Single Women Are Home Buying Ninjas

If you’re a single woman considering buying a home, you’re not alone. According to the National Association of Realtors, single women are more than twice as likely to purchase a home than single men. In fact, they made up 16 percent of homebuyers in late 2016, while just seven percent of buyers were single men.

While women earn less than men on average, they are finding ways to achieve homeownership. Like any other major purchase, preparation is essential. Here’s how you can make the investment and get the best outcomes.

Verify your new rateFirst Things First

Can you afford to buy a home? Is your credit strong enough? Do you have a down payment and closing costs? All are questions you need to ask yourself (or a good lender) before you go home shopping.

Affording a house means more than making a mortgage payment. You’ll also pay taxes, insurance, repairs and maintenance, utilities, possibly HOA dues and other fees. Research these hidden costs and make plans for paying them.

Many helpful down payment and closing cost assistance programs have income-eligibility guidelines. If income or savings are issues for you, look for these programs. You can search online (HUD’s State Pages or your State Housing Agency can point you in the right direction.

A knowledgeable mortgage lender can help you find grants or income-based mortgages. Some programs apply to new buyers, while others are available to anyone buying in certain neighborhoods.

Then, get pre-approved for a mortgage. You’ll find that sellers respect your offers a lot more if they come with a mortgage pre-approval.

Choose Your Team

A team of professionals makes the job purchase easier. First, consider hiring a buyer’s agent (whose services come from the overall commission and at no cost to you).

Your agent, escrow officer and mortgage lender should work together to help you ind a great house and close on your loan.

However, you get to choose your lender, and in many cases you also get to choose your title insurer and escrow company. These services can vary wildly in price, so pick your own providers when you can.

No one else is as invested in saving you money than you are, and the difference can be thousands of dollars.

Interview your next lender and agent like the job candidates they are. Let them earn your business.

Most want an exclusive contract to represent you so determine what kind of contract you’re willing to sign with them. Also, carefully consider whether you want to work with one who is also the seller’s agent. That’s called “dual agency” and isn’t evan legal in some states.

Verify your new rateDon't Get Mushy

Certainly, you want to love a home you purchase. But, a home is an investment. It’s part of your wealth building strategy, and you want to see it that way. A RealtyTrac study found women’s homes already are less profitable than men’s. The likely cause is that women often earn less money and can spend less on houses.

Therefore, you must focus less on how cute or charming the front door is. Look instead at potential profit — starting with its current market value and considering how much it will appreciate. You must take into account resale value of your home even if you plan to own it for many years.

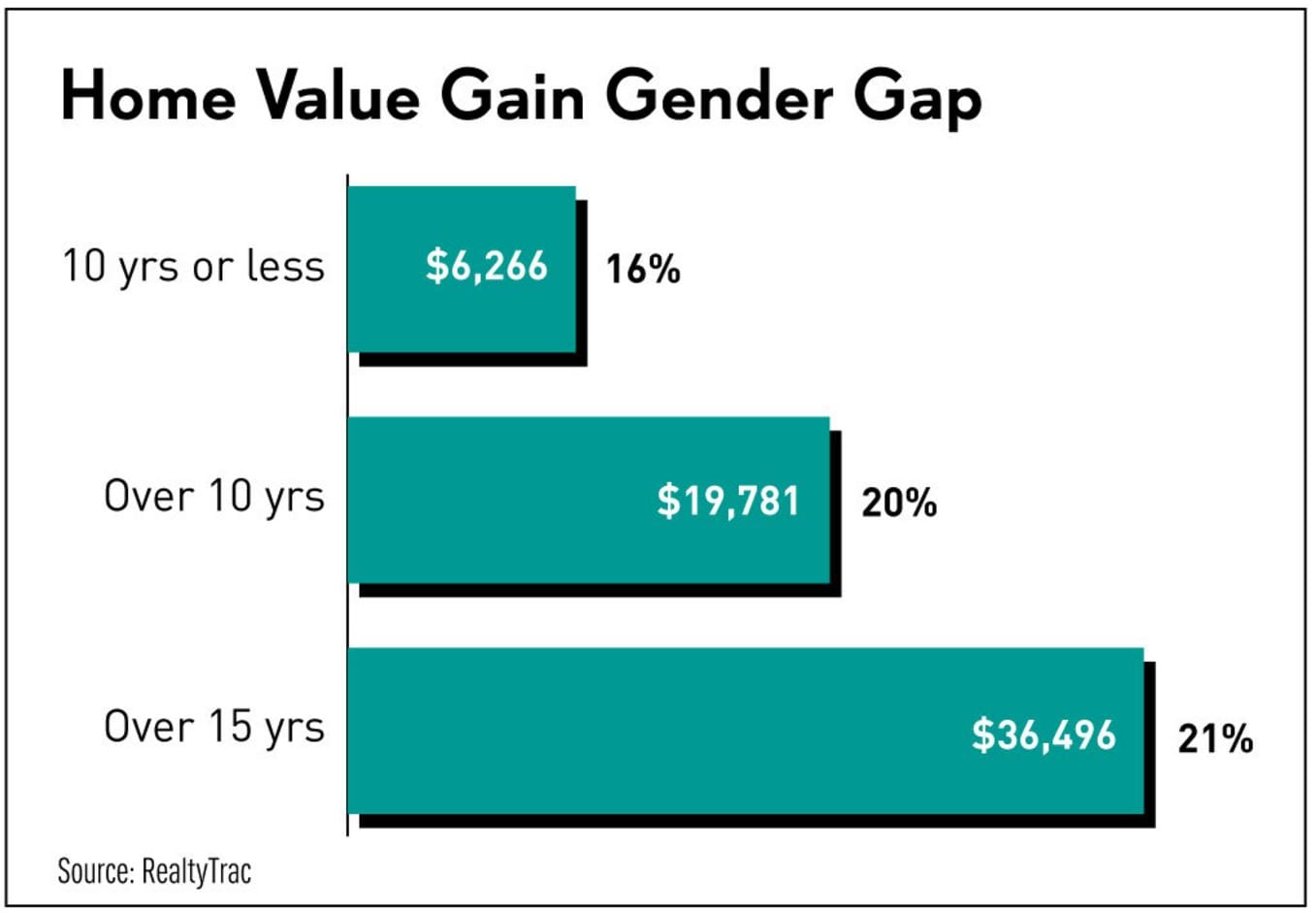

One reason for that is the gender gap in home values expands over time. Because men start with more expensve homes to begin with, increases in value add up to more over time.

Max Out Your Potential

One of the reasons single women’s homes appreciate less single men’s, 31 percent versus 33 percent, is single women often don’t buy in great neighborhoods where appreciation is higher.

Long-term ownership of a home doesn’t change that, either. After 15 years of homeownership, men see nearly 20 percent more appreciation in a home value than women.

So, carefully research the market in which you’re considering buying. Look around to see who is buying in that neighborhood and ask men you trust if they would buy in that area. Then, buy the best house you can in that neighborhood.

Happily Ever After? Maybe

Maybe you will settle down forever in your new home. But probably not. Life happens, new jobs beckon, romantic partners join households, and kids and pets require different living arrangements.

So don’t assume your purchase is forever, and get yourself an exit strategy before signing on a dotted anything.

Buy a home with the features buyers in your potential neighborhood want. Whether it’s bamboo flooring, concrete counters, pale grey walls, whatever.

If you’re buying a condo, check with the condo board and by-laws to make sure you can rent the unit out if you decide to use it as an investment property, and that it’s approved for FHA, Fannie Mae or VA mortgages. Condos are easier to sell when they’re easier to finance.

Oops

Some bying mistakes don’t become obvious until you try yo sell.

Make sure that’s a great location to buy, and be sure that your home fits in with its neighborhood.. Consider the property layout. For instance, don’t buy the only two bedroom home in a primarily three-bedroom home family neighborhood.

Avoid the oddly-shaped, too small or poorly located unit because it’s cheaper than the others in the area or building. Those oddball homes will be difficult to sell/ Even upgrading later might not help, since not all upgrades add value.

Check to make sure no significant changes are coming to your ideal neighborhood that will reduce the value of your home, too. Get historical resale data from your real estate agent, so you’ll have an idea of what you can expect at resale.

Fixing Up

Because a fixer-upper house is an investment, be careful to avoid the dreaded “money pit.”

After you’ve picked the right neighborhood for your investment, choose the best fixer you can afford there. If it requires substantial repairs that you can see, consider what you can’t see and hire a structural engineer to inspect the home, too.

Get more than one estimate for the rehabilitation / renovation costs.

A home inspector typically reports what he or she can see. This professional doesn’t necessarily know what’s behind cracks in walls and stains on ceilings.

A qualified structural engineer can help you determine the source or cracks, weird noises, etc., and estimate repair charges. Then, you can make an informed decision if that home is one you can afford and put the right financing in place to do those renovations.

Be Safe

Pick a safe house is a secure area. Not only will you feel better coming home at night and sleeping there, but you also may see increased resale value for the home.

Check crime and school district data . (Realtors cannot provide crime or school data by law but you can get it online.).

Make sure the home also has all the safety features you want. They should include secure windows higher off the ground, drive-in garages with remote door openers and interior access or secure underground parking for condos, secure, well-lit entries and walkways, solid doors with strong deadbolt locks and an alarm system.

What Are Today’s Mortgage Rates?

Today’s rates have probably already changed a few times — fortunately, not by much. To get a meaningful quote, including your credit rating, down payment, home value and more, check with a real lender about your real situation. That’ the only way to get information you can actually use.

Time to make a move? Let us find the right mortgage for you