What affects your mortgage rate?

Your mortgage rate depends on many factors, like the global economy, the loan you choose, and how many points you pay. other variables that can add 1.5 points or more to your costs are the property type (single family home, duplex, condo, manufactured home, etc.) and use (primary residence, vacation home or rental / investment).

Verify your new rateHow does the property type and use alter your mortgage rate?

The cheapest financing applies only to primary residences – the home in which you live most of the time. Some lenders charge more to lend on vacation property, and most impose higher credit score and down payments for these houses.

Investment property that you rent out or plan to resell quickly at a profit is riskier still. Expect to pay higher fees and deal with much stricter underwriting standards.

How to qualify for a mortgage with 2 primary residences

The type of property that you buy or refinance influences your mortgage rate. Condominiums, for example, are riskier to finance than single-family homes.

So are multifamily properties (like duplexes), co-ops, manufactured houses, high-rises, log homes, mixed-use developments, ranches and weird buildings like geodesic domes.

Fannie Mae and Freddie Mac add surcharges for loans secured by manufactured homes, condos and multi-unit properties. Many other lenders do also.

Investment property

How much more does it cost to finance a rental? Your down payment affects the surcharges for rentals. In fact, if you make a large enough down payment (30 percent or more), you may not have to pay extra to finance a rental. But most buyers will pay 1.5 percent or more for a home loan backed by investment property.

Live in your rental building and call it a primary residence

What if you don’t need the rental income to qualify for a mortgage? Can you finance your investment home as a vacation place and pay less?? It’s unlikely. Fannie Mae lists these requirements that must be met in order to finance property as a second home:

- The property must be reasonably far away from your primary residence

- You have to occupy it for some part of each year

- It must be a one-unit home

- It must be suitable for year-round occupancy

- You must have exclusive control over the property, with no management or time share arrangements

If you finance a property as a second home and not a rental, it has to pass the “smell test” or it will be considered a rental.

Vacation homes

As long as your mortgage amount falls within limits set by Fannie Mae and Freddie Mac, there are no additional fees for buying or refinancing a second home. However, jumbo or portfolio lenders often add about .5 percent to the loan fees for vacation properties.

How to get a mortgage for a second home / vacation property

Don’t expect to use a government-backed loan to finance a vacation or rental house — these programs are for primary residences only.

Condos

If you want to finance a condo, its community must meet the guidelines of the lender or the entity that backs the loan. That means limits on how many units can be occupied by renters, specifications about how many owners can be delinquent on their HOA dues, and other factors.

The homeowners association must submit an application package for review if the complex is not already approved by the lender.

Warrantable and non-warrantable condos

Condos can cost more to finance. While government mortgage programs like FHA and VA don’t add extra fees for condos, Fannie Mae and Freddie Mac charge a .75 percent fee for condo loans above 75 percent loan-to-value. Jumbo mortgage lenders typically add .125 percent to the rate (as opposed to the fees) when they lend on condominiums.

And high-rises? Jumbo or non-conforming lenders frequently charge more to lend on high-rise condos, and some refuse to lend on them at all. However, high-rises on Fannie / Freddie, FHA or VA approved lists can be financed just like other condos.

Manufactured homes

Financing manufactured homes can also be challenging. The is largely because traditional homes usually increase in value over time, manufactured housing usually depreciates over time.

To be eligible for mortgage financing, a manufactured home must be legally classified as real property. You must affix the manufactured home to a permanent foundation.

Getting a loan on a manufactured home

The taxes matter, too. If you pay the taxes on your home to the DMV, it’s not a house — it’s a really big car. In that case, you have to finance your home with a personal loan at a much higher rate.

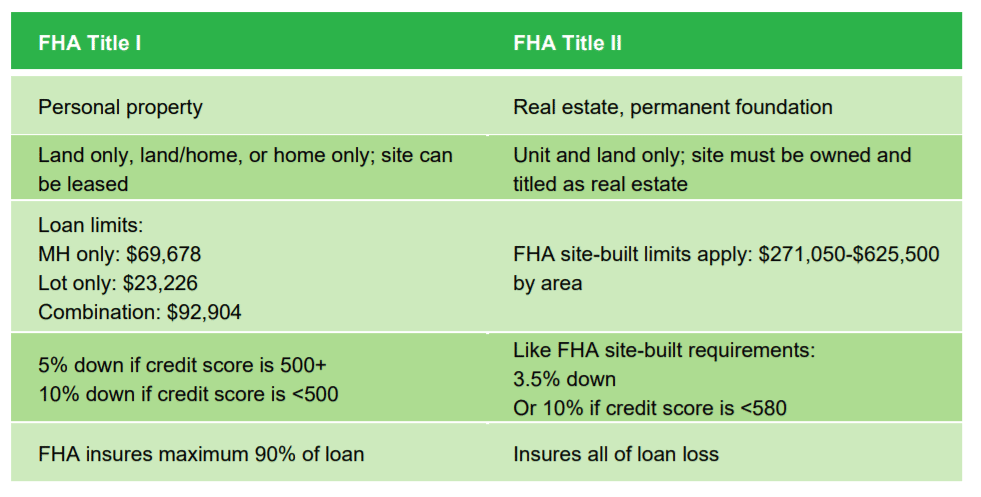

You can finance manufactured homes that are not real property with an FHA Title 1 Loan. That’s not a mortgage. It’s a personal loan, and rates are higher.

If your manufactured home is real property, it’s time to find your mortgage. Fannie Mae and Freddie Mac buy loans backed by manufactured homes. They do charge a .5 percent fee.

FHA and VA lenders do not assess this fee, and government mortgages have about 20 percent of the market for manufactured home financing.

Multi-unit property

Fannie Mae and Freddie Mac will finance duplexes to 85 percent of the property value, and triplexes and four-plexes up to 75 percent. There is a one percent surcharge.

2017 FHA loan limits for multi-unit homes

VA and FHA lenders let you finance multi-unit property without pricing add-ons. FHA’s loan limits are higher for multi-unit property than for single-family homes. You must live in one of the units if you want a government-backed loan.

What are today’s mortgage rates?

Today could be a very good time to buy or refinance if your mortgage rate is right. Try comparing offers from several lenders now and see what kind of offer you can negotiate.

Time to make a move? Let us find the right mortgage for you