Single women home buyers: flying solo

Single women home buyers home face challenges. One is the fact that women earn 20 percent less than men doing the same job.

Another is that ladies living alone earn home equity slower than men, based on new research.

But with the right planning, single females can achieve their home buying dreams and increase the value of their ownership quicker. The first step is to learn the facts.

Verify your new rateLocation, location, location matters more for women

A new report from Redfin show that single women build less home equity over time than men. In fact, they garner about 92 cents of home equity for every $1 of equity acquired by males. This is based on a Redfin study of 79,517 homes bought by single females in 18 of the biggest metros.

Homebuying tips: How to choose your neighborhood

These women earned a median $171,313 of home equity over five years versus $186,403 of equity earned by men. That’s a difference of 8.1 percent, or $15,090.

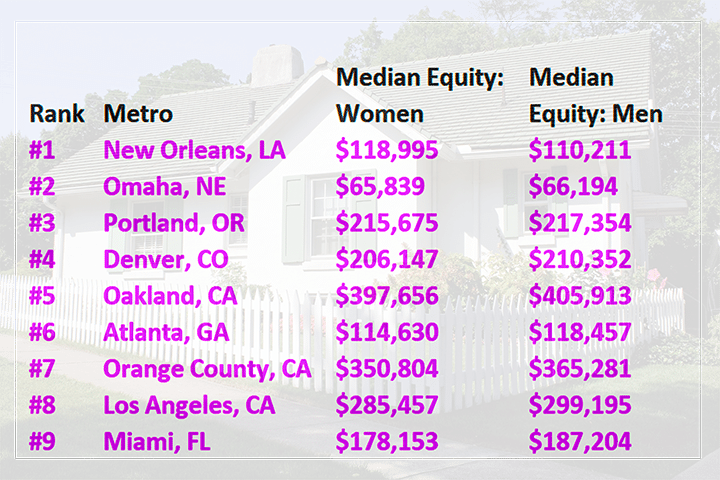

Yet a few metro areas are more favorable for women yearning to earn more in home equity over time. Here’s a list of the top nine markets where single ladies earned the best shares of home equity:

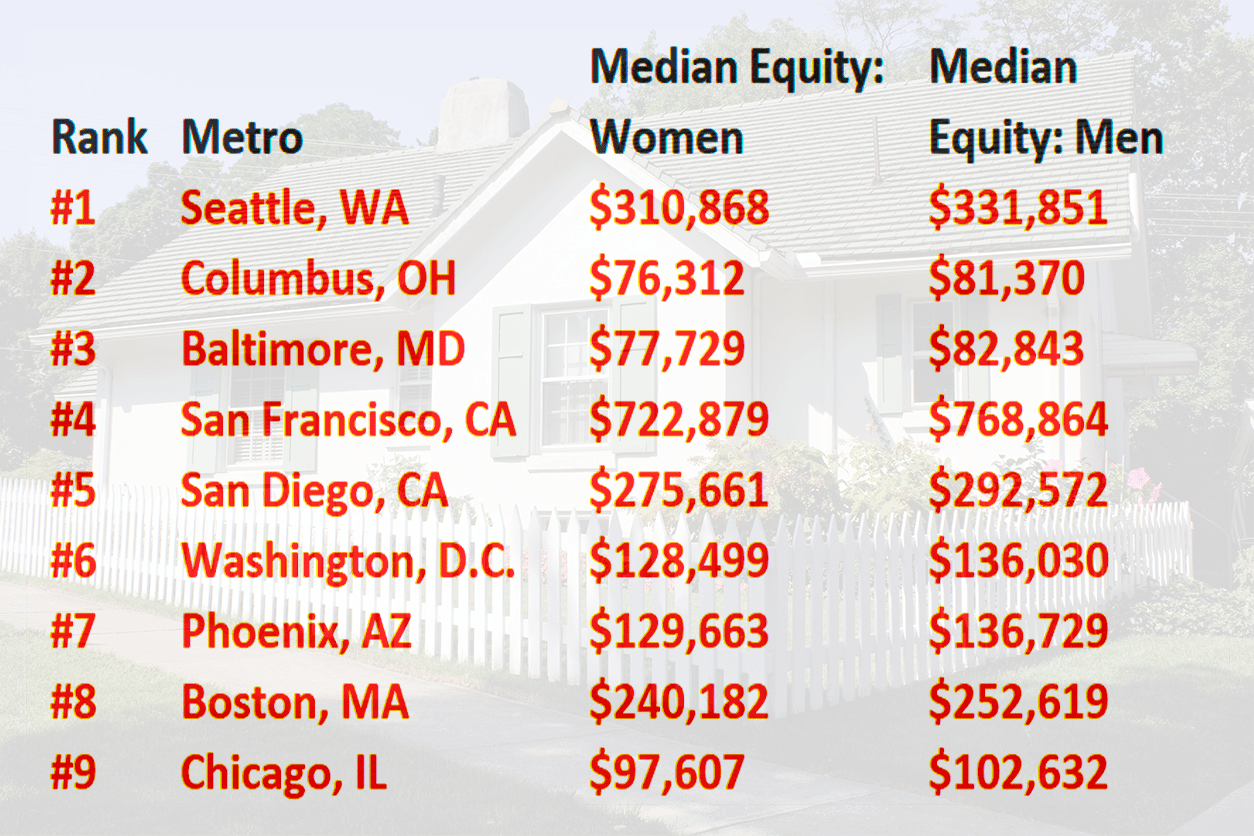

The nine markets where the equity ratio was worst for single women were:

It starts with your pay

Natalie Schwab, spokesperson for Redfin in Seattle, Wash., says she expected some level of home equity disparity earned by men and women.

“But I was surprised to see it was wider than the workplace pay gap and that women only earned more equity in one metro — New Orleans,” she says.

Single woman homebuyer: your guide to getting it right

The disparity in home equity is caused by many factors.

“But it really starts with the pay gap. Women are still paid less than men. Thus, they often put less down up front and buy less expensive homes that likely appreciate at a slower rate,” notes Schwab.

“Women also hold more of the United States’ student debt. That can impact their access to credit and loans.”

What you can do

Women don’t have to feel powerless or inferior based on these stats. Experts say there are things they can do to help close the wage gap and earn more home equity.

“It’s important for women to recognize their value in the workplace. They need to negotiate for fairer wages,” recommends Schwab.

Also, it’s crucial to know what you can truly afford. To find out, “speak to a lender or financial planner as soon as you begin your home buying journey,” Schwab adds.

Saving for a higher down payment and shopping around for the best interest rates can help you build more equity quicker, too.

Making accelerated mortgage payments can help as well.

“Paying even a small amount more than the amount due each month can, over time, have a dramatic impact toward the goal of acquiring equity,” says Tamara Dorris, adjunct real estate professor at American River College in Sacramento.

“Be sure to indicate to your lender that any extra amount you pay should apply directly to the principle, not interest.”

Rank your priorities

It can also help to move to one of the equity-favorable markets for women listed above. But that may not be practical.

“I don’t necessarily think it’s realistic for women to move to those places for that reason alone,” says Schwab.

Moving? Consider one of the nation's most affordable cities

The ability to earn more equity quicker can be an important criterion. Yet it shouldn’t be the main reason why you choose a given location. Instead, give greater priority to the following, say the pros:

- Job prospects. “Employment opportunities have to be present,” Schwab says. “Stable jobs will allow women to save for higher down payments. And it will potentially allow them to buy homes more comparable to those that men are buying.”

- Home price. “Affordability must be a priority, regardless of gender,” Dorris says.

- Quality of the community. “Most single women I have helped purchase a home were most concerned with neighborhood, safety, and schools if they had children,” notes Dorris. “Women want to feel safe in their homes.”

- Not all women (or men, for that matter) are comfortable with home maintenance, landscaping and basic repairs. “If you have minimal experience in these areas, you’d be wise to have a very in-depth inspection performed to ensure wiring, plumbing, and other structural components are in good condition,” Dorris says.

Women rule the real estate roost

The good news is that home ownership continues to be one of the best ways to build personal wealth. And single women are increasingly reaping the benefits. In fact, they now comprise the second largest group of home buyers at 17 percent, per the National Association of Realtors.

“That stat should be very empowering to women who are thinking about entering the market,” says Schwab.

Buy a duplex, triplex or fourplex and let your tenants pay your mortgage

Dorris agrees, noting that former traditional limitations for women are dissolving, including home ownership.

“Whether male or female, married or single, real estate remains one of the best long-term investments a person can make,” says Dorris. “I think women are finally realizing the white picket fence syndrome isn’t necessary the end-game. In fact, they’re learning it’s smarter and wiser to invest in a home than it is to rent.”

What are today’s mortgage rates?

Experts have expected mortgage rates to rise for a long time now, but they have remained affordable into the second half of 2017. And by comparing multiple offers, you can get an even better deal,

Time to make a move? Let us find the right mortgage for you