Takeaways

- To qualify for a home on $70,000 per year, we estimate that the full payment including principal, interest, taxes, insurance, and HOA dues should be $2,100 or less

- Of the 327 cities analyzed, 61 offered an affordable total monthly home cost assuming a $70,000 annual income

- Detroit, Michigan is the most affordable city on our list with a $710-per-month payment. An annual income of just $23,671 is needed to buy a home there

- The highest home price to make the affordable list was $247,648 in Winston-Salem, North Carolina

- Oklahoma City has an estimated homeowner’s insurance bill on the affordable list: $410 per month

- Sunnyvale, California is the least affordable city we studied. A $514,763 annual salary is needed to afford the typical home

In this article (Skip to...)

- Top 10 places to buy on $70K per year

- 3 most unrealistic cities to buy on $70K per year

- Other notable cities

- 9 cities where you can buy a home under $40K per year

- Methodology used for accessing affordability

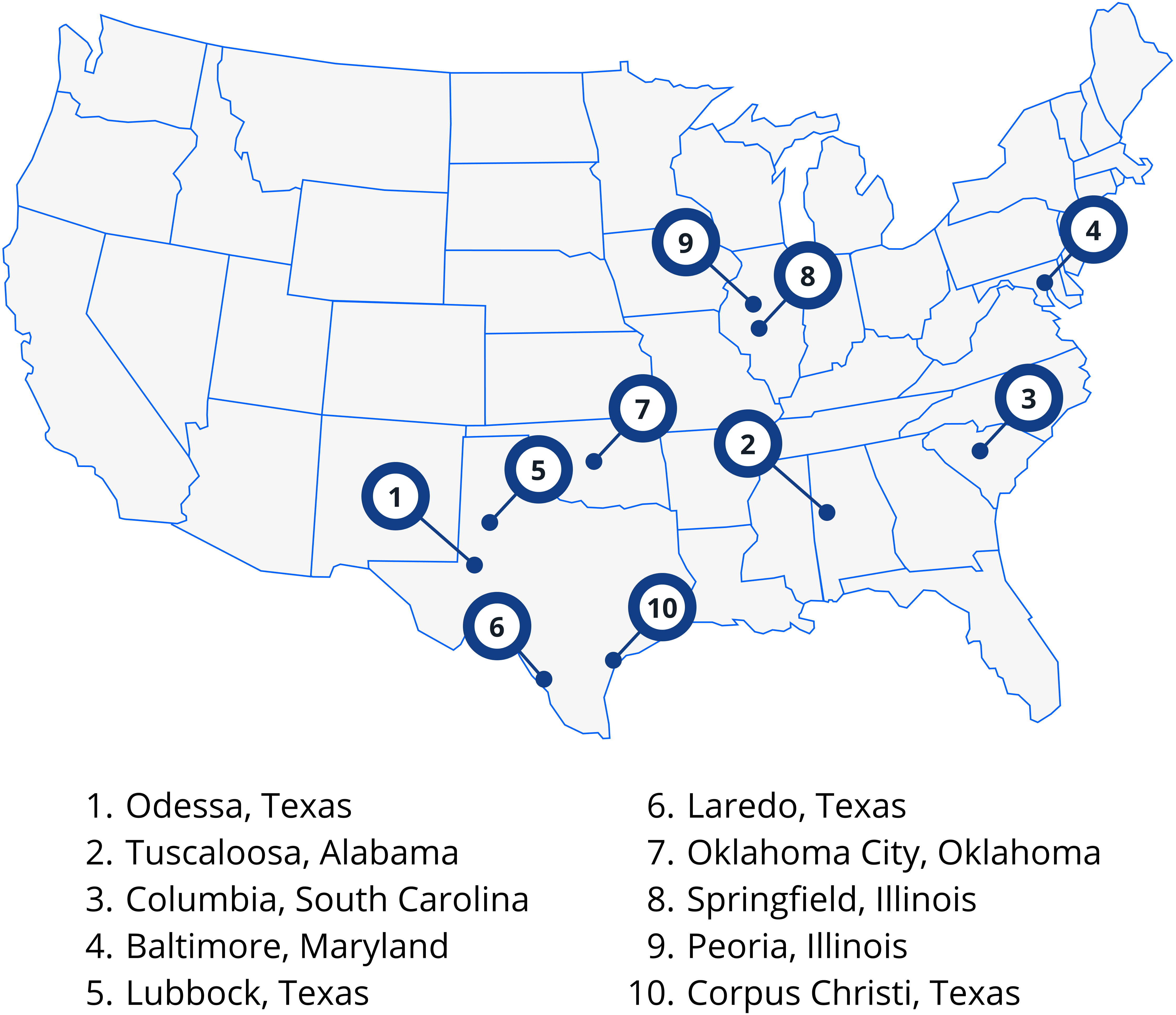

Top 10 cities to buy a home with a $70,000 annual income

- Odessa, Texas

- Tuscaloosa, Alabama

- Columbia, South Carolina

- Baltimore, Maryland

- Lubbock, Texas

- Laredo, Texas

- Oklahoma City, Oklahoma

- Springfield, Illinois

- Peoria, Illinois

- Corpus Christi, Texas

Top 10 places to buy on $70,000 per year

Sixty-one U.S. cities with populations over 100,000 offered affordable homes for someone making $70,000 per year. We chose our top 10 based on each city’s median household income among homeowners.

A city with a higher median income is likely to have a solid tax base, resulting in better schools, reliable services, and appreciating property values. Sure, there are cheaper places to live than our top 10, but quality of life and future opportunity are more important than rock-bottom housing costs.

Our top 10 are as follows.

#1 Odessa, Texas

| Typical home price | $213,630 |

| Total housing payment | $2,028 |

| Annual income needed to buy a home | $67,631 |

| Median income | $83,806 |

| Percentage of $70k income needed for housing | 34.8% |

This West Texas city is home to 115,000 people and has an unemployment rate of just 3.8%, says the Bureau of Labor Statistics (BLS). Common occupations in the city are in the oil, healthcare, retail, and education industries. Fans of the film Friday Night Lights will enjoy a visit to Ratliff Stadium, the backdrop for much of the 2004 movie.

#2 Tuscaloosa, Alabama

| Typical home price | $209,155 |

| Total home payment | $1,701 |

| Annual income needed to buy a home | $56,709 |

| Median income | $79,958 |

| Percentage of $70k income needed for housing | 29.2% |

Coincidentally, another football town, Tuscaloosa is home to the University of Alabama and its Crimson Tide football team, regarded as one of the best college teams in the country. The university as a whole is the town’s dominant force, although Mercedez-Benz has been a major economic engine in the area since the mid-1990s. With the economic infusion of the auto industry, it’s no wonder that manufacturing makes up a large portion of the area economy, boasting an unemployment rate of just 2.4% according to the BLS.

#3 Columbia, South Carolina

| Typical home price | $226,450 |

| Total home payment | $1,872 |

| Annual income needed to buy a home | $62,425 |

| Median income | $78,423 |

| Percentage of $70k income needed for housing | 32.1% |

The city of around 130,000 is the second-largest in South Carolina. The economy is supported by the many military bases in the area as well as the University of South Carolina. Fourteen Fortune 500 companies call the area home. “Soda City,” a nickname acquired from an antiquated city abbreviation “Cola,” is celebrated to this day with an outdoor market sporting the name and plenty of tongue-in-cheek references such as the city’s website Cola Today.

Verify your home buying eligibility. Start here#4 Baltimore, Maryland

| Typical home price | $178,037 |

| Total home payment | $1,608 |

| Annual income needed to buy a home | $53,631 |

| Median income | $77,421 |

| Percentage of $70k income needed for housing | 27.6% |

Just 40 miles away from the nation’s capital lies Baltimore, a city of more than half a million. Home prices are affordable considering its proximity to Washington D.C., one of the most expensive locales in the country. Museum and sea life buffs will enjoy the National Aquarium, which gets 1.5 million visitors per year and is Maryland’s largest tourist attraction.

Verify your home buying eligibility. Start here#5 Lubbock, Texas

| Typical home price | $207,910 |

| Total home payment | $2,076 |

| Annual income needed to buy a home | $69,211 |

| Median income | $77,137 |

| Percentage of $70k income needed for housing | 35.6% |

High median incomes in the Lubbock area are supported by agriculture, education, health care, and government. With a median income above the $70,000 mark and an unemployment rate of 3.9%, Lubbock could be high on a homebuyer’s list. Lubbock native Buddy Holly is celebrated to this day at the Buddy Holly Center, which features artifacts from the 1950s rocker.

#6 Laredo, Texas

| Typical home price | $215,609 |

| Total home payment | $2,063 |

| Annual income needed to buy a home | $68,799 |

| Median income | $76,953 |

| Percentage of $70k income needed for housing | 35.4% |

Border town Laredo supports nearly 50% of U.S. trade to Mexico. Not surprisingly, import and export operations largely prop up the local economy. Dining and shopping are abundant in the city and offer a unique blend of American and Mexican culture. Outdoor enthusiasts will enjoy Lake Casa Blanca for its fishing, camping, hiking, water-skiing, and other activities.

Verify your home buying eligibility. Start here#7 Oklahoma City, Oklahoma

| Typical home price | $200,070 |

| Total home payment | $1,997 |

| Annual income needed to buy a home | $66,568 |

| Median income | $76,577 |

| Percentage of $70k income needed for housing | 34.2% |

With a population of nearly 1.4 million in the metropolitan area, Oklahoma City is one of the larger cities on our list. Healthcare, retail, energy, and government propel the local economy, with an unemployment rate of just 3.2%. Recreation abounds, with the Oklahoma City Zoo and plenty of museums. For those more into nightlife, the Bricktown River Walk Park features bars, restaurants, and shopping.

#8 Springfield, Illinois

| Typical home price | $148,376 |

| Total home payment | $1,466 |

| Annual income needed to buy a home | $48,890 |

| Median income | $76,496 |

| Percentage of $70k income needed for housing | 25.1% |

The Illinois state capital is also the former home of Abraham Lincoln. The Lincoln Home is a National Parks Service location and attracts thousands of visitors per year. There’s plenty more to Springfield, though, including employment opportunities in healthcare, government, and other industries.

#9 Peoria, Illinois

| Typical home price | $115,042 |

| Total home payment | $1,216 |

| Annual income needed to buy a home | $40,548 |

| Median income | $75,933 |

| Percentage of $70k income needed for housing | 20.9% |

Peoria offers the lowest typical home price on our top 10 list, though the median income is among the highest, a fantastic combination for first-time buyers. The area economy is supported by Caterpillar and OSF HealthCare, among others. Being just two and a half hours from Chicago, Peoria offers close proximity to a big city while offering the affordability and slower pace of a smaller metro.

#10 Corpus Christi, Texas

| Typical home price | $219,214 |

| Total home payment | $2,062 |

| Annual income needed to buy a home | $68,754 |

| Median income | $75,827 |

| Percentage of $70k income needed for housing | 35.4% |

Whether you like birding, fishing, NASCAR, or music, Corpus Christi won’t disappoint. The city offers diverse activities for just about any taste. Beyond recreation, the region offers employment in the oil industry, tourism, and government.

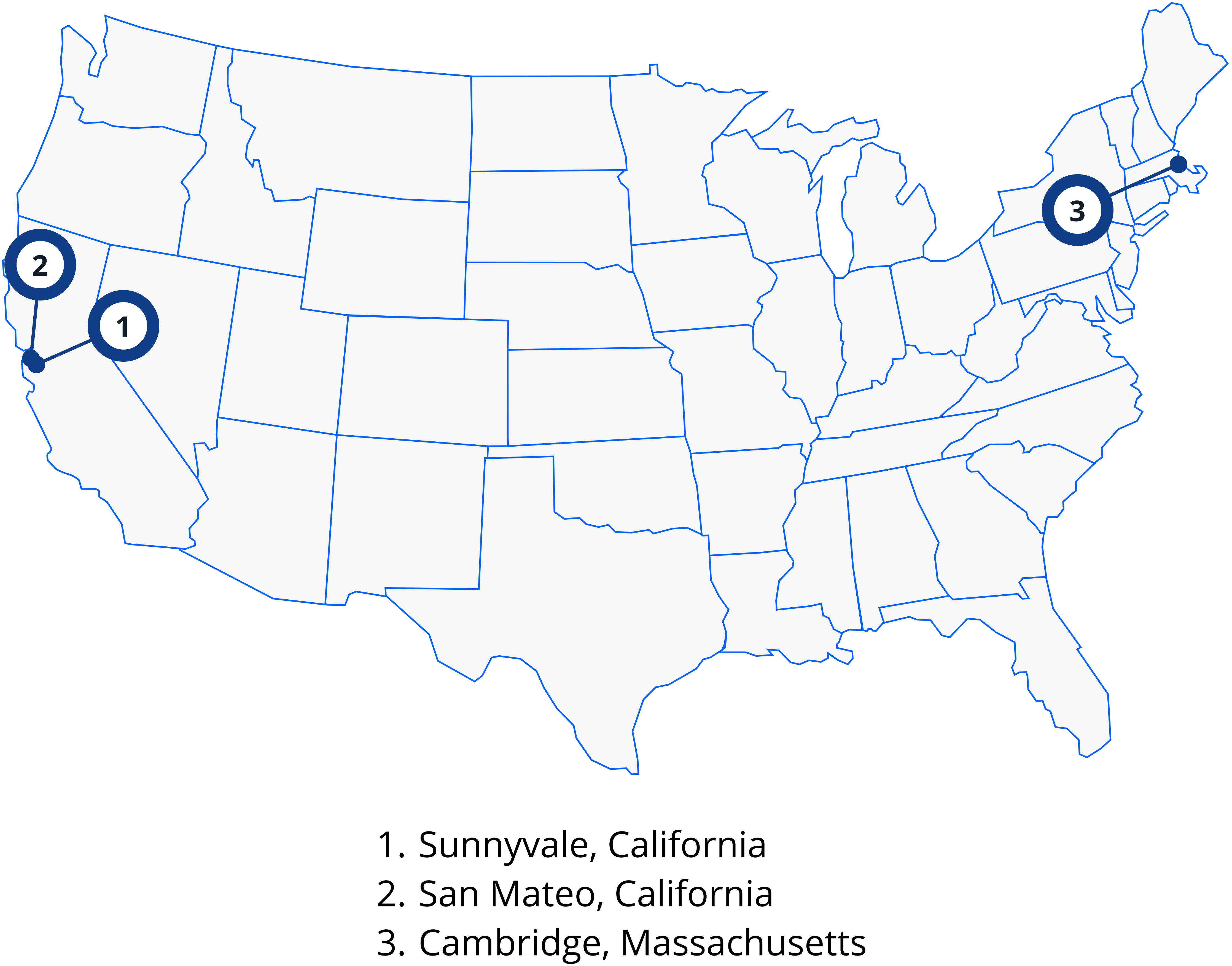

3 most unrealistic cities to buy on $70,000

We’ll refrain from saying these are the worst cities to buy a home on $70,000 per year because they are likely wonderful cities.

It’s just that homeownership is painfully out-of-reach at this salary level.

Verify your home buying eligibility. Start here

#3 Cambridge, Massachusetts

| Typical home price | $1,663,019 |

| Total home payment | $12,505 |

| Annual income needed to buy a home | $416,863 |

| Median income | $171,307 |

| Percentage of $70k income needed for housing | 214% |

#2 San Mateo, California

| Typical home price | $1,693,079 |

| Total home payment | $13,046 |

| Annual income needed to buy a home | $434,878 |

| Median income | $165,352 |

| Percentage of $70k income needed for housing | 223% |

#1 Sunnyvale, California

| Typical home price | $2,022,634 |

| Total home payment | $15,442 |

| Annual income needed to buy a home | $514,763 |

| Median income | $188,569 |

| Percentage of $70k income needed for housing | 264% |

Other notable cities

5 cities with the lowest total monthly house payment

- Detroit, Michigan: $710

- Jackson, Mississippi: $784

- Birmingham, Alabama: $893

- Cleveland, Ohio: $948

- Dayton, Ohio: $1,083

5 cities with the highest total monthly house payment

- Sunnyvale, California: $15,442

- San Mateo, California: $13,046

- Cambridge, Massachusetts: $12,505

- Santa Clara, California: $12,172

- Carlsbad, California: $12,032

5 cities with the lowest monthly homeowner’s insurance rates

- Honolulu, Hawaii: $40

- Hillsboro, Oregon: $67

- Eugene, Oregon: $69

- Portland, Oregon: $69

- Gresham, Oregon: $71

5 cities with the highest monthly homeowner’s insurance rates

- Hialeah, Florida: $491

- Miami Gardens, Florida: $476

- Oklahoma City, Oklahoma: $410

- Norman, Oklahoma: $397

- Miami, Florida: $394

5 cities with the lowest property tax rate

- Honolulu, Hawaii: 0.27%

- Montgomery, Alabama: 0.35%

- Birmingham, Alabama: 0.37%

- Cheyenne, Wyoming: 0.54%

- Denver, Colorado: 0.55%

5 cities with the highest property tax rate

- Elizabeth, New Jersey: 3.18%

- Paterson, New Jersey: 3.18%

- Waterbury, Connecticut: 3.16%

- Rockford, Illinois: 2.67%

- Peoria, Illinois: 2.59%

9 cities where you can buy a home at under $40,000 per year

| City | Annual income needed to buy |

| Detroit, Michigan | $23,671.35 |

| Jackson, Mississippi | $26,148.08 |

| Birmingham, Alabama | $29,781.20 |

| Cleveland, Ohio | $31,632.36 |

| Dayton, Ohio | $36,130.2 |

| Akron, Ohio | $36,421.76 |

| Toledo, Ohio | $36,490.71 |

| Montgomery, Alabama | $38,578.66 |

| Shreveport, Louisiana | $39,519.41 |

State with the most affordable cities: Texas

- Beaumont

- Brownsville

- Wichita Falls

- Abilene

- Amarillo

- Edinburg

- Odessa

- El Paso

- Corpus Christi

- Laredo

- Lubbock

Not in one of these cities? Don’t give up

Just because you don’t live in one of the affordable cities mentioned doesn’t mean you can’t buy with a $70,000 annual salary. While this study assumed conventional financing, there are other more lenient programs such as USDA loans, VA loans, and the ever-popular FHA.

There are also fantastic deals in every city in the U.S. if you look hard enough. You might find a home well below your area’s average price due to a motivated seller or a property issue you can easily correct with a renovation loan.

You might also get a leg-up using a co-signer, a down payment assistance program, gift funds from family, or other home-buying strategy.

If you make $70,000 per year, you are near the U.S. average. People at your income buy homes all the time in nearly every city. You can be one of them.

Methodology

How we determined affordability

In what cities can you afford a home if you make $70,000 per year? It’s about much more than home prices.

We looked at every aspect of a monthly house payment:

- Typical home price

- Down payment

- Interest rates

- Mortgage insurance

- Property taxes

- Homeowner’s insurance

According to current mortgage guidelines and some assumptions, a home is affordable with a $70,000-per-year income if the all-inclusive payment is $2,100 or less.

This amount is 36% of $5,833, the gross monthly income of someone making $70,000 per year. While conventional loans allow a 45% debt-to-income ratio in some cases, we left room for the average Millennial monthly debt payment, according to Credit Karma of $443 per month.

Whether $2,100 per month is affordable is a personal decision, but for our study, this was the line in the sand.

Total housing payment: Much more than principal and interest

When you go to buy a home, you mainly look at two factors:

- Home price

- Interest rate

These two numbers make up the bulk of your payment.

But other factors influence your total monthly housing payment more than most first-time buyers realize.

For example, the typical home in Columbus, Ohio will cost around $243,000, a very reasonable price. But with property taxes of 1.62% per year, you need an income near $76,000 to afford a home there.

Likewise, a Norman, Oklahoma home might set you back just $249,000. But with home insurance costing nearly $400 per month, you need an $80,000-per-year income to buy.

We assumed the same interest rate, down payment, and mortgage insurance for all cities since these are not largely dependent on geography.

Methodology continued

To determine cities where you can buy a home with a $70,000 annual salary, we reverse-engineered a maximum home price based on that income.

- $70,000 per year

- $5,833 per month

- $2,100 maximum total housing payment, including principal, interest, property taxes, and homeowners insurance (PITI). We arrived at this number based on a somewhat conservative 36% front-end (housing) debt-to-income (DTI) ratio. This leaves room for $525 per month in other debt payments; the average Millennial debt payment is $443 per Credit Karma. This puts Fannie Mae’s maximum 45% total DTI in reach.

In summary, an “affordable” city means that its typical home can be purchased with a PITI payment of $2,100 or less.

To determine a city’s estimated PITI payment, we looked at four key factors.

- Principal and interest

- Mortgage insurance

- Property taxes

- Homeowner’s insurance.

To determine principal and interest, we started with typical home values from the Zillow Home Value Index (ZHVI) Single-Family Homes Time Series. We assumed a 30-year fixed, 5% down conventional loan. We used a 7.296% interest rate, the average from loan software company Optimal Blue at the time of writing. We assumed a 707 credit score, the average among first-time buyers using Fannie Mae and FHA loans. Mortgage insurance rates are from MGIC based on these criteria as well.

We used city property tax rates from Roofstock. We gathered homeowner’s insurance city averages as well as median household income among homeowners from Policygenius. We assumed no HOA dues. To leverage the best data possible, we analyzed cities with populations of 100,000 or more.

We then calculated the typical payment for the city based on these factors.

Example:

McAllen, TX

Typical single-family home price - $217,850

X 95% (5% down) = $206,957

30-year-fixed mortgage at 7.296% = $1,418/mo

Mortgage insurance: Loan amount X 0.78% / 12 = $134/mo

Property taxes: Home price X 1.87% per year / 12 = $339/mo

Homeowner’s insurance: Avg for McAllen, TX: $2,880 / 12 = $240/mo

Total PITI: $2,131/mo

If a city’s total PITI payment came in at or below $2,100 per month, we deemed it affordable for someone making $70,000 per year. A payment above this level we called unaffordable at this salary, though a buyer may still qualify using an FHA loan or employing other strategies like finding down payment assistance or gift fund sources.

While each homebuyer’s credit, debt, and payment comfort levels will vary, the above methodology was used as a general guideline to determine $70,000-per-year affordable cities.