Key Takeaways

- Sunbelt states lead. Alabama, Mississippi, and South Carolina top the list for their mix of warm weather, modest home prices, and small average mortgage balances.

- Gen Z is borrowing less. In top states, under-25 borrowers take on 25 – 35 % less debt than the national average.

- Warmth equals well-being. NOAA data show these states enjoy 200 + sunny days per year, giving new homeowners more than just affordable payments.

- Job markets stay solid. Most high-scoring states maintain unemployment below 4%, balancing lifestyle with stability.

For Gen Z, homeownership isn’t about square footage or zip-code prestige. It’s about balance and finding places where you can buy without borrowing your future away.

New HMDA data show that in certain southern and sun-belt states, buyers under 25 carry mortgage balances far below the national average. Add warm temperatures, ample sunshine, and steady jobs, and the result is a new kind of American Dream: affordable, debt-light, and bright.

Top 10 Warm and Affordable States for Gen Z Home Buyers

Note: This interactive map shows the Top 10 “Cheap + Warm” states for Gen Z homebuyers in 2025, based on The Mortgage Reports’ Cheap + Warm Index. These states offer the best mix of affordable home prices, manageable debt-to-income ratios, and warm climates — key factors helping younger buyers stretch their budgets. Highlighted states across the South and Sun Belt stand out as especially favorable for Gen Z entering the market.

Top 10 Cheap and Warm States for Gen Z Homebuyers

1. Alabama

Average Gen Z loan: $178,700 | Unemployment: 2.9 % | Avg temp: 64 °F

Alabama tops the list for its rare blend of low home prices and balmy weather. Huntsville and Birmingham anchor growing tech and aerospace sectors, while small towns offer sub-$200 K starter homes. With nearly 220 sunny days a year, Gen Z buyers get both value and vitamin D.

2. Mississippi

Average loan: $154,900 | Unemployment: 3.9 % | Avg temp: 66 °F

Mississippi consistently posts the smallest mortgage balances nationwide. Add Gulf-Coast warmth, a relaxed cost of living, and some of the lowest property taxes in the U.S., and it’s clear why the Magnolia State gives young buyers room to grow, financially and literally.

3. South Carolina

Average loan: $224,900 | Unemployment: 4.3 % | Avg temp: 65 °F

Gen Z buyers drawn to beaches and historic cities find South Carolina surprisingly attainable. Columbia and Greenville pair strong job markets with affordable homes, while coastal regions offer sunshine nearly 220 days a year.

4. Georgia

Average loan: $239,800 | Unemployment: 3.4 % | Avg temp: 64 °F

Georgia blends a booming job scene with southern affordability. Atlanta’s suburbs and mid-sized cities like Augusta deliver low-debt entry points without sacrificing career growth or climate comfort.

5. Texas

Average loan: $235,900 | Unemployment: 4.1 % | Avg temp: 66 °F

Everything’s bigger in Texas, except Gen Z mortgages. The state’s sprawling inventory of starter homes, combined with 230 sunny days a year, make it ideal for debt-light buyers who still want big-city opportunity.

6. Arizona

Average loan: $320,400 | Unemployment: 4.1 % | Avg temp: 72 °F

Arizona earns its place for pure warmth appeal. While loan sizes are higher than in the Deep South, abundant sunshine (close to 300 days annually) and expanding employment hubs like Phoenix and Tucson make it a magnet for Gen Z buyers seeking both heat and affordability.

7. Arkansas

Average loan: $165,400 | Unemployment: 3.8 % | Avg temp: 62 °F

Arkansas keeps costs low and comfort high. Northwest Arkansas’s mix of corporate growth and outdoor access makes it ideal for buyers looking to balance work and play, without heavy debt.

8. Florida

Average loan: $274,300 | Unemployment: 3.8 % | Avg temp: 71 °F

Florida offers the classic combination of warmth and affordability outside major metros. Inland markets like Ocala and Lakeland remain attainable for under-25 buyers who want endless sunshine without Miami prices.

9. Oklahoma

Average loan: $171,900 | Unemployment: 3.1 % | Avg temp: 61 °F

Oklahoma quietly scores for affordability and stability. Tulsa and Oklahoma City feature short commutes, cultural amenities, and home prices well below the national median, all under clear skies most of the year.

10. Louisiana

Average loan: $177,900 | Unemployment: 4.4 % | Avg temp: 67 °F

Louisiana rounds out the list with warm Gulf breezes and modest mortgage balances. Baton Rouge and Lafayette offer job stability, culture, and comfort for young buyers ready to build equity instead of debt.

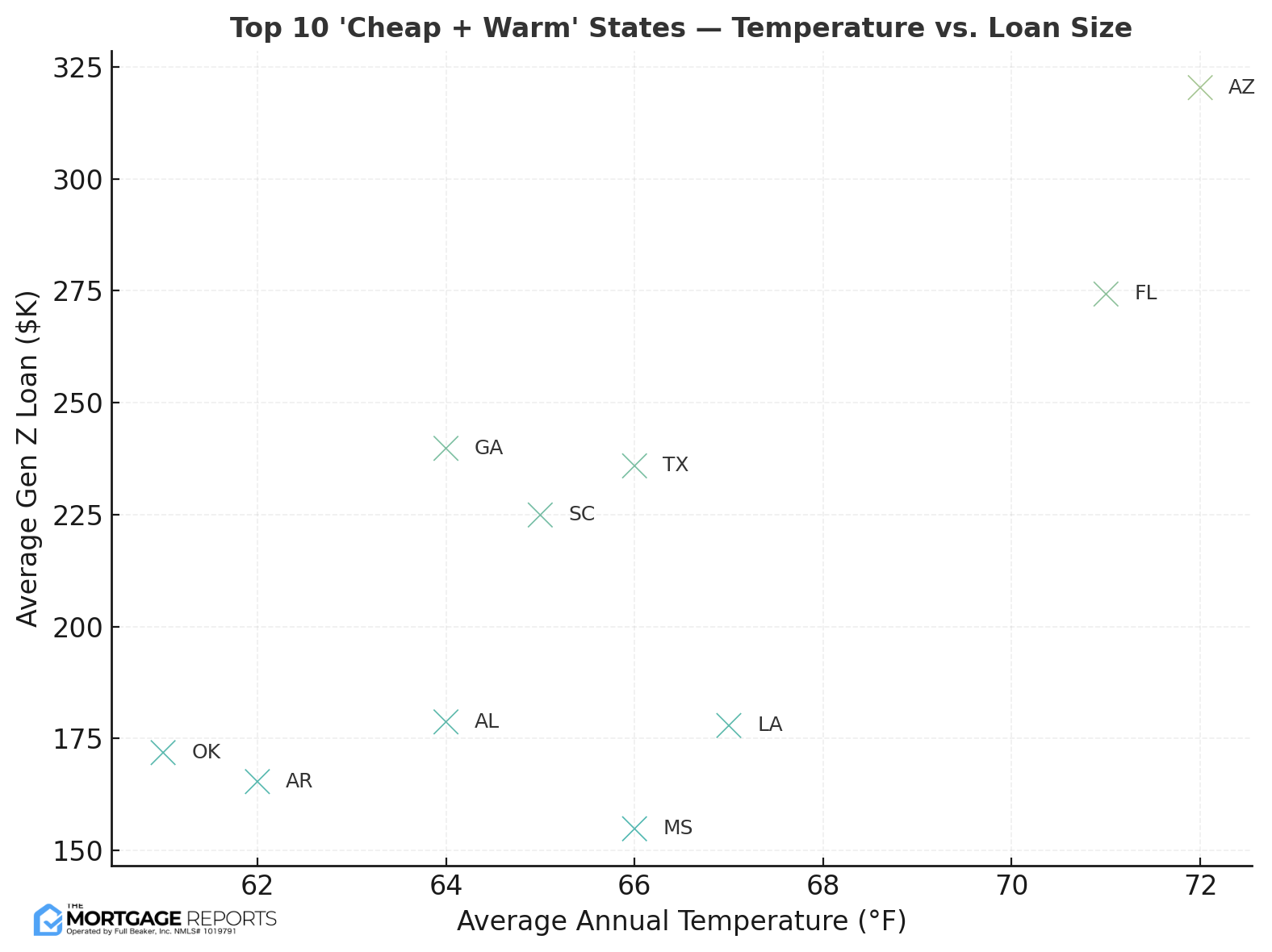

Top 10 Affordable and Warm States - Temperature vs. Loan Size

The bottom line

For Gen Z, the goal isn’t just to buy a house but to build a sustainable financial future. These “cheap and warm” states prove that affordable ownership is still within reach, especially for buyers who think creatively about where to plant roots.

If saving for a down payment feels like the biggest hurdle, The Mortgage Reports encourages young borrowers to explore down payment assistance programs available through state housing agencies and local lenders. Many programs offer grants or forgivable loans that can make the difference between dreaming about homeownership and achieving it.

Methodology

To identify the best warm and affordable states for Gen Z homebuyers, The Mortgage Reports created a Cheap + Warm Index blending financial, economic, and climate factors.

- Loan affordability (60%) — Based on 2024 HMDA data, we analyzed the average mortgage amount for borrowers under age 25 in each state. Smaller average loans reflect more accessible home prices and lower debt burdens.

- Warmth appeal (25%) — Using NOAA Climate Normals (1991–2020) and Weather Atlas sunshine data, we measured each state’s average annual temperature and percentage of sunny days. States with year-round warmth and abundant sunshine scored higher.

- Employment stability (15%) — We incorporated August 2025 preliminary unemployment data from the Bureau of Labor Statistics (BLS) to account for job security and local economic strength.

Scores were normalized and weighted to produce a 0–100 composite. States with lower average loan amounts, consistent employment, and sunny, warm climates ranked highest.