When it comes to affordability, homebuyers think home prices and interest rates. But property taxes are adding to rising homeownership costs.

According to the U.S. Bureau of Economic Analysis, property taxes nationwide are up an eye-popping 55% since 2012. It’s not uncommon for a homeowner to spend $500 to $1,000 per month on property tax assessments.

Luckily, tax amounts are highly localized. If one town, city, or state is too expensive, a homebuyer should shop around for a better value.

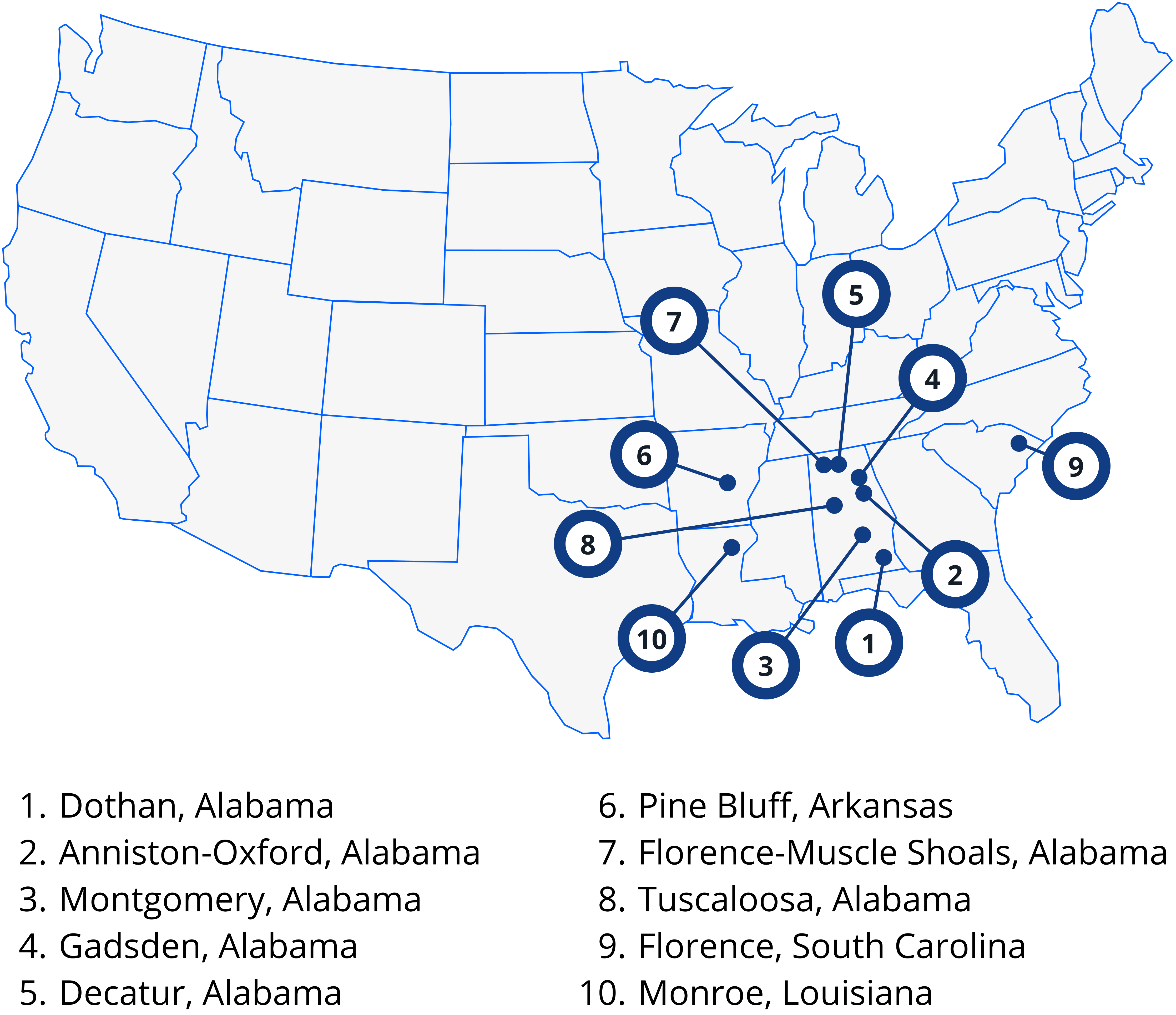

Verify your home buying budget. Start hereTop 10 Cities With Ultra-Low Property Taxes

Out of nearly 750 cities analyzed, the following 10 offered rock-bottom property tax costs. The U.S. Census Bureau estimates you’ll pay well under $100 per month on property taxes in these locales.

- Dothan, Alabama

- Anniston-Oxford, Alabama

- Montgomery, Alabama

- Gadsden, Alabama

- Decatur, Alabama

- Pine Bluff, Arkansas

- Florence-Muscle Shoals, Alabama

- Tuscaloosa, Alabama

- Florence, South Carolina

- Monroe, Louisiana

#1 Dothan, Alabama. Property taxes: $40 per month

- Typical home price: $182,863

- Median income: $58,054

- Population: 148,252

Homebuyers looking for extreme value should consider Dothan, Alabama. Home prices are under $200,000 and property taxes are next to nothing. Yet employment opportunities abound in the health, education, government, and energy sectors.

#2 Anniston-Oxford, Alabama. Property taxes: $42 per month

- Typical home price $126,494

- Median income: $52,819

- Population: 114,618

About an hour east of Birmingham, Alabama, Anniston-Oxford offers downright cheap property taxes. While home prices have risen about 37% since 2020, the average home is still ultra-affordable by national standards.

#3 Montgomery, Alabama. Property taxes: $48 per month

- Typical home price: $138,580

- Median income: $60,677

- Population: 373,544

The third of seven Alabama cities on our list, Montgomery provides low property taxes and housing costs overall. In fact, according to our analysis, you can purchase a home in this city even if you make less than $40,000 per year.

#4 Gadsden, Alabama. Property taxes: $48 per month

- Typical home price: $86,695

- Median income: $57,098

- Population: 102,748

It’s getting easier to buy a house in Gadsden, Alabama judging by average days a home sits on the market. In March 2022, homes took just 20 days to sell compared to 51 days in November 2023. It’s still a competitive market, though. In 2019, it took between 70 and 113 days to sell a home.

#5 Decatur, Alabama. Property taxes: $51 per month

- Typical home price: $209,055

- Median income: $60,663

- Population: 152,271

Home prices are up 52% since 2020. Luckily, prices are still quite reasonable and property taxes have remained low. The city offers robust employment opportunities in the manufacturing and tourism sectors.

#6 Pine Bluff, Arkansas. Property taxes: $55 per month

- Typical home price: $78,336

- Median income: $44,263

- Population: 90,865

The first city outside Alabama to make the list is Pine Bluff, Arkansas. Low property taxes aren’t all this town has to offer. Many area homes are priced well under $100,000. Employers in the region include Tyson Foods, Pine Bluff School District, and the Jefferson Regional Medical Center. These and other job opportunities could mean a decent income level paired with low housing costs.

Verify your home buying budget. Start here#7 Florence-Muscle Shoals, Alabama. Property taxes: $56 per month

- Typical home price: $190,605

- Median income: $56,563

- Population: 147,327

Just two hours south of Nashville, Tennessee, living in Florence-Muscle Shoals, Alabama costs about half of what it does in its northern neighbor. Nashville homes sell for over $440,000 and property taxes are $221 per month on average but the greater value can be found in this Alabama city.

#8 Tuscaloosa, Alabama. Property taxes: $60 per month

- Typical home price: $209,155

- Median income: $58,620

- Population: 250,681

Some college towns are expensive, but not Tuscaloosa. Home of the University of Alabama, the town features a higher median income than most, thanks to employment opportunities with the college as well as with Mercedes-Benz, which opened a major facility here in the mid-1990s.

#9 Florence, South Carolina. Property taxes: $60 per month

- Typical home price: $207,642

- Median income: $50,219

- Population: 205,502

The only South Carolina city to make the list, Florence offers extreme value when it comes to home affordability. And this is no declining market. Home prices are up 3% in the past year, says the Federal Housing Finance Agency.

#10 Monroe, Louisiana. Property taxes: $61 per month

- Typical home price: $134,164

- Median income: $44,507

- Population: 203,457

Not only is Monroe affordable, it also offers plenty of things to do. After all, you won’t have to put in the overtime to afford a home here. Kayak on the Ouachita River, one of America’s 10 most beautiful according to National Geographic. Explore the Black Bayou National Wildlife Refuge, 4,500 acres of habitat, trails, and wetlands. You might not find a better combination of recreation and affordability in the U.S.

Verify your home buying budget. Start hereWant affordability? Look beyond the price tag

While property taxes are never fun, the bite is taken out of them in these and many other locations. At the very least, home shoppers should consider this expense as they look for a home. High property taxes just might be enough to get a homebuyer thinking about alternatives.

Methodology

Property taxes are as reported by the Census Bureau 2022 American Community Survey: Annual median real estate taxes paid for homes with and without a mortgage divided by 12.

Time to make a move? Let us find the right mortgage for you