Mortgage Credit Certificate (MCC) Program Increases Your Home Buying Power

When real estate agents and mortgage writers (like this one) list the benefits of homeownership, the deductibility of mortgage interest on your federal tax return is always a biggie.

Because you get some of your mortgage payment back at tax time, your home costs you less. Renters don’t get to do that.

What’s almost never mentioned is that this benefit only works for about a third of taxpayers — the 30.1 percent of filers who itemize (file a Schedule A) instead of just taking the Standard Deduction.

Verify your new rateMCC Is For 1040 Short Form And 1040-EZ Filers

One of the biggest problems with the mortgage income tax deduction, say many experts, is that it only helps wealthier taxpayers — they’re the ones who usually itemize.

For the nearly 70 percent of households who don’t do their taxes this way, home mortgage interest deductions are worthless, and that makes buying a home more expensive for them.

MCC levels the playing field for eligible, less well-to-do homebuyers.

MCC Can Also Benefit Buyers In Lower Tax Brackets

The mortgage interest deduction is worth more to those who earn at higher levels. If you have $10,000 in interest to deduct, for example, and you’re in the 15 percent bracket, your deduction is worth $1,500. But if you’re in the 30 percent bracket, your deduction is worth twice as much.

The MCC is a credit, not a deduction, and may be worth more to a lower earner than a deduction. Always check with a tax pro before deciding to get (or NOT get) a mortgage with an MCC.

What Is The MCC?

The MCC is a certificate that allows eligible homeowners to claim a tax credit. This credit reduces the amount of income tax they have to pay, which frees up more cash to spend on the monthly costs of homeownership.

The amount of the MCC credit cannot exceed your annual taxes, but if your credit is more than the amount of your federal income tax, the extra may be carried forward to reduce your taxes in future years.

The amount of the MCC credit can be counted as income when mortgage underwriters qualify you for a home purchase, so it can help you buy a better property than you could otherwise.

How Much Is The MCC Credit?

The amount of your credit depends on the state that issues it, and sometimes other factors, like where you buy:

- Wisconsin, for instance, applies a 25 percent credit for most eligible recipients, but veterans and those buying in some neighborhoods get up to 40 percent.

- Oklahoma allows a credit of 50 percent of the interest paid on the first $100,000 of your home loan balance.

- California credits 20 percent of the annual mortgage interest paid.

The credit may have a cap. In Wisconsin, for example, it’s $2,000. Other programs may limit the credit by placing restrictions on the home’s purchase price or the size of the mortgage.

Who Is Eligible?

The income of eligible home buyers cannot exceed limits set by the state. In California, for instance, limits are defined by county and range from $70,000 a year to $137,000 a year for a one- to two-person household. These limits are higher for larger households, and for homes purchased in certain “target” areas.

The property being purchased must be a primary residence, and the buyer may have to commit to owning or living there for a certain number of years. If the homeowner fails to do so, some of the credit may have to be repaid.

Borrowers must also meet the guidelines of their mortgage lender. MCCs can be combined with almost any mortgage product, as long as the lender is approved by the government and participates in the MCC program.

How Does The MCC Work?

By reducing your income tax liability, MCCs allow you to qualify for a larger mortgage. (You don’t necessarily have to borrow more, but you can if you choose.)

Here’s how an MCC would look with a $300,000 California mortgage, a 4.0 percent interest rate, and a 20 percent mortgage interest credit:

- First-year interest: $11,900

- 20% credit: $2,380

- Monthly: $198

Because your federal income tax liability is $198 a month lower, you can have your employer withhold less tax and use the money to pay your mortgage.

When underwriting your mortgage, the lender is allowed to count the MCC savings as income, helping you qualify for your home loan.

Verify your new rateWhere Do You Find MCC Programs?

Each state administers its own program, and each state has its own rules.

The easiest way to find them is to search online for the “MCC mortgage credit certificate program” for your state. That’s where MCC program administrators post eligibility and application guidelines, and some offer brochures that you can download and print.

MCC Cautions

Each MCC program is different, and many have rules about the length of time you must own or live in your property.

If you plan to sell or move in just a few years, look up the program guidelines about tenure. You don’t want to be surprised with a big bill if you’re required to repay some of the credit.

Second, understand that just because you take the IRS Standard Deduction now doesn’t mean you won’t be able to itemize after buying a home.

Your lender can show you what your annual interest will be, and if it exceeds your Standard Deduction, you’ll be able to write off your mortgage interest without getting an MCC.

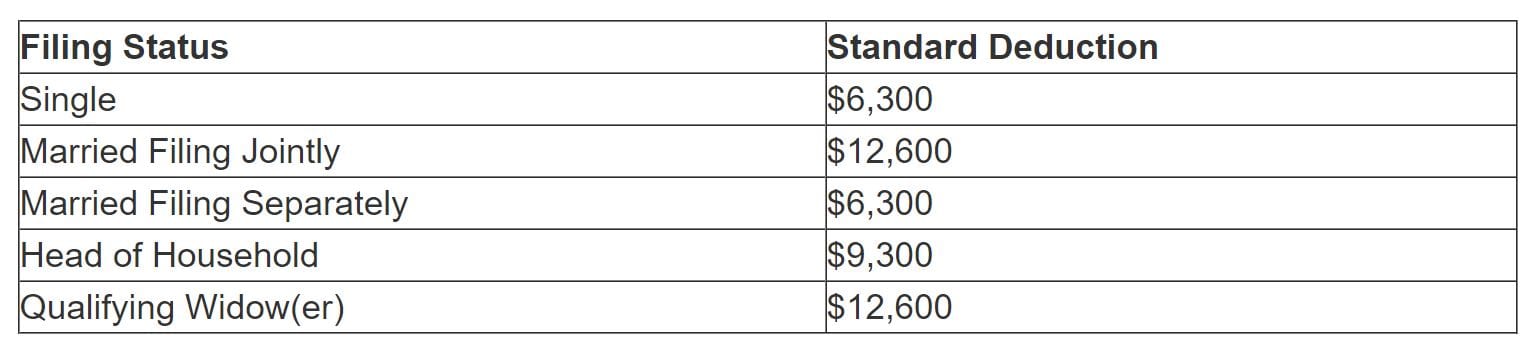

Here are the 2016 Standard Deductions from the IRS:

What Are Today’s Mortgage Rates?

Today’s mortgage rates for MCC mortgage credit certificate loans depend on the program you select, your qualifications, and the policies of the lenders in your state that participate in the program. Remember that almost any loan program can be used with the MCC.

Time to make a move? Let us find the right mortgage for you