Mortgage rates under 2.5% are real — for some

United Wholesale Mortgage (UWM) made headlines recently for offering 2.5% mortgage and refinance rates. Now, it’s lowered the bar even further with a 2.25% VA loan rate.

And other lenders are following suit. At the time of writing this, at least one lender in our network was offering 30-year refinance rates as low as 2.49% (2.644% APR).*

But how realistic are those rates? Is 2.5% the exception, or is it a real rate available to regular borrowers?

As always, it depends on what you qualify for.

Find and lock a low rate*Rate estimate assumes a 720 credit score and 73% LTV ratio

Whether or not you qualify for 2.25%, rates are ridiculously low

The truth is, the lowest advertised rates almost always go to top-tier borrowers; those with excellent credit scores and 20% down payments.

So a 2.25% mortgage rate will be out of reach for many. But the good news is, rates are still incredibly low across the board.

No matter how strong your application, lenders are offering better rates now than they were a year, six months, or even one month ago.

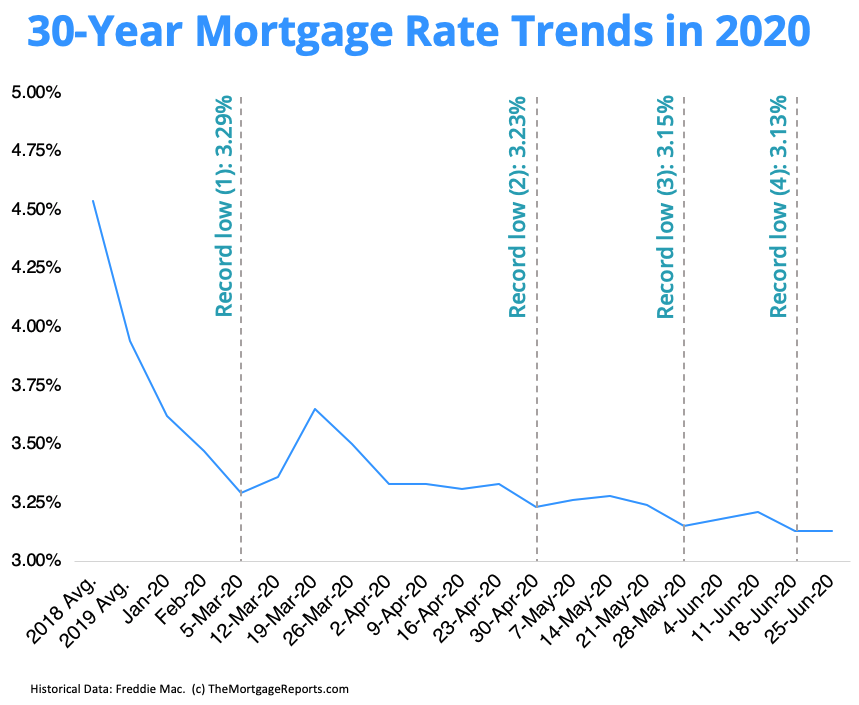

Just how low is low? Freddie Mac has been reporting average weekly mortgage rates since the 1970s. Consider where we’ve been.

The rates we’re seeing today are part of a long trend. A very long trend.

Since the early 1980s mortgage rates have generally trended down. 30-year rates have marched from 16.63% in 1981, to just 3.13% in June 2020.

| Time Period | Average 30-Year Rate | Time Period | Average 30-Year Rate |

| 1981 | 16.63% | Jan. 2020 | 3.62% |

| 1990 | 10.13% | Feb. 2020 | 3.47% |

| 2000 | 8.05% | Mar. 2020 | 3.45% |

| 2008 | 6.03% | Apr. 2020 | 3.31% |

| 2012 | 3.66% | May 2020 | 3.23% |

| 2019 | 3.94% | June 25, 2020 | 3.13% |

Data: Freddie Mac

Many wouldn’t have thought it possible 20 years ago — or even one year ago — but rates in the low-3% range are now being widely quoted. And rates in the 2s are a reality for some.

Verify your new rateAdvertised mortgage rates vs. the rate you get

You’ve probably heard the ads for $1 million term-life insurance for $26 a month. These policies do exist — but not if you’re a smoker or 65 years old.

In a similar sense, there are a lot of alluring mortgage offers out there. Rates that are so low they look like typos. But is such financing really available?

The answer is yes for some borrowers but no for others. To see who qualifies and who doesn’t, you have to look at the entire offer.

The truth about 2.25% VA loan rates

Consider the advertised 2.25% VA mortgage rate from UWM as an example. (Though this line of reasoning applies to non-VA loans, too.)

All real estate financing comes with conditions and requirements of some type.

In the case of the 2.25% VA mortgage offer, UWM provides an example that assumes a “30-year Fixed-Rate VA Loan at an interest rate of 2.25% and 80% loan-to-value (LTV).”

As you read the example and related materials, there are some questions to ask.

- Are you VA qualified?

- What’s your credit score? (A minimum of 640 is required)

- Are you buying a home or refinancing?

- If you’re buying, are you willing to put 20% down?

- If you’re refinancing, will you keep at least 20% equity in the home?

- What’s the rate for VA financing with nothing down?

VA financing is available with 0% down for buyers, and current homeowners can refinance 100% of the property’s reasonable value using the VA streamline (IRRRL).

But those taking advantage of zero-down or low-down-payment options likely won’t get the lowest possible rates.

There’s always a compromise between how strong your application is, and how low a rate lenders will offer you.

Verify your new rateThe best mortgage rate — it’s complicated

Mortgage lenders are in business to make money. The last thing they want is to decline loans, turn away borrowers, or make the application process any more difficult than necessary.

So why do borrowers have to meet such high standards to get the best mortgage rates?

The thing is, there’s a lot going on behind the scenes when a mortgage lender determines your rate.

Investors and the secondary mortgage market

Mortgages are routinely sold into the secondary market to such buyers as Fannie Mae, Freddie Mac, and investors worldwide.

The secondary market is an electronic “place” where mortgages are bought and sold. By selling mortgages, lenders get the cash they can use to make new loans.

But such investors have their standards.

Investors in the secondary market want to buy standardized products. They may require a loan to have a certain down payment, debt-to-income ratio, and credit score.

Why? Because they want to be sure they’re making a safe investment. These types of criteria help lenders and investors verify that borrowers will be able to pay back their mortgages.

Loan program requirements

There are also different requirements to qualify for a mortgage — and a low rate — depending on what type of loan you apply for.

You can buy with little or nothing down with backing from the FHA, VA, USDA, and private mortgage insurance. These programs protect lenders if borrowers don’t make their payments.

But they also have certain requirements borrowers must meet to qualify for program support. If a home buyer can’t meet program standards then the loan application will not go through.

Mortgage company requirements

Regardless of other requirements, lenders may have additional standards — so-called “layering” — that borrowers must meet. These standards arise because lenders want to reduce risk.

For instance, the official guidelines say you can get FHA financing with a credit score of just 500 and 10% down. But those loans can be hard to find in reality. In fiscal year 2019, HUD reports that just 1.04% of all forward FHA loans had credit scores below 579. That’s because many lenders simply don’t want loans with lower credit scores.

Similarly, lenders get to decide what rates they’ll offer to borrowers. And those rates change daily.

You might be offered a higher or lower rate from one lender depending on its current workload, what types of loans it prefers to take on, how available investor money is at the moment, and so on.

How to find your lowest rate

Despite the complicated factors that influence your mortgage rate, you don’t have to be a finance expert to find the best deal. You just have to be willing to do a little work.

You’ll get the best mortgage rate when you find the lender and loan program that best fit your needs.

Shop around and speak with a few lenders before committing to a mortgage. That way you can be sure you’re getting the lowest rate available to you.

Time to make a move? Let us find the right mortgage for you