Cash Out Refinance Rates Dropped With Other Mortgage Rates

It was hard to ignore the statement from Freddie Mac that in April 2017, prime mortgage rates fell below 4.0 percent. That’s good news for those looking at cash out refinance rates as well.

This was something of a surprise, given that most mortgage forecasts for 2017 suggested that we are on the way to higher mortgage costs.

Verify your new rateMortgage Rate Prediction: Art Or Science?

We don’t actually know what will happen in the future, and for several years, predictions of higher rates have proven wrong. Of course, eventually, they will rise and analysts can finally say they were right.

The Freddie Mac announcement said the interest rate for 30-year prime financing was at 3.97 percent on April 20, 2017. Alternatively, a year ago the same loans were priced at 3.59 percent, an even lower number.

However, at least one noted analyst said we’d be getting rates in the “4.75 percent to 5.75 range” in 2017. That could still happen, but year-to-date trends don’t support this.

Cash Out Refinance Rates: Past, Present And Future

In the 1970s, explained Lawrence Yun, the chief economist at the National Association of Realtors, mortgage rates averaged 8.9 percent.

In the 1980s, they hit an average of 12.7 percent. The 1990s brought us average rates of 8.1 percent, and in the first decade of the new century, they came in at 6.3 percent.

The in-and-around four percent rate,” Yun said, “is only a recent phenomenon from the year 2011 to today.”

Not only are recent mortgage rates low by historic standards. it’s fair to say they have been remarkably low. Freddie Mac reports that in 2016, the average annual mortgage rate for the year was 3.56 percent.

That’s not only low; that’s the lowest annual mortgage rate on record.

Going Down....

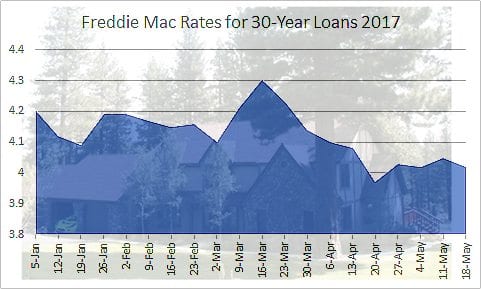

Between January and May this year, mortgage rates fell from about 4.2 percent to 4.0 percent. For those looking at cash out refinance rates, the picture is muddled.

If mortgage rates are going down, it makes sense to wait a little before refinancing. But if mortgage rates are actually higher than they have been in the recent past, does that mean now is the time to refinance?

There is no “right” answer to the question of whether this is or is not the ideal time to consider cash out refinancing. What we can do is look at some of the objective measures which are available to us.

Being Realistic

It’s great to bask in the recent news of low rates, but the reality is that the rates we’re seeing today are higher than the rates available a year ago. The worry is that we might be seeing the last four percent mortgage rates for a very long time to come.

This gets us to a very complicated conversation: why is it that mortgage rates go up and down?

We know that mortgage rates go up and down, but figuring out why is an uncertain process that generally involves complex economic models as well as Ouija boards and tea leaves.

In other words, we can’t reliably predict mortgage rates, but looking at history, it makes sense to assume that at some point they will increase.

Cash Out Refinance Rates

Cash out refinance rates move up and down in the same way “regular” mortgage rates do, but they are not the same.

Many mortgage borrowers are surprised to find that cash out refinance rates are usually higher than those of traditional refinances. That’s because these transactions are riskier to mortgage lenders than “rate and term” refinances, which just replace one mortgage with another in the same amount.

If your primary reason for refinancing is to get cash out of your home, and you can improve on your current mortgage rate, it probably makes sense to do it soon, while rates are low.

But if you like the home loan rate you have, and only want to cash out a relatively small amount of equity, a home equity loan or HELOC is probably a cheaper choice. The fees are lower and the apply to a smaller loan amount.

What Are Today’s Mortgage Rates?

If you believe — as many forecasters do — that cash out refinance rates are headed higher, then now is a good time to speak with mortgage loan officers. Alternatively, if you’re cynical, you might want to wait. It’s up to you.

Current rates for cash out refinancing and home equity loans change constantly, but are very attractive at this time. Check with several lenders to determine which is the better loan for you, and compare offers to get the best deal you can.

Time to make a move? Let us find the right mortgage for you