What Does A Mortgage Commitment Letter Provide?

A mortgage commitment letter is a document that your mortgage lender prepares after approving your home loan application. It informs you and the home sellers that you have a loan and can close on your purchase.

This letter may also be called an approval letter.

Verify your mortgage eligibilityWhat’s In A Mortgage Commitment Or Approval Letter?

An approval or commitment letter usually contains this basic information:

- The type of loan you’ll use – for instance, a VA home loan

- The amount borrowed

- The term of the loan – for instance, a 30-year repayment

- The loan’s interest rate

How Long Does It Take To Get pre-Approved For A Mortgage?

In addition, the letter may list certain conditions that must be met before the lender will release the borrowed funds.

Conditional Approvals

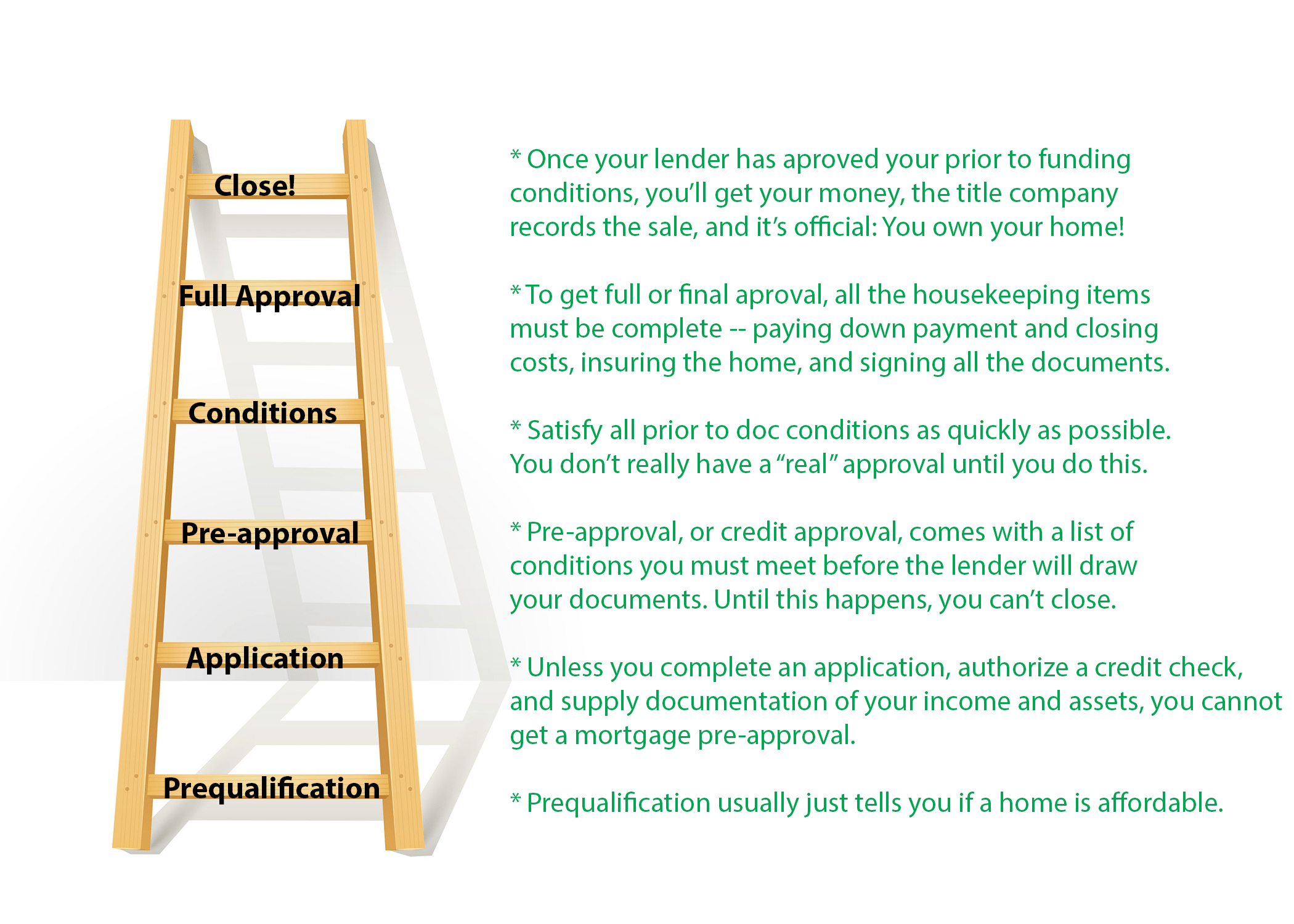

Most approvals come with a list of conditions that you must meet. The conditions might be “prior to docs,” which means you can’t get your loan documents until you provide these items and an underwriter signs off on them.

Examples of prior to doc conditions include:

- Providing updated income or asset documents

- Paying off an outstanding collection

- Completing a septic or well inspection

- Explaining certain financial withdrawals, transfers or deposits

- Documenting the source of your down payment

If the lender uses an Automated Underwriting System (AUS), the software may generate the approval and a list of conditions automatically.

Prior to doc conditions are the most important, and the underwriter can’t make a final decision until you provide these things. Your application may say that you earn $10,000 a month, and the lender may conditionally approve your loan, subject to you proving that you actually do earn $10,000 a month.

Full Approvals

Other conditions are considered “prior to funding,” and these items are more “housekeeping.” For instance, if your parents give you the down payment, your prior to doc conditions might be proving that they have the money to give you, and that you have deposited the money into your checking account.

The prior to funding condition might be bringing the money to closing in the correct form – a cashier’s check, for instance, or a wire transfer.

Here's How To Re-Approve An "Un-Approved" Mortgage

An approval with only prior to funding conditions is stronger than one with prior to doc conditions, because there is less to go wrong.

Other prior to funding conditions can include:

- Providing proof of insurance for the subject property

- Providing proof of the sale of your current home, if you are closing both your sale and purchase simultaneously

- If you’re refinancing, a three day right of rescission period must pass before your lender releases its funds

Prior to funding conditions are mostly handled by the lender and title company or attorney.

Verify your mortgage eligibilityDo You Have To Show The Seller Your Conditions?

Your real estate purchase agreement may require you to furnish a commitment letter to prove that you have adhered to the timeline dictated by your contract.

What if the conditions are embarrassing? For instance, your letter says you have to bring your child support arrearages current, or satisfy a judgment, or document your bankruptcy discharge?

If you don’t want to show the seller a conditional approval, your best bet is to provide everything the lender requests as soon as possible and get a new letter without the awkward conditions on it.

Alternatively, your loan officer may be willing to issue an approval letter stating that it is “subject to certain conditions” without saying what those conditions are.

The Difference Between Prequalification, Preapproval And Commitment

The distinction between these terms can be confusing, because not all mortgage lenders use them the same way.

For instance, the accepted definition of prequalification is that the lender assumes that if everything the borrower says is true, he or she *should* be able to qualify for a loan amount up to X dollars. lenders don’t usually check credit for a prequalification.

Mortgage Prequalifications Are Good (But Pre-Approvals Are Better)

However, some lenders pull a credit report before issuing a prequalification, and others might even review bank statements and pay stubs. The second lender’s prequalification is stronger.

In general, prequalification is only good for telling buyers what they should be able to afford.

The next step is preapproval. This is pretty much the same as a conditional approval. The buyer submits a mortgage application, along with proof of income and assets. The lender pulls a credit report.

For pre-approvals, one of the prior to doc conditions is a satisfactory appraisal of the subject property. Another name for pre-approval is credit approval.

8 Ways To Get A Mortgage Approved (And Not Mess It Up)

Submitting an offer with a pre-approval or credit approval puts you in a much stronger position than submitting an offer with just a prequalification.

Once there are only prior to funding conditions, the buyer has what’s generally considered to be a full approval. You can’t have a full approval until you find a property, open escrow and obtain an appraisal.

What Are Today’s Mortgage Rates?

As of this writing, current 30-year fixed mortgage rates are still under four percent for well-qualified applicants. Besides making yourself as qualified as possible before applying, you can save money by shopping aggressively for the best mortgage deals.

That means getting at least three or four quotes from competing mortgage lenders, which is easy to do online.

Time to make a move? Let us find the right mortgage for you