In this article:

Remember these three tips to negotiate lower rent:

- The best time to get a lower rent is before you sign the lease

- Offer to pay several months’ rent in advance, and/or to set up automatic payments from your bank

- Help lower landlord’s costs by offering to do yard work or small repairs yourself

When property is vacant, the landlord makes no money. That’s the time to look for discounts, especially if you have strong financials — a great FICO score and a stable job with good income. However, in many markets, you will have competition for the best deals.

Verify your new rateDon’t count on rental rates to stall or fall

Several years ago, a candidate for the governorship of New York, Jimmy McMillan, ran on a platform which said: “The rent is too damn high.” You’ve got to admit, it’s catchy. You also have to acknowledge that for millions of renters, it’s true.

5 steps to finding the best values in rental housing

In much of the US, we have a huge housing inventory problem at the most affordable levels. Too much demand is chasing too little supply. And according to the National Association of Realtors (NAR), homeowners are taking at least a decade to move, down from six years before the housing crisis (and three-to-five years for first-time buyers). So there are fewer houses to buy or rent.

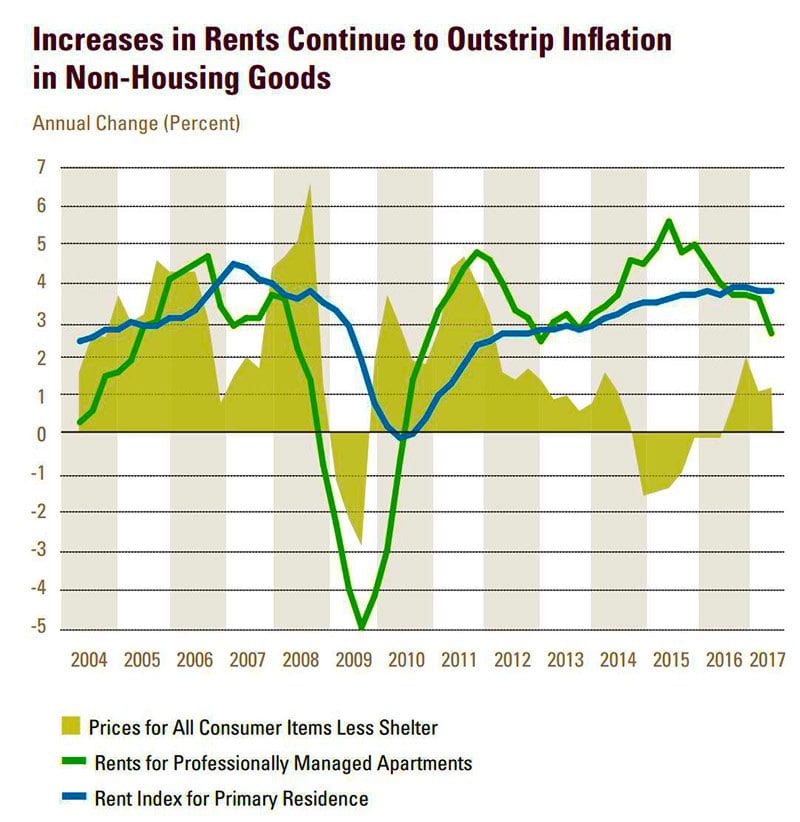

The illustration below from Harvard University’s Joint Center for Housing Studies shows how much faster rent is increasing than prices of other things.

While builders could construct more affordable rental units, that’s not happening. Last year, says the National Association of Home Builders (NAHB), “Multifamily starts were down approximately 10 percent, as apartment development levels off and the market finds a balance between supply and demand. NAHB is forecasting a small decline for multifamily construction in 2018. Multifamily permits were down almost 4 percent in December.”

And in case that isn’t bad enough, long-term renters may have new competition. Owners are turning units into overnight rentals through services such as Airbnb. Every hotel-like rental means one less long-term rental.

Negotiating lower rent from your landlord

With so many broad forces pushing up rental rates, what can you do to get a better deal? There are several steps you can take.

Look for a longer rental. Rising rental rates are great for landlords, but vacancies are not. If a property is vacant one month a year, the landlord’s income declines by 8.5 percent. Vacancies can also mean big costs for painting and repairs. Savvy landlords want to maximize both rental incomes and occupancy. The solution: suggest a longer rental term and fewer vacancies in exchange for a lower rent.

Improve your credit. Landlords hate to chase rent. What tenants see as rent landlords see as income. Landlords need income to pay mortgages, property taxes, and other costs. The picture of a rich landlord is often wrong. In many cases, we’re talking about small investors who can barely pay two mortgages, one for the rental and one for their home. Ease their minds. A good credit score, a solid credit report, and a good income will make you a more desirable tenant.

Tips for landlords: Beware of tenants who are identity thieves!

Pay in advance. It’s sometimes suggested that tenants can get a lower rental rate by paying ahead. This sounds logical, but most tenants simply don’t have that kind of free cash. An alternative idea is to request a discount for paying early.

Offer automatic payments. Suggest setting up an automated payment plan. The landlord will be paid electronically every month. A caution: account balances can move up and down every month. Avoid surprise late fees, overdraft costs, and credit dings. Have a line of credit attached to your account. Speak with your banker for details. Such lines are often cheap or free to set up and hopefully will never be used.

Lower the landlord’s costs. Reducing landlord expenses is no different than paying higher rent. For a single-family property offer to mow the lawn twice-a-month. In northern areas promise to clear snow from sidewalks and driveways.

Maybe it’s time to leave

If you’ve been a good tenant, remind your landlord of this — and ask for a rent reduction. Landlords value good tenants. Has every payment been in full and on time? Have you been a good steward of the property?

Buy or rent? Buying still beats renting in many parts of the country

Compare the value of a good tenant to the cost of replacing one — one or more months without rental income, plus the cost of screening new tenants, and the possibility of getting a bad one and starting over.

Or just don’t rent!

Don’t rent. Make buying a home your goal — studies show it can be cheaper than renting.

One of the best ways to lower rental costs is to move back home with Mom and Dad. The rent is likely to be far lower or maybe even free. Why will parents welcome you home? Because you will be able to save substantial amounts of money. Then, hopefully, you’ll have down payment cash and can buy your own house.

At a time of rising rental rates and few vacancies, the ability to negotiate lower rent may be limited. But not impossible.

Time to make a move? Let us find the right mortgage for you