Easier mortgage qualification: how you can benefit

It’s not always easy to qualify for a mortgage. As a borrower, you have to meet a lender’s credit standards. They can often be strict.

But these rules are in place to protect you from buying a home you cannot afford. They also safeguard the lender from the risk that you won’t be able to pay back what you borrow.

Verify your new rateGood news for today’s borrower

The good news is that lenders are making it a little easier to get a mortgage lately. That’s because they appear to be relaxing some of their rules in order to attract more clients. At least, that’s what the results of a recent lender survey suggest.

Don’t outright dismiss the idea of applying for a mortgage because you don’t think you will qualify. If you do your homework ahead of time, you may find that the process is easier than you think today.

Lender survey: mortgage standards easing up

Fresh findings from Fannie Mae’s third quarter 2017 Mortgage Lender Sentiment Survey should encourage would-be borrowers. Among lenders polled, as many as 26 percent say they’ve eased instead of tightened home mortgage credit standards for all loan types.

How do I know that I'll be approved for a mortgage?

That marks a new high since the quarterly poll began in March 2014. Lenders have increasingly said they’re easing credit standards since the fourth quarter of 2016.

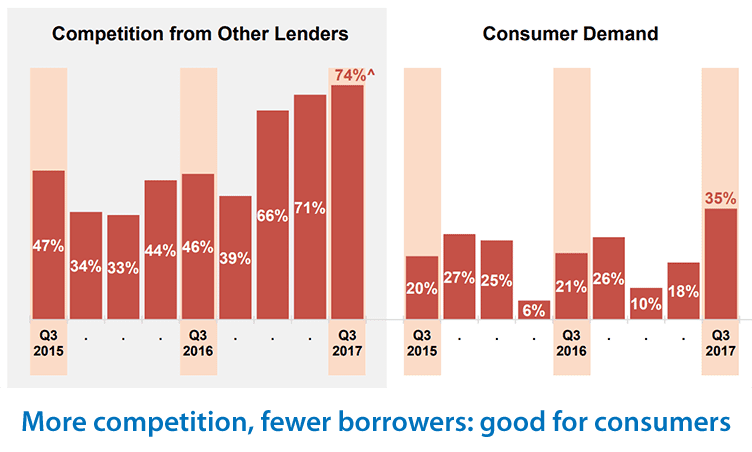

The main reason for credit loosening was listed as “competition from other lenders.” Mortgage lenders are also facing a negative profit margin outlook and seeing less demand for loans. In fact, the net share of lenders seeing growth in purchase mortgage demand over the last three months has dropped year over year for all types of loans.

(source: Fannie Mae)

These factors have helped to loosen credit standards slightly in recent months.

“Lenders further eased home mortgage credit standards during the third quarter, continuing a trend that started in late 2016,” said Doug Duncan, senior vice president and chief economist at Fannie Mae, in a prepared statement.

6 mistakes to avoid when qualifying for a mortgage

“Lenders’ comments suggest that competitive pressure and more favorable guidelines for (government-sponsored enterprise) loans have helped to bring about more easing of underwriting standards for those loans. Market competitiveness also led to the fourth consecutive quarter in which lenders’ net profit margin outlook deteriorated.”

What to expect when you qualify for a mortgage

To qualify for a home mortgage today, you’re still going to need to meet minimum standards. These include:

• A favorable credit score. Fannie Mae requires a minimum credit score of only 620.

• An appropriate debt-to-income (DTI) ratio. Your DTI number signifies your total recurring monthly debt payments (such as credit cards, student loans and mortgages) versus your gross monthly income. Fannie Mae’s new DTI ceiling is 50 percent.

• An acceptable loan-to-value (LTV) ratio. Your LTV represents the loan’s size compared to the property’s value. Fannie Mae’s maximum LTV is a generous 97 percent.

• A reasonable loan limit. Fannie Mae’s maximum loan limit in most states is $.

What the changes mean to you

J. Keith Baker, Mortgage Banking Program coordinator and faculty at North Lake College, says easing credit standards is welcome news to first-time buyers.

“One of the top reasons many mortgage applications are rejected is the borrower is already carrying too much monthly debt compared to their monthly income,” he says. “This is one of the reasons many millennials are priced out of the market. When they are first out of college, they are covering student loans along with other debt from normal household formation. Thus, they can’t meet the requirements of Fannie Mae and Freddie Mac.”

Offer letter home loans: getting a mortgage when you're between jobs

Thankfully, Fannie Mae made it easier to qualify for a mortgage by raising its DTI maximum from 45 percent to 50 percent in July.

“This opens doors for additional borrowers with good credit. And it increases the ability to make a reasonable down payment to obtain a home mortgage,” says Baker.

The recent DTI increase allows someone with $5,000 in monthly gross income to afford a total of $2,500 in payments. Before, they would only be able to afford a total of $2,250.

“This means they will be able to purchase as much as $50,000 more home on a 30-year fixed-rate mortgage at 4.5 percent interest,” he adds. “That’s a big deal.”

Looser rules ahead?

Mark Lee Levine, professor at the Burns School of Real Estate and Construction Management, University of Denver, says he’s personally seen some loosening of credit standards recently. But he cautions that standards are not as lax as they were back in 2006.

“Lenders are more restrained today as compared with the early 2000s,” says Levine. He adds that buyers shouldn’t hope for lending rules to get too easy.

8 ways to get a mortgage approved (and not mess it up)

“If credit standards are too relaxed, we will see more defaults on loans. This happened after the 2006 to 2008 downturn,” he says. “But unless the market hits a big bump, I think we will see additional easing on loan criteria.”

In other words, it might get even easier to qualify for a mortgage in the coming months. Remember that mortgage interest rates remain near record lows. So now’s the time to see if you can qualify for a loan and get on the fast track to owning your own home.

What are today’s mortgage rates?

Today’s less-strict mortgage underwriting standards have not been accompanied by higher mortgage rates. That means you have a better chance of being approved for a home loan, without paying a huge premium for the privilege. Find out today’s rates and if you qualify for a mortgage.

Time to make a move? Let us find the right mortgage for you