Mortgage life insurance: Should you accept that offer?

Once you buy a home, expect offers to purchase mortgage life insurance. Yes folks, step right up, sign on the dotted line, and give your family the gift of a mortgage-free home should you die before the last payment is due. There may even be “scary” language to get you acting before thinking:

- “IMPORTANT NOTICE: PLEASE COMPLETE AND RETURN”

- “FINAL NOTICE: MORTGAGE PROTECTION CARD”

- “NOTICE OF OFFERING: MORTGAGE FREE HOME PROTECTION”

At first, such offers may seem enticing. You do want to protect your family, don’t you? And the name of your lender is likely slathered all over the promotions, so maybe these are offers you need to accept. Before you write a check, consider these ideas.

Verify your new rateWhat is mortgage life insurance?

In basic terms, mortgage life insurance pays off your mortgage balance if you die while the policy is in effect. In exchange, you pay a given monthly premium for the life of the coverage.

Is PMI bad? No, and here are the "silent" benefits of mortgage insurance

While it seems like a simple arrangement, there are a number of factors to consider.

Who benefits?

According to The Washington Post, mortgage lenders have no incentive to promote the least expensive policies — in fact, they are likely to promote the most expensive, because those get them a better commission.

Why flood insurance is so important: "We are all in a flood zone"

That cost increases over time — here’s why. As your mortgage balance declines so does the coverage needed. Yet, monthly premiums do not change. The result is that coverage falls while your benefit declines.

As the mortgage balance goes down, the mortgage insurance premium becomes less and less attractive. While $62.50 a month may be attractive when you owe $250,000, it may seem burdensome when the balance falls to $50,000.

Loopholes

It might matter how you die. For instance, the policy might cover accidental deaths (you’re hit by a bus) but not death by natural causes (you have a heart attack).

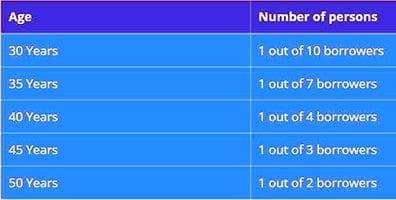

30-YEAR MORTALITY RATE FOR BORROWERS BY AGE

According to MedicalNewsToday, the latest available figures show that about 2.6 million people die in the US each year. Of that number 136,000 deaths – 5.2 percent – are from accidents.

In other words, getting life insurance which only protects against accidents is not likely to pay off. There just isn’t much risk from accidental deaths for most people.

The benefit is not flexible

Mortgage life insurance pays off your existing mortgage debt. That sounds great, but consider what it means. If you die under covered terms, the insurance company sends a check to the lender. It does not send a check to you. Depending on your circumstance, you might prefer to get a check from the insurance company.

Should you pay off your mortgage just because you can?

On a more positive note, you can generally get mortgage life insurance without a health exam. This does no good, however, if the policy only covers accidental deaths

More bad news: if you refinance the property, your old mortgage life insurance plan may not cover the new loan. You may need a new policy.

Mortgage life insurance alternative

While mortgage life insurance may work for some homeowners, it’s not the ideal solution for most. Consider term life insurance instead.

With term life insurance, you buy a policy, which has a given death benefit, say $250,000. The policy continues for an agreed term, for example, 30 years. Term insurance offers a number of advantages over mortgage life insurance.

What to expect after your mortgage closing

First, the policy payoff with term insurance does not decline — you still get the full benefit, regardless of your mortgage balance. In addition, the premiums tend to be lower than those of mortgage life insurance. And when you die, your heirs get a check. They can spend the money any way they like.

Customize coverage

With term insurance, you can get coverage that is related or not related to your mortgage balance. You can get a bigger policy or a smaller policy, as you prefer. Term insurance continues whether or not you refinance your home.

One potential downside is that if you have a short-term life policy — say, ten years — and then want another term life policy, the new rate may be higher.

If you want to consider a mortgage life insurance policy, shop around. Speak with brokers that offer both mortgage and term life insurance and compare costs and benefits.

What are today’s mortgage rates?

Today’s mortgage rates are on their way up and have been for several days. However, the important thing to remember is that while rates may have increased by .125 percent or so, you can save between .25 and .5 percent on your rate simply by shopping and comparing rates between lenders. That’s the difference you can find on any given day, according to Mortgage Industry Advisory Corporation (MIAC).

Time to make a move? Let us find the right mortgage for you