Conventional loan limit grows over $26K for 2026

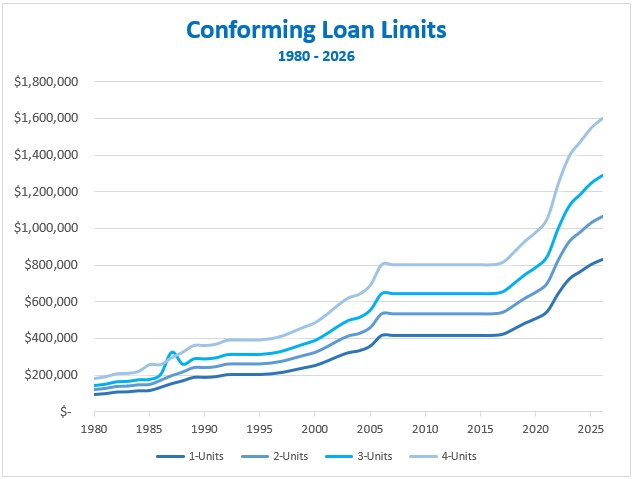

Every year, usually around Thanksgiving, the Federal Housing Finance Agency (FHFA) adjusts the conforming mortgage limits based on the annual home price growth.

The limits change to reflect the latest homebuying market and ensure borrowers have access to appropriate financing. Beginning January 1, 2026, new conventional loan limits will rise to $832,750 in most of the U.S. — with larger limits for multi-units and high-cost areas.

Depending on your lender, you may not even need to wait until the new year to be privy to the increased limits.

Check your home buying options. Start hereConventional loan limits for 2026

The FHFA increased the lending limits for conventional conforming mortgages in 2026.

On November 25, the agency announced a 3.26% increase to the borrowing threshold of conventional home loans. For one-unit properties, this amounts to a $26,250 jump to $832,750 in 2026 from $806,500 in 2025.

This bump mirrors the annual growth rate in the FHFA’s Home Price Index through the third quarter.

Below is the full breakdown of 2026’s conventional borrowing limits by unit size, for both standard and high-cost locations:

| Unit Count | Standard Limit | High-Cost Area (Maximums) |

| 1 Unit | $832,750 | $1,249,125 |

| 2 Units | $1,066,250 | $1,599,375 |

| 3 Units | $1,288,800 | $1,933,200 |

| 4 Units | $1,601,750 | $2,402,625 |

The standard limits will apply to the vast majority of the country. Among the 3,235 counties and county-equivalent areas in the United States and U.S. territories, only 160 or 4.9% adhere to higher limits. Of those, 77 (2.4% of the total) observe the maximum conventional borrowing limits.

Locales like San Francisco County, California; Arlington County, Virginia; and Honolulu County, Hawaii enjoy the maximum conforming loan limits, while typically expensive cities like Boston, Seattle, and San Diego fall between the standard and ceiling limits.

Check your home buying eligibility hereAlaska, Hawaii, Guam, and the U.S. Virgin Islands — which all have their own loan rules — follow the maximum limits as well.

The chart below maps out the 2026 conforming loan limits by county, according to the FHFA:

The bottom line

As home prices rise, the conventional loan limit increase will help more house hunters become eligible for mortgage financing in 2026.

If you’re ready to buy, prepare yourself and reach out to a local lender to get started. And remember, shopping to compare interest rates can save you over the lifetime of your loan.

Time to make a move? Let us find the right mortgage for you