Should you borrow against or withdraw from your 401(k) to buy a home?

The 401(k) down payment sounds like an easy solution to a difficult obstacle: how to save to buy a new home while paying rent on your current one. If you have money invested with your employer for your retirement, those funds are tempting.

Withdrawing or borrowing from your retirement might be a good idea, but it could also prove a catastrophe. Here are the pros, cons, and alternatives to the 401(k) down payment.

Verify your new rateGaining access to your 401(k) account

While your 401(k) account is technically your money, your employer often gets to determine if you have access to these funds. You either borrow against your account or withdraw from it.

Over 591/2

Older homebuyers have the advantage when it comes to accessing their money, because they can usually avoid the 10 percent penalty the IRS imposes on underage withdrawals. But it can get tricky if you’re still working for the employer that administers the plan.

No longer with the company: Do a regular 401(k) withdrawal

If you have reached 591/2, and you no longer work for the employer that sponsors your plan, you can withdraw from your 401(k) without penalty. You can do this even if you are still working and employed by another company.

However, you will pay income tax on this money. So you may want to withdraw enough for your down payment, plus whatever’s needed to cover the tax in your bracket.

Still working for the company: options

If you are still working for your employer, but have reached age 591/2, the rules are a little different. You can’t take a regular withdrawal while still working for your company. But your company may still provide access to your money:

- You may be able to borrow from your 401(k), up to the lesser of $50,000 or half of your vested balance.

- You may qualify for a “hardship withdrawal” from your account. The IRS allows hardship withdrawals for buying a home, but your company policy determines whether or not you get one.

- If you are lucky, you belong to one of the few plans that allow an “in-service distribution.” That’s similar to a regular withdrawal and incurs no penalty.

Hardship withdrawal or 401(k) loan?

If you are not subject to the 10 percent penalty, does it matter if you choose a loan or withdrawal? It can.

Borrowing against your 401(k) does not trigger taxation. So if you want to control when you pay tax on your 401(k) funds, perhaps deferring them until you are in a lower bracket, borrowing can make more sense.

In addition, 401(k) funds are protected against bankruptcy. So if you are worried about financial hardship, keep in mind that once you remove funds from a 401(k), they become fair game for creditors. The good news is that in most jurisdictions, home equity is also protected from creditors, at least partially.

So if you put all the funds into your home purchase, they are probably protected.

Under 591/2

If you have not yet reached that magic number, things can become a bit more complicated, and possibly more expensive.

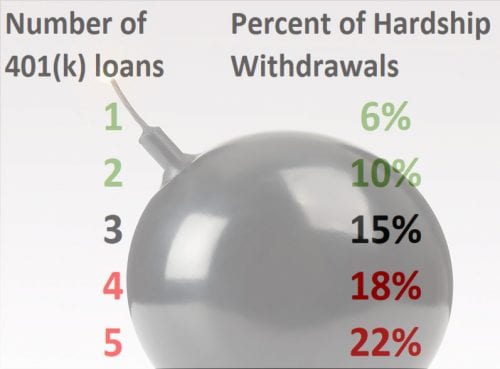

Note that the chances of ending up in financial trouble increase with the number of 401(k) loans you take out, according to research from Fidelity.

Retirees age 50 to 55: Regular withdrawal

Once you completely retire, most plans allow penalty-free withdrawals after age 55, and for first responders, that age may be as low as 50. However, you usually must have been at least 55 (or 50) when you retired from the company in order to get penalty-free access.

Former employees: Early distribution

If you no longer work for the employer that sponsors your plan, and you’re not old enough to take a regular withdrawal, your option is an early distribution. That means you’ll pay income taxes on the funds at your current tax rate, plus an additional 10 percent penalty.

Current employees: Hardship withdrawal or loan

If you are still working and under 591/2, your options again depend on your company’s policy. You may be able to borrow against your funds, up to the lesser of $50,000 or half of your vested balance.

How to get a 401(k) loan

First, your employer does not have to allow you to borrow against your account. Consider yourself lucky if it does. You don’t qualify under credit and income guidelines, because you are actually borrowing from yourself.

When calculating your maximum loan amount, divide your vested account balance (the amount that belongs to you) by two and use that figure or $50,000, whichever is lower. You may have to have worked at your company for a minimum number of years before any employer contributions become “vested,” or yours.

Some employers also set a minimum loan amount, for instance, $1,000.

How to repay a 401(k) loan

You repay your loan through a payroll deduction, and you can’t make additional contributions to your account as long as there is a balance against it. However, you do pay yourself interest on your outstanding balance at a predetermined interest rate — for example, the prime rate plus 1 percent.

So if you take five years to repay a 401(k) loan, that’s five years in which you did not contribute toward your retirement. Even worse, if your company matches contributions, you’d forego that benefit as well.

One disadvantage of borrowing against your 401(k) is that if you terminate your employment, voluntarily or involuntarily, your loan balance becomes a distribution — taxable and also subject to a 10 percent penalty unless you can repay it within 60 days.

How a hardship withdrawal works

You apply for a hardship withdrawal through your employer. Understand, however, that just because your 401(k) allows hardship withdrawals, and your company determines that buying a home qualifies as a hardship, you don’t get out of paying taxes on a withdrawal — or the additional IRS 10 percent penalty.

You may be able to avoid the 10 percent penalty if you qualify because:

- You are disabled.

- Your medical debt exceeds 7.5 percent of your adjusted gross income.

- You are required by court order to give the money to your divorced spouse, a child, or a dependent.

Is the 401(k) down payment ever a good idea?

The 401(k) down payment can be a decent way to pay for a house, under the right circumstances. For instance, if you have a plan for quick repayment of the loan so that you can go right back to contributing toward your retirement. Or if the property in question represents a great investment opportunity. Because home equity can also be considered a tax-deferred retirement source.

Supplementing your savings to increase the size of your down payment — for instance taking it from 10 percent to 20 percent — can save you more than it costs because you are likely to get a better mortgage rate as well as avoid mortgage insurance. Compare the cost of borrowing from yourself (including employer matching if you’d be giving that up) to that of a purchase money second mortgage and see if it’s worth doing.

401(k) down payment the smart way

The biggest danger of a 401(k) down payment lurks for those under 591/2, because those are the folks subject to that 10 percent penalty if they withdraw the funds or fail to repay a loan in time.

But there are other dangers as well. Your lender won’t count a 401(k) payment in your debt-to-income ratios, but your employer will be taking that payment out of every paycheck.

So you could find yourself with too little ready cash to pay your other obligations. This could cause a downward spiral of lower credit scores, depleted emergency savings, stress, or deprivation of things that are important to you.

Finally, there is the cost of not contributing to your retirement while repaying the loan. You can mitigate this by either choosing the highest payment you can make, or by setting aside the amount you used to contribute into some other investment, preferably one with favorable tax treatment. A good accountant or financial planner should be able to help with this.

To make your 401(k) down payment as bullet-proof as you can, pay back the loan over the shortest possible term. Have a backup plan in case you part ways with your employer. And you’ll need to make up some ground with your retirement program.

While you won’t be able to contribute to your 401(k) while there is a balance against it, every mortgage payment you make builds home equity, another asset. Protect this asset by leaving it alone while you repay your 401(k) loan — meaning that you resist the temptation to borrow against it with a second mortgage or home equity line of credit.

Alternatives to the 401(k) down payment

The 401(k) down payment may be a great deal for some. But it should probably not be the go-to solution without a little checking. Here are a few other options, and links to articles with more details:

- Low-to-no down payment mortgage: You may not have to come up with as much as you think

- “Family” mortgage: Co-borrowers, co-owners and family members can lighten the burden

- Let your seller or lender cover your closing costs, reducing your out-of-pocket costs when you buy a home

- Down payment assistance (DPA): The majority of properties in the US qualify for some sort of down payment assistance

- Seller carry: Your seller may be willing to help you with your down payment in the form of a loan

There are many ways to clear the down payment hurdle. The 401(k) down payment is just one of them. It might be the right one for you, and it might not. You owe it to yourself to do a little more reading before you decide.

What are today’s mortgage rates?

Current mortgage rates are very low, among the most affordable in recent history. Understand that published rates are based on certain assumptions and that your own personal quote may vary.