you can skip a payment or pay less, should there be a credit ding? After all, the creditor agreed to the modification.

These are the questions that have yet to be answered. Likely, there will be unexpected effects on consumer credit as these changes play out.

The worry is that with so many billing suspensions, reductions, and credits, that incorrect information can wind up in credit reports. Such errors can unfairly lead to lower credit scores and higher mortgage rates.

With the ability to check reports weekly borrowers can monitor their own credit, and be on top of any errors or changes that need to be addressed.

>> Related: How to check your free weekly credit reports

Who should get a mortgage right now?

The answer is no different now than before: Getting a mortgage or refinance is a very personal decision. It depends on your current finances, your goals, and the rates you qualify for.

The pandemic has introduced new challenges as many are laid off or temporarily out of work. But the silver lining, if there is one, is that rates are expected to stay low through the rest of the year.

So even if you’re unable to apply right now, you might have a chance at affordable financing later on.

As always, check your options, chat with a professional, and decide what’s the right move for you on an individual level.

Time to make a move? Let us find the right mortgage for you