Hispanic buyers may power the next real estate boom

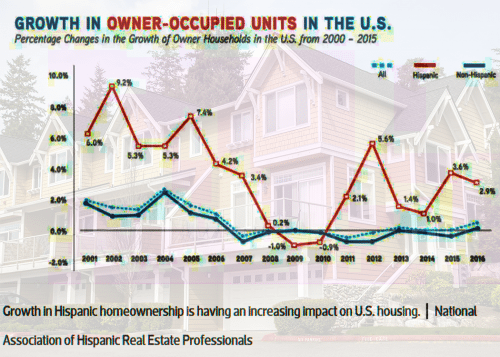

You might be surprised by the face of today's homebuyer -- it's likely to be young and Hispanic. According to the 2016 State of Hispanic Homeownership Report, created by the Hispanic Wealth Project and the National Association of Hispanic Real Estate Professionals (NAHREP), Hispanic homeownership has increased by 6.7 million households.

Latinos will likely comprise 52 percent of new homebuyers between 2010 and 2030, and the housing industry and home sellers should take notice.

Verify your new rateDesire for homeownership overcomes many obstacles

Hispanics bucked housing trends as homeownership rates fell nationwide, despite several hurdles:

- less likely to inherit wealth

- the recent dearth of low-cost housing options

- higher-than average denial rates for mortgages

7 hidden benefits of home ownership

Analysts suppose that "high workforce participation" and the “fervent desire to own a home” drove the increase in Hispanic homeownership when other groups pulled back from home-buying.

What do Latino buyers want?

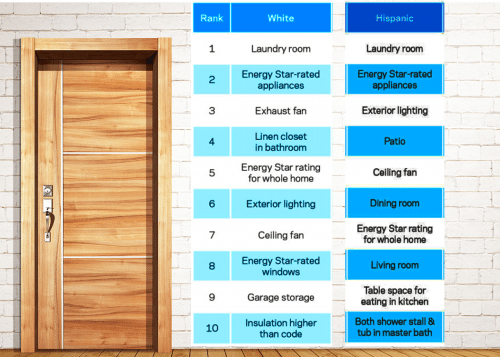

Ethnic groups do exhibit certain preferences in housing, and home sellers and industry professionals should take note. (Of course, not everyone conforms to these. They are only generalities that can, nevertheless, be helpful.)

- Latino buyers are, on average, considerably younger than white non-Hispanic buyers -- 37 years old versus 43.

- They want more bedrooms. While just 36 percent of Caucasian buyers want at least four bedrooms, over half of Latino buyers do.

- The two-car garage is most popular with these buyers.

The table below shows the most popular home features for Latino vs Caucasian homebuyers, according to the National Association of Home Builders (NAHB).

Not all roses and puppies

Despite the intense motivation of Latinos wanting to purchase houses, there is some discouraging news. Latino Millennials are less likely to own than their young, non-Hispanic white peers.

Just 27 percent of Latinos own a home, while 51 percent of non-Hispanic whites do, says the group Young Invincibles. The Great Recession took an outsized toll on Latinos, wiping out two-thirds of their wealth, according to Pew Hispanic. Much of this loss occurred in real estate equity.

Low down payment mortgages you've never heard of

In addition, the median white household net worth is over 13 times that of Latino households. That makes coming up with a down payment and closing costs a challenge, at a time when many markets are encumbered by a massive shortage of affordable properties.

In 2016, 17.3 percent of Hispanic mortgage applicants were denied loans, while non-Hispanic white applicants were about half as likely to be turned down.

How to encourage these new homebuyers

The addition of new programs requiring lower down payments is a good start. But there is a cultural problem, too.

According to NAHREP, it would be very helpful to have more Hispanic and Spanish-speaking real estate and mortgage professionals. Communication is challenging when just four percent of mortgage professionals and seven percent of real estate agents in the U.S. are Hispanic.

This creates difficulty for the 25 percent of Hispanic buyers who indicate that they prefer working with Spanish speakers.

Préstamo convencional con 3% de pago inicial disponible a través de Fannie Mae y Freddie Mac

Finally, the shortage of affordable homes to buy is taking its toll. Ironically, one contributor to this shortage is the difficulty finding labor in the construction industry. It's been made worse by recent deportations of many undocumented workers, who fill about 15 percent of construction jobs in the US.

What are today's mortgage rates?

There are some great programs with low down payment requirements and flexible underwriting -- perfect for young borrowers of all ethnicities who want to buy homes. And their interest rates are extremely affordable right now.

Time to make a move? Let us find the right mortgage for you