Mortgage Deduction Does Not Help Everyone Equally

When you apply for a home loan, mortgage underwriters don’t factor in the mortgage interest tax deduction. That’s probably because not everyone takes it.

What Mortgage Underwriters Don't Consider When You Apply For A Home Loan (But You Should!)

However, you should consider it, because the tax deduction can have a huge impact on your home’s affordability.

Verify your new rateHow The Mortgage Interest Tax Deduction Works

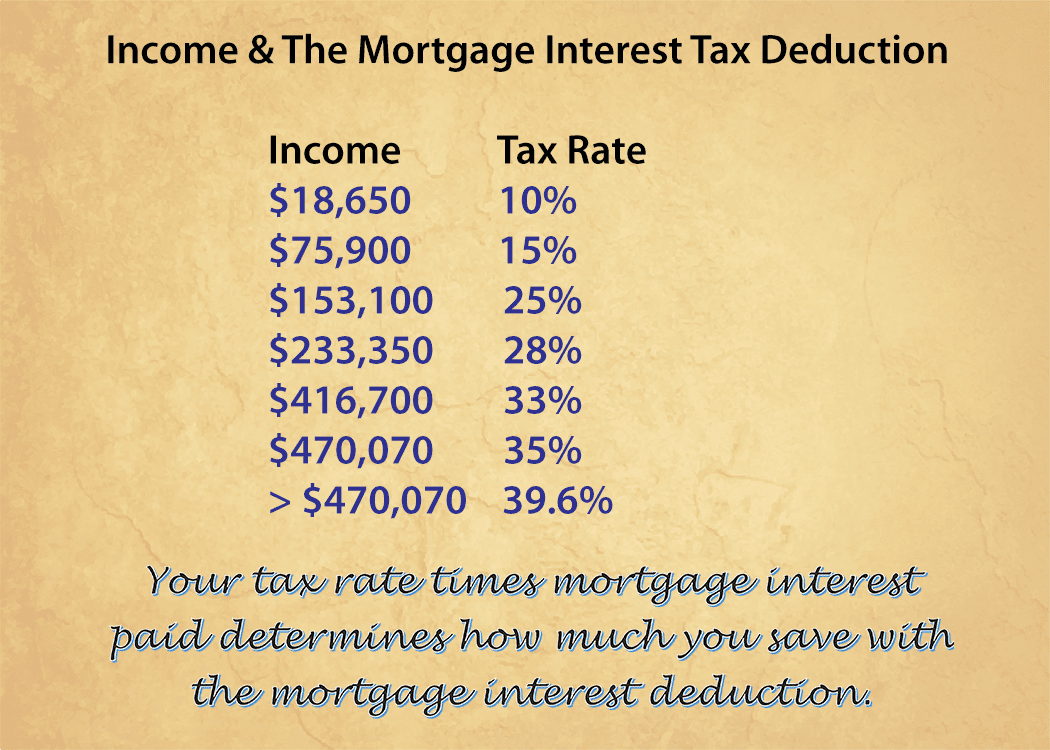

When you deduct your mortgage interest, you save between ten and almost 40 percent of your interest costs. Note that you don’t calculate the deduction from your entire payment, just the interest.

Mortgage Credit Certificates: A Tax Break For Those Who Don't Itemize

Because interest costs are higher in the first years of your mortgage, you get to deduct more at first, usually when you need it most.

The chart below shows tax brackets for a married couple filing jointly.

Calculating Your Savings

Here are the steps you’ll take to see what your deduction is worth.

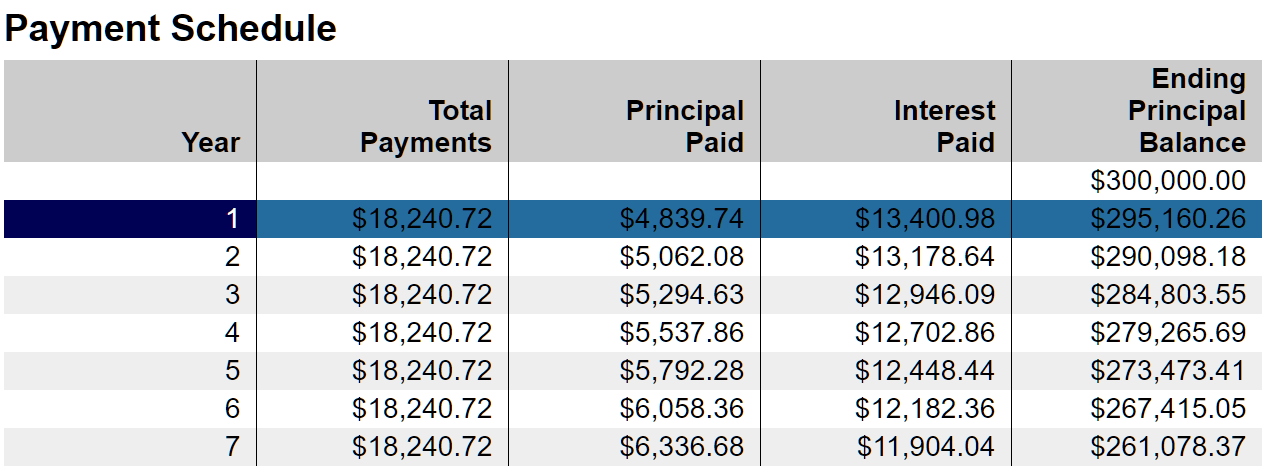

First, look at your loan’s amortization schedule to see how much interest you’ll pay the first year.

3 Cool Things You Can Do With A Mortgage Calculator

Suppose Mr.and Mrs. Hanson buy a house, and that’s their amortization schedule below. In Year 1, the Hansons will pay $13,401 in interest.

Savings If You Normally Take The Standard Deduction

Before they bought their home, the Hansons always took the standard deduction, which is $12,600 for a married couple filing jointly. Because their home mortgage interest deduction exceeds the standard deduction, they will want to itemize on a Schedule A instead of filing a 1040 EZ.

Mortgage Rates And Purchasing Power

In addition, the Hansons can deduct another $2,599 for other items. They would not get to write those things off without the home mortgage interest, because it’s that extra $13,401 that makes itemizing a better deal than taking the standard deduction.

So the Hansons can deduct $13,401 + $2,599, or $16,000. If the Hansons earn $100,000 a year, their tax bracket is 25 percent. Their tax savings is $16,000 * .25, or $4,000.

But Wait, There’s More

However, if the Hansons thought they were saving $4,000 a year in taxes by buying a house, they would be wrong. Before buying a home, they were already deducting $12,600. To determine their true savings, they’d have to subtract the standard deduction.

- $16,000 - $12,600 = $3,400

- $3,400 * .25 = $850 per year

- $850 / 12 = $71 per month.

If the mortgage interest deduction is what allows you to itemize, you have to subtract the standard deduction to get your true savings.

If your mortgage interest plus other deductions don’t exceed your standard deduction, you should not deduct your mortgage interest, and should just take the standard deduction. In that case, the mortgage deduction will not save you any money.

(However, if your income is not too high, you may be able to get a tax credit instead.)

When You Itemize Without The Interest Deduction

If you have enough deductions to itemize, even without the mortgage interest, that’s a different story. In that case, you simply multiply your mortgage interest by your tax rate.

If the Reynolds family has $15,000 in Schedule A deductions, plus their home interest deduction, and they earn $200,000 a year, they would multiply $13,401 by .28, because they would be in the 28 percent bracket.

- $13,401 * .28 = $3,752 per year

- $3,752 / 12 = $313 per month

You can see that the mortgage interest deduction is potentially more helpful to those in higher brackets, and those who already itemize.

How To Put The Money In Your Pocket

Okay, you probably think. It’s great that I get this money back at the end of the year, but that’s not helping me pay my mortgage right now.

It’s time to grab your latest pay stubs and make friends with this helpful IRS withholding calculator. You’ll input your income and withholding amounts, and be sure to add your estimated mortgage interest deduction.

The IRS will tell you how many exemptions to claim on your W-4. By increasing your exemptions, you’ll have less tax withheld, and more cash available to make your mortgage payments.

What Are Today’s Mortgage Rates?

The more interest you pay, the higher your mortgage interest deduction — but that’s no reason to pay any more than you have to!

You can minimize what you pay for a mortgage by contacting several competing mortgage lenders for quotes, comparing their offers and then choosing your best deal.

Time to make a move? Let us find the right mortgage for you