More expensive homes, bigger mortgages

Property values are rising in most markets, and that means jumbo loans have become more important. As of December, home prices nationwide had increased for 70 straight months, according to the National Association of Realtors (NAR). Home prices are at new highs in nearly two-thirds of our major metro areas.

2018 conforming loan limits jump by nearly $30,000

Property prices in many areas exceed so-called “conforming” loan limits — the maximum mortgage amount allowed by Fannie Mae and Freddie Mac. The single-family limit is now $453,100 in most of the U.S. and as much as $679,650 in “high-cost” markets. Limits in Alaska, Hawaii, Guam and the U.S Virgin Islands are higher still.

How do you finance a home if the value is well above the conforming loan limits? How can you get a million-dollar loan? The best solution in many cases is to use jumbo loans, larger mortgages that make financing and refinancing easy for qualified borrowers.

Verify your new rateJumbo loans

After the mortgage crisis, the government created a series of laws designed to make the real estate market less risky. One result is that mortgages are now divided into two groups, Qualified Mortgages (QMs) and Non-Qualified Mortgages (non-QMs).

Most mortgages today are QMs, and this is important for jumbo borrowers. Lenders love to originate QM loans, including jumbo mortgages. Why? Because a QM mortgage makes the lender virtually immune from lawsuits.

How your loan size affects your mortgage rate (and what to do about it)

In exchange for lawsuit protection, lenders have to follow certain rules with QMs. For example, balloon payments are not allowed. Prepayment penalties are limited to 2 percent the first year, 2 percent the second year, and 1 percent in the third year. Points and fees are limited. Loan terms cannot exceed 30 years.

Qualified jumbo mortgages: they’re out there

Under the rules, FHA, VA, and conforming loans are automatically Qualified Mortgages. However, a jumbo loan is too big to be insured by the FHA or VA or to be bought by Fannie Mae and Freddie Mac. So how can you have a jumbo QM loan?

The answer is that lenders can originate “portfolio” loans that are Qualified Mortgages. A “portfolio” mortgage is a loan that will not be sold by the lender. Because the lender originates and keeps the loan, program guidelines can be different – and more flexible – than those of FHA, VA and conforming loans.

With portfolio loans, lenders can originate jumbo QM mortgages, because there is no QM loan limit. There is no minimum QM down payment requirement. You can refinance with cash out. Interest rates can be fixed or adjustable. In other words, lenders and borrowers can bargain over portfolio mortgage terms, whether the loan is small or jumbo.

Non-QM jumbo loans

Not only can borrowers get jumbo QM loans; they can also get non-QM jumbo loans. Why would a borrower want a jumbo non-QM mortgage?

Crazy mortgage programs that really exist

Because jumbo lenders may offer one or more features which are not available with QM financing. For example, non-QM loans allow:

- Debt-to-income ratios higher than the 43 percent limit required for most QM mortgages

- Interest-only financing

- A 40-year term

- Millions of dollars

- Non-occupant co-borrowers

- Bank statement loan applications

- Alternatives for proving income

- Low credit scores

- Financing immediately after a foreclosure or bankruptcy

Jumbo loans & taxes

Under tax reform, the government has enacted new policies that will impact mortgage borrowers. The most important issues look like this:

First, mortgage interest when you buy a home is deductible — up to $750,000 for personal real estate. This is down from $1 million under the old rules.

Is a jumbo mortgage better than a conforming loan?

Second, interest on home equity lines of credit is no longer deductible, in most cases. But there is an exception if the money is used to improve the property.

Third, there is a $10,000 write-off limit on itemized deductions for personal property taxes PLUS state and local taxes. As a result, property owners in high-cost, high tax areas will see higher tax bills.

Speak with a CPA, tax attorney, or enrolled agent for specific tax information before financing or refinancing under the new rules.

Jumbo mortgage rates

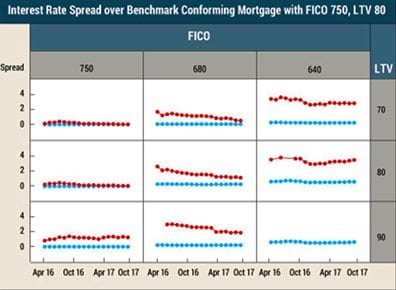

The difference, or spread, between jumbo and conforming mortgage rates rises and falls, depending on markets. In the early years of the mortgage crisis, this spread got as high as two percent. Currently, there is little difference between average jumbo and conforming rates for 30-year fixed mortgages.

Source: Liberty Street Economics

However, every lender is different, and that’s why shopping for a mortgage is important. In fact, it’s even more important when your loan amount is large because the amounts involved are greater.

Time to make a move? Let us find the right mortgage for you