In this article:

To get the best homes for rent, you need to be an attractive prospect for landlords.

- Check your credit and clean it up — or at least explain any blemishes

- Get references in advance

- Choose property you can afford so the landlord knows you’ll be able to pay on time

Rental housing: Get the most for your money

At first glance, homes for rent may look like any other products: you shop around, you choose, you “buy” (or rent, in this case). But it’s not that easy because landlords — unlike most retailers — are picky about their customers.

You need to be as persuasive at selling and proving your trustworthiness as the person who shows you the home is at highlighting the property’s features and amenities.

Here are five easy steps that could help you find the apartment or house you want — and then move forward all the way to signing the lease.

Time to make a move? Let us find the right mortgage for you1. Think like a landlord

A highly effective technique when you’re selling anything is to put yourself in the shoes of the person who’s buying. You’re selling your attractiveness as a tenant, and the person buying is your prospective landlord.

Guide to becoming a landlord in 2018

Know what your landlord values

Try to imagine what she sees as an ideal tenant. You then want to paint a mind portrait with yourself in that role. She’s likely to want someone who is going to:

- Pay rent reliably and on time — So she’s likely to pull your credit report and score

- Care for the property — A small landlord will be entrusting a big part of her net worth into your hands

- Abide by the rules — Your lease will contain some duties and obligations that you must observe, including not causing a nuisance to neighbors

- Be low-maintenance — Of course, you’re entitled to report issues and get them fixed. Do so with a sense of reasonableness and proportionality: there’s a difference in urgency between a failed hot water system and a single power outlet that’s not working

Worst places in the US to rent: Is it time to buy a home?

If you meet your landlord’s criteria for an ideal tenant, there’s a good chance you’ll catch some breaks further down the road. That might include consideration when rent reviews arise. Many landlords value “golden tenants” and will do a lot to keep them happy and in place.

Head off problems

Most new landlords will want to call your previous landlords to check on your past behavior as a tenant. That’s the best indicator of what’s likely to happen in the future.

If you had a big falling out with a previous landlord, be upfront about it. Say, “Landlord x hates me because [say why]. But call landlords y and z and they’ll tell you what I’m really like as a tenant.”

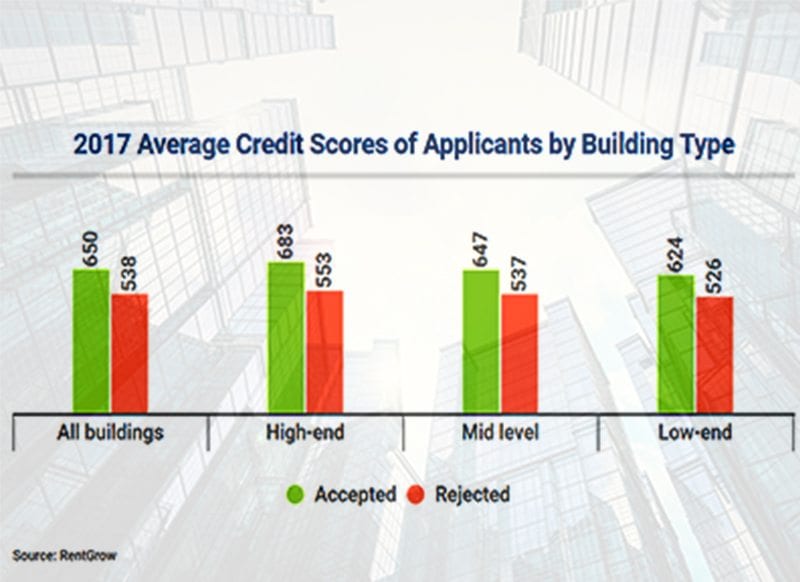

Renting credit score: You might need better credit to rent than to buy a home

The same applies to blemishes on your credit report. If you explain them upfront, they’ll be read in context when she receives your report. For example: “I was unemployed for three months back in 2015 and things got messy. But I’ve been in a steady job for two years now and things are back to normal.”

Differing expectations

The more high-end the property you want to rent, the more choosy the landlord’s likely to be. When you’re looking in the bargain-basement (perhaps literally) end of the market, you’ll typically face lower hurdles.

If you have poor credit and other credentials, you may stand a better chance with a small landlord than a corporation. The former has the discretion to make her own choices while the latter may have inflexible criteria when selecting tenants.

2. Set your budget

Of course, you want to be sure you can afford your new rental home. Your prospective landlord is even keener that you’re able to do so. The last thing she needs is some deadbeat tenant who’s going to create headaches by always being late with payments — or, worse, who’s going to skip out leaving months of unpaid rent.

Some experts recommend that your housing costs don’t exceed 30 percent of your income. Housing costs include any utilities your landlord doesn’t cover and any extras you choose, such as storage or parking.

Landlords’ ratios

Many landlords set their own thresholds for that ratio between housing costs and income. You may have to show (as you would to a mortgage lender) that you can easily afford the monthly payment.

Do the math in advance. Multiply your monthly income by 30 percent to see the dollar amount of your ideal housing costs. If you can afford more, be ready to show how and why: perhaps you have less debt to maintain than most other people or receive significant annual bonuses.

3. List your needs and wants

It’s great to live in an area with a plentiful supply of homes to rent. You’ll likely have a wide choice. But, regardless of supply, you’ll need to filter your options.

Rental house or apartment: How to choose

So think through what you need: the things that will make you rule out a property where one or more is absent. Having a list of needs can help you skim quickly through listings. It will certainly assist any professionals you involve in your search.

Additionally, come up with a list of thing’s you’d like. These aren’t necessities but are features and characteristics that would be part of your ideal home.

Your lists

Here are some items that often feature on lists:

- Size — Both number of rooms and square footage

- Location — How handy you want to be for work/schools/restaurants and bars/stores/healthcare ...

- Amenities — HVAC, washer-drier within the home, dishwasher, bathtub, fireplace, bay window ...

- Floor — A fourth-floor apartment in a walk-up may not bother you when you’re 20-something. It might when you’re 80-something

- Furnished/unfurnished

- Storage/parking

Your lists are highly personal to you. Don’t expect them to be set in stone. If you fall in love with a place, you may surprise yourself. Your emotional attachment to it could see you drop things you’d previously regarded as absolute must-haves.

4. Price your needs and wants

This is when your dreams collide with reality. It’s when you start looking at listings for the neighborhood, area or city where you want to live.

Perhaps you’ll be able to get all your wants and needs fulfilled within your budget. You may even expand your wish list. Often this is when you have to pare down your lists and make some compromises.

Read your market

This is also a time when you’ll begin to get a feel for your local market. Is there a glut of properties similar to the one you want? In that case, you can negotiate hard with prospective landlords. Any blemishes on your own record (long past credit or tenancy issues) may become less important.

Rent-to-own homes: Move in now, buy later

But, if there’s a shortage of suitable homes for rent, the opposite will apply. You’ll likely have to chase new listings hard and accept a landlord’s take-it-or-leave-it deal.

5. Find the best homes for rent

Nowadays, the internet is likely to be your best source of listings. Use word of mouth, too. A friend of a friend or colleague may be a landlord who’d prefer to rent to you than a complete stranger. Or a friend or colleague might be having trouble selling his or her own home and would consider renting it instead.

In parallel with putting out the word, check online listings. A good starting point is a web search containing your target zip code(s) and “apartments for rent” or “houses to rent.” You can try adding more filters at this point, but good listings sites let you carry out intelligent searches once you’re there.

Apartment finder websites key to good rentals

Some smaller landlords prefer Craigslist to more mainstream platforms such as Rent.com. So cast your net wide.

Beware scams!

There’s a lot of money in the homes for rent market. It’s inevitable it attracts plenty of criminals.

Before parting with a cent, take care to establish that the person you’re dealing with really owns the home you’re going to rent —or legitimately represents the person who does.

And watch out for a whole list of other scams: