What is a closing statement?

Real estate transactions are a major investment, and a closing statement (or Closing Disclosure) plays an essential part in them.

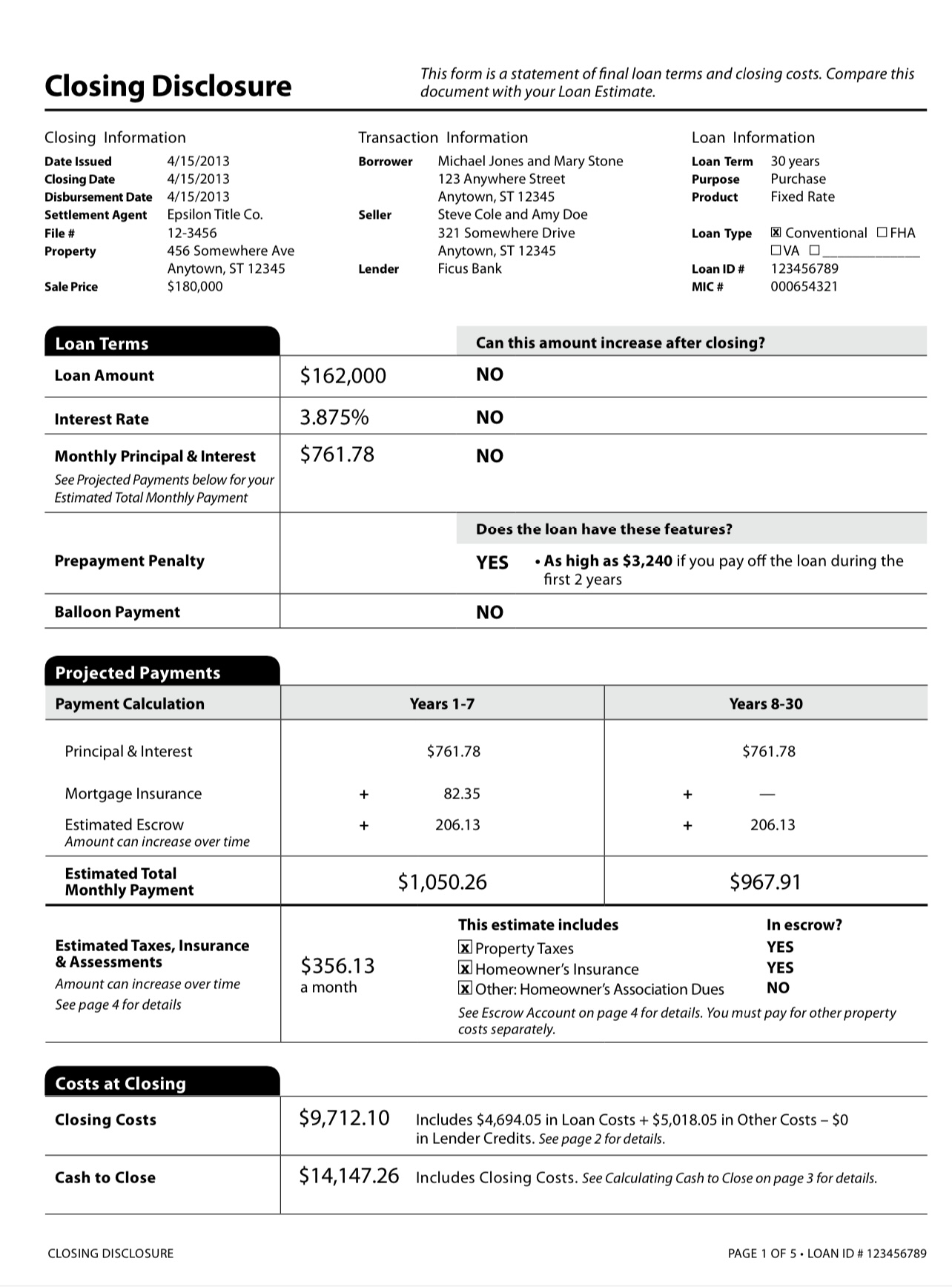

These five-page legal documents outline the final costs and fees associated with a home purchase, providing clarity and transparency around the expenses.

You’ll receive the closing statement from your mortgage lender at least three business days prior to closing and it’s one of the ultimate steps to homeownership.

Find your lowest mortgage rate. Start hereIn this article:

- What is the purpose of a closing statement?

- What does the closing statement contain?

- Closing statement examples

- Importance of reviewing your closing statement

- What can you expect from the closing process?

What is the purpose of a closing statement?

The closing statement isn’t just some boring piece of paper.

Mortgage loans involve costs whether you’re purchasing or refinancing, and you need to understand what you’re agreeing to before signing on the dotted line.

Verify your home buying eligibility. Start hereThat’s where closing statements come in. They provide a comprehensive final breakdown of mortgage-related terms and expenses, including your monthly payment, interest rate, cash needed to close, etc.

The information on the statement benefits both parties, but it’s especially beneficial to home buyers. Knowing all of your financial responsibilities before closing helps eliminate last-minute surprises on closing day.

Simply put, the closing statement ensures that you and your lender are on the same page when it comes to the financial details of the purchase.

They also serve as a legal record of the home sale. In the unlikely case of a dispute arising, your closing statement can verify the agreed-upon terms.

Keep in mind, this statement is the last opportunity to review details about your mortgage loan before closing. So it’s important to read it carefully and ask questions, if necessary.

What does the closing statement contain?

Knowing what to expect in each phase of the home buying process is helpful and important. That way, you’re prepared for what you need and what to expect.

Check your home buying options. Start hereThat holds true for closing statements and what you’ll find in them. The typical information found in a closing statement includes:

- Property details: This section has information about the property you’re buying, such as the physical address and legal description.

- Loan details: This section of the closing statement includes key details about your loan, such as the type of loan, loan amount, interest rate, and monthly principal and interest payments. The statement also provides details about prepayment penalties and balloon payments, if applicable.

- Loan costs: The costs associated with getting the mortgage. These can include the loan origination fee, mortgage points, application fee, credit report fees, pest inspections, title search fees, appraisal fees, and attorney fees.

- Prepaids, prorated expenses, and government fees: This section includes information on property taxes owed, prepaid expenses (homeowners insurance, interest, etc.), and other prorated expenses like utility bills or homeowners association dues.

- Real estate commissions: This is the amount paid to real estate agents involved in the purchase.

- Escrow account details: This section includes information about funds held in an escrow account, such as earnest money and down payment funds.

- Credits and adjustments: This section outlines details related to credits or adjustments made to the purchase price, such as seller concessions.

Closing statement examples

Closing statement details can vary depending on the transaction, but here’s an example of what the first page of a typical closing statement looks like.

Find your lowest mortgage rate. Start hereTo review all five pages of a closing statement, visit the Consumer Financial Protection Bureau’s website.

Importance of reviewing your closing statement

Don’t wait until the last minute to review your closing statement. Read through it as early as possible after receiving it. This allows enough time to go through the document page-by-page to verify the loan details and ask questions, if necessary.

It’s good to note that these statements can be complicated, particularly if you aren’t familiar with them. You should always feel comfortable reaching out to your loan advisor or mortgage broker to go over the forms with you, according to Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

Check your home buying options. Start hereYou should also compare the Closing Disclosure with the Loan Estimate you received after applying for the mortgage. The latter provides an estimation of loan terms whereas the former reflects your actual terms. A final comparison of both can reveal significant changes in your interest rate, monthly payment, and closing costs (if any). This, too, helps avoid surprises at closing.

“It is normal here to see some changes but it’s important to take note of anything drastically different, especially when it costs you more,” said says Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

Additionally, make sure you understand all fees listed on the document, and review your closing statement for accuracy. Errors might include misspellings of your name, incorrect property address, calculation mistakes, or missing details for prepaids and prorated expenses.

If you have any concerns, don’t wait until closing day to speak up. Talk with your mortgage lender as soon as possible to avoid closing delays.

Keep in mind that nothing is set in stone until you sign the papers with the title. Signing the Closing Disclosure means that you agree to the terms and conditions listed on the document and they become finalized.

Questions to keep in mind as you review the statement include:

- Is my personal information and property details accurate?

- Is the monthly payment, interest rate, mortgage term, and cash needed to close what I expected?

- Do I understand all fees associated with the loan?

- Does the loan have a pre-payment penalty or balloon payment?

What can you expect from the closing process?

Closing is the final step in buying a home and it’ll take place at your settlement agent’s office. On average, it takes about 30 to 45 days to close on a home, although the actual closing process only takes about one to two hours.

Verify your home buying eligibility. Start hereAfter signing your closing statement, you’ll schedule a final walk-through of the property. This provides a final opportunity to inspect the home and make sure the seller completed agreed-upon repairs.

On closing day — which must be at least three days after signing your disclosure — you’ll arrive at your settlement agent’s office with your cash needed to close in hand, or you can electronically wire funds in advance.

The settlement agent will review a stack of mortgage documents, which you’ll sign and receive a copy. The title transfers from the seller to you after you’ve signed the mortgage paperwork and transferred funds for your down payment and closing costs. The final step is receiving the keys to your new home.

Conclusion

The closing statement is an important part of buying a home. Unlike the Loan Estimate that provides an estimation of your loan terms, your closing statement outlines final details about your mortgage, such as your interest rate and monthly payment.

It’s important to review this document carefully and understand all the costs associated with your home purchase.

Time to make a move? Let us find the right mortgage for you