Coronavirus couldn’t stop the housing market

Homeownership is at its highest level in 12 years.

At least, that’s what a new report from the Census Bureau says.

Some experts doubt the data. Since the pandemic affected the survey, homeownership numbers might not be as high as they look.

But one thing seems clear: Home buying hasn’t gone away during coronavirus.

In fact, Americans are buying homes about as fast as they can be listed — even as the economy has stalled.

How is that possible? And what happens next? We asked the experts.

Verify your home buying eligibilityIn this article (Skip to...)

- New report shows U.S. homeownership skyrocketing

- Can record homeownership numbers be trusted?

- Why home buying has been popular during COVID

- Affordability for first-time home buyers

- Will the upward trend continue?

- Advice for home buyers right now

New report shows U.S. homeownership skyrocketing

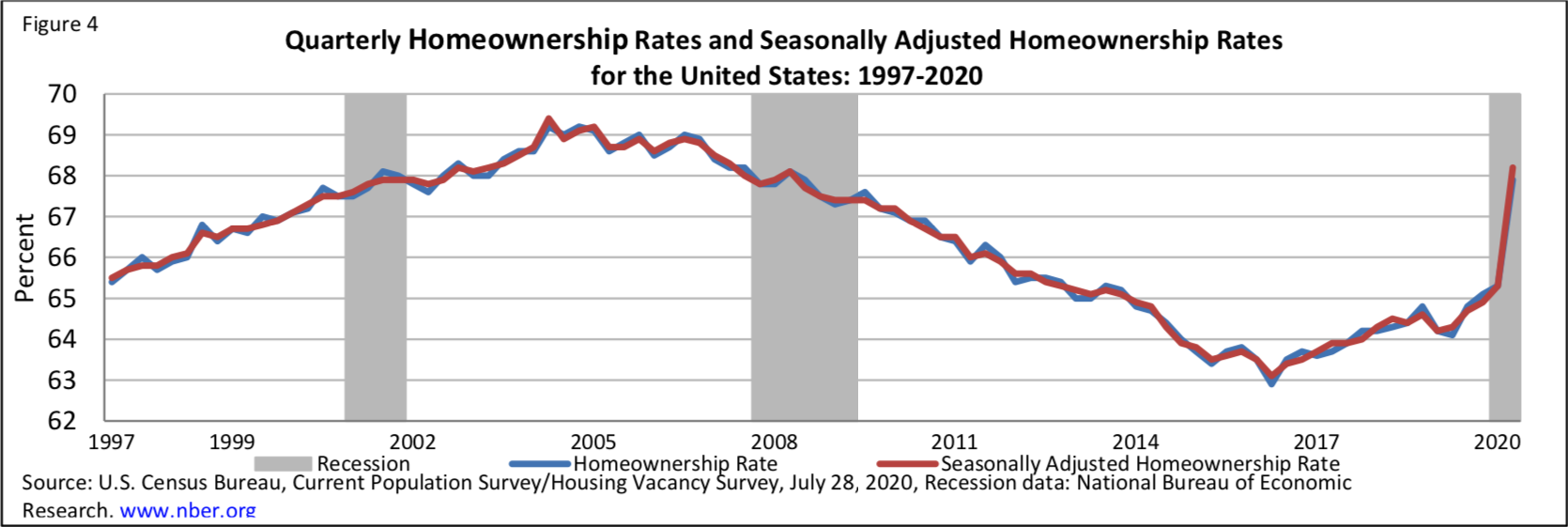

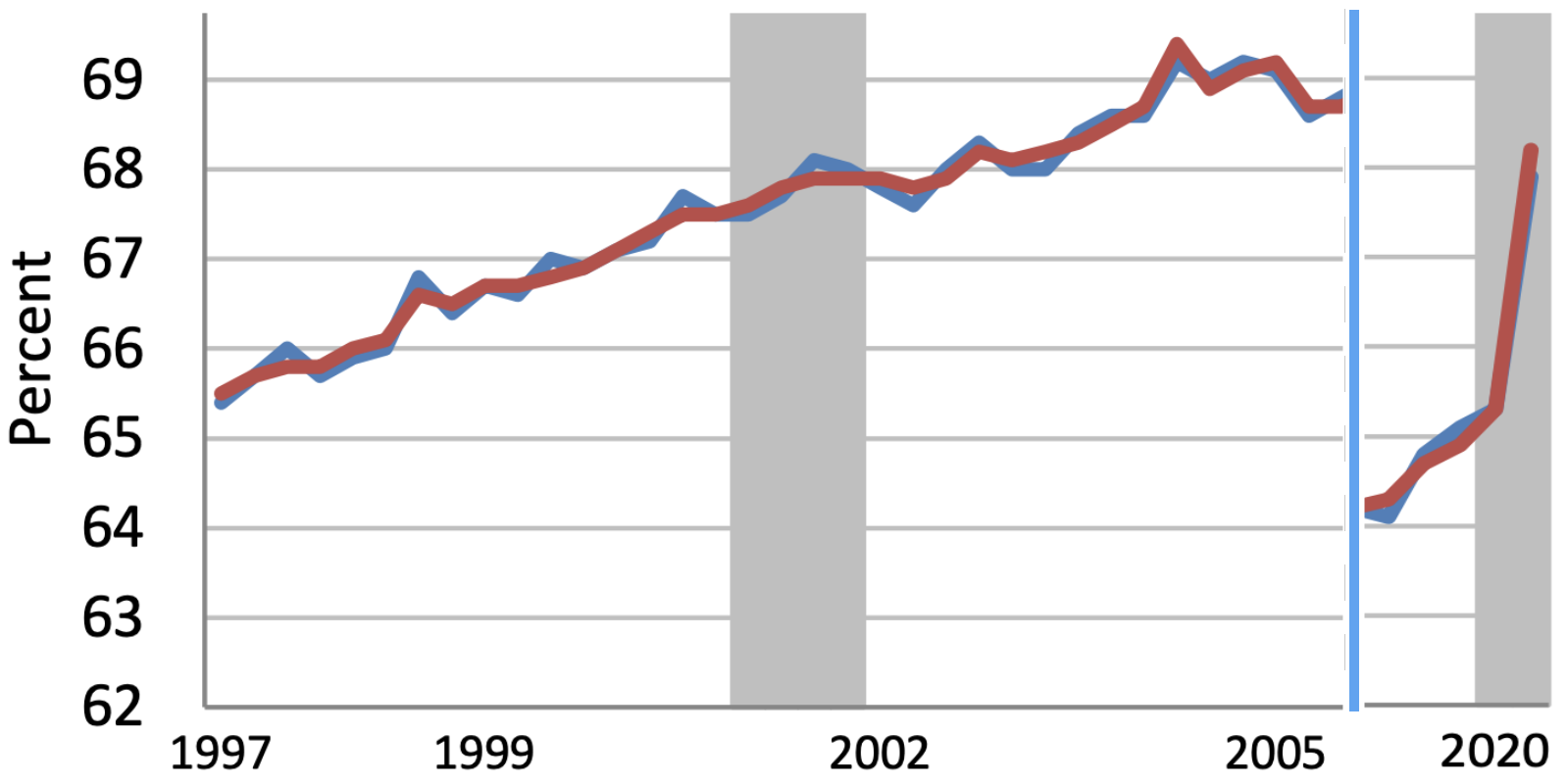

The latest data from the U.S. Census Bureau showed an almost unbelievable spike in homeownership during the coronavirus pandemic.

According to the report, the homeownership rate increased substantially in the second quarter of 2020, hitting almost 68 percent. That’s the highest level observed since the third quarter of 2008 — 12 years ago.

Amazingly, in the first half of 2020, it took just a few months for the homeownership rate to rise by about 3 percentage points.

To put that in perspective, it took around eight years for the rate to increase 4 percentage points to its highest level in 2005.

Closeup: Rise in homeownership from 1997-2005 (4%) and in 2020 (3%)

Image: U.S. Census Bureau

It’s worth noting a few other stats from the Census Bureau’s report, too:

- The Q2 2020 report showed an increase in homeownership for all age groups (from 35 and under to 65 and up)

- Homeownership among African Americans, Hispanics, Asians, Native Americans, Hawaiians, and Pacific Islanders increased as well

All in all, the data painted a very rosy picture of homeownership in the U.S. — despite the toll coronavirus has taken on the economy at large.

But some experts are saying the numbers look too good to be true. Here’s why.

Can record homeownership numbers be trusted?

Many experts are skeptical about the Census Bureau data, as coronavirus affected the way the survey was conducted.

Criticism of the Census Bureau’s 2020 homeownership data

Nadia Evangelou is a senior economist and director of forecasting for the National Association of Realtors. She says this was one of the most anticipated reports in the housing industry, since it reflects the impact of COVID-19 on housing demand.

“However, there are some serious questions about the accuracy of this survey. It is likely the results in the second quarter are distorted by the pandemic,” she cautions.

“Specifically, in-person interviews were suspended for the second quarter and replaced with telephone interview attempts when contact information was available.”

“The current report might show an increased homeownership trend. But we should exercise caution when using the absolute numbers of homeownership rates.” —Nadia Evangelou, Senior Economist, NAR

Consequently, the response rate was lower in this report than the average response rates for the second quarter of 2019.

“The current report might show an increased homeownership trend. But we should exercise caution when using the absolute numbers of homeownership rates,” says Evangelou.

Tony Julianelle, CEO of Atlas Real Estate, agrees.

“This is fascinating data. But it seems too much of a move in the underlying numbers that I’m not sure correlates to actual sales data across the country,” explains Julianelle.

Support for record homeownership numbers in 2020

Suzanne Hollander, a real estate professor at Florida International University, thinks these numbers could be legit.

“The Realtors I regularly deal with as a broker, professor, and attorney tell me that single-family homes are flying off the charts,” says Hollander.

Dan Putney, managing director of mortgage solutions at Finastra, echoes those thoughts.

“We understand there has been a move from cities to rural America allowing a safer coronavirus environment for families,” says Putney.

“And while spring is typically the busiest buying time, that was postponed. That led to the biggest June ever in terms of purchase volumes.”

Based on loan application data coming through Finastra’s loan origination portal, “we’ve seen a 34 percent spike in applications for June, year-over-year,” he adds.

Fewer foreclosures may lead to higher homeownership numbers

Hollander also notes that homeownership numbers may be a bit skewed due to an overlooked factor.

“Foreclosure moratoriums have been in effect for several months. This impacts the number of current homeowners,” she says.

When foreclosure bans end, there’s a chance homeownership numbers could tip back downward, or at least level out instead of continuing to rise.

Why home buying has been popular during coronavirus

The U.S. may or may not have seen a record spike in homeownership this year.

But regardless of the final numbers, one thing is clear: Home buying has been hot during coronavirus.

Evangelou says there are two main reasons why the homeownership rate has bumped up lately.

“The first and foremost reason is record-low mortgage rates," she says.

“Homeowners have the opportunity to lock in at the lowest mortgage rates in history right now. According to Freddie Mac, the rate was 2.88% on a 30-year fixed-rate mortgage recently.”

Secondly, consider that Americans are increasingly working remotely due to the pandemic.

“As a result, there is a significant shift to their home feature preferences. More buyers want bigger residences with a home office and space for their children to engage in remote learning,” Evangelou adds.

“Specifically, they are looking to own a property with a yard or more acreage — a place where they can get fresh air without having to worry about social distancing.”

Verify your home buying eligibility

Affordability for first-time home buyers

Matthew Dailly, managing director of Tiger Financial Ltd., points to other factors for the reported spike in homeownership.

“People are spending less money on entertainment, eating out and other discretionary purchases,” he says.

“For those who are already saving money for homes, this behavior may have gotten them to their goal a lot quicker than expected, leaving the market with an abundance of potential buyers.”

“We’re seeing more millennials benefiting from lower mortgage rates and buying their first homes to raise their families.” —Nadia Evangelou, Senior Economist, NAR

Gen Y may be a big reason for the spike, too.

“Homeownership gains continue to be concentrated among millennial households. They represent the largest cohort of home buyers,” Evangelou says.

“We’re seeing more millennials benefiting from lower mortgage rates and buying their first homes to raise their families.”

Will the upward trend continue?

Many predict that homeownership will continue its upward trend in the near-term. That’s especially true if mortgage rates stay low, as expected, and lack of inventory doesn’t kill the trend.

“I expect the [homeownership] rate to continue to increase since mortgage rates will continue to hover around all-time lows. Specifically, the 30-year mortgage rate is expected to average 3.1 percent for 2020 and 2021,” says Evangelou.

Julianelle also foresees more people buying and owning homes in the months ahead.

Homeownership could continue to rise as rates stay low. Or, a coming recession could stem the tide of home buyers.

“Post-COVID-19 there will be continued demand for homeownership as families work through the lingering impacts of work- and school-from-home scenarios,” says Julianelle.

Others are not as optimistic that the desire to purchase and own will continue at this pace.

“I wouldn’t expect to see continued growth as we head toward a potential recession in a rumored second wave of the pandemic,” says Dailly.

“I believe people will start to save more money as protection for whatever the next six months might hold in store for them. And we’re likely to see a flip from big picture thinking to immediate effect considerations.”

Advice for home buyers right now

Buying a home during coronavirus is bound to be a unique experience for everyone.

On the surface, record-low mortgage rates make it easier than ever to buy a house with an affordable mortgage payment.

But qualifying for low rates — or for financing at all — has become more difficult as COVID has created higher volatility and more risk in the economy.

So, is it a good time for you to buy a house? That depends heavily on your income, credit, job stability, and the local real estate market where you’re looking. The answer is going to be different for everyone.

Time to make a move? Let us find the right mortgage for you