Could mortgage rates just keep dropping?

In the world of interest rates, so much can change in a relatively short amount of time.

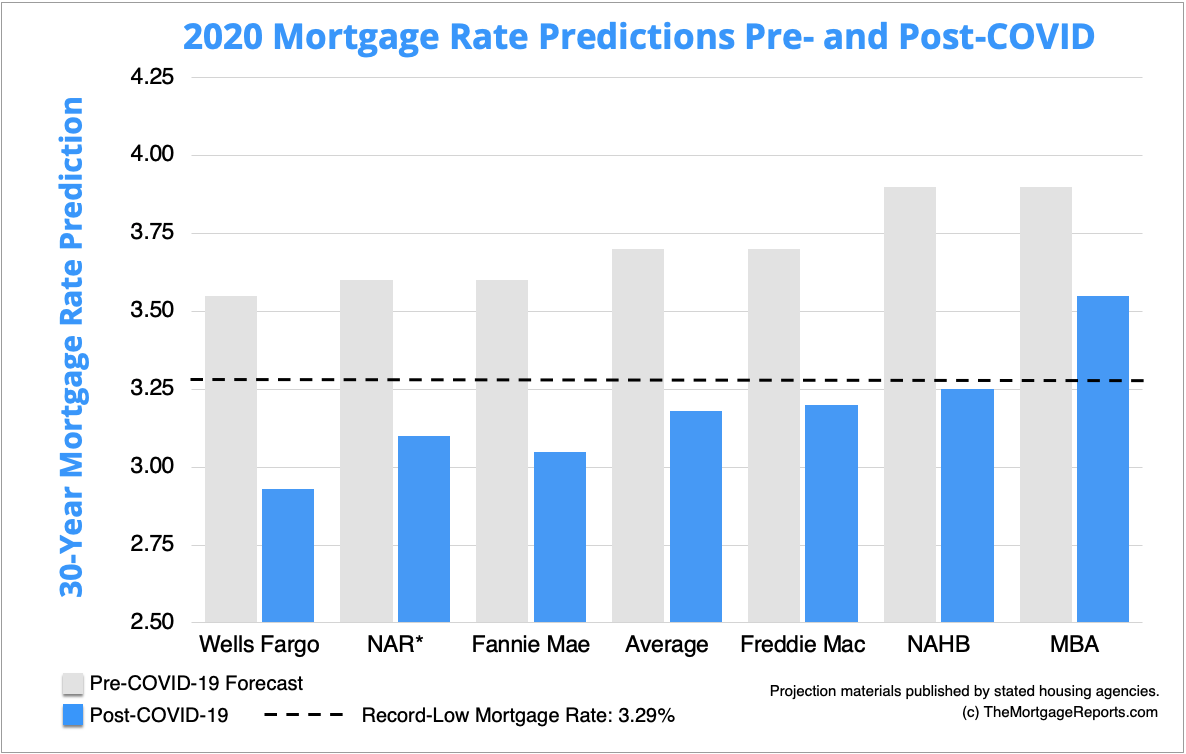

Case in point: Mortgage rate predictions for 2020, given by experts six months ago, didn’t come to pass.

Leading housing authorities now have new mortgage rate predictions for the post-coronavirus market.

Many of them are saying that mortgage rates for late 2020 will stay below their current record of 3.29%.

If that’s true, home buyers and refinancers could be in for record affordability in the rest of the year and beyond.

Find and lock a low mortgage rate. Start hereExpect rates at or below 3% through 2021

Leading housing authorities were asked in recent weeks: Where will 30-year fixed mortgage rates settle in the second half of 2020?

They agreed rates should end up lower than they have been.

| Agency | 30-YR Mortgage Rate Prediction for Q3 & Q4 2020 |

| Wells Fargo | 2.93% |

| NAR | 3.10% |

| Fannie Mae | 3.05% |

| Average | 3.18% |

| Freddie Mac | 3.20% |

| NAHB | 3.25% |

| MBA | 3.55% |

If some of them are right, the average 30-year rate could break records and fall below 3% — making for a strong purchase and refinance environment throughout the year.

Consider that, before 2020, the lowest rate recorded for a 30-year fixed-rate mortgage was 3.31%, reached in late 2012.

In March 2020, this mark was briefly beat when rates dipped to 3.29%.

Over a year ago, The Mortgage Reports even asked if we’d ever see rates in the 2% range. It has yet to happen, but it’s certainly possible.

Adding fuel to that speculation is the fact that Fannie Mae and Wells Fargo recently predicted that rates will hit around 2.9% this year or next.

Why mortgage rates plummeted in 2020

Katsiaryna Bardos is an associate professor of finance at Dolan School of Business. She says several factors have resulted in today’s near-record-low mortgage rates.

“The Federal Reserve has responded to COVID-19 shock much faster than they responded to conditions during the Great Recession of 2008,” Bardos points out.

“In addition to cutting the Federal Funds rate to near zero, the Fed dramatically expanded its asset purchase program. This included the purchase of billions of dollars of mortgage-backed securities,” she explains.

“These actions have increased the supply of money and liquidity in the economy. And that has led to historically affordable mortgage rates.”

“There’s a significantly lower demand for loans, declining inflation, and 10-year Treasury Notes approaching zero. These factors will cause rates to decrease.” —Bruce Ailion, Realtor and Attorney

Bruce Ailion, Realtor and attorney, agrees.

“There’s a significantly lower demand for loans, declining inflation, and 10-year Treasury Notes approaching zero. These factors will cause rates to decrease,” he says. “The economy has taken its hardest hit in decades. And the prognosis for a significant recovery post-COVID-19 is weak.”

These and other reasons are why mortgage rates should continue to stay enticingly low, says Ailion. He predicts rates going down to 2.75% before long.

Rates could keep dropping in 2020 if the economy stays slow

The idea behind lower rates is to help get the economy moving again. That’s what Suzanne Hollander, a Florida International University real estate faculty, teaches to her students.

“Lower rates will encourage financial activity. They may convince people who are on the fence to purchase or refinance now versus later,” Hollander says.

Tilden Moschetti, property attorney, points out that 2020 mortgage rates were forecast to be lower than they were in 2019 — even before the pandemic hit.

“That’s because the consensus was that the economy was slowing and growth would be down. The Fed was expected to respond by lowering rates, which they did,” says Moschetti.

Verify your new rateThe Fed cut rates to near zero, so why aren’t mortgage rates zero?

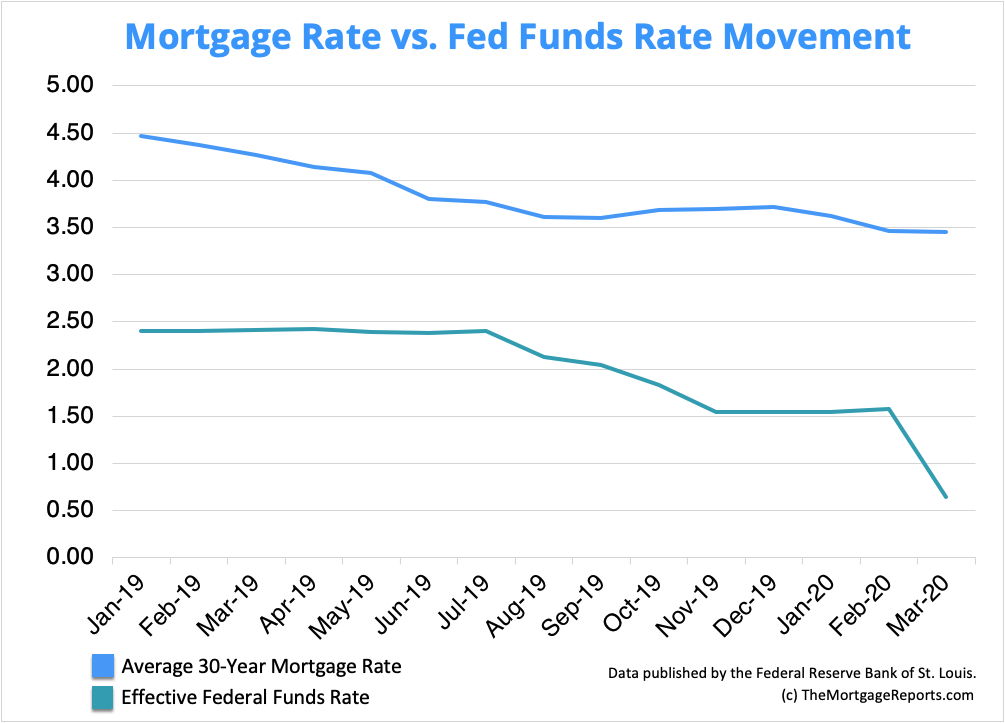

Contrary to popular belief, Fed rate cuts don’t control what happens to mortgage rates.

Consider that, when the Fed cut rates to zero, mortgage rates didn’t mirror that movement. They actually shot up for a short period before falling back to their prior average.

Although Fed Funds rate cuts often influence mortgage rates, the two aren’t directly tied together.

In reality, mortgage rates are controlled by larger movements in both the U.S. and worldwide economies.

>> Related: How mortgage rates connect to the fed funds rate

“The coronavirus has wreaked havoc on the global economy,” says Rick Sharga, president and CEO of CJ Patrick Company — who expects rates to drop as low as 3.1%.

Sharga points to U.S. Treasury yields, which are typically a better indicator of mortgage rate movements than the federal funds rate.

“It’s driven a massive amount of investments toward the relative safety of US Treasuries. That drives down their yields,” says Sharga.

“The interest rate on the 30-year fixed-rate mortgage tends to move up and down in tandem with [Treasury] yields. And these yields are currently near their lowest levels in history.” —Rick Sharga, President & CEO, CJ Patrick Company

“The interest rate on the 30-year fixed-rate mortgage tends to move up and down in tandem with these yields. And these yields are currently near their lowest levels in history.”

Alan Rosenbaum, CEO and founder of GuardHill Financial Corp, seconds those thoughts.

He notes that, “during a time of economic stress, money is reallocated from equities to bonds as a safe haven. That’s why a reduction in Treasury yields will typically lead to a reduction in mortgage rates.”

In fact, Sharga believes that mortgage rates should be even lower than they are today, based on these yields.

Will low rates help the housing market recover post-coronavirus?

Rosenbaum is bullish on the effects low rates will have on the housing market.

“Once the virus subsides and major cities restart their economies, real estate will become more attractive again,” says Rosenbaum. “Homeowners will look for new homes, and lower rates will help people afford larger homes.”

Mat Ishbia, president and CEO of United Wholesale Mortgage, is also hopeful.

“I anticipate the housing industry to make a big contribution to America’s economic comeback following the impact of COVID-19,” says Ishbia.

“There will be a great purchase market in the third quarter of 2020. Plus, expect exceptionally low rates in the second half of this year, based on market conditions,” he predicts.

“This will be a great opportunity for people to save money while shopping for their dream home during the second half of 2020.” —Mat Ishbia, President & CEO, United Wholesale Mortgage

“This will be a great opportunity for people to save money while shopping for their dream home during the second half of 2020.”

Others aren’t so optimistic.

“As rates drop, consumers should and will benefit from refinancing. But at some point, lower rates will not motivate buyers to enter the market,” says Ailion.

“Low mortgage rates and resulting greater affordability might not be sufficient to support the real estate market,” cautions Bardos.

“That’s especially true in the wake of record unemployment and a smaller supply of houses on the market to choose from.”

Should you lock a rate now or wait?

The decision on if and when to lock in a mortgage rate will depend on your unique circumstances.

It also has a lot to do with your tolerance for risk.

If you lock in now, there’s always the possibility that rates will drop lower.

But wait too long, and rates could unexpectedly creep up higher than desirable.

That’s why many pros recommend not trying to time the market. Instead, if you’re in a good financial position with prospects of continued employment, capitalize on low rates today—which are at or near all-time lows.

Many pros recommend not trying to time the market. Instead, if you’re in a good financial position ... capitalize on low rates today — which are at or near all-time lows.

“That’s especially true for those who want to refinance. Ask your lender to run the numbers to understand if the costs to refinance are worth the amount you’ll save,” Hollander suggests.

Rosenbaum is convinced rates won’t get any sweeter. Your window of opportunity for the greatest savings is now, he believes.

“Because of the systemic risk in the industry due to forbearance and unemployment, banks will widen their rate spreads. Hence, rates will not fall further,” says Rosenbaum, who forecasts a 3.5% rate before the end of the year.

Time to make a move? Let us find the right mortgage for you