There’s no doubt about it: 15 year mortgage rates are lower than those of their longer-term cousin, the 30 year mortgage. Not only that, 15 year mortgages can save borrowers a ton of money when compared with traditional 30 year financing.

Verify your new rateYour Payment Does Not Double

Given such advantages, why is it that 15 year mortgages are not more popular?

Perhaps many believe that they can’t afford the higher payment that comes with zeroing your balance in half the time.

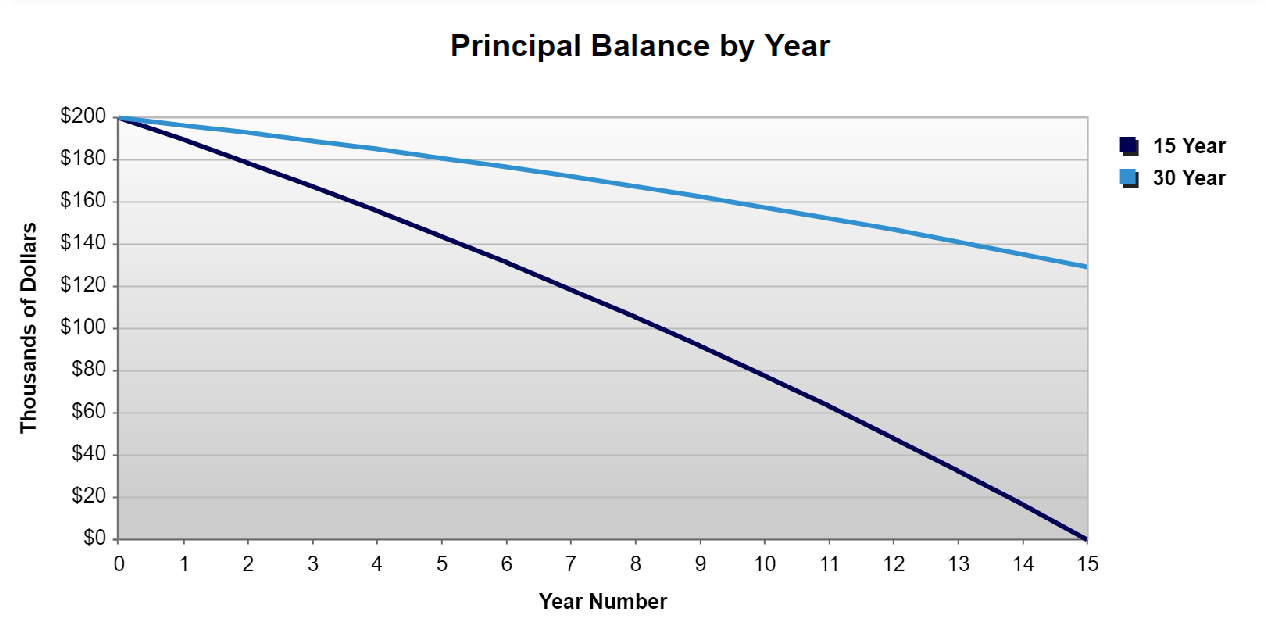

To understand how 15 year mortgages work, we need to take a look at some numbers. Let’s imagine that you can borrow $200,000 over 30-years at 4.0 percent with a fixed-rate loan.

The monthly cost for principal and interest will be $954.83. If you hold the loan to term — if you keep it for the full 30 years — the interest cost will be $143,739.

If you paid the same rate and chose a 15-year loan, your payment would not be twice as high. It would be $1,479.38.

15 Year Mortgage Rates

But 15 year mortgage rates are NOT the same s 30 year mortgage rates. Let’s borrow the same amount of money and finance over a 15 year period.

Instead of a 4.0 percent interest rate, borrowers are likely to pay substantially less, perhaps 3.25 percent. The reason for the lower rate is that loans with shorter terms are less risky to the lender.

If you look at the weekly rates for prime mortgages published by Freddie Mac, you can see that the 15 year loan is typically available at a roughly .75 percent lower rate than the rate for 30 year loans.

If we finance $200,000 with a fixed rate mortgage at 3.25 percent over 15 years, our payment would be $1,405.34, and the total interest cost will be $52,961. That’s a difference of almost $91,000.

This may not be enough to make you rich, but as the old expression goes, it couldn’t hurt.

15 Year Mortgage Payments

As you probably guessed, there has to be a catch somewhere — the payment is higher, which makes it harder to qualify.

So, while 15 year mortgages are attractive, the brutal reality is that many borrowers can’t begin to afford them. Lender debt-to-income (DTI) ratios rule out the higher costs of 15 year loans, even if borrowers are willing to scrimp to make the larger payments.

Equally important, 15 year mortgages represent a potent problem if household finances sink because of a job layoff, fewer work hours, or other problems.

With a 15 year mortgage, you MUST pay that $1,405 every month. If you have 30-year financing, your obligation is to pay $955 a month, a much easier burden.

It might seem as though the door to big savings is closed. But – as they say on late-night television – wait; there’s more.

While some borrowers may not be able to get the full benefits of a straight up 15 year mortgage, it’s possible to get a lot of the benefits associated with shorter loans. Without facing a stiff monthly obligation if income falls.

The Prepayment Option

Unlike the mortgages that dominated the marketplace before the financial meltdown, most loans being originated at this time have no prepayment penalties.

In fact, VA loans, FHA mortgages, and conforming loans all come without prepayment penalties.

So, let’s imagine that $450 a month is not an expense you can afford, but $150 a month is okay. If you borrow $200,000 at 4.0 percent interest and pay $1,105 instead of $955 a month, here’s what happens:

First, the loan is completely repaid in 278 months instead of 360 months. That’s a difference of 82 months, or 6.8 years.

Second, the total interest cost for the loan goes from $143,739 to $107,087. You save $36,652 if you keep the loan until it’s paid off.

While $36,600 is not as big a savings is $91,000, it’s not bad.

In other words, what you do is qualify for a 30-year mortgage, with the right to prepay in whole or part without penalty. You can then structure your own mortgage term by making prepayments that are comfortable in your situation.

The ARM

Another option, if you know that you won’t keep your home and mortgage more than a few years, is to refinance to an ARM, like the 5/1. Rates are similar to those of 15 year mortgages.

You could choose to accelerate your loan repayment by paying more than required each month. Or simply add the difference between the 5/1 and 30 year payment to your savings each month.

Cautions

As you look at the idea of prepaying a 30 year fixed mortgage to get lower interest costs, be aware that you are not getting the benefit of a lower mortgage rate. You’re not getting 3.25 percent instead of 4.0 percent in our example.

Also, the savings benefits which are possible over the life of the loan are unlikely to be achieved, because most loans are simply refinanced well before their full term. Today, the typical loan is outstanding less than five years, according to Freddie Mac.

And, according to the National Association of Realtors, the typical existing home – on average – is sold in just 10 years.

Finally, putting every available dollar into pre-paying your home loan could leave you short in an emergency. The only way to get that money back would be to take a home equity loan or sell the property.

Taking Advantage

However, if we’re going to point out the shortfalls of prepayments, we should also look at some of the positives.

By making consistent prepayments, you will owe less to the lender, and therefore have a bigger credit at closing when you repay the mortgage or sell the home.

And, not to be ignored, if you run into tough financial times, there’s no requirement that you continue to make prepayments.

Alternatively, you can put money aside into a savings or investment account, and use that to pay off your home loan early when you’re ready. You can earn a decent return on your funds, while keeping them available to you in an emergency.

What Are Today’s Mortgage Rates?

The value of the 15 year home loan depends on the spread, or difference, between available 30 year mortgage rates and 15 year mortgage rates. This is not a constant amount, so you’ll want to check with several mortgage lenders to find the best deal on a 15 year loan.

Time to make a move? Let us find the right mortgage for you